BRICA Wealth Demand Driving Long-term Agri-Food's Mega-trend

Commodities / Agricultural Commodities Jul 13, 2009 - 04:10 PM GMTBy: Ned_W_Schmidt

While visions of economic stability and other fantasies dance in the heads of the elves at the Federal Reserve and those in the Obama Regime, the financial markets seem to be losing momentum. Both equity markets and Gold have succumbed to the Summer heat, wilting under the Sun. But sorry that is not global warming, that is just Summer.

While visions of economic stability and other fantasies dance in the heads of the elves at the Federal Reserve and those in the Obama Regime, the financial markets seem to be losing momentum. Both equity markets and Gold have succumbed to the Summer heat, wilting under the Sun. But sorry that is not global warming, that is just Summer.

With the failing economic policies of the Obama Regime in place, investors might do better for themselves by looking beyond the current situation. Not all economies are mired in the floundering failures of North America. In other parts of the world economic growth continues, though of course it was wounded by the Western recession. The nations of BRICA, Brazil, Russia, India, China, and ASEAN, each have their own set of circumstances. However, one common characteristic they all share is that a decade from now they will all be wealthier. A decade from now they will be eating more due to that wealth. Richer people do tend to dine better. And those that satisfy those exponentially higher Agri-Food needs should be also wealthier.

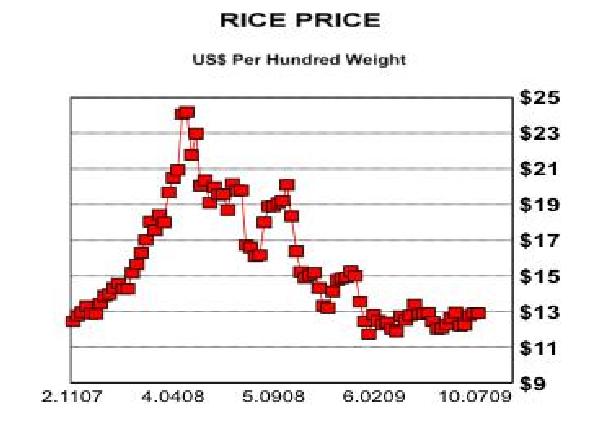

The most widely consumed grain in Agri-Foods is rice. It is especially favored by consumers in BRICA. Rice is largely consumed by the producer, or within the nation it is produced. Very little rice, relative to total global consumption, trades in international markets.

Rice prices can, therefore, act as a good barometer of the condition of the global Agri-Food system. If market price of rice is rising, the global Agri-Food system is becoming tighter. That can happen for a variety of reasons. In the case of early 2008 it was due to shortages made worse by the hedge fund mania. Shortages, from severe to mild, can move prices upward. In today’s world, an extremely mild shortage situation is suggested. India monsoon season may be a factor forcing some forward buying.

Another reason for rising rice price is increasing incomes in BRICA. If those consumers are experiencing rising prosperity, they will be buying and eating more rice. That seems to be part of the situation at the present time as price of rice found a bottom in February that has held. Also a factor has been the lingering influence of the global credit crisis which has reduced funding available to farmers around the world. As shown in the chart, price of rice has broken the down trend line that had been dominant since the end of the hedge fund mania. That condition suggests that the down trend is no longer dominant, and a new trend is emerging.

The global Agri-Food system, after productive factors came together in near optimal conditions in 2008, seems to be returning to more normal. Weather was wet for the North American planting season, delaying some planting. Indian monsoons have not maintained the published schedule as nature is prone to do. 2009 is going to be more normal, which generally means it will not be like the last. Normal is the norm, too good and too bad are not.

As 2009 fades and 2010 arrives, supply will be less dominant as a consideration and influence on Agri-Food prices. Demand, driven by higher incomes in BRICA, will become more important. The Agri-Food price lows of 2008-9, particularly for rice, may be lows of significant historical importance. World is moving into a decade when global demand for Agri-Food will dominate supply like it never has in modern history. Remember, the world only has slightly more than two and a half months of grain consumption in the bins. No room for slippage exists.

The North American planting season is now essentially done. This period of time is the one of highest optimism. Simply putting seeds in the ground may be one of mankind’s most optimistic acts. But more than that, this is the period of maximum forecaster optimism. Forecasts for acres planted and the bushels to be produced per acre are nothing more than manifestations of mental optimism. What matters is the reality in the Fall, when the combines bring it in from the fields.

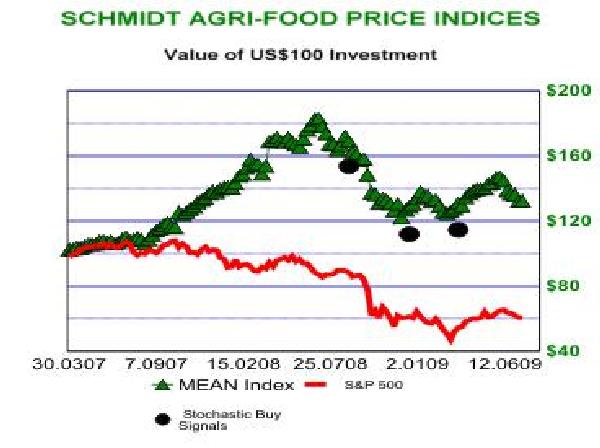

Our second graph compares the Agri-Food Price Index to the S&P 500. Market strategists that predicted the death of commodities and the reemergence of equity markets seem to have got the order of results confused. Currently, seasonal price pressures related to the North American planting season are depressing Agri-Food prices. Because of that, they are at the present deeply over sold.

In that chart are also plotted buy signals based on a stochastic oscillator for the Agri-Food Price Index. The depth of the current over sold condition suggests that another buy signal may develop in the next month or so. Most significant is that this seasonal period of price weakness may be creating an opportunity to accumulate under valued Agri-Food investments.

When last we talked, the U.S. House of Representatives had just passed the unwritten and unread American Clean Energy and Security Act of 2009(ACES), despite it being based on what is now readily acknowledged as junk science. However, as bad as this legislation may be, it might benefit Agri-Food players. ACES will raise the costs for and prices of both energy and Agri-Food. Those higher costs will be due to producers before forced to idle marginal acreage. Higher prices will be required by meat producers in order to remain in business. For those wanting to learn more about how the Global Climate Change Scam has taken control of governments, we suggest Red Hot Lies: How Global Warming Alarmists Use Threats, Fraud and Deception to Keep You Misinformed by Christopher C. Horner(2008). A dynamite book!

Gold is the natural and historical means of defending your wealth against government power. However, some nations, in particular BRICA, will continue to grow over time more than the average of the world. Investors, after acquiring Gold, need to develop an offensive component in their wealth by capturing part of that higher growth. Not all nations will be hamstrung by the anti-growth taxation policies of the Obama Regime and others. BRICA is one of those possibilities, and Agri-Food is one way of participating in expansion of those nations’ wealth. Read more at http://home.att.net/~nwschmidt/Order_AgriValueRECENT.html

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View , a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To receive the most recent issue of this publication, use this link: http://home.att.net/~nwschmidt/Order_AgriValueRECENT.html

Copyright © 2009 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.