GOLD Analysis and Trading Strategy for 20th July 2009

Commodities / Gold & Silver 2009 Jul 20, 2009 - 02:39 AM GMTBy: Florian_Grummes

Gold in USD (1 ounce = US$936,70

Gold in USD (1 ounce = US$936,70

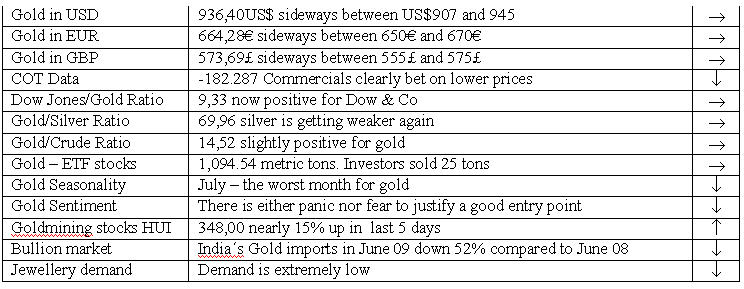

- Compared to the price two weeks ago nothing much has happened in the goldmarket. After a short drop down to 905US$ Gold moved up again to the rising 50d MA (US$ 938,03). Short covering, a weaker dollar and the strong rally in the broader stock market were responsible for the US$35 gain in the last 5 trading sessions.

- The mid & longterm charts are very positive. Gold is building a base below US$ 1.000 and one of the next attempts to break through that level will be successful.

- Within the next weeks the sideways movement should continue, but expect also a quick and short drop below US$900 to test the 200d MA. Even a drop below the 200d MA down towards US$ 845 is very possible – that would not be a surprise but instead very typical for this market. Here we could find a very good risk reward entry for a longerterm position.

- Instead should Gold rise above the US$ 950 level we have a clear buy signal – although I personally don´t think that this would be the move above US$ 1.000 everybody is waiting for. But in this case the price of Gold should at least move quickly above US$965 to start a new attempt to break through the US$ 990 Level.

- The long term technical & fundamental perspective for gold is still super bullish. The next price targets are the Fibonacci‐Extensions of the correction since March 2008 at US$1.250 and U$1.600.

- The DowJones/Gold ratio is now at 9.33. The strong gains of the last 5 days indicate that the stockmarktes all over the world will continue to recover. The german DAX could move up to 5.350 - 5.500 within the next weeks and until the end of summer the bulls will probably be in charge of the game.

- Long term I expect the price of gold moving towards parity to the Dow Jones (=1:1). The next primary cyclical change is still years away. This means we are still in a long term bull market in gold (and also commodities) and in a secular bear market in the broader stock markets.

Gold in EUR (1 ounce = 664,28€)

- EUR Gold is basically moving sideways as well. The pullback down to the €650 level was only a short one and buyers came back in the market pretty fast. Obviously for Gold in Euros we have the summer doldrums.

- The rising 200d MA (actually 659€) is still an important support. If that support fails we can expect prices around 630-625 within the next weeks.

- Be consequent and buy physical bullion with prices below 670€.

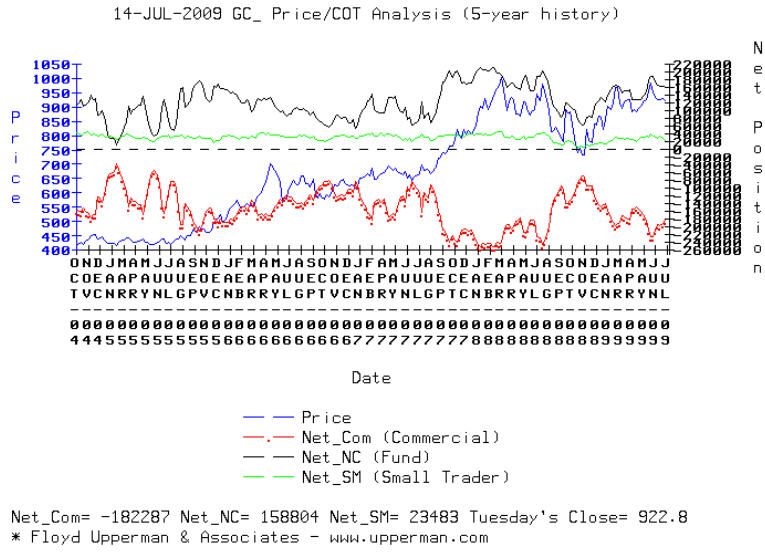

Gold COT Situation

- The newest COT Data indicate that the commercials cover their short positions slowly below the level of US$930. But we are still far away from a buy signal.

- I still believe that a new big sustainable rally in the price of gold can only start, when the commercials reduce their short positions to below -100.000 contracts. Under US$900 the commercials probably will start cover more of their sold positions. If a move down to US$845 should really happen, the COT Data will look much better.

17.02.2009 = -196.360 ( PoG Low of the day = US$ 970 )

10.03.2009 = -172.851 ( PoG Low of the day = US$ 892 )

18.04.2009 = -153.419 ( PoG Low of the day = US$ 885 )

19.05.2009 = -183.065 ( PoG Low of the day = US$ 920 )

26.05.2009 = -208.136 ( PoG Low of the day = US$ 939 )

02.06.2009 = -226.521 ( PoG Low of the day = US$ 970 )

09.06.2009 = -225.047 ( PoG Low of the day = US$ 947 )

16.06.2009 = -207.368 ( PoG Low of the day = US$ 929 )

23.06.2009 = -194.430 ( PoG Low of the day = US$ 913 )

07.07.2009 = -191.307 ( PoG Low of the day = US$ 922 )

14.07.2009 = -182.287 ( PoG Low of the day = US$ 917 )

- Only a few very big players hold this concentrated short position. In the same time the spread between the spot price and the price for the next future contract is shrinking. As soon as we are in a backwardation in the goldmarket the game is over for the bears. It´s not yet the time to bet against this and to expect a shortsqueeze soon. But keep in mind that every cartel & manipulation end one day.

Gold Seasonality

- It’s July – the worst month for gold. The trading volume in most of the markets is decreasing and erratic can easily happen.

Gold Sentiment

- Last Thursday - on my flight back from Milan - I accidentally listened to a conversation between two young men. One of the guys proudly mentioned how important it would be to watch the gold price all the time (he was using his iPhone to do that). They were average investors and not specialized in trading & investing. That short conversation strengthened my belief that the average investors – the „weak hands“ - have to be shaken out before the breakout through the US$ 1.000 level can finally be successful.

Conclusion

- Gold is pretty strong or in other words the correction so far seems to be limited. Early next week we might see an attempt to break through the level of US$950. But I don´t see any strong reason why that important resistance should break soon. I expect another move down from that level, but if the stock market gets momentum gold might be able to rise up to the US$990 level again.

My main concern is the negative COT Data. On top seasonality does not support such a strong rise either. I expect at least a test of the US$875-885 level within the next two month. I believe even a short drop down to US$845 is very probable. If the Commercials cover more of their short positions here – at least partially – the base for a new and this time successful attempt up to the US$1.000 level (and further) will be set. That should happen in autumn and winter.

Gold mining stocks Analysis

Goldbugs Index USD (348.00 points)

- The HUI Goldbugs Index had a strong reversal last week – the index is up nearly 15% in the last five days.

- The MACD indicator gave a clear buy signal. The next resistance is the upper Bollinger Band (US$364.64). But to get there the HUI has to rise above the rising 50d MA (350.37US$) first. I doubt that this will happen very soon. But on the other hand the mining stocks tend to move with the broad stock market. If the Dow, DAX & Co should make new highs this summer the HUI should do even better.

- Only the flat 200d MA (actually 289.14) is far away from the current price level and indicates potential for futher correction.

- The weekly chart is not very positive. Especially MACD shows no need to get in the market. Short term everything might be possible, but mid term I expect a much better opportunity to buy goldstocks later in autumn this year.

Recommendations

- Commodity exchanges can dump gold debts on ETFs - http://www.gata.org/node/7586

- Gold Mid-Year Seasonal Trend Review July 2009 by Bill Downey - http://www.marketoracle.co.uk/Article12059.html

If you would like to receive these free trading reports or my trading signals please visit this link: Free Weekly Trading Reports - Click Here

By Florian Grummes

www.TheSilverGoldSpot.com

Learn to Trade ETF's While Your Making Money Trading

© 2009 Copyright Florian Grummes - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Florian Grummes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.