Housing Market Bottoming, Economy Recovering?

Economics / Recession 2008 - 2010 Jul 12, 2009 - 10:44 AM GMTBCA Research: US economy - it looks like a recovery

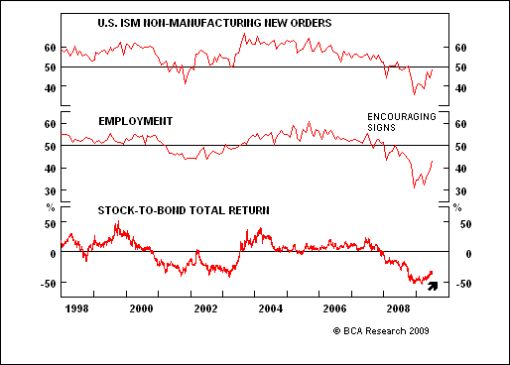

“The US economy is transitioning to a recovery path, though it will be bumpy and subdued compared with past cycles.

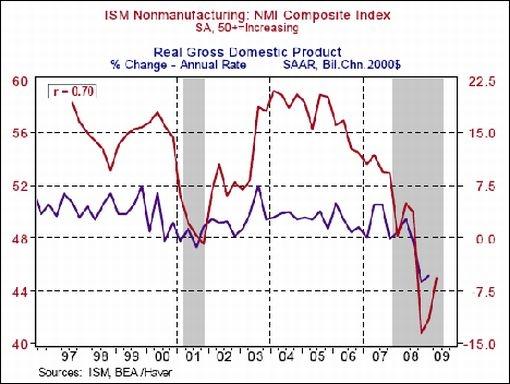

“The ISM for the non-manufacturing sector reinforced that the economy is stabilizing following the ’sudden stop’ that occurred in the fourth quarter of last year. The new orders index rose to a post-Lehman high and is probing expansionary territory, indicating companies are regaining some confidence in final demand. This is corroborated by the continuing rise in the employment component, which shows that businesses are slowing the pace of job cuts, despite June’s disappointing payroll figures.

“The ISM surveys signal that the economy is on the cusp of a recovery. Investor conviction, however, will only come with evidence that the US consumer is beginning to spend a bit more freely, which we expect to see over the next several months.”

Source: BCA Research, July 8, 2009.

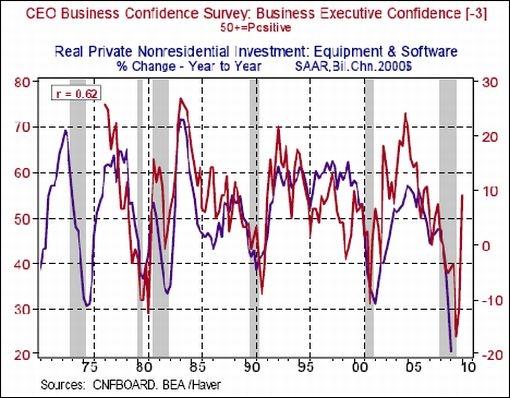

Asha Bangalore (Northern Trust): CEO Business Confidence moves up in the second quarter

“The Conference Board’s CEO Business Confidence Survey increased to 55 in the second quarter from 30 in the first quarter. The cycle low for the index is 24. The CEO Confidence Index advanced three quarters has a strong positive correlation (0.62) with the year-to-year change in equipment and software spending. Based on this historical evidence, capital spending most likely posted its worst performance in the first quarter of 2009.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 8, 2009.

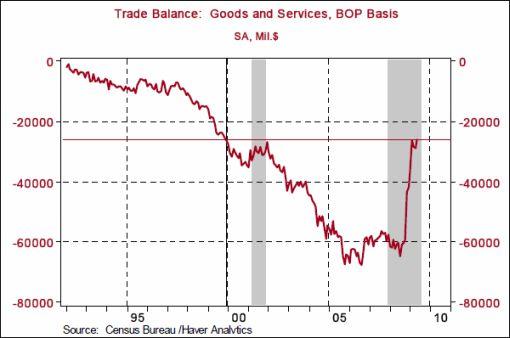

Asha Bangalore (Northern Trust): Trade gap posts significant improvement in May

“The trade deficit narrowed to $26 billion in May from $28.79 billion in April. Readings close to the May trade gap were last seen in November 1999.

“After adjusting for inflation, the trade deficit of goods narrowed to $36.2 billion. This is the smallest trade deficit since December 1999 ($35.31 billion). The significant improvement in the trade deficit is a big plus for second quarter real GDP and for the long term status of the economy.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 10, 2009.

Asha Bangalore (Northern Trust): ISM Survey points to moderation in pace of decline in economic activity

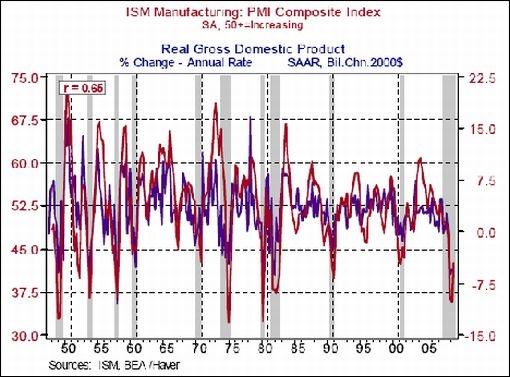

“The ISM Non-Manufacturing survey results for June indicate improving conditions in the non-manufacturing sector, with the composite index climbing 3 points to 47.0. Indexes tracking business activity (49.8 versus 42.4 in May), new orders (48.6 versus 44.4), and employment (43.4 versus 39.0) moved up in June. These readings are below 50.0 implying that the sector continues to contract but each index is moving closer to the line of demarcation between contraction and expansion suggesting that the pace of decline is moderating.

“Both the non-manufacturing and manufacturing composite indexes have a strong positive correlation with the quarter-to-quarter change in real GDP. The recent moderation in these composite indexes points to a moderation in the pace at which real GDP is declining.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 6, 2009.

Bill King (The King Report): Labor situation much worse than headline numbers depict

“Net of the Concurrent Seasonal Factor Bias and net of distortions built into the reporting by the Birth-Death Model, the June jobs loss likely exceeded 700,000.

“John Williams (Shadow Government Statistics) on the goofy B/D Model: ‘The system was not designed to accommodate recessions, but the benchmark revisions tended to show a pattern of fairly consistent overstatement with the annual revisions, regardless of the business cycle. During the reporting cycle covering the 1990 to 1991 recession, a particularly large downward benchmark revision in previously reported payrolls levels was blamed partially on the BLS assuming that companies that had stopped reporting during the recession still were in business, with proportionate payroll employment attributed to them by the BLS. The problem was that much of the non-reporting reflected companies going out of business. The bulk of that modeling was based on periods of economic growth.

“‘The unadjusted annual decline in June payrolls was the deepest since a similar decline at the trough of the 1958 recession, but still shy of the 4.9% trough seen in the 1949 downturn. When the 1949 annual low growth is broken, possibly next month, the annual percentage contraction in payrolls will be the most severe since the production shutdown following World War II.’”

Source: John Williams, Shadow Government Statistics (via The King Report), July 6, 2009.

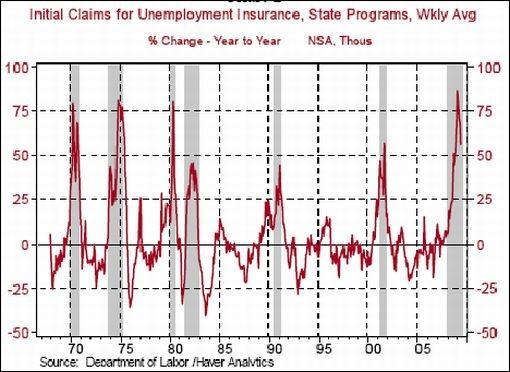

Asha Bangalore (Northern Trust): Initial Jobless Claims report - seasonally distortion

“Initial jobless claims fell 52,000 to 565,000 for the week ended July 4. Seasonal distortions arising from the smaller-than-expected layoffs in the auto sector and the holiday shortened week are cited as reasons for the large drop in the seasonally adjusted data.

“Using seasonally unadjusted jobless claims numbers eliminates the problem of interpreting data with seasonal distortions. Seasonally unadjusted data indicate that on a year-to-year basis, initial jobless claims advanced 56% in June versus larger gains in the prior months. The peak appears to have occurred in February (86% yoy increase). The chart below points out that the worst in the labor market is most likely behind us.

“Continuing claims, which lag initial claims by one week, increased 159,000 to 6.883 million and the insured unemployment rate rose to 5.1% from 5.0% in the prior week.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 9, 2009.

Yahoo Finance: Retailers report weak June sales

“Escalating job worries and rainy weather dampened shoppers’ appetite for buying summer staples like shorts and dresses, resulting in sharper-than-expected sales declines for many merchants in June and increasing concerns about the back-to-school shopping season.

“As retailers reported their monthly figures Thursday, the weakness cut across all sectors but hit mall-based clothing stores particularly hard.

“Same-store sales - sales at stores open at least a year - are considered a key indicator of a retailer’s health.

“‘Consumers are under severe pressure on the job front, so discretionary spending is just not happening,’ said Ken Perkins, president of retail consulting firm Retail Metrics.

“… financial worries are clearly discouraging shoppers too. The latest federal jobs report, which showed wages shrinking and higher job losses than expected in June, is increasing concerns about consumers’ ability to spend in the months ahead.”

Source: Anne D’Innocenzio, Yahoo Finance, July 9, 2009.

Asha Bangalore (Northern Trust): Consumer outlook turns a bit sour once again

“The University of Michigan Consumer Sentiment Index fell to 64.6 in the early-July survey from 70.8 in June. Both the Current Conditions Index (70.4 versus 73.2 in June) and the Expectations Index (60.9 versus 69.2 in June) dropped in July. The decline in the Consumer Expectations Index is a big negative for the July Index of Leading Economic Indicators. The latest outlook of consumers has turned grim after showing improvements during five of the six months ended June.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 10, 2009.

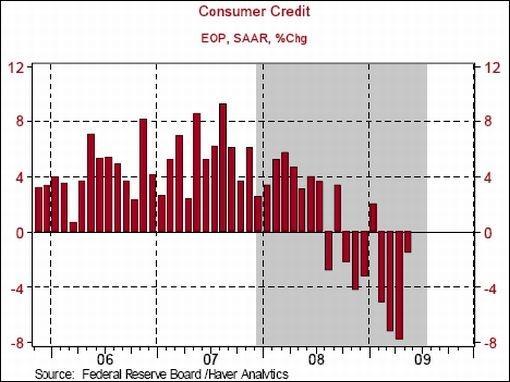

Asha Bangalore (Northern Trust): Consumers continue to borrow less but pace of decline is notable

“Consumer credit declined at an annual rate of 1.5% in May, after a 7.8% plunge in April and a 7.3% drop in March. The consumer deleveraging trend commenced in August 2008. The small decline in borrowing after a larger drop in prior months suggests that household balance sheets are mending which is a big plus for consumer spending, albeit not immediately. The important point is that the preferred trend in consumer borrowing is emerging.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 8, 2009.

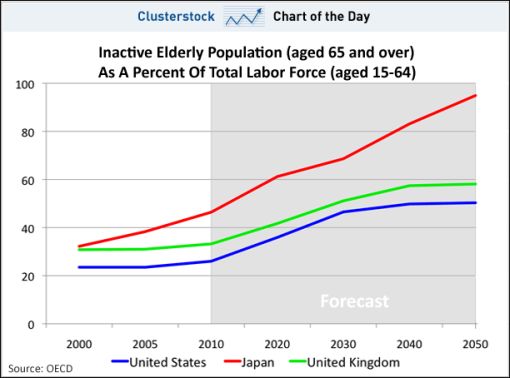

Clusterstock: Hey, America, get ready to support your parents

“While the official retirement age in the US is 66, the majority of workers retire at 64 and draw their pensions for 16 years on average. Currently, there are about four American workers for every person who is 65 and over, and retired. This ratio will change significantly in the next 40 years putting a strain on our pension system as there will be about two workers per retiree.

“But the US and the UK still have better odds than aging Japan, which will have 1:1 ratio by 2050.”

Source: Kamelia Angelova, Clusterstock, July 10, 2009.

Asha Bangalore (Northern Trust): Mortgage Purchase Index suggests an increase in home sales during June

“The Mortgage Purchase Index of Mortgage Bankers Association increased 6.7% to 285.6 during the week ended July 3. The important news is that this index has risen in seven of the last ten weeks. The Pending Home Sales Index (PHSI) has risen in each of the four months ended May. The upshot is that it should not be surprising to see an increase in home sales in June when the sales reports are published later in the month. The chart below indicates the positive relationship between home sales and the Purchase Index. The PHSI points to a likely increase in home sales in July; the Purchase Index of the next few weeks should help to confirm this forecast.

“Multiple applications for the same property and a reduction in the number of mortgage bankers distorted the Purchase Index in 2007. The Mortgage Refinance Index also advanced 15.2% in the latest weekly tally.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, July 8, 2009.

Bloomberg: Delinquencies on US home-equity loans reach record

“Late payments on home-equity loans rose to a record in the first quarter as 18 straight months of job losses and a slumping economy left more borrowers unable to pay their debts, the American Bankers Association reported.

“Delinquencies on home-equity loans climbed to 3.52% of all accounts from 3.03% in the fourth quarter, and late payments on home-equity lines of credit climbed to a record 1.89%, the group reported today. An index of eight types of loans rose for a fourth straight quarter, to 3.23% from 3.22% in October through December, the group said.

“‘The number one driver of delinquencies is job losses, which we’ve seen build and build,’ James Chessen, the group’s chief economist, said in a telephone interview. ‘Delinquencies won’t come down without a dramatic improvement in the economy and businesses will have to start hiring again.’”

Source: Margaret Chadbourn, Bloomberg, July 7, 2009.

Bloomberg: Distressed commercial property in US doubles to $108 billion

“Commercial properties in the US valued at more than $108 billion are now in default, foreclosure or bankruptcy, almost double than at the start of the year, Real Capital Analytics said.

“There were 5,315 buildings in financial distress at the end of June, the New York-based real estate research firm said in a report issued today. That’s more than twice the number of troubled properties at the end of 2008.

“Hotels and retail properties are among the most ‘problematic’ assets following bankruptcy filings by mall owner General Growth Properties and Extended Stay America, according to the report. The scarcity of credit is causing property defaults in all regions and among every investor type, Real Capital said.

“‘Perhaps more alarming than the rapid growth in the distress totals is the very modest rate at which troubled situations are being resolved,’ the report said.

“About $4.1 billion of commercial properties have emerged from distress, according to Real Capital.

“‘In far more situations, modifications and short-term extensions are being granted, but these can hardly be considered resolved, only delayed,” the study said.”

Source: David Levitt, Bloomberg, July 8, 2009.

Bloomberg: Goldman trading-code investment put at risk by theft

“Goldman Sachs Group Inc. may lose its investment in a proprietary trading code and millions of dollars from increased competition if software allegedly stolen by a former employee gets into the wrong hands, a prosecutor said.

“Sergey Aleynikov, an ex-Goldman Sachs computer programmer, was arrested July 3 after arriving at Liberty International Airport in Newark, New Jersey, US officials said. Aleynikov, 39, who has dual American and Russian citizenship, is charged in a criminal complaint with stealing the trading software. Teza Technologies LLC, a Chicago-based firm co-founded by a former Citadel Investment Group LLC trader, said it suspended Aleynikov, who started there on July 2.

“At a court appearance July 4 in Manhattan, Assistant US Attorney Joseph Facciponti told a federal judge that Aleynikov’s alleged theft poses a risk to US markets. Aleynikov transferred the code, which is worth millions of dollars, to a computer server in Germany, and others may have had access to it, Facciponti said, adding that New York-based Goldman Sachs may be harmed if the software is disseminated.

“‘The bank has raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways,’ Facciponti said, according to a recording of the hearing made public today. ‘The copy in Germany is still out there, and we at this time do not know who else has access to it.’

“The proprietary code lets the firm do ’sophisticated, high-speed and high-volume trades on various stock and commodities markets,’ prosecutors said in court papers. The trades generate ‘many millions of dollars’ each year.”

Source: David Glovin and Christine Harper, Bloomberg, July 6, 2009.

Bloomberg: Stealing secrets from Goldman Sachs

“Former Goldman programmer Sergey Aleynikov arrested for theft charges on July 3.”

Source: Bloomberg (via YouTube), July 9, 2009.

Bespoke: Investment grade corporate bonds holding up well

“Even though equity markets have pulled back since the June 12 top, investment grade corporate bonds have continued to perform well. Below is a year-to-date price chart of LQD, which is an ETF that tracks the investment grade corporate bond market. Since bottoming in early March, the ETF has been in a very strong uptrend, bouncing off of the bottom and top of an upward sloping channel as it has worked its way higher. While the S&P 500 is off more than 7% from its recent high, LQD is on the verge of breaking out to a six-month high.”

Source: Bespoke, July 9, 2009.

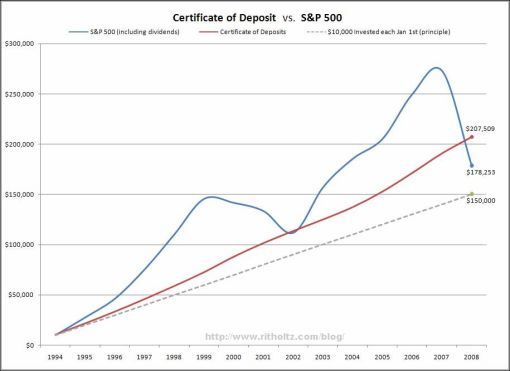

Barry Ritholtz (The Big Picture): S&P 500 vs CDs (1994-2008)

“Imagine two people who added $10,000 to their investment accounts on January 1, every year for the past 15 years.

“One of them is risk averse. They put the money into Certificates of Deposits, getting a few percentage points each year, but the principal is insured.

“The other is less risk averse; they put money into an S&P 500 Index each year.

Stocks versus Certificates of Deposit (1994-2008)

“CDs in 2009 yield 1%-2%, as the market fell and then rally; if the S&P doesn’t perform well for the rest of this year, CDs will have more gains again.

“As of March, bonds had outperformed stocks from 1968 to 2009 - 40 years.”

Source: Barry Ritholtz, The Big Picture, July 7, 2009.

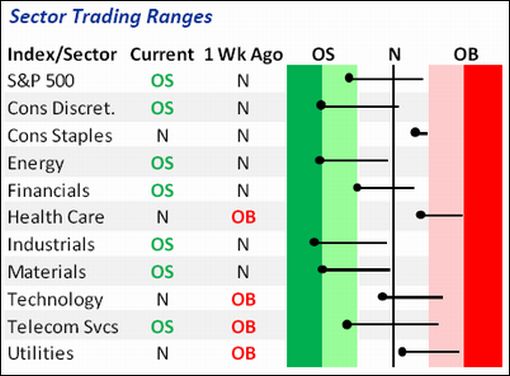

Bespoke: Oversold market reaching extremes

“The graphic below shows the current levels as well as the one week change in the trading ranges of the S&P 500 and its ten sectors. The circles represent where the sectors and index currently stand, while the tail represents where it was one week ago. When the circle is in the red zone, the sector or index is overbought (light red = overbought, dark red-extreme overbought). Readings in the green zone indicate that the index or sector is oversold (light green = oversold, dark green = extreme oversold). For this analysis, overbought and oversold measures are defined as one standard deviation above or below the index’s 50-day moving average.

“Following the recent declines, the S&P 500 has now moved into oversold territory for the first time since March 11. On a sector basis, only two (Health Care and Consumer Staples) are currently above their 50-DMAs, while eight are below. Of the eight trading below their 50-days, six are currently oversold, and four of those (Consumer Discretionary, Energy, Industrials, and Materials) have reached ‘extreme’ oversold levels (two standard deviations below 50-DMA). Like the overall market, it has been a while since this many sectors were ‘extremely’ oversold. You have to go all the way back to the March 9 low to find a day when more sectors were oversold. If you’re bearish, this is the break you’ve been looking for, while if you’ve been waiting for a correction to get in, now is your chance.”

Source: Bespoke, July 8, 2009.

Bespoke: Just 24% of S&P 500 stocks are above their 50-day moving averages

“After resting above 75% for most of the past three months, the percentage of stocks above their 50-day moving averages in the S&P 500 has tanked to just 24%. There are currently zero stocks in the Energy and Telecom sectors that are trading above their 50-days. Industrials are the third worst at 3%, followed by Financials at 6% and Materials at 7%. Utilities, Consumer Staples and Health Care are all above 60%, so there has been quite a bit of rotation during this market pullback. The last time the overall numbers were this weak, all sectors were down in the dumps.”

Source: Bespoke, July 8, 2009.

Financial Times: Morgan Stanley lifts equities

“Improvements in market conditions over the past few weeks have led Teun Draaisma, equity strategist at Morgan Stanley, to shift from an ‘underweight’ position on equities to ‘neutral’.

“But he adds: ‘We are keeping an open mind and not turning outright bullish, as there are still plenty of uncertainties related to US housing, European earnings, the European banking system, the default cycle, Chinese growth and policy action.’

“Lower bond yields, a pull back in sentiment and falling equity prices are among the factors that have led Morgan Stanley to move 5% of their weighting from government bonds to equities.

“But with stronger signals still needed to take a stance on market direction either way, Mr Draaisma argues there are ‘plenty of opportunities to make money beyond the market direction call’ by pursuing a strategy that he describes as ‘the middle ground’.

“‘Macro and the next big market move has become everyone’s favourite investment topic over the past two years. We suspect it is time to move on to the micro of sectors, stocks and styles.’

“Among a large ‘middle ground’ of investment opportunities include ‘the forgotten market’ Japan and ’sectors that are cheap and under-owned with improving fundamentals’ such as utilities, telcos and energy. Also ‘buying stocks with a management change, financial restructuring or a change of focus can be very lucrative’.”

Source: Teun Draaisma, Financial Times, July 6, 2009.

Richard Russell (Dow Theory Letters): March lows to be tested

“I’ve given this next statement a lot of thought. I don’t think most analysts understand the amazing power and tenacity of the great primary trend of the market. Most of today’s analysts have had no experience with bear markets. We’re now in a primary bear market. Most people believe that if the government or the Fed does this or that, the bear market can be halted or reversed. Nothing could be further from the truth.

“The fact is that in the market, nothing is more powerful or insistent than the great primary trend. The primary trend can best be compared with the tide of the ocean. All man’s efforts to thwart or turn the tide are like so many sand castles built on the edge of the nearest waves. The incoming tide will wash all the sand castles away, if not with the first wave then with the second or the third. Thus, the incoming tide will conquer all.

“This is why all of Obama’s and Bernanke’s and Geithner’s ’sand castles’ will be washed away by the bear market. All that will be left will be crippled corporations and monster debts.

“Obama believes that Roosevelt with his spending and alphabet agencies ended the Great Depression. Sorry, President Obama, you are wrong. The Great Bear market and Depression finally ended when the bear market died of exhaustion on July 8, 1932. That was the day when the D-J Industrial Average halted its decline at Dow 41.22. At that time, the Dow provided a dividend yield of 10.2%. That’s when the bear market actually ended. It ended the way all bear markets do - in utter exhaustion.

“On another subject, I’ve felt all along that the government and the Fed should have allowed this bear market to run its course, rather than wasting trillions of dollars in an attempt to halt the bear market. Perhaps politically, this would have been impossible, but in the end it would have been better for the nation.

“Accordingly, although I certainly do not want to see the March lows violated, my studies suggest that the odds favor an eventual breaking of the March lows and then a much lower bear market.

“Sorry, those are my deepest and most truthful thoughts.”

Richard Russell (Dow Theory Letters): Gold looks interesting

“Below we see a daily chart of gold going back six months. The 50-day MA is rising and above the rising red 200-day MA. RSI and MACD are in bullish positions, and it remains to be seen whether gold will (once again) try for the ‘over-one-thousand area’.

“Below is a weekly picture showing the huge ‘head-and-shoulders’ pattern that has formed in gold. The obvious question is whether gold can rally to break out above the resistance at roughly 1,000. This is a potentially very powerful formation, and gold is at an exciting juncture. Hard to believe that this formation won’t eventually break out to the upside, but gold is the most emotional of all tradable items. The Fed does not want to see gold spurt higher, and there’s no telling what the Fed might do to halt gold’s progress.

“The supreme irony is that the Fed and the government want a lower devalued dollar, but they don’t want the world to see what they’re doing via surging gold.”

Source: Richard Russell, Dow Theory Letters, July 6, 2009.

David Fuller (Fullermoney): Risky assets temporarily in retreat

“Recently we have seen an unwinding of speculative positions in crude oil and many other commodities.

“Inevitably, this will influence monetary policy decisions, including quantitative easing, taken by many governments. Commodity price inflation is temporarily in retreat once again. The stock market correction will subdue talk of economic ‘green shoots’. Consequently government long-dated bond yields are retreating once again in what I believe will be a base formation extension phase. For instance, the US 10-year bond yield nearly doubled in rising from a low just above 2% in December 2008 to a high fractionally over 4% last month. A mean reversion towards 3% should not surprise us.

“While these recent trend reversals continue, many governments are likely to increase their efforts to cushion economic recession and stem the advance in unemployment figures. This will not be easy, as we have already seen. Nevertheless, having embarked on the road of quantitative easing, they are unlikely to change course until commodity prices, stock market indices and particularly long-dated government bond yields are strengthening once again.”

Source: David Fuller, Fullermoney, July 8, 2009.

Jeffrey Saut (Raymond James): Cautious, but not bearish “

The call for this week: We think the world is changing; and, changing VERY rapidly. Ergo, we suggest thinking more strategically, which would be in accord with the aforementioned points. That said, we also believe there will be tactical opportunities for the well prepared investor in the months ahead. Tactically, we are currently cautious, but not bearish, as we await opportunistic points to enhance our capital. Overall, we are optimistic, believing the worst is in the rear-view mirror as we anticipate a better future. Indeed, the future is coming, but only you can decide where it is going …

Source: Jeffrey Saut, Raymond James, July 6, 2009.

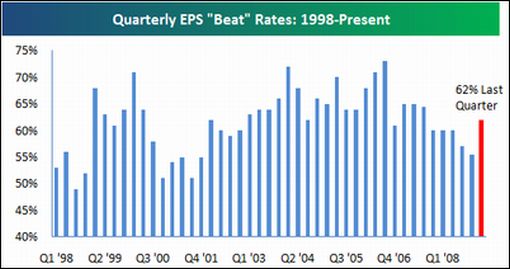

Bespoke: 62% is the magic number

“If the market is going to be able to trade higher this earnings season, the percentage of companies beating earnings estimates needs to be equal to or higher than the 62% reading we saw last quarter. The market did well during the last earnings season because the earnings beat rate finally saw a quarter over quarter increase. Prior to the 62% reading, the number had gone down every quarter since the second quarter of 2007 when the bear market started. It’s going to be hard to top 62% because analysts have been raising earnings estimates instead of cutting them this quarter.”

Source: Bespoke, July 9, 2009.

MoneyNews: Zoellick - dollar reserve currency not at risk

“The US dollar’s role as a global reserve currency is not currently at risk but Washington should heed concerns about its large and growing budget deficit, World Bank President Robert Zoellick said on Tuesday.

“‘The US should take all these (remarks by) commentators as serious statements about the need to preserve the unique status of the dollar as a reserve currency,’ Zoellick said in an interview with Reuters by telephone ahead of a G8 leaders’ summit in Italy.

“‘That means making sure, that after the stimulus plans, to restore fiscal discipline and have a sound monetary policy,’ he added.

“China, Russia and Brazil have said they will use this week’s summit to push their view that the world needs to start seeking a new global reserve currency as an alternative to the dollar.

“However, G8 sources told Reuters they do not expect a serious discussion on the issue.”

Source: MoneyNews, July 7, 2009.

Fin24: Zimbabwe puts rand on table again

“The Zimbabwean government put the adoption of the rand back on to the table with the country’s industry and commerce minister saying the option would be debated.

“Welshman Ncube, industry and commerce minister, was quoted by Reuters to have said on Tuesday that the country could not ‘… re-enter the Zimbabwe dollar without the economy to support that’.

“‘We need another solution. We cannot continue forever with multiple currencies,’ Ncube said. He was addressing an Africa forum in Zimbabwe.

“‘If we can at least join rand monetary union, we will have money allocated to Zimbabwe through that system,’ he said.

“The Zimbabwean dollar was abandoned at the beginning of the year, when runaway inflation and a thriving black market rendered the dollar virtually useless. The issue of Zimbabwe using the rand as its bespoke currency hit the news at the turn of the year but after several weeks of speculation the matter was ditched.

“Dawie Roodt, an analyst at Efficient Group said Zimbabwe does not have the means to peg its currency to the rand. ‘Whether they do it with or without the South African government’s permission, they need large currency reserves to enact such a plan, which don’t exist,’ he said.

“According to Roodt, Zimbabwe needs to focus on rebuilding its institutions to ensure a proper democracy, before any real improvement in the economy will be seen.”

Source: Leani Wessels, Fin24, July 7, 2009.

Financial Times: G8 shifts focus from food aid to farming

“The G8 countries will this week announce a ‘food security initiative’ at their summit, committing more than $12 billion for agricultural development over the next three years, in a move that signals a further shift from food aid to long-term investments in farming in the developing world.

“The US and Japan will provide the bulk of the funding, with $3-4 billion each, with the rest coming from Europe and Canada, according to United Nations officials and Group of Eight diplomats briefed on the ‘L’Aquila Food Security Initiative’ - named after the Italian town where the summit is being held. Officials said that it would more than triple spending.

“At the summit beginning on Wednesday, G8 leaders will pledge to reverse ‘the tendency of decreasing official development aid and national financing to agriculture’, according to the draft declaration seen by the FT.

“‘The combined effect of long-standing underinvestment in agriculture and food security, price trends and the economic crisis have led to increased hunger,’ it states. ‘Food security is closely connected with economic growth and social progress as well as with political stability.’

“The G8 initiative underscores Washington’s new approach to fighting global hunger, reversing a two-decades-old policy focused almost exclusively on food aid. Hillary Clinton, US secretary of state, and Tom Vilsack, the agriculture secretary, have highlighted the shifting emphasis in recent speeches.”

Source : Javier Blas, Financial Times, July 6, 2009.

Peter Hickson (UBS): Cyclical recovery for metals

“Metals prices are expected to weaken in the third quarter as China completes re-stocking and its government becomes more cautious on loan growth - but Peter Hickson, analyst at UBS, expects commodity markets to benefit from a broad cyclical upswing later this year.

“‘We expect global economic growth to accelerate into 2011 as the full impact of stimulus programmes and accommodative monetary policies takes effect,’ says Mr Hickson.

“UBS has revised higher its metals and bulk commodity price forecasts for 2010.

“Among the biggest movers include copper, up 43% to $5,500 a tonne, silver, also up 43% to $18.30 a troy ounce, and nickel, up 33% to $700 a tonne.

“The copper market will remain tightly balanced for the foreseeable future as Chinese re-stocking prevents a sizeable inventory surplus from accumulating. But after buying between 500,000 and 700,000 tonnes of copper in the first half of 2009, Mr Hickson says China is now ‘overstocked’.

“China’s State Reserve Bureau has offered to sell up to 100,000 tonnes of copper back to the market and a significant portion of the stockpiles will be used to satisfy domestic demand.”

Source: Peter Hickson, UBS (via Financial Times), July 7, 2009.

MarketWatch: Regulator to consider limits on commodity speculators

“In their biggest move yet to respond to irregular swings in oil and other commodity prices the past few years, market regulators are considering imposing a range of controls including limits on investments by exchange-traded funds and index investors.

“The Commodity Futures Trading Commission said Tuesday it will hold a series of hearings this summer on whether to limit investor positions in commodities to address the speculation that has roiled prices of everything from oil to wheat and corn in the last few years. The regulatory focus comes in the wake of trading patterns that saw oil jump to almost $150 a barrel last year, only to fall back to below $40 this spring before rising again to $70.

“Big pension and endowment funds in recent years have diversified their investments into commodities to hedge against inflation and a weaker dollar. Some positions grew so large that legislators and analysts said the trend was pushing oil prices to levels that couldn’t be justified by fundamentals.

“A MarketWatch analysis last week showed that passive investors increased their crude-oil holdings to the equivalent of more than 600 million barrels in June, up more than 30% from the end of last year, likely supporting the climb in oil prices.

“The Futures Industry Association, an industry group representing brokers, hedge funds and other futures market participants, said in a statement that it hopes the CFTC’s hearings ‘will address public concerns about the impact of speculation on futures market prices without causing these markets to become less fair, open and efficient’.

“‘FIA would be concerned by any measures to bar legitimate participants from these markets or that would make it less efficient for US corporations to use futures as a tool for managing price risk,’ it added.”

Source: Moming Zhou and Christina Burton, MarketWatch, July 7, 2009.

The New York Times: US-Russia nuclear agreement is first step in broad effort

“President Obama signed an agreement on Monday to cut American and Russian strategic nuclear arsenals by at least one-quarter, a first step in a broader effort intended to reduce the threat of such weapons drastically and to prevent their further spread to unstable regions.

“Mr. Obama, on his first visit to Russia since taking office, and President Dmitri Medvedev agreed on the basic terms of a treaty to reduce the number of warheads and missiles to the lowest levels since the early years of the cold war.

“The new treaty, to be finished by December, would be subject to ratification by the Senate and could then lead to talks next year on more substantial reductions.

“The progress reflected an effort to re-establish ties a year after Russia’s war with Georgia left the relationship more strained than at any time since the fall of the Soviet Union. The two sides agreed to resume military contacts suspended after the Georgia war and sealed a deal allowing the United States to send thousands of flights of troops and weapons to Afghanistan through Russian airspace each year.

“They remained at loggerheads over American plans to build a missile defense system in Eastern Europe, which Washington describes as a hedge against an Iranian nuclear breakthrough and which Russia vehemently opposes as a threat in its backyard.

“But after hours of meetings at the Kremlin, the presidents agreed to conduct a joint assessment of any Iranian threat and presented a united front against the spread of nuclear weapons.

“Mr. Obama hailed the arms agreement as an example for the world as he pursued a broader agenda aimed at countering - and eventually eliminating - the spread of nuclear weapons, a goal he hopes to make a defining legacy of his presidency.”

Source: Clifford Levy and Peter Baker, The New York Times, July 6, 2009.

Financial Times: Obama urges end to Cold War distrust

“Barack Obama on Tuesday called on Russia and the US to shake off Cold War distrust and forge a new global partnership as he bid to ‘reset’ strained relations between the two countries. Quentin Peel, international affairs editor, talks to Daniel Garrahan about whether Mr Obama’s trip has been a success.”

Source: Financial Times, July 7, 2009.

Financial Times: Bern to block UBS record transfer to US

“The Swiss government on Wednesday waded into the legal battle between UBS and the US authorities by saying it would forbid the bank from handing over confidential client information, if a crucial court case next week required it.

“Bern warned it might go as far as confiscating the data, should a US court in Miami rule the bank was obliged to transfer the client names requested.

“The move marks a major escalation in the war of words between Bern and Washington over US demands that UBS hand over names of up to 52,000 US taxpayers holding offshore accounts in Switzerland.

“Although the Swiss government is not directly involved, Bern is represented as a ‘friend of the court’. In a filing revealed Wednesday, the government warned it would issue a blocking order and, if necessary, confiscate all relevant material, to prevent UBS from complying, should the Miami court side with the US authorities.

“‘The enforcement of the summons would require UBS to violate Swiss law,’ it said.

“UBS has argued such matters are best handled bilaterally between governments. The US has contended its action is valid, as UBS has admitted that Switzerland-based bankers broke US laws when visiting clients in America.

“Last February, UBS agreed to pay $780 million to settle a separate, but linked, criminal action by the US authorities. However, a civil case requiring the bank to reveal up to 52,000 client identities remained open, culminating in next week’s hearings.

“Swiss ministers have acknowledged UBS made mistakes in soliciting business from US clients and have recognised the bank will face heavy penalties. Observers expect an out-of-court settlement, involving heavy fines and possibly other sanctions. But while the bank has long appeared ready for a deal, the US has held out for names, raising pressure on UBS and turning the affair into a diplomatic issue.”

Source: Haig Simonian, Financial Times, July 8, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.