May Retail Sales Looking Soft as Bernanke Appears To Be A Team Player

Economics / US Economy Jun 06, 2007 - 01:15 PM GMTBy: Paul_L_Kasriel

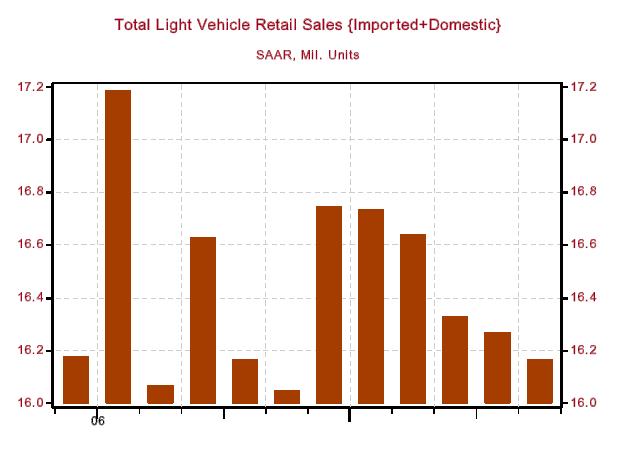

Last week we learned that seasonally-adjusted car and truck sales were down a little from April, which were down a little from March, which were down a little from February, which were down a little from January, which were down a little from December (see Chart 1). Today we learned that seasonally-adjusted chain store sales in May, according to the International Council of Shopping Centers (ICSC) were down 0.7% from April. Nominal gasoline prices may energize nominal May retail sales to be reported next week by the Census Bureau.

Last week we learned that seasonally-adjusted car and truck sales were down a little from April, which were down a little from March, which were down a little from February, which were down a little from January, which were down a little from December (see Chart 1). Today we learned that seasonally-adjusted chain store sales in May, according to the International Council of Shopping Centers (ICSC) were down 0.7% from April. Nominal gasoline prices may energize nominal May retail sales to be reported next week by the Census Bureau.

But the sales reported by the motor vehicle producers and by the ICSC suggest that May retail sales ex gasoline will be on the soft side. Real personal consumption expenditures were flat in March and were up only 0.2% in April, thanks largely to heating bills. May is shaping up to be another month of anemic real consumer spending. But the housing recession is contained? Businesses are going to go on an expansion spending spree as demand for their product dries up? It truly must be a new era.

Chart 1

Bernanke Appears To Be A Team Player

Fed Chairman gave a speech today that appeared to be nothing but the warmed-over May FOMC meeting "minutes." In fact, I have yet to observe Bernanke saying anything different about the cyclical behavior of the economy and/or near-term monetary policy from what was communicated at the FOMC meeting prior to his speech or testimony. It would appear that Bernanke makes his policy case at the FOMC meeting, not in public. He then keeps to script until the FOMC decides to revise it. In other words, Bernanke appears to be trying to rehabilitate the Federal Reserve as an institution rather than a cult of personality.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.