Comparing Job Losses and Investment Opportunities in Post WWII Recessions

Stock-Markets / Stocks Bear Market Jul 08, 2009 - 01:58 PM GMTBy: Mike_Shedlock

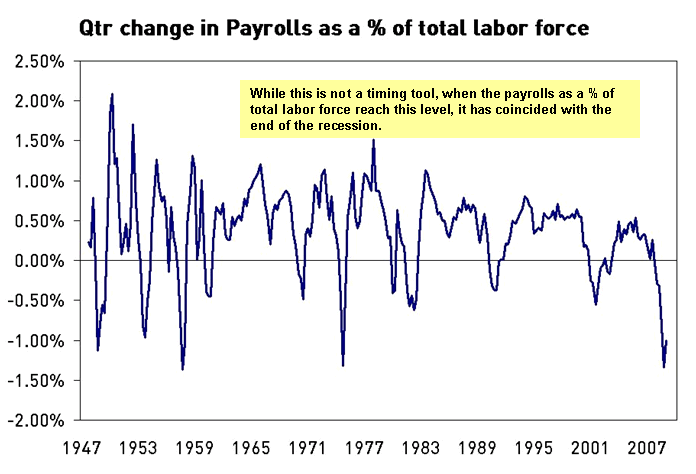

Minyanville Professor Tony Dwyer posted an interesting chart yesterday about recessions and payrolls that is worth a look.

Minyanville Professor Tony Dwyer posted an interesting chart yesterday about recessions and payrolls that is worth a look.

Professor Dywer commented:

"The long awaited correction is finally showing up in the index prices. The equity market has been weakening internally since mid-April following a historic rally off the March low. I continue to expect the market to follow the 2002-2003 playbook that suggests the S&P 500 (SPX) should move back toward the mid-to-low 800s as the non-government credit markets continue to improve and hold the historic gains.

I've been waiting for the correction to become a more aggressive buyer as long as credit held the gains. The dramatic government intervention and historic improvement in credit, coupled with the cash buildup by investors should protect the downside and lead to a second half rally, while a weak economic recovery should keep the market from running too far ahead of itself into 2010.

While the correction may cause many to focus on the still problematic economic influences, the good news is the 2nd derivative improvement in just about all the macroeconomic indicators suggests the recession is very close to being over.

As an example, since the 1940's, every time the quarterly change in payrolls adjusted for the size of the labor force reaches a low and turns, it was the last quarter of the recession. The significant headwinds facing the consumer should limit the economic recovery, but there is sure to be a least a temporary recovery that should show up in higher stock prices by the end of the year.

I've been waiting for the correction to use the liquidity as an opportunity to become more aggressive and see no reason to change that plan. When the SPX moves back toward the mid-to-low 800s, I'll add to equity market exposure with a particular focus in Information Technology and Health Care."Everyone it seems is waiting to buy the dip. Can it be that easy?

Perhaps it can, as the herd is often right. However, recessions since 2000 don't exactly seem to be playing out like other post WWII recessions.

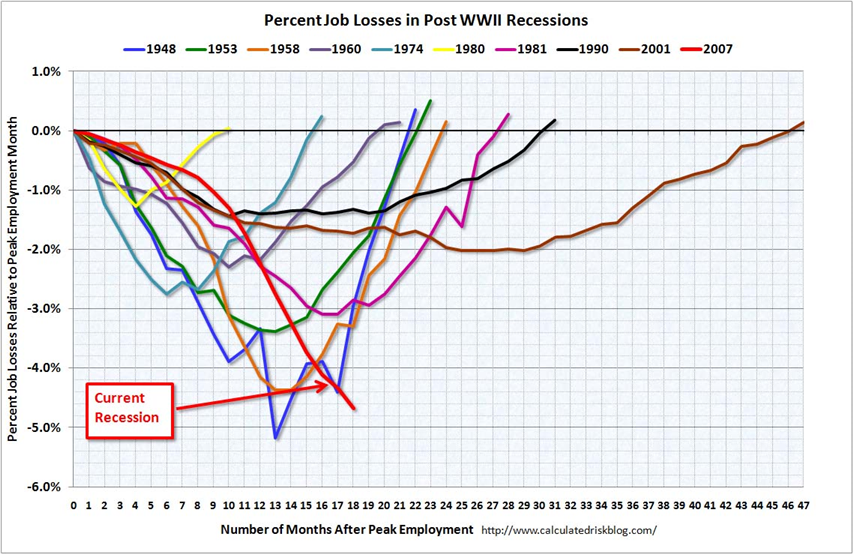

Please consider the following chart from Calculated Risk on Job Losses In Post WWII Recessions.

The above chart shows that this recession is not comparable to other post WW2 downturns. Indeed, modern day payroll data are not directly comparable with any of the data prior to 1990.

Perhaps the recession is over soon, but given the shape of the curves above, can we expect a typical recovery in the stock market and the economy? There certainly may be a recovery that will show up in stock prices by the end of the year, but being sure of a rally is a bit overconfident.

The bottom could indeed be in, even thought it fundamentally does not feel like it should be.

The model I think we may be following looks like this.

Nikkei Japan Index 1980-Present

Technically there is room for huge rallies, but there is also room for plenty of misery (for both bulls and bears). The key will be to stay nimble as the opportunities that present themselves may not follow traditional post WWII recovery patterns.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.