National Flu Helpline, a £70 per Person TamiFlu General Election Bribe?

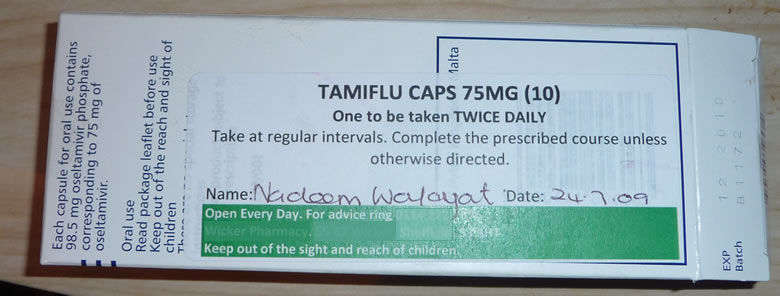

Politics / Global Pandemic Jul 24, 2009 - 05:18 PM GMTBy: Nadeem_Walayat

The National Flu helpline has now been online for more than 24 hours, and traffic levels suggest more than half of the british population has visited the site during this time, many of whom have gone on to obtain the requisite straight forward ant-viral authorisation within a few mouse clicks.

The National Flu helpline has now been online for more than 24 hours, and traffic levels suggest more than half of the british population has visited the site during this time, many of whom have gone on to obtain the requisite straight forward ant-viral authorisation within a few mouse clicks.

Whilst the GP's have a tendency to criticise anything that takes them out of the loop, the fact of the matter is that swine flu is a reality and therefore it would be political suicide (in a long line of recent Labour electoral suicide notes) for the Labour government to not go overboard and over-react to the global swine flu pandemic, which has resulted in an unprecedented action of Labour effectively handing out 10 tablets of TamiFlu to anyone that bothers to ask, whether or not they actually have swine flu or not which many people who use the National Flu Help line or online version will soon realise.

So yes it is an election bribe, BUT A GOOD ONE that actually is cost effective in terms of saving lives and costs to the NHS of prevention of avoidable occupation of hospital general and critical care beds, for in an non election year as in years past, we would all have been left at the mercy of over paid under worked GP's to under perform in the face of a real pandemic. Especially as swine flu particularly hits the young with reports out of America suggesting brain problems for children - Brain problems from swine flu.

Additionally the last thing an economy that's already on its back needs is for 1 in 8 of the workforce to be off sick which would cost the economy an estimated £20 billion, though significantly less than the scare mongering of £100 billion being bandied about by the mainstream press economists, who were again surprised earlier today on release of 0.8% GDP contraction against expectations of -0.3%, as against my own original projection for -1% for Q2. It appears mainstream economists who do not actually participate in the markets and hence live in ivory towers are perpetually surprised and have a tendency to be anywhere from 6 to 12 months behind the curve as illustrated recently - NIESR Reports UK Recession Over, Economic Recovery Underway , OECD Joins the UK Double Dip Recession Forecast Club.

Back to swine flu - So the people of Britain are lucky to have the swine flu pandemic hit during an election year, the only problem is how many of these millions of TamiFlu hand outs will now start appearing on Ebay or similar ?

What's next ? - The Tax payer Swine Flu bailout ? i.e. a great opportunity to take several thousand non medical persons off the surging unemployment lines.

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on the housing market and interest rates. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 250 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.