Crude Oil Looks Weak, both Technically and Fundamentally

Commodities / Crude Oil Jul 10, 2009 - 10:52 AM GMTBy: Mike_Shedlock

As hyperinflationists scream from the top of their lungs about the rebound in oil prices, others calmly note Japan’s Producer Prices Fell a Record 6.6% in June.

As hyperinflationists scream from the top of their lungs about the rebound in oil prices, others calmly note Japan’s Producer Prices Fell a Record 6.6% in June.

Japan’s producer prices fell at a record pace in June as oil costs declined and companies required fewer materials amid a global recession. The costs companies pay for commodities and unfinished goods tumbled 6.6 percent from a year earlier after sliding a revised 5.5 percent in May, the Bank of Japan said today in Tokyo.

The year-on-year drop in costs was the biggest since the central bank started compiling the report in 1960. Prices fell 0.3 percent in June from May, when they declined a revised 0.5 percent, today’s report said.

Consumer prices excluding fresh food, the central bank’s preferred gauge of inflation, fell 1.1 percent in May from a year earlier, the sharpest decrease since comparable figures were first compiled in 1971. Corporate service prices dropped a record 3 percent.

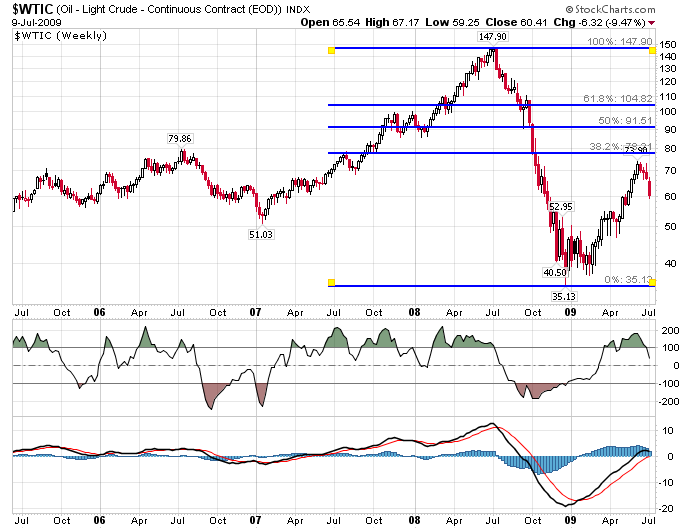

$WTIC Light Sweet Crude - Weekly Chart

While the rebound looks impressive on a log chart, Fibonacci retrace levels show the real story. Crude oil price did not even muster the strength to get to the 38.2% retrace level.

Moreover, technicals are now pointing down as evidenced by the moving average convergence/divergence (MACD) and and commodity channel index (CCI) in the above chart. A pullback to $50 or even $40 is certainly not out of the equation. And if that happens, expect to see media concerns over deflation.

The truth is the rebound in oil prices proved nothing in regards to the inflation/deflation debate, nor will a retest of the December lows prove anything should it happen.

Inflation is a monetary event not a price event. And even if inflation was regarded as a price event Speculation In China Does Not Constitute Inflation In The US.

Oil is subject to peak oil concerns, increasing demand from China, and speculative pressures. As such, in isolation, the price of oil is a poor measure for inflation regardless of what ones view of inflation and deflation is.

For traders, the technicals and the fundamentals both look weak.

Green shoots are withering on the vine, fuel supplies are rising, Crude oil supply far outstrips motorist demand, tankers at sea act as floating storage, and the technicals look awful. For now, that is what matters. Peak oil be damned.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.