UK Savings and Banking Services Update

Personal_Finance / UK Banking Jun 08, 2007 - 09:19 AM GMTBy: MoneyFacts

Moneyfacts.co.uk team comments on:

Moneyfacts.co.uk team comments on:

o Mortgages – the best of both worlds

o The fixed rate mortgage disappearing act

o Post Office card – giving with one hand and taking with the other

o New Halifax Online Card – a great 0% deals

o Personal loan rates take a battering

o Fixed rate ISAs on the up

Mortgages

Julia Harris, Mortgage Analyst at Moneyfacts.co.uk – the money search engine, comments:

Mortgages – the best of both worlds

“With uncertainty still rife as many industry experts predict another rate rise is on the cards, the launch of products from Skipton & Woolwich offering different ways to ‘hedge your bets’ is perfect timing.

“Woolwich ‘fix and track’ range offers borrowers the option to fix at a competitive 5.39% for one year, with the option to revert, free of charge to a lifetime tracker (BBR + 0.39%). The drop lock deal has no ERC, is available up to 80% LTV and charges an initial £595 fee.

“By comparison the Skipton BS’s new range allows borrowers to mix and match from a selection of fixed rates, base rate trackers, discounts and capped rate products. So by choosing the mix of fixed and variable rates, it’s an ideal way to tailor your mortgage towards your expectations of further rate changes. With a large range of rates, terms and fees available, borrowers have a great portfolio from which to choose.

“Borrowers who want to speculate against future base rate moves, to protect their repayments in the short or longer term, or who would like a slice of security but still take advantage of any rate reductions, will find these products are a welcome addition to the mortgage market.

“It is great to see an innovative approach to rates reaching the marketplace.

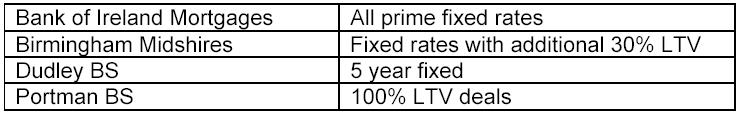

The fixed rate mortgage disappearing act

“The last week has seen many lenders launching new fixed rate deals at higher rates, including some of the largest mortgage providers such as Halifax (+0.30%) and Northern Rock (+0.10%). With several other lenders withdrawing all or selected fixed rate deals completely. These include:

“Perhaps the reason behind this is simply that they have used their fixed rate funds, or are taking time out to reprice depending on the base rate decision this week. But the examples of Portman BS and Birmingham Midshires may show a more worrying trend.

“A few weeks ago HSBC announced it would be lowering its maximum loan to value, and with the second two institutions now withdrawing their higher risk deals, is it a sign that lenders are beginning to adopt a more cautious approach?”

Credit Cards & Loans

Michelle Slade, Personal Finance Analyst at Moneyfacts.co.uk – the money search engine, comments:

Post Office – give with one hand take with the other

o 0% for 10 months now available on balance transfers on Classic MasterCard and Platinum MasterCard

o Classic MasterCard – purchase rates increased to 16.9% (+2%), cash rates increased to 20.94% (+2.77%),

o Platinum MasterCard – purchase rates increased to 15.9% (+2%), cash rates increased to 20.94% (+3.856%), balance transfer fee increased from 2.5% min £3 to 2.75%.

“The latest product changes by the Post Office are a classic example of giving with one hand to offer enhanced 0% deals, yet taking back with the other hand by increasing fees and rates. But overall the cards still offer reasonable deals, charging average rates and fees and offering a slightly less than market leading 0% deal.

“The fairly unique feature of the Post Office cards is that they don’t charge a foreign usage loading. With other card providers such as NatWest and Morgan Stanley have increased their charges, and most other cards charging in the region of 2.75%, using a Post Office Card overseas could provide significant savings.

Halifax – great 0% deals

“The new Online One MasterCard from Halifax and Bank of Scotland offers a great 0% package, offering not only a market leading 12 months on purchases, but also a respectable 12 months on balance transfers. For anyone looking to use one card for both balance transfers and purchases, this card and the deal from HSBC cannot be beaten.”

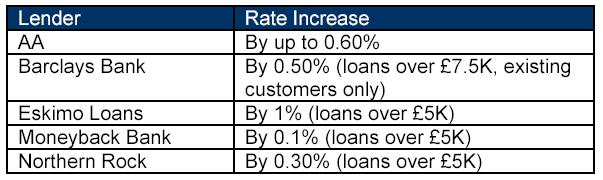

Personal loan rates take a battering

“With the disappearance of sub six percentage loans, rates continue to get a battering. This week alone, five providers have increased rates by as much as 1%. Even best buy loan rates, such as Moneyback Bank are rising in line with the market.

“Particularly for higher value loans, those over £5K, there are still some great deals to be found. But when shopping around, you must consider the full cost of the loan, especially if you take the lender’s PPI.”

Savings

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk – the money search engine, comments:

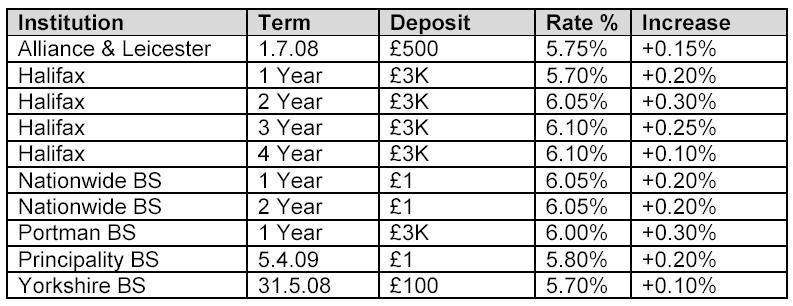

“The last week has seen a raft of activity in the fixed rate ISA market, with six providers increasing rates by as much as 0.30%.

“Rates of around 6% can be easily found on both variable and fixed rate ISAs. This offers great choice for savers, for those who want piece of mind to know what their investment will return or for those who want the flexibility of a variable rate and are prepared to take the rate gamble in the hope that rates will rise further.

“Whether you choose a fixed or variable ISA, it should be the first port of call for any saver. Offering not only great rates, but is also tax free, so Gordon Brown won’t be able to take a slice of your interest.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.