What's the Real CPI Inflation Rate?

Economics / Inflation Jul 14, 2009 - 03:14 AM GMTBy: Mike_Shedlock

Inquiring minds are asking "What is the Real CPI?" It's a good question, too. However, you can find many widely differing opinions. For example, you will get one answer from the government, a different answer from sites like Shadowstats, and a third opinion from me.

Inquiring minds are asking "What is the Real CPI?" It's a good question, too. However, you can find many widely differing opinions. For example, you will get one answer from the government, a different answer from sites like Shadowstats, and a third opinion from me.

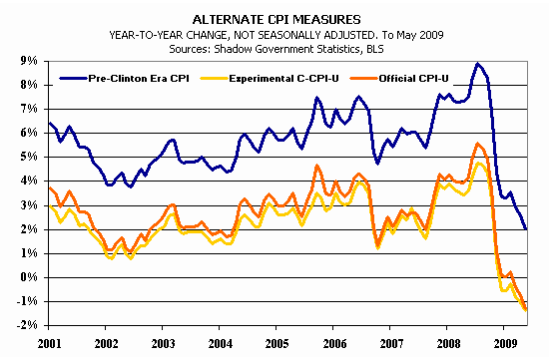

First let's look at John Williams' Shadowstats .

That's an interesting chart, especially given the hyperinflationary bent of John Williams. He pegs the CPI at 2% as of May 2009 and had it at 9% mid-2008 and right around 5% in 2007. In contrast, the official CPI was 5.5% in mid-2008 and 2+% in 2007.

The problem will all of those numbers is they fail to properly take housing into consideration. And housing has been falling like a rock.

Should housing be in the CPI? How?

Bear in mind the government considers housing a capital good not a consumption item. Based on the idea that one would be renting a house if one did not own it, the government uses Owners Equivalent Rent (OER) and not housing prices in the CPI. OER is the largest component in the CPI.

By the same measure one might argue that lawn mowers and automobiles are capital goods. Lawn mowers are durable, not immediately consumed, and if one owns buildings and uses lawn mowers to maintain their properties (or if one hired someone to cut their lawns for them), the mowers would indeed be depreciated over time as a capital expense. The same logic also applies to auto leases.

Let's explore this from a practical standpoint starting with theory.

Consumer Price Theory and Practice

Here are a few excerpts of note from the Consumer Price Index Manual, Theory and Practice By Ralph Turvey.

Page 47: The treatment of owner occupied housing is difficult and somewhat controversial. There may be no consensus on what is the best practice. The distinctive feature is that it requires the use of an extremely large fixed asset in the form of the dwelling itself.

Page 147: The treatment of owner-occupied housing is arguably the most difficult issue faced by CPI-compilers. Equally important it may be difficult to identify a single principal purpose for the CPI.

In particular, the dual use of CPIs as both macroeconomic indicators and also for indexation purposes can lead to clear tensions in designing an appropriate treatment for owner-occupied housing costs.Watch what happens when the Case-Shiller Housing Index is substituted for OER in the CPI.

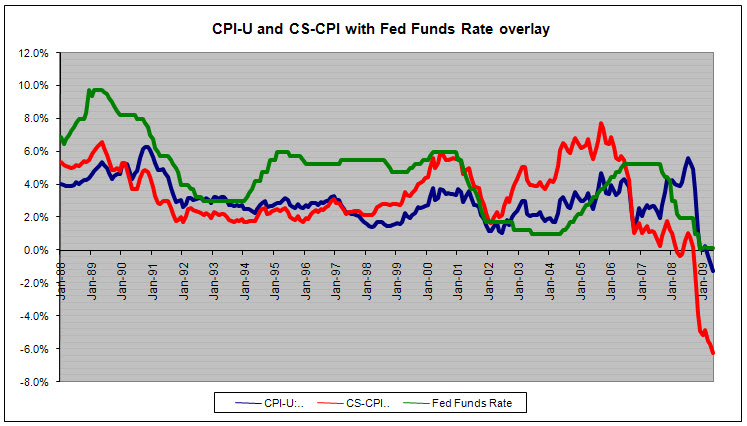

Case Shiller CPI vs. CPI-U

The above chart is courtesy of my friend "TC".

CS-CPI fell at the fastest pace on record to measure at -6.2% year over year (YOY). Meanwhile the government’s CPI-U declined at the fastest rate since the 1950s at a -1.3% YOY pace.

The diverge is to due to the government’s housing metric of Owners’ Equivalent Rent (OER) continuing to show price increases (+2.1% YOY) vs. Case-Shiller data showing price decreases (-18.1% YOY). In fact, since the housing market peak in June 2006 OER is up +7.6%, while the Case-Shiller index is down -32.6%, an amazing 4020 basis point divergence!

CS-CPI Year over year has now fallen for 8 consecutive months and 11 of the past 15. High Year over year comparison data points for the next several months will likely result in CPI deflation coming in at -7% to -8% in the coming months.

Case Shiller CPI vs. Shadowstats

Whereas John Williams had the CPI at 9% in mid-2008, the official CPI was 5.5%, while Case-Shiller CPI had the CPI at +1%.

Which one fits events happening in the credit markets, stock market, and treasury market? The answer of course is CS-CPI.

A Practical Matter

From a consumer standpoint, what's more important, home prices dropping 25% to 50% in value over the course of a few years or the price of gasoline going from $2.00 a gallon to $4.00 a gallon over the course of those same few years?

From a macroeconomic standpoint, the correct answer to the above question is housing. People complain about gas prices when they rice because they buy gasoline every week. However, the destruction of housing wealth matters far more. Here is the question to ponder: How many tanks of gas will it take to equal the loss of $50,000 on a house?

Moreover, Fed interest rate setting is a macroeconomic event. The Fed should have been paying attention to housing prices but failed to do so. Finally, the treasury markets and consumer behavior are sure acting as if housing prices belong in the CPI.

By ignoring housing prices, CPI massively understated inflation for years and the CPI is massively overstating inflation now. Thus, as both theoretical and practical matters, Greenspan and Bernanke blew it by failing to take housing prices into consideration.

This is of course just another reason why we should not have a Fed at all. Greenspan micro-mismanaged interest rates to a ridiculously low level and Bernanke went along not understanding the problem. Now we are all paying the price for this Fed Folly.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.