White House Buys into “Immaculate” Recovery Theme

Economics / US Economy Jun 07, 2007 - 11:49 AM GMTBy: Paul_L_Kasriel

Today the White House updated its economic forecast from that made last November. Back then, the Bush administration was expecting real GDP growth of 2.9% in 2007 on a Q4/Q4 basis. Now it is forecasting 2007 real GDP growth of 2.3%. Given the 0.6% annualized growth in Q1, this forecast implicitly assumes average growth of 2.87% in the remaining three quarters of 2007. For 2008, the White House is forecasting even stronger growth from the assumed 2.87% over the remainder of 2007 - 3.1% for 2008. As far as I can tell by looking at the White House's annual average forecast for the 3-month T-bill rate in 2007, 4.8, it assumes no Fed interest rate cuts this year.

Today the White House updated its economic forecast from that made last November. Back then, the Bush administration was expecting real GDP growth of 2.9% in 2007 on a Q4/Q4 basis. Now it is forecasting 2007 real GDP growth of 2.3%. Given the 0.6% annualized growth in Q1, this forecast implicitly assumes average growth of 2.87% in the remaining three quarters of 2007. For 2008, the White House is forecasting even stronger growth from the assumed 2.87% over the remainder of 2007 - 3.1% for 2008. As far as I can tell by looking at the White House's annual average forecast for the 3-month T-bill rate in 2007, 4.8, it assumes no Fed interest rate cuts this year.

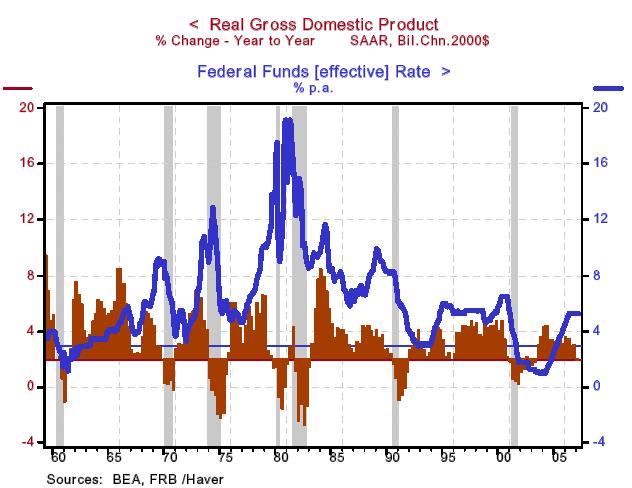

Where does the risk lie for the White House's real GDP growth forecast - above the forecast or below it? Given the White House's and the market's assumption of no Fed interest rate cuts, history suggests the White House is too optimistic in its forecast. The history is shown in the chart below. The year-over-year change in real GDP in the first quarter of this year was 1.9%. From 1960 up until today, whenever the year-over-year change in real GDP approached 1.9%, the Fed engineered a decline in the federal funds rate. Sometimes, such as in the late 1960s, mid 1980s and 1996, real GDP growth rebounded above 2.87% (the blue horizontal line in the chart). At other times, 1960, 1970, 1973, 1980, 1990 and 2001, despite the Fed interest rate cuts, real GDP growth did not rebound and an NBER-designated recession occurred.

History suggests, then, with real GDP growth as low as it currently is, a necessary condition for a rebound in growth, as assumed by the White House and, presumably, the Fed, would be some Fed interest rate cuts. But even these interest rate cuts are not a sufficient condition for the assumed rebound in real GDP growth. In short, the White House, the Fed and probably the consensus of economic forecasters are betting on an "immaculate" economic recovery.

By Paul L. Kasriel The Northern Trust Company Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.