U.S. State Budget Gaps and Investment Implications

Economics / Recession 2008 - 2010 Jul 07, 2009 - 07:59 PM GMTBy: Richard_Shaw

State budgets are a shambles. Sales taxes, corporate taxes, personal income taxes and other taxes are being raised all over the country. The budget problems and consequential taxes will impact municipal bond rates and default risk, and after-tax investment returns on many forms of investment.

State budgets are a shambles. Sales taxes, corporate taxes, personal income taxes and other taxes are being raised all over the country. The budget problems and consequential taxes will impact municipal bond rates and default risk, and after-tax investment returns on many forms of investment.

California Muni Money Funds:

We have been advising our California clients holding reserve assets in California tax-exempt money funds to consider moving assets to a national tax-exempt money fund or a taxable money fund while California works out its problems. It’s one thing to take credit risk and interest rate risk in muni bonds intentionally, but if parking cash for safe keeping is the goal, the default risk (albeit perhaps temporary) or the the risk of being paid in IOU’s is just not worth holding reserve in California muni money market funds at this time.

California On The Ropes:

Reuters (June 19, 2009) “California… faces the prospect of a “multi-notch” downgrade in its credit rating if the state’s legislature fails to act quickly to produce a budget, Moody’s Investors Service warned on Friday. … The state’s current A2 credit rating is Moody’s sixth-highest investment grade and makes California the lowest rated of the 50 states. … The A2 rating is just five notches above speculative status and Moody’s raised the potential for the rating to tumble toward “junk” status if lawmakers fail to quickly produce a budget for Governor Arnold Schwarzenegger to sign.”

New York Times (June 19, 2009) [on the Moody's statement] “The warning follows a similar one from Standard & Poor’s, which put the state on a negative credit watch earlier this week because of its dismal financial condition.”

If California did receive multiple level downgrades (from A2), they could be rated at the same or lower level than Puerto Rico (rated Baa1). If you’d like to know your state’s Moody’s rating, drop us a line naming your state and we’ll send it along.

Moody’s Long-Term Rating Scale and Definitions:

Aaa: Obligations rated Aaa are judged to be of the highest quality, with minimal credit risk.

Aa: Obligations rated Aa are judged to be of high quality and are subject to very low credit risk.

A: Obligations rated A are considered upper-medium grade and are subject to low credit risk.

Baa: Obligations rated Baa are subject to moderate credit risk. They are considered medium-grade and as such may possess certain speculative characteristics.

Ba: Obligations rated Ba are judged to have speculative elements and are subject to substantial credit risk.

B: Obligations rated B are considered speculative and are subject to high credit risk.

Caa: Obligations rated Caa are judged to be of poor standing and are subject to very high credit risk.

Ca: Obligations rated Ca are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest.

C: Obligations rated C are the lowest rated class of bonds and are typically in default, with little prospect for recovery of principal or interest.

Moody’s appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aa through Caa.

Federal Intervention:

We have speculated an adverse set of scenarios for muni bonds nationally, based on plausible federal intervention in state finances and federal assault on tax-exempt income — Build America Bonds being the camel’s nose under the tent (see our article, “Bye-Bye Muni Bonds? Muni-TARP To Follow?“).

Sorry State of the States:

Here is an excerpt from Barron’s this weekend that summarizes the terrible condition of the state budgets.

Barron’s (July 6, 2009) by Alan Abelson “… California, with a budget deficit of over $24 billion and counting and a fractious legislature that can’t agree on what to do about it. Running dangerously low on cash and credit, the state has resorted to IOUs for the first time since 1992, and temporarily shut down its offices three days a month, placing employees on an abbreviated workweek, increasing the bite from their paychecks this year to 14%.

As David and Jay Levy observe in their latest edition of the Levy Forecast, “The entire state and local government sector, representing about 15% of the economy, is starting a contraction like none other in postwar history.” Citing estimates by the National Conference of State Legislatures, they reckon that the states had a combined deficit approaching $102 billion in fiscal ‘09 and in the new fiscal year will find themselves a cool $121 billion in the red.

And those daunting figures … do not count the multi-trillion-dollar problem of unfunded future retiree benefits, nor the revenue shortfalls of local governments, including school districts.

… The bottom line is glum. “The state and local government crisis,” they predict, “will worsen, scaring the municipal finance market, creating a divisive national debate on federal aid to states and shaking household confidence in hard-hit areas by forcing painful cuts in basic public services.”

The National Conference of State Legislators (www.ncsl.org) had this to say on June 25th about state budget gaps;

“… half of the states are projecting a cumulative shortfall of $121.2 billion for FY 2010, a gap likely to grow as more states assemble revenue and expenditure forecasts for the coming fiscal period. The state fiscal situation is rapidly deteriorating and the figures for fiscal year FY 2009 and FY 2010 have moved from sobering to distressing.”

In April they said,

“States have been hammered by the national recession and will end up resolving a cumulative budget gap exceeding $281 billion, according to the National Conference of State Legislatures’ (NCSL) new report on state budgets. Gaps began opening in fiscal year (FY) 2008, and are expected to continue through FY 2011 and beyond. … When enacting their budgets for FY 2009, 44 states collectively resolved a $40.3 billion budget gap. But those actions were not enough to keep budgets balanced. Just a few months into the fiscal year, a new $32 billion gap opened, which eventually climbed to $62.4 billion. Officials hope the FY 2009 gap has peaked, but a few indicate that upcoming revenue forecasts could still add to their current fiscal year imbalance. … The situation will be even more difficult in the next two years, given the serious cuts that have already been made. The easy adjustments have already been taken … The national recession and the resulting effects on state revenue collections have led to the majority of state fiscal problems. Revenues from personal income, general sales and corporate income taxes continue to falter. State legislative fiscal directors are using terms like “grim,” “bleak” and “dire” to describe the situation. … As bad as the FY 2009 situation has been, it’s being eclipsed by a jaw-dropping gap of at least $121.2 billion for FY 2010,” says Corina Eckl, director of NCSL’s Fiscal Program and author of the report. “And that won’t be the end of it because many states already see big gaps looming in FY 2011 and beyond. … The fiscal situation facing states is like a bad horror movie … The details get more gruesome, and the story never seems to end.”

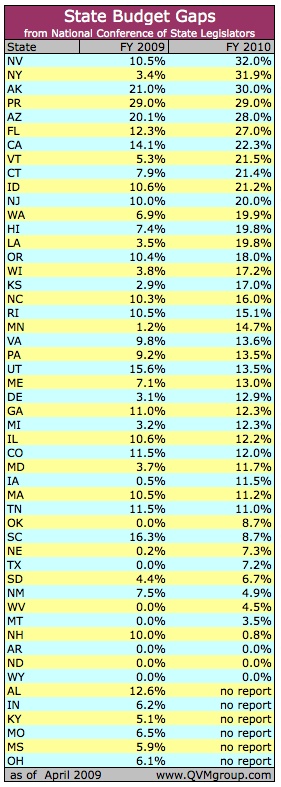

State-By-State Budget Gaps:

To put these comments in greater perspective, here is a state-by-state forecast extracted from the NCSL April report on budget gaps (revenue shortfall of expenses) for the fifty states and Puerto Rico for FY 2009 and FY 2010. The gaps presented in the table below are the the highest estimates for each state.

California is #4 in terms of financial gap for FY 2009, with Arizona, Puerto Rico and Alaska in a larger gap situation. For FY 2010, California drops to #7, behind Nevada, New York, Alaska, Puerto Rico, Arizona and Florida in terms of budget shortfall as a percentage of the total budget.

At the other end of the spectrum, three states report no budget gap for either FY 2009 or FY 2010. They are Arkansas, Wyoming, and North Dakota.

Some other states that aren’t in deep difficulty for FY 2009, see substantial improvement in their financial condition for FY 2010. They are South Carolina, New Mexico, and New Hampshire.

New York, as one of the troubled states for example, reports that it has about $129 billion in state debt (with several categories not counted), of which only $3.5 billion is state funded general obligations (meaning backed by full faith and credit and taxing authority). The balance are either state funded, but not general obligations (about $45 billion) , or debt of public authorities (about $80 billion). New York carries a Moody’s rating of Aa3.

Geography:

This map may help refresh memory of the location of each state and its proximity to other states:

New York History and California Today:

Going back to the California tax-exempt muni matter, this history of financial crisis in NYC in the 1970’s may be instructive:

Beginning in 1974 NYC had muni issuance problems, beginning with inability to sell $50 million in one issue. In May 1975 the mayor and governor sought federal financial help. New York faced the prospect of bankruptcy. New York State set up the Municipal Assistance Corporation (“BigMac”) and issued $3 billion of muni bonds on behalf of the city, but still only guaranteed by city taxes. They were a tough sell and (if memory serves) yielded about 13% triple tax-exempt. After receiving $150 million loans from the NYC Teacher’s Pension Fund, the City avoided default. Unable to obtain federal assistance for NYC, the Emergency Moratorium Act was passed, which froze principal payments on $1.6 billion of short-term muni debt for 3 years, and NY State and its pension funds purchased $6.8 billion of the debt. The State subsequently found itself in financial hot water and raised taxes to pay off debt – and true to government form, the taxes never went back down – just up.

In the end, owning 13% triple exempt muni bonds was a great deal, but hard to see at the time they were issued. Similarly, California muni bonds may see high rates, which may become great deals in the future. However, as with New York, the risk of a moratorium on principal is real, and (in view of the shaft given to Chrysler and GM bondholders in 2009) the risk of a moratorium on interest payments is also real.

We think California tax-exempt money market funds are a terrible idea at the moment.

Defaults Still Do Happen:

In 1983, Washington Public Power Supply System defaulted on $2.25 billion in muni bonds due to massive cost overruns.

In 2009, Jefferson Country Alabama defaulted on $3.2 billion, although due to bad decisions more than profligate spending or a faltering economy.

There are defaults each year. That is why muni bond insurers exist, but they are weak now too.

Default Risk:

An article by Charles Schwab & Company said that state general obligation bondholders in California are second in line for payment after mandatory education benefits are paid. However, it may be useful to note that Chrysler first lien bond holders were denied their first priority in liquidation as their contractual rights were trumped by the so called greater good of society. And, the bond holders of GM got about 1/6th as much stock in the new company as the unions got.

As the rules are being rewritten by the federal government, the needs of the collective seem to take priority over the contractual rights of capital. Once the federal government provides “exceptional assistance” to California or any other state, it would be imprudent to deny the possibility of the rights of bondholders being subordinated to the “greater good”.

Bankruptcy Risk:

In a 2009 University of Chicago presentation on methods to respond to municipal financial crisis, they cited bankruptcy, bailout or stimulus. They point out that there are over 89,000 municipal governments in the US, and that 15 cities, counties or villages have gone through bankruptcy as a solution. Recent important examples are:

- 1991: Bridgeport, CT (unsuccessful filing)

- 1994: Orange County, CA

- 2008: City of Vallejo, CA

Certainly, for investors, bankruptcy is the worst solution. The stimulus package obviously isn’t getting the job done. Given the Build America Bonds program (federal payment of 35% of interest on new fully taxable muni bonds), as well as the corporate bailouts that have been undertaken, the bailout route seems most likely for states.

Bankruptcy is not universally permitted under state laws, according to the University of Chicago presentation. In the map below, states where municipal bankruptcy is permitted are colored green. States where is is not allowed are colored red. The situation is unclear in Vermont, colored yellow.

We’re not at all sure what may or may not be used to help cities. Larger cities are more likely to be helped than smaller cities. There is enormous moral hazard in bailouts, not just is enabling future profligacy, but also in political bias in selecting who to help and not to help – more Washington picking winners and losers.

State Taxes:

State sales taxes, corporate income taxes and personal income taxes are being raised or proposed for increase in most states. They can’t print money under constitutional law (although California is essentially doing just that with IOU’s — call it what you will, but they are paying debts with paper that is not legal US currency), so they must either cut services or raise taxes, or both.

Local Taxes:

Towns and cities are in the same fix and they are cutting expenses and raising property taxes and/or income taxes.

CNNMoney.com (February 4, 2009) said “Some 84% of cities say they are facing financial difficulty, according to new survey. Things won’t improve this year.”

Federal Sales Tax:

Congress in its search for more money (in addition to plans or intent to revive higher estate taxes, raise income taxes, tax carbon, and tax health benefits) is mulling a national sales tax (alternatively called a “value added tax” — call it what you will, but it is essentially a sales tax).

Taxes of the future:

Maybe in order to get money circulating, the federal government will decide to tax wealth other than tangible property and estates which they already tax, by taxing the value of your stocks and bonds — you know, a spend it for the greater good, or lose it tax policy. Sounds impossible, but so did so many of the rules changes and government interventions that have occurred in the past year. We have “New Think” in Washington which could go that way. It deserves watching.

Interest Rates:

There is ample written about the ultimate probability of increases in Treasury interest rates, as larger and larger amounts of issuance are required to support ever more financial stimulus. There is likely to be a rise in muni rates too for many states as their credit worthiness declines and their issuance increases. Rising rates cause issued bonds to fall in price. Those who own the bonds now would be hurt, and those with cash might be able to buy at more attractive rates later, if the investors believes the worst is past.

How bad did it get with NYC in 1975? That year in October, AAA corporate bonds yielded about 8.75%, 30-year fixed rate conventional mortgages yielded about 9.0%. The rate on 10-year Treasuries was about 8.00%. Yet the coupon on Big Mac bonds was 11% and (if our personal memory of that time 34 years ago is intact) they traded to about 13% YTM.

When you can’t easily sell a bond, the the coupon is high, the bond may trade down in the secondary market and the yield becomes very high (and liquidity to resell the bond may be nil). We certainly saw that with bank debt and mortgage debt in the past year.

As it turned out, Big Mac bonds were a rewarding investment. Maybe that will happen again, but maybe the new scenario is wealth redistribution with bond holders getting the short end of the stick. Time will tell.

Who Owns Muni Bonds:

According to Morgan Keegan, individual investors and mutual funds own about 71% of municipal bonds. Insurance companies own about 15% and banks own a majority of the remainder at about 10%

Stock Market Impact:

Banks have enough trouble without defaults on muni bonds on top, but that is a possibility to keep on the radar screen.

P&C insurance companies are perhaps more at risk. According to Morningstar, 40% of P&C insurance company assets are in muni bonds, and for Travelers (TRV), Chubb (CB), WR Berkely (WRB) and Mercury General (MCY), the holdings are 50% or more. Expectation of significant muni payment deferrals (sounds better than default) would have adverse stock price impact on P&C insurance companies.

As for limitation of tax-exempt income, we would speculate that personal income tax exemptions are more at risk, or at earlier risk than for insurance companies. The concern for systematic risk would tend to protect insurance companies for a while; although we wonder when the federal government will begin to think of the financial condition of the tax payer base as a systematic risk too — each new tax or tax increase or fee at every level of government is just a little bit, but all the little bits at the federal, state and local level do add up.

We are the golden goose upon which every level of government feels entitled to take whatever it wants to balance its books, while our books look worse and worse. Let’s hope politicians will be able to see when they are about to cross the red line on aggregate taxation. Just as there was no overall systematic risk observer for the country, there probably is no systematic aggregate tax observer for the country (or no overall way to prevent the aggregate tax burden from going over the top).

Summary:

If the federal government does not take steps to limit tax-exempt income (see our article on how they might limit the exemption) then there may be better muni investment opportunities coming up in the next year or so, compared to those available now.

If you do invest in muni bonds. Diversification is key. If you buy individual bonds, purchasing General Obligation bonds from states is a better idea than revenue bonds or general obligation bonds from local governments.

Watch the Build America Bonds substitution of tax-exempt muni interest with federally subsidized taxable interest (that important phrase activating federal controls, “exceptional assistance”) – and how developments arising form Build America Bonds may impact individuals, banks and P&C insurance companies.

Everything could work out just fine. Current owners could do well. Or, maybe future buyers will do better. In any event, complacency is not a good idea with respect to muni bonds in this period of major flux.

As muni bond fund holders, we are hopeful, but anxiously watchful.

The time frame for decisions about California is before now or now. The time frame for other states is less immediate.

[Some relevant ETFs and individual stocks: MUB, TFI, CMF, NYF, TRV, CB, WRB, MCY]

Disclosure: we own MUB and some Vanguard muni bond funds in some managed accounts.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.