Weakening Stock Market Drives U.S. Dollar and Gold Trends

Stock-Markets / Financial Markets 2009 Jul 12, 2009 - 04:58 PM GMTBy: Donald_W_Dony

The recent roll over and weakness of the S&P 500 has caused traders to shift out of stocks and begin moving to the 'safe haven' of the US dollar. This action is providing the underpinning for support of the currency, which in turn, is forcing gold to fall. Throughout most of the March-to-June equity rally, money flowed out of the security of US T-Bills and into stocks. This caused the fundamentally weak dollar to drift lower which helped drive the price of gold upward. The precious metal climbed over $100 per ounce from April to June.

The recent roll over and weakness of the S&P 500 has caused traders to shift out of stocks and begin moving to the 'safe haven' of the US dollar. This action is providing the underpinning for support of the currency, which in turn, is forcing gold to fall. Throughout most of the March-to-June equity rally, money flowed out of the security of US T-Bills and into stocks. This caused the fundamentally weak dollar to drift lower which helped drive the price of gold upward. The precious metal climbed over $100 per ounce from April to June.

However, as weak fundamental data in June stressed that the economic recovery was still distant, traders started to reverse their profitable long stock positions and transfer funds back to the USD$. And as money flowed over to the big dollar, price stability developed (Chart 1). The results for gold was negative. A rising US dollar is normally detrimental for this commodity.

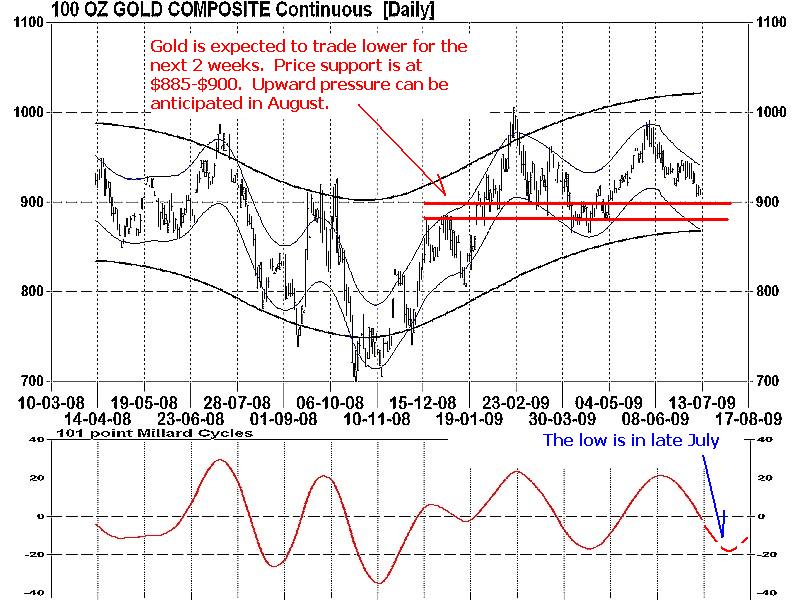

Given the linking of the S&P 500 and gold, when will the metal recover? Models for gold are suggesting that there is a low coming in late July (Chart 2). And as gold is still in a primary bull market, the probability that the yellow metal will advance back to the resistance level of $1,000 in August is high. This would also point to the likelihood of some weakness in the USD$.

The tight correlation between the three markets, stocks (the S&P 500), currencies (US dollar) and commodities (gold) during this bear market would suggest that the expected strength in gold during August should indicate some stability in stocks (S&P 500).

Bottom line: During the final phase of this severe bear market, short-term stock market activities can often be evaluated more accurately by the movements of other markets. As traders are using the big dollar as a 'safe haven' during periods of decline in equities, the ebb and flow of capital between stocks and currencies leaves a footprint on gold. This short-term mark on the commodity can help investors understand the direction of the S&P 500.

Final note. Though the short-term movements between stocks, currencies and raw materials are important, the longer-term perspective of the three markets are also vital for investors to remember. Commodities are in a secular bull market which is anticipated to last another 8-9 years. The US dollar is in an extended downward trend. Currencies always move to their fundamentals. The outlook for the dollar remains negative. The S&P 500 has been in a bear market for 9 years and is expected to stay range-bound for another 8-9 years.

See the June 10th eNews report: Alternating leadership. A long-term review of bull markets.

More research on currencies, commodities and equities is available in the July newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.