eBay’s Slow and Painful Death Spiral

Companies / Tech Stocks Jul 23, 2009 - 01:15 AM GMTBy: Mike_Stathis

Despite a big boost in shares in after hours trading, Wednesday's (disappointing) earnings for the online auctioneer represent a continuing trend that will not be broken anytime soon. Yes, they beat estimates, but this means nothing. Estimates have been revised downward over and over.

Despite a big boost in shares in after hours trading, Wednesday's (disappointing) earnings for the online auctioneer represent a continuing trend that will not be broken anytime soon. Yes, they beat estimates, but this means nothing. Estimates have been revised downward over and over.

Management and Wall Street analysts have placed blame with this floundering company on the economy, but this is simply not the case.

Those of you who have been following me for some time now realize I have not liked eBay for over three years. The fact is that eBay management has never had any idea about corporate strategy. For years, management sat on its behind thinking they could milk the online auction market forever, without adding a sufficient number of synergistic business lines.

The previous success of eBay (even persisting through the dotcom recession) was due to millions of desperate people who became unemployed and were led to believe they could make a living as full-time sellers of goods on eBay.

Indeed, for a while, many were able to make some decent income. But the sales volume was boosted by the credit bubble and bargain buyers. Things are different now.

In my view, eBay is just another example of my belief that over 90% of publicly traded U.S. corporations are clueless. Rather than provide real business leadership, most of America's large corporations rely more on lobbyist bribes to Washington in order to get the laws passed to their benefit.

Despite eBay's latest earnings statement that points to the contrary, Skype is going nowhere; it's the living dead; just another useless acquisition by clueless management, wasting shareholder equity without any real strategy to leverage the momentum generated early on.

Rather than make some smart acquisitions and expand its auction business into an Amazon-like retailer, eBay stuck with the auction model and expanded its product offering. Whitman thought auctions for autos and real estate represented the growth of this company without having any clue that a bubble was forming. Amazon is the king of ecommerce. eBay is the loser.

This represents an example of the need for corporate management to understand what's really happening in the economy, or at to be in a position to react appropriately. Of course, when you are a CEO in America, there is no penalty for failure. You are guaranteed wealth beyond your dreams. In the process, shareholders get hosed. Welcome to the United States of America, land of government-sponsored corporate fraud and crony capitalism.

The ONLY thing eBay did right was its acquisition of Paypal. Paypal represents the company's ONLY future growth prospects because the online auction market has reached full saturation. Yahoo! tried to get into this space and it didn't work. Even Amazon tried it and it didn't work. That should tell you one thing. The market is saturated.

As well, rule number one of business and investment strategy is that you never design (or invest in) a business that does not have the majority control over costs. eBay is uniquely positioned within the arms of the USPS. And since individual sellers handle the shipping, eBay is unable to strike the kinds of shipping deals that have contributed to Amazon's success.

Adding insult to injury, most of the long-time eBay sellers hate the company due to fee increases and other changes that have gouged their already low profit margins. eBay is suffering from something that is extremely difficult to erase. It's the same thing that destroyed Verisign and the same thing that is destroying Home Depot - brand name destruction via pissing off your customers and vendors.

eBay won't go away. However, without RADICAL change, the company will continue to flounder.

It is entirely possible that the Paypal could be eventually spun off in order to please angry shareholders.

For those who own shares of eBay, you might want to consider using the recent strength as an exit opportunity. There are many other investment options for your money.

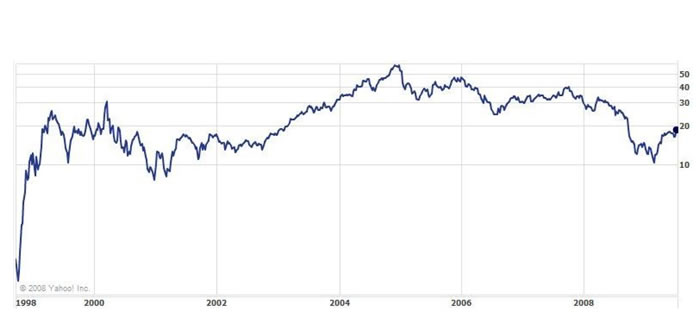

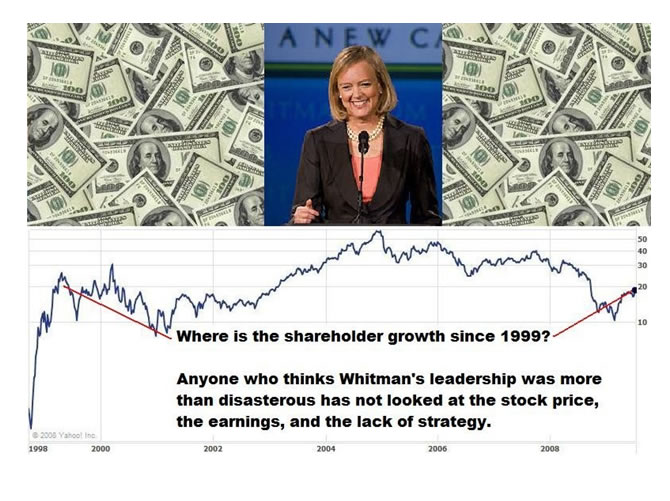

Whitman saw the writing on the wall and resigned as CEO in 2008; yet another example of another CEO being granted a dynasty for doing nothing productive. The stock market has become as much of a joke as America's pseudo-free market economy. But of course, the media now claims she was a great CEO, just as they claimed Alan Greenspan was a genius; simply amazing.

The last thing California needs is a proven business failure as its next governor. But you can bet her PR campaign will highlight the myth that she successfully led eBay to the top, when the facts tell a different story.

For eBay management, I suggest you take a crash course on business strategy. Better yet, feel free to give me a call. I guarantee positive results at 1/100 the price you're paying all of those brainless robots with MBAs.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.