NO Chance of Inflation on Near Horizon

Economics / Deflation Jul 17, 2009 - 02:57 PM GMTBy: The_Gold_Report

Unlike many of his colleagues in the world of investment analysis, Discovery Investing pioneer Dr. Michael Berry doesn't expect inflation to enter the economy for two or three years, after considerably more deleveraging takes place and real recovery begins. In this exclusive interview, he tells The Gold Report this is a great time for contrarians to do some bargain hunting. (7/17/09).

Unlike many of his colleagues in the world of investment analysis, Discovery Investing pioneer Dr. Michael Berry doesn't expect inflation to enter the economy for two or three years, after considerably more deleveraging takes place and real recovery begins. In this exclusive interview, he tells The Gold Report this is a great time for contrarians to do some bargain hunting. (7/17/09).

The Gold Report: In one of your recent Morning Notes—which of course we publish on our home page—you projected further deleveraging, contraction and deflation in Canada and the U.S. Would you summarize how you see things?

Michael Berry: Many people are talking about oncoming inflation and even hyperinflation, but in my opinion there’s no chance of either for at least a couple of years. The reason is that a huge amount of deleveraging remains. Whenever we see the dollar and the yen climb and all other currencies fall, that is a symptom of the need for dollars and yen to deleverage. So much was borrowed in the first decade of this century—and it was borrowed in dollars and yen.

Of course, when the dollar is strong, commentators say it’s a safe haven. That’s total nonsense. I’m not sure there is a safe haven now except perhaps in gold. But when the dollar strengthens like that, you know that a deleveraging is going on. And there’s still a huge amount of debt in the global economy. Until that gets wrung out of the system, we’re going to have very, very slow growth (if any) and deflationary tendencies with more contraction of the global economies. We’ll have deflation with us for the next year or two or three, depending upon how quickly we pull ourselves out of this situation, perhaps convert debt to equity or somehow wring it out of the system.

TGR: Can we go through deleveraging of a $70 trillion debt in a couple of years?

MB: I’m an optimist. I know for sure is that debt has to be taken care of at some point—all of it. If we don’t get after it quickly enough, it will take a lot longer than two or three years. Some people have said 10 or 15 years of living in the shadows, much like the Japanese economy has done since about 1990. That’s a prospect I hope is not true and I don’t think it will be true because the U.S. economy is more vibrant. So I’m saying two to three years should put us in position for a real economic recovery, not just one due to fiscal spending.

TGR: And are we then looking at inflation and potential hyperinflation?

MB: Yes, we are looking at inflation. How much will depend upon the precision with which the Federal Reserve drains the money they’ve put in the system. I don’t think we’ll have hyperinflation. But once inflationary expectations are embedded, they’re fearfully difficult to dig out. I think there’s a 60-40 chance we’ll see inflation because the Fed won’t be able to react exactly at the right time and by exactly the right amount in terms of draining out the liquidity it’s thrown at the system.

TGR: Are you expecting the deflationary tendencies you mentioned primarily in North America?

MB: Unfortunately, it’s absolutely worldwide. Brazil, India and China are running surpluses so they can pretend for a while, but no matter how you look at it, you’ve got a global debt deleveraging scenario in place that has to be worked through.

TGR: Would you expect those countries to come back into growth faster than North America or is the whole international economy linked together?

MB: My expectation—which is pretty much out of the box and not accepted by too many economists here—is that those countries actually will lead us within the next decade. Of course, anything can happen in 10 years, but I believe within the next decade, you’ll see the quality-of-life syndrome that I’ve written so much about really start to take hold in countries like India and China, where there are huge populations and where there’s a leverage effect of lifestyle change.

So my guess is those domestic economies will begin to really heat up and they will be the leaders. They will be the engines of economic growth and the lifestyles in those countries will improve because of that and they’ll lead us out.

TGR: Why would that take a decade?

MB: Basically because you’re talking about a societal change. If they were at our quality-of-life level, if they all owned homes and cars and cell phones, if they had all these implements that you need energy for, their change would be smaller —but they don’t. Most of the population of China is still impoverished. I think within a decade or so that will not be the case. It might take India a little longer. But you’re going to see the quality of life broadly increase over 10 years in these countries. There’s some quality of life polarization in the U.S., Canada and Western Europe, but because we’re all living roughly at the same quality of life, which is really quite high, you won’t see as strong an impact as in the emerging countries.

TGR: How is what you’ve outlined affecting your investment strategy?

MB: It’s much more difficult to be a resource investor now than it was before July 13 of last year. That’s the date Treasury Secretary Paulson turned the world on its head with his Sunday speech and that’s when global deleveraging started. Until then, any copper company that was even remotely close to a discovery would be purchased. The same enthusiasm was evident for uranium and molybdenum. After last July, the impact on commodity prices was tremendous, and everything was sold that could be sold to initiate this deleveraging. That’s still going on. So investing in discovery of the resource sector is far more difficult now.

If you go to New York or Boston or Toronto and try to do a financing today, you face the prospect of finding money only if you’re mining precious metals and near production, because people believe inflation is near term. It’s just a completely different environment in which to do discovery investing in the resource sector than it was a year ago.

And it’s interesting because the oil sands and energy sector in general also have been turned on their heads. Where we had a lot of heavy oil and natural gas projects starting up in the U.S., they’ve all stopped. The supply destruction across the resource sector since last July 13 has been significant. Right now investors want near-term gold and silver production. Everything else is on the sidelines.

TGR: Doesn’t supply destruction mean opportunity for investors?

MB: It does. My thesis is that if we have a two- to three-year hiatus in terms of deleveraging and downward price pressure, the number of companies that will have to sell themselves to other companies and to investors at reduced rates will be very significant. So yes, I see opportunities for investors. However, you’re going to have to be a bit of a contrarian because if the economic news is bad, it’s really hard to step into a hard asset, a resource investment, when growth is slowing and unemployment is increasing. So this is a great time for contrarians who believe that we will have a real recovery in the next several years.

TGR: Some writers and analysts say gold is the safe place to be because it’s the only asset that will retain its value in a deflationary environment.

MB: People go to gold for two or three reasons—one is safety, another is inflationary expectations and the third (much less in impact) is deflation. When we had the banking crisis—which had nothing to do with deflation—you saw a run to gold for safety. In a deflationary environment, gold should hold its value (and silver, too). But I don’t see it being a tremendous wealth creator. It’s very possible that we could see $700 gold in the next year or two. Then when inflation finally kicks in, it’ll turn around pretty quickly.

TGR: You’re a big proponent of what you call discovery investing, to which you alluded earlier. What is that all about?

MB: It’s an investment discipline that I developed because I thought it was an area that wasn’t being served and one that has great social value. If you invest in a potential cancer cure or a new nuclear or solar technology, these have positive potential for society and our quality of life. If you have a portfolio of potential world-class discoveries—whether they’re resource, biotech, healthcare or high tech—you have a chance to create significant wealth when the market recognizes that discovery.

I’ve seen a few other funds now starting to think that way, but I developed the discipline from scratch because I was a value manager at Heartland Advisors in 1999 when value went out of favor. My thesis is that when you have a great discovery, it will create wealth; it doesn’t matter whether you’re in recession or in a growth cycle.

TGR: You say other funds are beginning to follow your lead?

MB: Maybe in a manner of speaking. Something quite different in the resource sector is called the 49 North Resource Fund (TSX.V:FNR). It’s basically an incubator fund for the Province of Saskatchewan and kind of discovery investing in practice. It’s run by Tom MacNeill, who finances a lot of these early-stage opportunities, and he’s doing a great job of it. He has gold in the portfolio, as well as uranium, potash and coal.

TGR: Investing in discovery seems inherently speculative. How do you manage that in terms of generating wealth?

MB: It boils down to the same kind of work you do if you invest in any equity. You perform your due diligence, study management and directors and their track record, you get to know something about the area in which you’re investing and whether there is potential for a great discovery. Most discoveries are serendipitous and require lots of money up front to get going. And I must say that discoveries don’t usually happen quickly. Normally they incubate for four or five years so you need patience. This is the biggest failing of most investors. For all of these reasons, discovery investments are speculative and there is risk, but there’s great upside too.

In his book, A Random Walk Down Wall Street, Burton Malkiel suggests a passive investment strategy in indexes because you can’t forecast share prices. My mentor at the University of Virginia, when I was a professor there, was Bob Vandell, who wrote an article in the Journal of Portfolio Management called “A Purposeful Stride Down Wall Street.” His idea was that active management pays off.

So I took that idea and realized that it’s hard to know what stock prices will do, but if you do your homework and create a portfolio to lessen rick, you can begin to understand when discoveries might be possible and play those odds rather than just hoping for the stock price increases. That’s really at the heart of discovery investing.

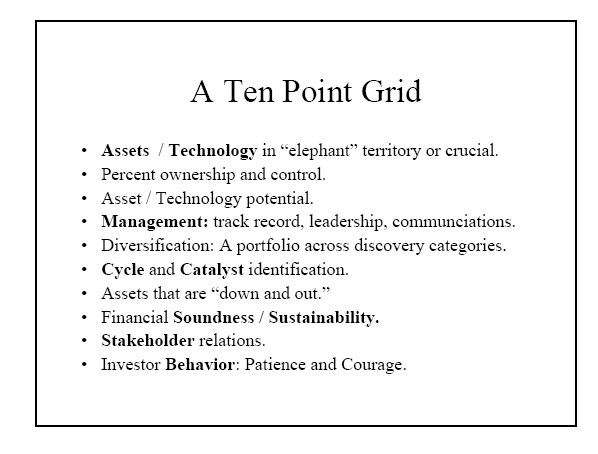

TGR: You have a 10-point discipline outline for discovery investing (see below). Can you give our readers some background on this?

MB: Absolutely. I modeled this on a grid for general companies developed by Bill Nasgovitz at Heartland Advisors in Milwaukee, and tailored it to discovery investments. Bill is one of the best in the world on micro caps, and a lot of these discovery companies are micro caps.

The first question on my grid deals with the asset quality: Is this potentially a world-class discovery? If so, it has the potential to create tremendous value. We’ve seen that in a few biotechs. Second: What is the quality of management, their track record? Third: Does this have the potential to be a game changer? Think about Goldcorp’s mine Peñasquito in Zacatecas. That’s a game changer for Goldcorp (TSX:G) (NYSE:GG); it’s a game changer for investors. In some cases, discoveries—such as a cure for cancer or Lou Gehrig’s disease—can be game-changers for society.

TGR: As you’re look at discovery opportunities, do you find certain sectors more promising than others?

MB: I think that’s an individual preference. You go where your interests and expertise lie. Diversification is important in discovery investing, but I do about 70% of my investing in the resource sector. I’ve worked with some of the best geologists in the world, whose work underlies the whole discovery strategy. If you work with good people, they teach you a lot about what they do and how the world works. So you get an education in discovery as well.

TGR: What appeals to you these days?

MB: Right now, gold and silver deposits, and to a little bit lesser extent copper, really interest me because of the inflation potential down the road. I think gold is a must in a discovery portfolio; I’ve just visited a gold discovery company in Northern Ontario called Houston Lake Mining (TSX.V:HLM). They are making tremendous progress with good drill results. And we have a great silver deposit with Quaterra Resources Inc. (NYSE.A:QMM) (TSX.V:QTA).

TGR: Where is that?

MB: Quaterra has a really diversified portfolio. It’s copper, moly and uranium in the U.S., silver in Mexico. It has 30 million ounces of silver at a place called Nieves, which is in Western Zacatecas, and they’ve barely scratched the surface there. After five or six years, they’ve finally found where the silver is. One of the things about resource investing is that it normally takes a geologist a few years to really figure out the geology. Once they do, things often get better.

TGR: Is Quaterra a near-term producer?

MB: I think they’re 18 months from producing silver. This is the same management team that developed Peñasquito—1.8 billion ounces of silver and 25 million ounces of gold and Goldcorp eventually took them out. They’ve got a great track record and my guess is that a company like Goldcorp or something probably will end up looking at Nieves when they finish developing it. Freeport McMoRan just did a 70/30 deal with them on their Tintic copper property.

Endeavour Silver Corp. (TSX:EDR) (NYSE.A:EXK) is also interesting, and I’m going to see them later this month. Endeavour has two operating mines now. One is Guanacevi, which is in Durango, and the other is in Guanajuato. They’re producing silver now and down the road silver could be a lot higher. It’s a good management team. I’m anxious to get down there and actually kick the rocks around a bit. We’ll be seeing Great Panther Resources (TSX:GPR) on that trip as well. I also like the world-class potential of Avalon Rare Metals Inc. (TSX:AVL) in rare earth metals. They have a world- class deposit in Canada’s Northwest Territories near Yellowknife that I just visited.

TGR: Are any other areas aside from resources of particular interest to you?

MB: Absolutely. Biotech and cancer research. Genetics is big today. There are gene discoveries virtually every week. I study the journal Science, which is readable for the layman. I’ve met many famous biologists and have developed relations with them, so they can explain to me what’s going on and how important a particular gene or gene mutation is to a new therapy.

To give you another example, I recently met with a group that has a new encryption technique that could revolutionize cyber security. It’s early days for Vadium, but it has world-class potential.

I’m trying to educate not only individual investors, but also institutions as to the potential for discovery investing. Some institutions are into socially responsible investing. So you could take the whole area, I think it’s fair to say, of green investing, of environmentally friendly investing. We need to make a lot of discoveries there in terms of carbon sequestration, new solar cell technology, the smart grid. Many, many discoveries are still coming out of the labs and coming into micro cap companies that need institutional investments to move ahead.

TGR: The people who invented Betamax might tell you that a game-changing discovery is kind of irrelevant if you can’t bring it to market or you’re second to the market after another technology that maybe isn’t as good. How does an investor begin to weigh those go-to-market timing issues?

MB: Right from the very beginning, as part of the 10-point grid, you have to assess the likely exit strategy. In the resource sector, if somebody drills 100 holes and discovers a large new ore body, the exit mechanism has been that a large mining company will come along and take it off your hands. I think the same holds true in biotech and high tech. Data security is going to be a big, big, big issue; companies like Microsoft, Google and so on are going to be there.

TGR: You mentioned biotech and genetics research as well as the resource sector. Do you find some companies within those sectors particularly intriguing?

MB: One of the companies I’ve worked with closely is Senesco Technologies Inc. (NYSE/AMEX:SNT). I’ve written about it dozens and dozens of times over the last six years. Their chief biologist, who is a professor at the University of Waterloo named Dr. John Thompson, discovered an important gene that controls cell death. Cancer cells don’t like to die; if you could target this gene in each of those cells and turn up the volume, if you will, you can cause it to kill the cell. They’ve done it very successfully in pre-clinical trials and they’re going into clinical trials at the Mayo Clinic within the next year on humans. They’re going to be doing several rounds of trials on terminally ill patients with multiple myeloma, which is both a cancer and a disease of the immune system. There’s really no drug, no treatment, no therapy that is effective at all, so it’s a very exciting technology.

TGR: How long before this might come to the marketplace?

MB: Well, it depends. I would say three to five years. In the clinical trials, they’ll be looking for blood markers to determine whether they’re doing the kinds of things they want to do.

In terms of discovery investments, if they have good markers, I believe that would have a lot of impact on the share price. In other words, the discovery may make an impact long before you really get into using the therapy in the healthcare system. So I think there’s great promise here and the more we learn about the genetics, the more these things bubble to the surface.

TGR: You mentioned that a lot of the discovery investing is personal preference and you are 70% into resources because that’s where your interest has been. Aside from gold, silver and copper, what discovery resource stocks intrigue you at this point?

MB: The great thing about resource investing is that as technology improves, new resources become of interest and so you constantly learn in this game. Discovery is so open-ended that you constantly find new opportunities. At one point, because it hardens steel, molybdenum was the metal of the day. A few years ago, all of a sudden uranium became the place to be. We made a lot of money because uranium’s price increased and we know now that we are going to have nuclear in this country and around the world. I guess I would have to say that Avalon’s Canadian rare earth metals exposure intrigues me most at this point.

Most rare earth metals come from China now, but I’ve just visited Avalon Rare Metals' rare earth metal deposit and talked to the geologists at Thor Lake in the Northwest Territories. I think this will be an incredibly valuable deposit once it’s developed.

And look at lithium today. The great lithium deposits are actually in South America—Chile and Peru and so on—and we’re going to need lithium for lithium ion batteries. So I’m looking at opportunities there.

TGR: Speaking of new technology, isn’t tantalum of growing importance to the electronics industry?

MB: That’s right. I’ve met some of the people at Commerce Resources Corp. (TSX.V:CCE) (PK SHEETS:CMRZF). I haven’t been to see their deposits, but I think the Upper Fir tantalum and niobium deposit in British Columbia is a very good one. I’m hoping to see that deposit and spend some time with them, kick some rocks there, too. I really like the management team. They’re doing exactly what they need to do, which is educate. It’s not about promotion; it’s about educating people about tantalum, what it’s used for, where the demand is and who the suppliers are. As a discovery investor, knowing those things helps me to figure out their probable exit strategy, identify a potential buyer and evaluate whether they’re ultimately going to have to go into production. They have a deposit in Northern Quebec as well. So Commerce is doing all the right things and I think they’re in the right space. For them, it’s now a matter of being discovered by the investing public, of people all of a sudden realizing, “We’ve got to own this stock.”

TGR: What’s holding them back?

MB: Commerce is doing a good job of educating the public. One of the problems now takes us back to that whole discussion of deflationary tendencies. It’s just that people worry about anything that isn't gold and silver that might be oriented toward rising production. That’s cast a little pall, but it will pass in the next couple of years.

DISCLOSURE: Michael Berry I personally and/or my family own the following companies mentioned in this interview: Quaterra resources, Goldcorp. I personally and/or my family am paid by the following companies mentioned in this interview: None

Michael Berry has lived in the U.S. for 36 years but born and raised in Canada. He supposes that “maybe mining is in my bones.” That may be what skews his Discovery Investing portfolio 70% toward the resource sector, too. A math major at the University of Waterloo in Ontario, he earned an MBA at the University of Connecticut and obtained a PhD specializing in quantitative analysis and investment finance from Arizona State University. While he was a professor of investments at the Colgate Darden Graduate School of Business Administration at the University of Virginia (1982-1990), Michael spent considerable time with some world-renowned geologists on the Carlin Trend. He also held the Wheat First Endowed Chair at James Madison University in Virginia, and managed small- and mid-cap value portfolios for Milwaukee-based Heartland Advisors and Chicago-based Kemper Scudder. His Morning Notes publication, distributed worldwide, provides analyses of emerging geopolitical, technologicaland economic trends, as well as identifying opportunities for the Discovery Investing strategy he developed.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

The GOLD Report is Copyright © 2009 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open mar ket or otherwise.

The Gold Report Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.