Iceland's Banking Crisis: The Meltdown of an Interventionist Financial System

Economics / Credit Crisis 2008 Jul 09, 2009 - 12:43 PM GMTBy: MISES

By Philipp Bagus and David Howden: [Editor note: If you are interested in helping to fund the writing, publication, and distribution of a longer version of this article, with more technical detail and analytics, please write the development department.]

By Philipp Bagus and David Howden: [Editor note: If you are interested in helping to fund the writing, publication, and distribution of a longer version of this article, with more technical detail and analytics, please write the development department.]

Icelandic Prime Minister Geir Haarde's resignation on January 23rd of this year marked the first political casualty of the current financial crisis. While the Icelandic situation has received scant attention relative to other calamities reverberating through the world's financial markets, the source of Iceland's woes can be found in many of the same locales. Unfortunately, while the events affecting Iceland's populace have been severe, the country's diminutive size — approximately 320,000 residents — has made it a target all too easy to miss. However, the repercussions on both the country's native Icelanders as well as global financial markets give reason to dedicate serious attention to the causes, and cures, of this unfortunate and wholly avoidable event.

Icelandic Prime Minister Geir Haarde's resignation on January 23rd of this year marked the first political casualty of the current financial crisis. While the Icelandic situation has received scant attention relative to other calamities reverberating through the world's financial markets, the source of Iceland's woes can be found in many of the same locales. Unfortunately, while the events affecting Iceland's populace have been severe, the country's diminutive size — approximately 320,000 residents — has made it a target all too easy to miss. However, the repercussions on both the country's native Icelanders as well as global financial markets give reason to dedicate serious attention to the causes, and cures, of this unfortunate and wholly avoidable event.

Regrettably, the current focus on the causes of the crisis continually misidentifies its true source, resulting in prescribed cures that fall short of the necessary actions. Peter Gumbel writing for the December 4th, 2008, edition of Fortune reckons previous Prime Minister Davíð Oddsson's free-market reforms during his 1991–2004 years in office are what ultimately gave rise to the bust. Likewise, the IMF's mission chief sent to Iceland to survey the nature of the problem, Poul Thomsen, recently commented in an interview that the root problem in Iceland was an unregulated environment that allowed an oversized banking system to develop.[1] Indeed, the post-privatization banking experienced in Iceland resulted in a banking sector that saw assets increase to over 1,400% of GDP!

What analysts and authors commonly miss is the reason the banking sector could expand so rapidly. Indeed, as we shall see, the incentive structure of the Icelandic economy was manipulated through government guarantees, artificially low interest rates, and monetary spigots opened wide, allowing liquidity to be flushed through the economy. In addition, Iceland's homeowners were offered tantalizingly low interest rates through the "Housing Financing Fund" (HFF), a state agency that enjoyed explicit government guarantees on its debt, resulting in reduced interest charges for homeowners. Interestingly, while the Fund's merely implicitly guaranteed American counterparts — Freddie Mac and Fannie Mae — have been the center of much controversy, the HFF has remained relatively unscathed.

The policy prescriptions in the wake of the crisis have called for more interventions, which will prove to exacerbate the situation if put into effect. Only by gaining a true understanding of the unsustainable and artificial nature of the boom of the past decade may we arrive at effective solutions to navigate the bust that engulfs the country.

Maturity Mismatching and Artificial Booms

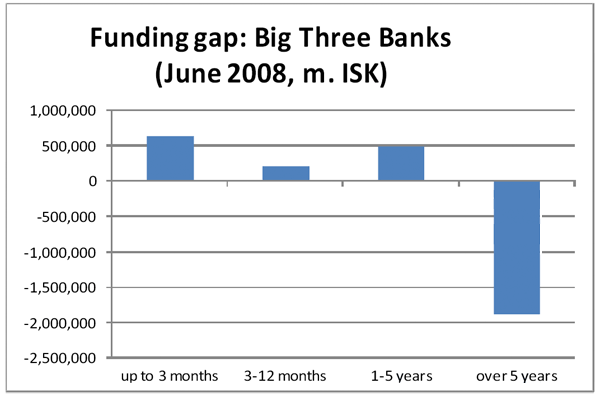

Iceland's crisis shares a common bond with those that have infected other developed economies recently: all have banking systems heavily engaged in the practice of maturity mismatching. In other words, Icelandic banks issued short-term liabilities in order to invest in long-term assets, as can be seen in figure 1, which presents the funding gaps (i.e., liabilities less assets) of a given maturity for the three largest Icelandic banks — Kaupthing, Glitnir, and Landsbanki.[2]

Figure 1: Funding gap: Big Three Banks (in million króna)

Source: Kaupthing, Glitnir, Landsbanki: 2008 annual reports

Thus, the banking system had to continuously roll over (renew) their short-term liabilities until their long-term assets fully matured. If an event arose whereby Icelandic banks failed to find new borrowers to continue rolling over their liabilities, they could face a liquidity crisis and, more importantly, spark the collapse of the Icelandic financial system; recent events have borne out this exact scenario.

Considering these recent events, the question that immediately comes to mind is, why did Icelandic banks engage in such a risky practice in the first place? First of all, maturity mismatching can turn out to be a very profitable business, involving a basic interest arbitrage. Normally, long-term interest rates are higher than their corresponding short-term rates. A bank may then profit the difference — the spread between short- and long-term rates — through these transactions. Yet, while maturity mismatching can turn out to be profitable, it is very risky as the short-term debts require continual reinvestment (i.e., a continual "rollover" must occur).

As in other countries, Icelandic banks enjoyed guarantees by the government to bail them out should their bets on the market turn erroneous. However, while this guarantee is merely implicit in most developed economies, the CBI committed to it explicitly.[3] The Central Bank of Iceland effectively functioned as the "roller-over of last resort," providing fresh short-term debt as the market required it. Indeed, the three main Icelandic banks — Kaupthing, Glitnir, and Landsbanki — were so big in comparison to the GDP that they could regard themselves as too big to fail. This led to moral-hazard problems: If we have rollover problems threatening our solvency, someone — be it the government or the central bank — will come to help us, lest a detrimental shock reverberate through the financial community. The result of this explicit guarantee was excessive maturity mismatching.

The most obvious effect of this undertaking is that it represents a financially unsound practice and may lead to banking-system instability. However, another even more important effect of excessive levels of maturity-mismatched loans is that it leads to distortions in the real economy by distorting the capital structure, as demonstrated by Austrian business-cycle theory. By expanding credit, banks create demand deposits (zero maturity) in order to invest in loans issued to the public (longer-term maturity). A similar maturity mismatch occurred, as we shall see, when Icelandic banks borrowed in (mainly international) wholesale markets (via short-term interbank loans and repurchase agreements, asset-backed commercial paper, etc.) in order to investment in long-term loans, such as commercial and residential mortgages.[4]

The ultimate problem with maturity mismatching is that there are insufficient savings available to finish the artificially high number of projects undertaken. Lenders have only saved for 3 months (i.e., the term of the commercial paper) or not saved at all (i.e., the term of the deposit), and not for 30 or 40 years (i.e., the term of the mortgage or capital project). Maturity mismatching deceives both investors and entrepreneurs about the available amount of real long-term savings. Hence, by borrowing short and lending long, long-term interest rates are artificially reduced. Entrepreneurs think that more long-term savings are available than really exist and accordingly engage in malinvestments that must be liquidated, once it becomes obvious that there are not enough real savings to sustain them to completion.

In the Icelandic case, the malinvestments were made mainly in the aluminum and construction industries. Both aluminum mines and residential and commercial housing represent long-term investment projects that were financed by short-term funds and not by savings of an equal term.

Another consequence of malinvestment was that resources were drawn into the financial sector, which expanded enormously. Thus, resources were redirected from consumer goods' industries into the financial sector. As one professor noted, fishermen became investment bankers to meet the insatiable demands of the newly profitable financial sector:

"Everyone was learning Black-Scholes" (the option-pricing model), says Ragnar Arnason, a professor of fishing economics at the University of Iceland, who watched students flee the economics of fishing for the economics of money. "The schools of engineering and math were offering courses on financial engineering. We had hundreds and hundreds of people studying finance."[5]

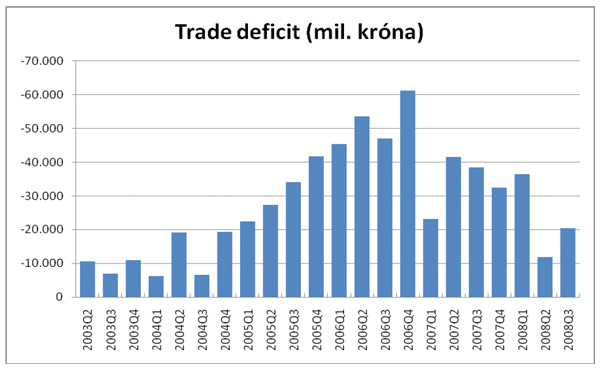

As a result, Iceland became an exporter of financial services and an importer of goods. As Iceland basically stopped producing "real" goods and services, a substantial trade deficit developed, as shown in figure 2.

Figure 2: Balance of Trade (in million króna)

Source: Central Bank of Iceland, Statistics (2009)

This distorted structure of production threatened to "starve" the population during the currency breakdown last fall when Iceland had problems obtaining foreign exchange to pay for the imports the country had become so reliant on consuming.

However, maturity mismatching alone does not explain the Icelandic case sufficiently. As domestic funds for profitable maturity mismatching were limited in Iceland's small economy while the financial sector was booming, banks started to look elsewhere for funds. Thus, Icelandic banks borrowed foreign short-term funds to invest them for the long term, both domestically and internationally. This was even more attractive as domestic interest rates were higher than those of foreign central banks, which had undertaken even more extreme cases of loose-money policies. This leads us to the second and more specific problem of Iceland: currency mismatching.

Who Lends to the Lender of Last Resort?

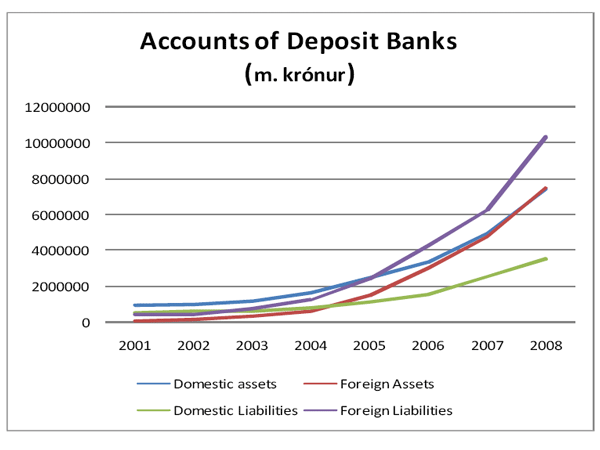

Over the past decade, the Icelandic financial system had accumulated a significant portion of its funding requirements in foreign currencies. In figure 3, we can see the evolution of Icelandic deposit banks' accounts at the CBI through the end of 2008. Most shockingly, we may draw attention to the increase in foreign liabilities that occurred over the seven-year period, resulting in a 2,300% increase. Domestic liabilities, in contrast, also saw a significant 600% increase — the result of low nominal interest rates, which hovered near zero when factored for inflation. The evolution of bank assets may seem reserved by comparison with Icelandic foreign assets, now only approximately the same size as domestic assets. However, looking at the relative positions from just seven years ago, we see the much more "normal" position financial institutions prefer to be in — large asset holdings in the domestic currency to minimize risks from exchange-rate shocks. Indeed, foreign assets become the asset class that ballooned as much as any other, increasing a staggering 10,600% over the period!

Figure 3: Accounts of Deposit Banks at the central bank (in million króna)

Source: Central Bank of Iceland, 2008 annual report

One main source of external funding was Japanese-yen-denominated loans.[6] The Bank of Japan has pursued a loose monetary policy for many years to combat an extended period of recession. As a result of these artificially low borrowing rates, yen-denominated loans could be obtained for historically low yields — sometimes as low as 1% per annum. As a result of these attractive yields, an ample amount of short-term liquidity was available, which in turn was invested in the now-famous maturity mismatch. As long as the liquidity remained high, Icelandic banks faced no problem continually obtaining new short-term funding. However, as the interbank lending markets dried up last year after the collapse of Lehman Brothers, Icelandic banks found themselves unable to cover the short fall.

One problematic area this foreign borrowing filtered into was the domestic mortgage market. In fact, this particularly complex market went through a period of intensely discoordinating occurrences over the past decade, resulting in the detrimental results now apparent.

The Housing Financing Fund (HFF), formed in 1999 to take over the assets and obligations of the previous State Housing Board, lent domestic mortgages to Icelanders. By mid-2004, almost 90% of Icelandic households held an HFF loan, and HFF issued bonds dominated over half of the Icelandic domestic bond market. While in many other countries, state-controlled mortgage-assistance schemes were reserved for those deemed most in need, Icelandic society — one that prides itself on treating everyone equally — saw no need to discriminate between those who should receive assistance and those who should not.

Iceland's newly privatized banks, led by the big three, found themselves unable to compete with the state-supported system based on low interest rates alone. Instead, they increasingly were forced to reduce the quality of the collateral posted on their mortgages, an occurrence that resulted in a general underpricing of risk.

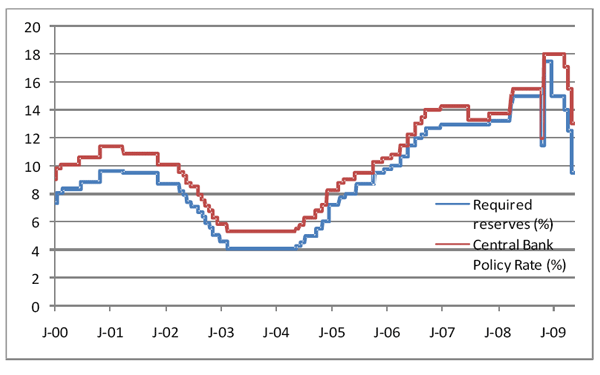

Mortgage market lending was further exacerbated by two central-bank policies. First, a central-bank reduction in the reserve requirements in place in the country's fractional-reserve banking system (as shown in figure 4) caused a sudden availability of liquidity in the financial market, resulting in many banks requiring a place to park the extra liquidity (Hunt, Tchaidze and Westin 2005: 33n8).

Figure 4: Required reserves (%) and the CBI's policy rate (%)

Source: Central Bank of Iceland, Statistics (2009)

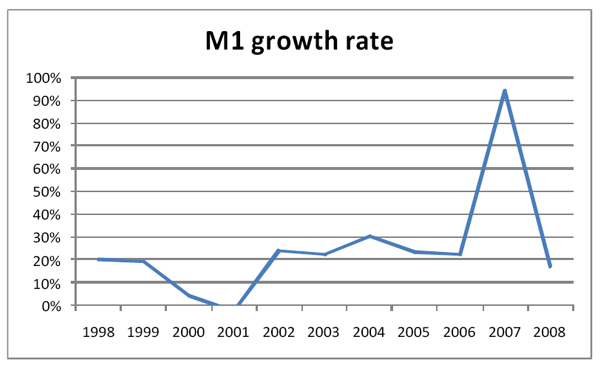

Second, an extremely accommodating monetary policy — both domestically and internationally — made ample quantities of liquidity available to be borrowed and invested. In Iceland's specific case, broad-based monetary aggregates such as M1, grew at a rate of 20–30% per annum every year between 2002 and 2007 (figure 5).[7]

Figure 5: M1 growth rate (%)

Source: Central Bank of Iceland, Statistics (2009)

Additionally, about half of the borrowing in Iceland carried short-term flexible interest rates, made at appealing low interest rates, artificially reduced by the central bank. With a bountiful quantity of liquidity available at historically low prices, the outlets of this monetary expansion saw their values rise to ever greater heights. The average house price in Iceland saw its value increase almost 30% in domestic króna, and every year between 2003 and 2007 saw a greater-than 10% annual price appreciation.

A significant boom had materialized, much of it realized in foreign currency at captivatingly low interest rates. However, when the house of cards finally came tumbling down, this boom sustained on foreign currencies soon came to an end. With the bankruptcy of American financial-service provider Lehman Brothers, the banks that had engaged in maturity mismatching — the essence of the Icelandic model — found themselves in a squeeze to roll over the necessary funds to maintain liquidity. Unfortunately, unlike many other areas of the world where quantitative easing by the central bank has provided short-lived relief, Iceland was forced to suffer a much more dire fate. The island's currency — the króna — plunged in value, making bankers, both private and central, unable to raise the cash necessary to continue funding their liabilities.

Before asking why the Central Bank of Iceland has been so ineffective in mitigating the current crisis, it is important to point out that the drying up of liquidity and the ensuing negative effects on financial assets' values by stopping the necessary rollover did not occur by pure accident, as many economists seem to think. Rather, it was triggered by the malinvestments that were caused by the mismatching practices — both maturity and currency — in the first place. When commodity and housing prices started to fall and consumer goods' prices soared, it became obvious that many assets of the Icelandic banking system would lose value and that the structure of production of Iceland had to be readjusted accordingly. This triggered the run on the króna that ended the rollover.

Conclusion

In the end, a banking system once thought to be "too big to fail" was quickly seen as the white elephant it was — "too big to bail." The liabilities of the banking system had been induced to make a shift from domestic to foreign assets, which bred detrimental misallocations in the real economy. Furthermore, the relative increase in profit in the banking sector caused many Icelandic resources to shift from the real economy — once dominated by marine activities — to the more modern world of banking and finance. These imbalances will take time to repair themselves, as the real economy must revert back to a sustainable structure, conducive to the desires and preferences of consumers. Indeed, as one fisherman-turned-banker recently commented, "I think it is easier to take someone in the fishing industry and teach him about currency trading, than to take someone from the banking industry and teach them how to fish" (Lewis 2009). Disruptions to this essential process will cause undue duress and prolonged hardship for the Icelandic people.

Many analysts were caught completely off guard by the recent turmoil — epitomized by the Icelandic experience. Three IMF economists — Robert Tchaidze, Anthony Annett, and Li Lian Ong — almost identified the problem two years ago, noting, "Foreign currency borrowing has been growing strongly … and this could potentially become an important indirect credit risk for banks" (2007). While they were quite correct as this potentiality became reality, the indirect risk is decidedly more direct than once thought. Economists are only now awakening to the true risks involved in currency mismatching; however, the larger problem — maturity mismatching — still proceeds unabated.

The systemic misallocations in the real structure of production — those activities that provide the livelihood of the Icelandic residents — were disrupted as severely as anywhere else on the globe by the maturity mismatching undertaken. While it may be all too easy at this juncture to blame the bankers' ignorance and arrogance concerning this risky procedure as the cause of the consequent disaster, the root cause lies in a more concealed location. Bankers, at least in the past, have been well aware of the risks of this procedure. In fact, the "golden rule" of banking dates back over 150 years — the term of the loans a bank grants should be equal to the term of the loans a bank receives (Hübner 1854).

Government interventions are at the root of the problem as they disrupt the incentive structure that bankers face, limiting their propensity to abide by this sensible practice. The explicit guarantee by the Central Bank of Iceland altered bankers' risk preferences, and resulted in the risky undertaking being gingerly assumed to be sustainable. The continual liquidity injections by the central bank ensured that rolling over short-term loans would not pose a significant problem. Finally, the collaborative effort of all central banks over the past decade to reduce interest rates to historically low levels had ingrained in individuals' minds that cheap credit could drive a boom towards ever greater heights. The events of the past year have demonstrated conclusively the fallacy of this viewpoint.

Unfortunately, most policy recommendations to Iceland have been undertaken with little to no knowledge as to the true source of the bust. Willem Buiter and Anne Sibert (2008) have completed the most complete analysis of the Icelandic crisis to date. By only dealing with the evident issues, they deem the real downfall of Iceland to have been a central bank unable to issue the necessary credit when the need arose. Hence, as a recommendation, they believe Iceland should look towards joining the European Monetary Union in order to gain a central bank credible as a lender of last resort. What they fail to realize, unfortunately for those who will listen to their prescription, is that the boom was unsustainable from the start; prolonging it will only offer temporary relief, if any at all. The misallocations of capital disrupted the productive portion of the economy in ways that could not prevail indefinitely, given the preferences of Icelanders as well as foreigners. The moral hazard created by the diminutive Icelandic central bank has already provided us with a spectacular blowup; are we to believe that the moral hazard guaranteed by the European Central Bank will be any less malign?

Instead, we find that the solution is not a central bank as a lender or roller-over of last resort, but, as Ludwig von Mises had already stated in 1912, the solution is rather that banks conform to the golden rule of banking:

For the activity of the banks as negotiators of credit the golden rule holds, that an organic connection must be created between the credit transactions and the debit transactions. The credit that the bank grants must correspond quantitatively and qualitatively to the credit that it takes up. More exactly expressed, "The date on which the bank's obligations fall due must not precede the date on which its corresponding claims can be realized." Only thus can the danger of insolvency be avoided. (The Theory of Money and Credit)

The fatality of the banking practices of mismatching assets and liabilities has been exposed. Let's hope that the calls of some do not exacerbate the situation by allowing it, indeed prompting it, to flourish further.

Philipp Bagus is an associate professor at Universidad Rey Juan Carlos, Madrid and a visiting professor at Prague University. Send him mail. See his article archives.

David Howden is a PhD candidate at the Universidad Rey Juan Carlos, in Madrid, and winner of the Mises Institute's Douglas E. French Prize. Send him mail. See his article archives.

Comment on the blog.![]()

Helpful input from Juliusz Jablecki is greatly acknowledged.

References

Andersen, Camilla. 2008. "Iceland Gets Help to Recover from Historic Crisis." IMF Survey Magazine 37(12). December 2.

Bagus, Philipp and David Howden. 2009. "The Legitimacy of Loan Maturity Mismatching: A Risky, but not Fraudulent, Undertaking." Journal of Business Ethics.

Buiter, Willem H., and Anne Sibert. 2008. "The Iceland banking crisis and what to do about it: The lender of last resort theory of optimal currency areas." CEPR Policy Insight, 26.

Central Bank of Iceland. 2001. "New Act on the Central Bank of Iceland." Press Release November 13.

Gumbel, Peter. 2008. "Iceland: The Country that become a hedge fund." Fortune, December 4.

Hunt, Benjamin, Robert Tchaidze, and Ann-Margret Westin. 2005. Iceland: Selected Issues. IMF Country Report No. 05/366.

Hübner, Otto. 1854. Die Banken. Leipzig: Verlag Heinrich Hübner.

Lewis, Michael. 2009. "Wall Street on the Tundra." Vanity Fair, April.

Mises, Ludwig von. [1912] The Theory of Money and Credit.

Tchaidze, Robert, Anthony Annett, and Li Lian Ong. 2007. "Iceland: Selected Issues." IMF Country Report No. 07/296.

Notes

[1] See Andersen (2008) for the full IMF interview.

[2] These three largest banks dominated the Icelandic financial landscape, with assets which ballooned to 1100% of Icelandic GDP in 2007 (Buiter and Sibert 2008:4) and comprised nearly 80% of total Icelandic banking assets.

[3] See CBI (2001) for the press release which, among other things, promises a new era of price stability through an inflation targeting framework, and the formal provision of lender of last resort functions.

[4] There exist, however, important differences between credit expansion and other types of maturity mismatching in that credit expansion always increases the money supply. Furthermore, an initially created unbacked demand deposit may lead to a far greater expansion of demand deposits if the rest of the banking system follows suit. Other types of maturity mismatching do not increase the money supply. Another difference lies in the ethical status of the practices. Credit expansion can be regarded as fraudulent in nature, while borrowing short and lending long (i.e., maturity mismatching) is merely risky. On this point see Bagus and Howden (2009).

[5] As quoted in Lewis (2009).

[6] As Buiter and Sibert (2008: 16) report, approximately 80% of foreign currency loans made to households were denominated in the two currencies with the lowest interest rates — Swiss Francs and Japanese yen.

[7] Additionally, even government agencies such as the HFF provided liquidity to an already saturated system. In 2005 alone, the Fund funneled its own excess liquidity to commercial banks by extending loans of approximately 80 billion krónur.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.