Investment Banks CDS Derivatives Positions Deceptions, Deceit and Distrust

Stock-Markets / Credit Crisis 2009 Jul 17, 2009 - 08:07 AM GMTBy: Rob_Kirby

With the former Investment Banks being granted Commercial Banking status due to the unfolding financial crisis in late 2008 – it was widely reported in the mainstream financial press that this “change” would mean that these banks would be subject to more oversight and hence, more transparency would result regarding their derivatives activities.

With the former Investment Banks being granted Commercial Banking status due to the unfolding financial crisis in late 2008 – it was widely reported in the mainstream financial press that this “change” would mean that these banks would be subject to more oversight and hence, more transparency would result regarding their derivatives activities.

Ladies and gentlemen, nothing could be further from the truth. View the Q1 / 09 Quarterly derivatives report here.

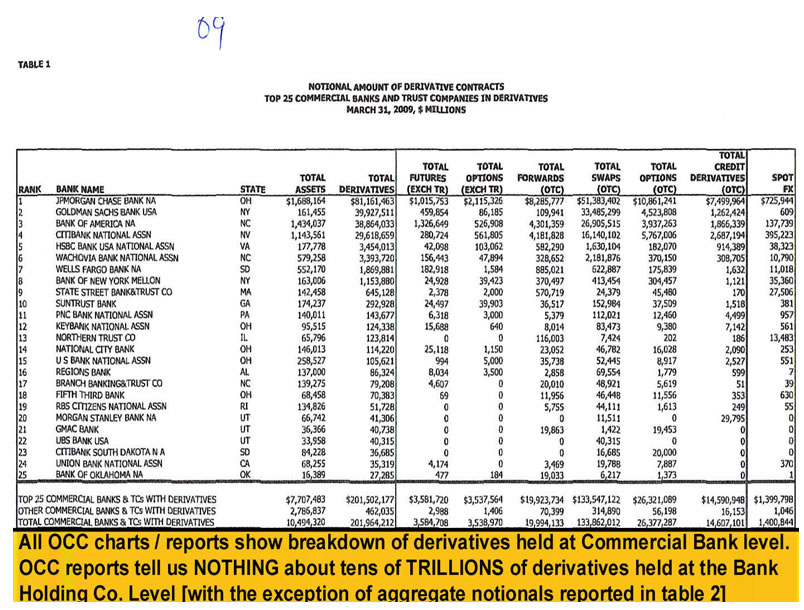

If we take a look at the latest Quarterly Derivatives Report published by the U.S. Office of the Comptroller of the Currency, in table 1, we see a detailed breakdown of the derivatives activity of the 25 largest Commercial Banks in the U.S. Take special note of the aggregate total derivatives being reported by the top 4 names on the list:

Now let’s contrast table 1 with table 2, which shows the outstanding derivatives notionals held by the top 25 Bank Holding Companies, a completely different picture [or lack of, perhaps?] emerges. The total amounts of derivatives held by the same names are, for the most part, MUCH LARGER:

The OCC Quarterly Derivatives Report provides a great deal of analysis and charts examining further breakdown of total derivatives reported by Commercial Banks; by product [precious metal, foreign exchange, interest rate], by contract type, by concentration, by credit exposure, by profitability, by revenue and by product type and maturity.

For derivatives held by many of these same U.S. institutions at the Bank Holding Company level, the OCC gets summary data only. The detailed data under the purview of the Federal Reserve and no detailed analysis is made public through the OCC or any other regulator.

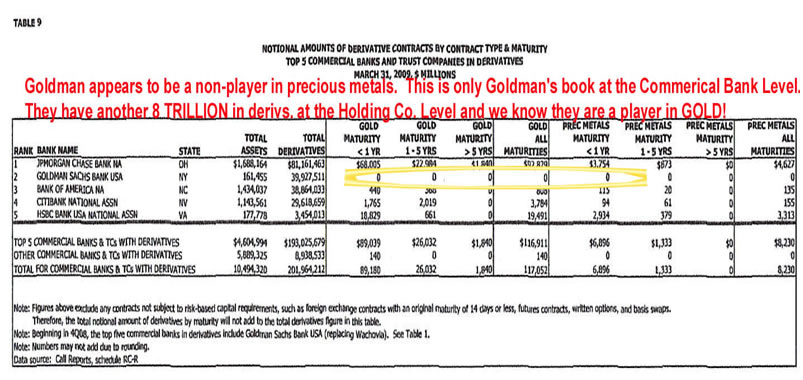

For instance, while the chart appended below DOES include / measure precious metals futures holdings of Goldman Sachs at the Commercial Bank Level, as goose-eggs across the board – it says nothing about Goldman’s holding of precious metals futures at the Holding Co. level. The same can be said for Morgan Stanley, who do not even appear on list appended below:

The above chart published by the Office of the Comptroller of the Currency would mistakenly lead us to believe that Goldman Sachs does not participate in the gold market, ditto with Morgan Stanley.

I suggest this is done intentionally to misdirect in much the same way that a group of conspirators assembled at Jekyll Island, Georgia almost 100 years ago today to frame up plans for a Private Central Bank. Knowing there was no appetite in the U.S. for a Private Central Bank, the proposed legislation was dubbed the Federal Reserve Act to give the intended Private Central Bank an air of being ‘Federal’, or, ‘of the people’ and being in possession of reserves - when in fact it was neither FEDERAL nor did not posses ANY reserves.

Deceptions like this have more recently come to be known as the HALLMARKS of American banking and finance. Why is anyone surprised? American corporations did learn from the deceptive best, didn’t they? This is a significant contributing factor as to why the international financial community has grown so displeased and distrustful of American finance.

You see folks, the truth about Goldman Sachs and Morgan Stanley is that BOTH of these institutions are MAJOR players in the precious metals futures markets – but apparently only at the Holding Company Level where we are not permitted to see the size of their holdings and the influence they exert on the market. That information remains another one of the Federal Reserve’s dirty little secrets.

This is why the New York Commodities Exchange [COMEX] has already taken provisions – CHANGING THE RULES - to allow for the delivery of ‘paper’ exchange-traded-funds in lieu of delivering physical bullion. The commodities exchanges are “supposed to be” mechanisms engaged in the price discovery of physical bullion – not paper alternatives.

The Federal Reserve has ALWAYS known the true state of the unfolding derivatives debacle. They fostered and protected its growth; Alan Greenspan used to claim that derivatives innovations gave the U.S. financial system “flexibility”.

When the false economies brought on by artificial derivatives pricing finally sunk the American financial house, an accounting change was mandated to make insolvent banks appear, for accounting purposes - they are rolling in dough. Rest assured, American banks are rolling in something – but it’s not dough.

More disingenuous clap trap – get the picture?

The Bank for International Settlements [BIS] informed me the Federal Reserve has been gathering data on the derivatives market for years:

1) OTC derivatives: The data is collected by the FED-NY from a population of more than 3,000 reporting dealers located worldwide and whose head office in the US. Reporting dealers are mainly commercial and investment banks and securities houses, including their branches and subsidiaries and other entities which are active dealers. Please be informed that due to the confidentiality policy agreed with the reporting central banks we are not allowed to disclose the list of dealers participating in the survey. Having said this, please be also informed that the FED-NY publishes in their website the documentation related to this survey, i.e. reporting forms and methodology; I believe that this documentation includes the list of reporting institutions (only head offices): http://www.newyorkfed.org/banking/reportingforms/FR_2436.html

Now, only with the former investment banks now reporting a mere “glimpse” of their interest rate swap derivatives positions [listed under “OTC Swaps” in table 2] it reinforces and validates earlier work reported in The Elephant In the Room – chronicling how the Fed has taken complete control of the entire interest rate curve [bond market] utilizing interest rate swaps books of their proxy institutions.

With new legislation currently being tabled to grant the Federal Reserve an expanded mandate and even more POWER, it is essential that the Obama Administration – that campaigned on transparency and change – DEMAND this illegitimate institution first be FULLY audited by an independent third party.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.