Credit Crunch Crisis Part2

Economics / Credit Crisis 2009 Jul 21, 2009 - 08:16 AM GMTBy: Axel_Merk

Green Shoots Everywhere! The credit crisis is over; an economic recovery is just around the corner! Hold your horses – there may not be enough water to nourish them at the next pit stop. Hold on – isn’t a bad decision supposed to turn into good policy when you back it by trillions of freshly printed U.S. dollars?

Green Shoots Everywhere! The credit crisis is over; an economic recovery is just around the corner! Hold your horses – there may not be enough water to nourish them at the next pit stop. Hold on – isn’t a bad decision supposed to turn into good policy when you back it by trillions of freshly printed U.S. dollars?

Conventional wisdom suggests that when you lower interest rates, splatter lots of money onto the economy through spending programs and credit facilities, the economy will recover. There are a couple of problems with that view. For starters, given the magnitude of the credit bust the world has just seen, “conventional wisdom” may no longer hold up. But wait – we have seen nascent signs of a recovery – the touted green shoots! Let’s examine some of these:

- the stock market has bounced substantially from its lows;

- policy makers tell us that the economy is improving;

- banks report strong earnings.

Do you notice a theme here? The first two reference expectations of things improving (arguably the view of policy makers should be taken with a grain of salt, as their own policies contributed to the present mess). Furthermore, it should be no surprise that when a financial institution has access to essentially free money and all losses are guaranteed that they manage to report “better than expected” earnings. Wait, there is another one: Intel tells us that chip shipments are up again; yet Dell and others continue to warn about the reluctance of consumers and businesses to buy their products. Could it be that refilling depleted inventories is not a harbinger of an economic recovery?

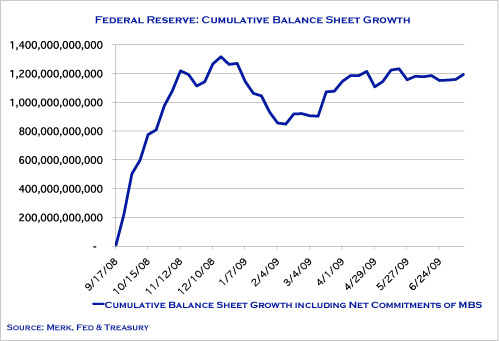

There are other indicators that have shown signs of improvements; those searching for a glass half full have been able to find it. To be sure, an improvement in sentiment is essential to any recovery as consumer confidence influences spending and investment decisions. So with trillions of dollars committed, with fiscal and monetary spending put into high gear, what is a policy maker to do? Let’s take a peek behind the scenes at the Federal Reserve (Fed) and look at the growth of the Fed’s balance sheet:

As a rule of thumb, the Fed’s balance sheet can be viewed as the money that has been printed out of thin air, even if that “printing” is done electronically and no dollar bills are created. When the Fed increases its balance sheet, an uptick in economic activity may result as more credit is made available to the economy; think of the Fed’s balance sheet as “super money” as there is a high multiplier effect between the money the Fed makes available to the banking system and the economic activity that may be created. However, this only works if first banks indeed make the cheap money available, but then individuals and businesses take the “bait”, i.e. take out more loans. Rather than risking that banks may not pass on the money, the Fed has engaged in various “credit easing” programs, essentially bypassing the banks to extend credit to specific sectors of the economy.

In mid-September last year, the Fed’s balance sheet stood at about $1 trillion; since then it has more than doubled, but the growth has tapered off. Other charts you may see showing a decline in recent weeks do not reflect the net commitments to buy mortgage-backed securities. Indeed, we would not be surprised if the Fed were to employ more derivatives to provide the illusion of a more conservative balance sheet; the New York Fed, for example, has been very interested in moving assets into special purpose investment vehicles (SIVs) to remove them from its balance sheet. This isn’t so different from companies delivering what investors are asking for: You want sales? We give you top line growth (read mail-in rebate programs that appear as liabilities while reported sales are high). You want margins? We give you margins (read stuffing inventory channels and the periodic write-down of unsold inventory). You want a strong balance sheet? We give you a strong balance sheet (read off-balance sheet vehicles). Everyone wants to be appreciated and the Fed is no different in trying to please the market. Except that it is not the role of the Fed to be loved, but to foster an environment that promotes price stability (low inflation). Incidentally, it is well established that the Fed’s secondary mandate to promote maximum sustainable growth is best achieved in an environment that fosters price stability.

The Fed may want to see the impact of the current initiatives before ramping up its programs. It generally takes about 6-9 months for Fed policy changes to work their way through the economy. There are a couple of factors why the Fed’s balance sheet has plateaued in recent months:

- Seasonal factors influence the Fed’s balance sheet and are responsible for a fall early in the year;

- Some of the Fed’s programs are indeed fading out. Amongst them are support for the commercial paper market as the panic has abated; as well as certain liquidity facilities that are not cost effective to the borrowers;

- Some of the Fed’s purchase programs have been off to a slow start. Some, like the Public Private Investment Partnership program (PPIP) because they are ill-designed; others because the Fed may want to influence the market by the simple announcement that they intend to become active, but then saving its firing power. The mere announcement can move a market – at least in the short-term. However, this “active communication” strategy is risky as it jeopardizes the credibility of the Fed.

We don’t think the Fed is done printing money – indeed, the Fed has committed to printing substantially more, amongst others, to purchase a further $600 billion worth of mortgage-backed securities. The purpose of this discussion, however, is that the Fed’s actions in recent months have hovered sideways. If all the money that has been thrown at the system does not stick, the Fed, in our assessment, is likely to print more. The stock market rally coincided with the typical lag time to the initial boost of the Fed’s printing press, and when the green shoot theories begun to spring up. But those green shoots are wilting; the “conventional wisdom” is not playing out as planned. There are many reasons for this, amongst them:

- Market forces are stronger than the Fed and the credit contraction has not run its course.

- Inefficiencies in how the Fed’s programs have been designed: the Fed may be able to prop up financial institutions, but it does so by substituting rather than encouraging private sector activities. That’s because rational market participants may have no interest in extending credit at artificially low rates. Warren Buffett, amongst others, has complained his firm cannot compete at the terms offered by government subsidized programs or companies.

- Inefficiencies in how the Administration’s programs have been designed: when you give a break to someone shocked by the credit crisis and deeply in debt, that person is likely to save a good portion of any government handout. In contrast, had the stimulus plan provided an incentive to small businesses to invest, a positive economic snowball effect may have been created. Instead, the most recent proposals suggest a tax increase for small businesses to finance more government spending (think healthcare reform, amongst others).

Looking forward, there are more headwinds in the pipeline:

- CIT, the troubled small business lender that serves 950,000 mostly small and midsize businesses including 300,000 retailers and 1,900 manufacturers, is struggling to survive. As of this writing, it seems possible that CIT may be able to avert bankruptcy, but is likely to become more conservative and thus make less credit available to small business.

- The federal government will need to issue an enormous amount of debt in the coming months. Given that the summer months are typically slower months to raise debt, there may be an unprecedented supply of new government debt in the fall, which will likely put upward pressure on rates.

- Corporate America also needs to go back to the financial markets in the fall with massive funding needs. On a related note, in Europe, the European Central Bank (ECB) recently provided an unlimited supply of 1 year financing to the banking system – the equivalent of over $600 billion was handed out. The connection: the ECB may foresee a crunch in the fall and may be taking advantage of a relatively calm period in the market to create a buffer against a possible funding shortfall.

- California’s first round of IOUs are due October 2. Of course Sacramento will have resolved all of its budget issues by then and tax revenue will have stabilized. And pigs might fly. California, for now, is as well as other states, will need to raise a lot more money. In that case, as many want to access the credit markets at the same time, don’t be surprised if the appetite to finance local, state, federal, corporate and international needs will be low.

Before we get too excited about the reflation that is said to take place around the world, consider that the Fed’s been pausing to wait out market reaction to its policies. Given the typical lag time of Fed intervention, the green shoots may have wilted and died in the absence of fresh liquidity, just as massive financing requirements hits the markets. Call it Credit Crunch Part Deux.

We shall note that we don’t have a crystal ball. However, it’s a possible scenario and investors who believe that there’s a reasonable probability that it may play out that way may consider taking it into account in their portfolio allocation. What does this mean for the markets? For starters, we believe the equity markets may have got ahead of themselves. In addition to what we mention above, the business model of corporations that rely on cheap financing is fundamentally broken – CIT is a prime, but by far not the only example of that – and won’t come back anytime soon.

Will we see a flight to panic, a flight back into the U.S. Dollar and Treasuries? If it does, we believe the pendulum will swing less than last year. Consider in particular that the balance sheet of the U.S. has deteriorated over the past 12 months. While the U.S. may still be considered a safe haven, it is not the safe haven it was a year ago. Governments around the world have also not been sitting idle, making a flight to the U.S. less likely. Panic may not evolve as the U.S. and other governments have made it clear that they may do whatever it takes to keep the financial system together – read: print money, lower the barrier to what may be too big to fail and provide liquidity.

The massive supply of debt to be issued should push up the cost of borrowing (raise yields, lower prices of debt securities). However, that scenario is exactly the opposite of what the Fed wants to achieve. The Fed wants to keep the cost of borrowing low – especially for the housing market. As a result, we believe the Fed will ramp up its intervention in the bond markets if and when credit deteriorates once again. This time around, many tools will be in place that were not available last year, allowing policy makers to react more promptly. While this may appease those in desperate need of funding, it again means that the securities targeted may no longer be attractive to rational buyers, as they won’t be adequately compensated for the risks they are taking. More specifically, if the Fed buys Treasury Bonds or mortgage-backed securities (MBS) to lower interest rates, why would rational buyers – be that foreigners or private domestic investors – buy these? This abstract concept is nothing but the Fed printing money to finance government spending, even if the Fed denies that it is “monetizing the debt” as this is called. By the way, while it is not the Fed’s job to monetize the debt, it is in the Fed’s interest to provide the perception that it is not monetizing the debt for as long as possible so as to – once again – lower the cost of borrowing. Needless to say, the U.S. dollar may come under considerable pressure if the public were to agree to what seems obvious to us. The fact that a weaker dollar may not be in the interest of U.S. creditors may not be enough to prop up the greenback should this transpire.

A brief word on other regions: China’s stimulus package has been more effective (and China can afford its stimulus); in Asia, China may not only be best positioned to allow its currency to appreciate, but China will also find that a stronger currency may be the most effective tool to counter inflationary pressures that have been building as a result of its highly expansionary policies. Europe may see its share of suffering, but it won’t be as “efficient” in creating government debt (because of the decentralized nature of the European Union that makes bailouts and fiscal stimuli more difficult to coordinate); we believe that the less aggressive actions should continue to make the euro more attractive than the U.S. dollar. Please read our past Merk Insights for a discussion of specific currencies and regions.

Gold continues to be true money that cannot be printed and thus something to consider for those who lose their confidence in all fiat currencies. Overall, don’t expect smooth sailing in the months ahead – those familiar with gold know that, relative to the U.S. dollar, gold can be a rather rocky ride, even if it may ultimately be profitable for those who have the stomach to bear the volatility. As the U.S. dollar in particular is at risk of losing its function as a store of value, investors may want to consider a diversified approach to something as mundane as cash.

We manage the Merk Hard and Asian Currency Funds, no-load mutual funds seeking to protect against a decline in the dollar by investing in baskets of hard and Asian currencies, respectively. To learn more about the Funds, or to subscribe to our free newsletter, please visit www.merkfund.com.

By Axel Merk

Chief Investment Officer and Manager of the Merk Hard and Asian Currency Funds, www.merkfund.com

Mr. Merk predicted the credit crisis early. As early as 2003 , he outlined the looming battle of inflationary and deflationary forces. In 2005 , Mr. Merk predicted Ben Bernanke would succeed Greenspan as Federal Reserve Chairman months before his nomination. In early 2007 , Mr. Merk warned volatility would surge and cause a painful global credit contraction affecting all asset classes. In the fall of 2007 , he was an early critic of inefficient government reaction to the credit crisis. In 2008 , Mr. Merk was one of the first to urge the recapitalization of financial institutions. Mr. Merk typically puts his money where his mouth is. He became a global investor in the 1990s when diversification within the U.S. became less effective; as of 2000, he has shifted towards a more macro-oriented investment approach with substantial cash and precious metals holdings.

© 2009 Merk Investments® LLC

The Merk Asian Currency Fund invests in a basket of Asian currencies. Asian currencies the Fund may invest in include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund invests in a basket of hard currencies. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a hard or Asian currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfund.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfund.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invests in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds owns and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

The views in this article were those of Axel Merk as of the newsletter's publication date and may not reflect his views at any time thereafter. These views and opinions should not be construed as investment advice nor considered as an offer to sell or a solicitation of an offer to buy shares of any securities mentioned herein. Mr. Merk is the founder and president of Merk Investments LLC and is the portfolio manager for the Merk Hard and Asian Currency Funds. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.