How Long Can the U.S. Dollar Defy the Law of Gravity?

Currencies / US Dollar Jul 07, 2009 - 12:56 PM GMTBy: Gary_Dorsch

In the midst of the longest and deepest, post World-War II recession, America’s financial position with the rest of the world has deteriorated sharply. Three decades of massive trade deficits have turned the United States from the world’s top lender to the world’s largest debtor, - and dependent upon the whims of the so-called emerging nations, laden with huge foreign currency reserves, to finance the bailout of Wall Street Oligarchs, and President Barack Obama’s social programs.

In the midst of the longest and deepest, post World-War II recession, America’s financial position with the rest of the world has deteriorated sharply. Three decades of massive trade deficits have turned the United States from the world’s top lender to the world’s largest debtor, - and dependent upon the whims of the so-called emerging nations, laden with huge foreign currency reserves, to finance the bailout of Wall Street Oligarchs, and President Barack Obama’s social programs.

Foreigners own roughly half of the US-government’s publicly traded debt, or $3.47-trillion, representing nearly 25% of the size of the US-economy, the highest level in history. If foreign lenders were to significantly reduce their purchases of US-Treasury notes, without even dumping their current holdings, US long-term interest rates could zoom higher, and the US-dollar could crumble.

That would deal a double whammy to the US-economy. Higher yields on Treasury debt could translate into higher mortgage borrowing rates for homebuyers, - weighing on the housing market, while a weaker US-dollar could lift the price of crude oil to above $70 per barrel, inducing an “Oil Shock” to the world economy. This nightmare scenario has been relegated to the den of doomsayers and fear mongrels, yet is starting to become an increasingly realistic proposition.

Increasingly, some of the biggest foreign lenders to the US Treasury, such as Brazil, China, India, Russia, and Qatar, are grumbling aloud, about the endless string of trillion dollar US-budget deficits projected in the years ahead. Lenders are crying foul over the Federal Reserve’s radical experiment with “Quantitative Easing” (QE) - the printing vast quantities of US-dollars, and monetizing the US-government’s debt.

“America, through this financial crisis, is accumulating a huge amount of debt. It’s a heavy burden on the US-dollar,” warned Jassem al-Mannai, chief of the Abu Dhabi-based Arab Monetary Fund on June 28th. “You have China and Russia proposing an international reserve currency other than the US-dollar. These developments could affect negatively the dollar, and you cannot just ignore them,” he warned.

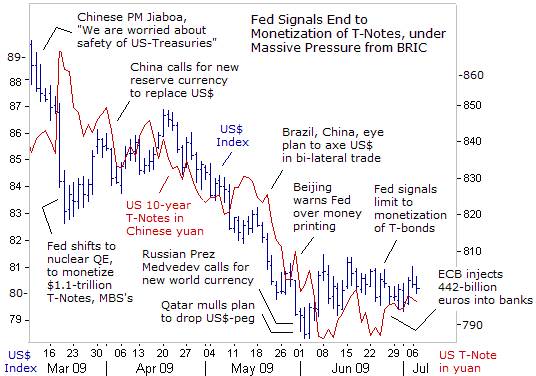

“We have lent a massive amount of capital to the United States, and of course we are concerned about the security of our assets,” warned Chinese PM Wen Jiaboa on March 13th. To speak truthfully, I do indeed have some worries. So I call on the United States to maintain its creditworthiness, and abide by its commitments and insure the security of China’s assets. We have already adopted a management policy of diversifying our ($2-trillion) foreign exchange reserves,” Wen warned.

The Congressional Budget Office has recently forecast the US-budget deficit for fiscal 2009, to reach a mind-boggling $1.825-trillion, or approximately 13% of GDP. Next year, the budget deficit is expected to total $1.43-trillion under Obama’s budget plan. Furthermore, the CBO sees the US-deficits between 2010 and 2019 totaling $9.1-trillion, thereby raising doubts about America’s ability to finance its debt at low interest rates, and whether it can maintain its top-tier AAA credit rating.

The exploding US-budget deficit and the Fed’s policy of flooding the financial markets with US-dollars, knocked the value of the greenback 7% lower in the second quarter, and heightened fears on global bond markets about a surge in inflation. This had the effect of eroding the value of China’s holdings of US-Treasury notes, estimated at roughly $1.45-trillion, putting Beijing on the offensive with Washington.

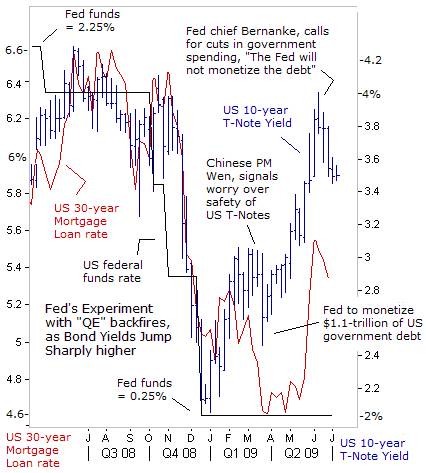

Since the Fed shocked the global markets on March 18th, by unleashing the “nuclear option” for monetary policy - “QE,” or printing an extra $1.1-trillion US-dollars, in order to buy US T-Notes and mortgage backed bonds, there has been a new dynamic influencing the psychology of the US-credit markets, namely, - latent paranoia over foreign flight from the US-dollar and Treasury Notes.

On March 24th, the People’s Bank of China’s (PBoC) chief Zhou Xiaochuan, emphasized his worry over the inflationary risks from the Fed’s money printing scheme, by proposing to replacing the US-dollar with the SDR currency, that is controlled by the IMF, as the new global reserve currency. Suresh Tendulkar, an adviser to Indian Prime Minister Manmohan Singh, is urging New Delhi to diversify its $265-billion foreign-exchange reserves and hold fewer US-dollars.

China’s holdings of US-Treasury debt have soared by $257-billion from a year ago, to $763-billion today, exceeding Japan’s holdings of $686-billion. Increasingly, the functioning of the massively indebted American economy is dependent upon China’s willingness to recycle much of its export earnings, (largely dependent on sales to the US-consumer), to provide loans to the US-government.

Yet, any precipitous move by Beijing to become a net seller of US-Treasury debt, runs the risk of igniting a US-dollar selling panic, triggering massive losses in China’s own portfolio of Treasuries, and the collapse of its main export market, the United States. India’s economic adviser Tendulkar says US-dollar holders face a “prisoner’s dilemma” in terms of managing their bond holdings.

Recent saber-rattling by Beijing over Washington’s mis-management of its fiscal and monetary affairs, began to conjure-up fears in the global bond market, that Beijing was discreetly selling-off some of its US-bond holdings. The benchmark Treasury’s 10-year yield, which influences the direction of home mortgage rates, zoomed higher in the second quarter, briefly penetrating the psychological 4.00% area, up from 2.50% when the Fed began its mad experiment with “nuclear QE.” The surge in yields caught the Fed and the US Treasury by complete surprise.

Selling hysteria in the Treasury bond market reached a fever pitch on May 27th, when Dallas Fed chief Richard Fisher, told the Wall Street Journal, “senior officials of the Chinese government grilled me about a hundred times, on whether we are going to monetize the actions of our legislature. I was asked at every single meeting about our purchases of Treasuries. That seemed to be the principal preoccupation of those that invested their surpluses in the United States,” he said.

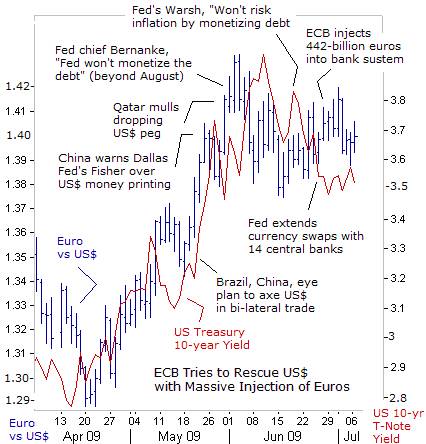

With the Treasury’s 10-year yield bumping against the 4.00%-level, the US Treasury chief Timothy Geithner began a two-day visit to Beijing, amid speculation that China might scale back its purchases of US Treasury notes. Geithner’s main objective was reassure top-Chinese officials that the Obama team will safeguard Beijing’s holdings of US-debt by bringing down the federal budget deficit and phasing out the Fed’s policy of flooding the financial markets with US-dollars.

The next-day, on June 2nd, Fed chief Benjamin Bernanke, boxed into a tight corner by Beijing’s saber rattling, warned the US-Congress that there is a limit to how many US-dollars the central bank can print. “Unless we demonstrate a strong commitment to fiscal sustainability in the longer term, we will have neither financial stability nor healthy economic growth,” Bernanke warned US-lawmakers.

“Maintaining the confidence of the financial markets requires that we begin planning now for the restoration of fiscal balance. Either cuts in spending or increases in taxes will be necessary to stabilize the fiscal situation. The Fed will not monetize the debt!” Bernanke’s pledge to stop the printing presses after August was a grand omission of Washington’s subservience to its paymasters in Beijing.

After Bernanke signaled the outer limits of the Fed’s experimentation with “nuclear QE”, the Treasury bond vigilantes loosened their vice-grip, and yields on the 10-year note tumbled by 50-basis points over the next four-weeks to 3.50-percent. On June 16th, Fed governor Kevin Warsh backed-up the Fed chief, declaring, “we will not compromise price stability buy monetizing large US budget deficits,” explaining that “financial markets may extract penalty pricing, if fiscal authorities are unable to demonstrate a credible return to sustainable budgets.”

Sure enough, on June 24th, the Fed held to its pledge to limit its purchases to $1.45-trillion in mortgage-related debt by year-end, and $300-billion in Treasury notes by the end of August. Beijing taught the Fed learned a valuable lesson, - trying to peg long-term interest rates at artificially low levels, through massive money printing, can backfire, by igniting inflation fears and sending yields sharply higher.

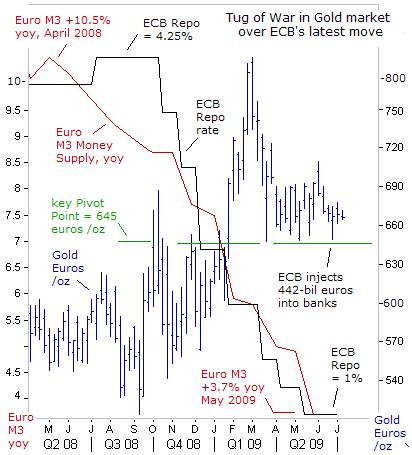

ECB Rescues of US$ vs Euro, Deflation weighs on Gold

The Fed’s promise to put nuclear “QE” on ice after August, helped to block the Euro’s advance at $1.4200. But trying to push the Euro lower was like pushing a helium balloon under water, after the Fed had already injected $1.5-trillion into the world money markets. The Fed was caught in a desperate position, and needed outside support to prevent the greenback from plummeting. Luckily, the European Central Bank (ECB) came to the rescue on June 26th, by pouring 442-billion Euros ($613-billion) into one-year deposits, to encourage banks to start lending again.

Surprisingly, the ECB’s injection of 442-billion Euros barely moved the gold market, which stayed locked within a tight trading range between 645-euros and 690-euros /ounce. In fact, gold stayed flat in the second quarter, lagging behind the broader commodities markets, when crude oil gained +45%, London copper added 27%, and wheat rose almost 30-percent. Overall, the Reuters/Jefferies CRB index of 17-exchange traded commodities posted a 15% gain in the second quarter.

There is a tug-of-war underway in the European gold market. On the one hand, the ECB’s ultra-low interest rates, and massive money injections are buoying the yellow metal. However, on the other side of the coin, Euro-zone bank lending and money supply growth are plummeting, into what can best be characterized as a deflationary spiral that’s crippling the Euro-zone economy, and weighing on gold.

Euro-zone bank loans to businesses and households grew at a paltry +1.8% pace in May, the slowest on record. Euro-zone banks are hoarding the cash from the ECB, to plug-up the holes in their balance sheets, from losses on bad loans, which expected to reach 265-billion euros in the year ahead. Likewise, the Euro M3 money supply slowed to a +3.7% annual growth rate in May, down from +10.5% in April 2008. Consumer prices turned negative last month, also keeping a lid on gold.

China Inflates Money Supply, buoying Gold,

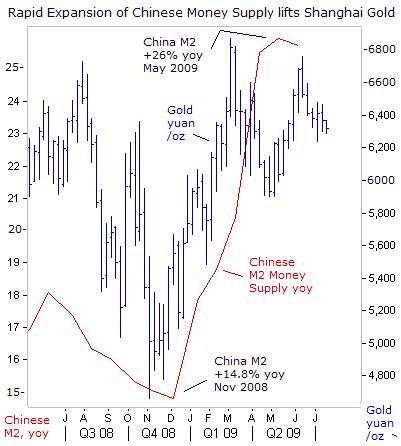

Gold is foremost an international currency, and traders from wide-ranging parts of the world, view the yellow metal from different perspectives. And while Chinese leaders are scolding the Fed over its penchant for printing vast quantities of US-dollars, the PBoC is expanding the Chinese M2 money supply at a blistering +25.5% annual clip, sparking fears of faster inflation, and buoying Shanghai gold. Monetary conditions in China appear to be the exact opposite of Europe and Japan.

New lending by Chinese banks is likely to hit 7-trillion yuan ($1.1-trillion) in the first six-months of this year, easily topping Beijing’s full-year target of 5-trillion yuan. Banking regulators are now warning that credit is being channeled into the property sector and the stock market, creating asset bubbles instead of supporting small businesses and the broader economy. New lending by Chinese banks is likely to exceed 10-trillion yuan ($1.46-trillion) this year, or roughly equal to one-third of the size of China’s economy, the Shanghai Securities News reported on July 3rd.

The surge in Chinese bank lending has resulted in a large increase in real estate transactions of a speculative nature, and into projects that are wasteful, making it hard for investors to repay bank loans in the future, China’s central bank chief warned on July 4th. The Shanghai Composite Index has risen by over 50% this year, reflecting not so much the strength of the underlying economy, but rather, the large amounts of speculative capital flowing into equity markets.

About 1.16-trillion yuan ($170-billion) of Chinese bank loans are estimated to have been funneled into the Shanghai stock market in the first five-months of 2009, China Business News reported. That is 20% of the 5.8-trillion yuan loans banks made in that time period. Thus, Chinese leaders are essentially following the playbook of Fed chief Ben “Bubbles” Bernanke, and “Easy” Al Greenspan, which calls for flooding the banking system with paper currency, in order to forestall a normal economic recession, which in turn, creates new bubbles.

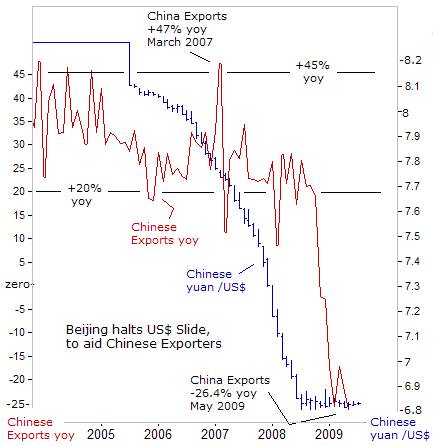

China is the world’s second largest exporter, and suffered a record year-on-year fall in exports of 26.4% in May, following similar trends in other export-led Asian economies including Japan, South Korea and Taiwan, indicating weak global demand. The collapse in Chinese exports also follows a 21% devaluation of the US-dollar against the yuan, which Chinese leaders partly blame for the slump.

Beijing has ramped-up the growth of its money supply, to prevent the US-dollar from falling below 6.80-yuan, in a bid to remain competitive with other central bankers around the world, who seek advantages in global trade through weaker currency exchange rates. Beijing aims to reduce its exposure to the US-dollar through the use of currency swaps with key trading partners, such as Argentina, Malaysia, Indonesia, Brazil, and Russia. The PBoC signed an agreement with Hong Kong to allow the settlement of cross-border trade in yuan.

Japan fights Deflation by defending US-dollar

Japan does not disclose the currency breakdown of its $1-trillion of foreign reserves but most of its FX-stash is parked in US-dollars. Tokyo doesn’t favor a change in the dollar’s status as the key currency, since it’s comfortable with a gentleman’s arrangement with the US Treasury that allows it to manipulate the yen’s value. The Bank of Japan (BoJ) still commands a lot of respect as a tough currency manipulator, when its economic interests are threatened by speculators.

The BoJ’s reputation for hard nosed intervention was etched in stone during the 15-months ending March 31, 2004, when it sold 35-trillion yen ($327-billion) in the

currency market to support Nikkei-225 multinationals and exporters, and prevent the dollar from falling below 100-yen. As a result, Japan’s FX-stash ballooned to a record $826-billion, with the US-dollars acquired, recycled into US-Treasuries.

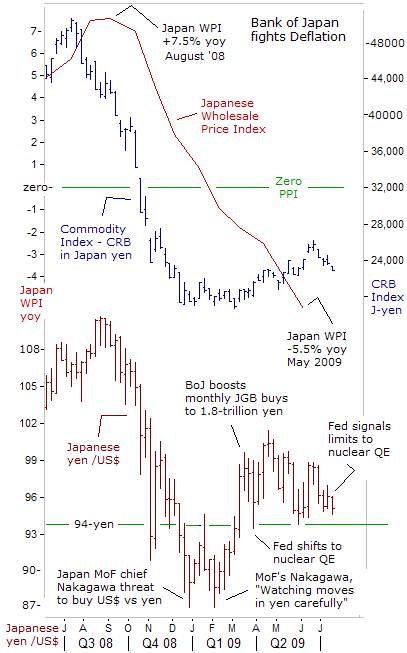

Japan is now facing the threat that deflation will become deeply entrenched in its economy, preventing a rebound from its worst postwar recession. Japanese wholesale prices were -5.4% lower in May from a year earlier, the sharpest decrease since 1971, reflecting the collapse of key commodities, in the second half of 2008. Deflation is a vicious cycle, where companies start cutting prices to attract customers, as falling wages and the worsening job outlook dampen spending.

The primary tool that Tokyo has at its disposal to fight deflation, is pressure on the Bank of Japan (BoJ) to print more yen, in order to prevent the dollar from moving lower, and exerting more downward pressure on commodity prices, in yen terms. On March 18th, the BoJ increased its monthly purchases of government bonds (JGB’s) by a third to 1.8-trillion yen ($18.3-billion) from 1.4-trillion yen, in order to inflate the supply of its currency. The BoJ pegs interest rates at 0.1-percent.

Japan’s export slump deepened in May, casting doubt on its ability to emerge from its worst postwar recession. Overall, shipments abroad dropped 41% from a year earlier, while exports to the US and Europe fell by 45%, from a year ago. Tackling two threats with one stone, the BoJ is trying to fend of deflation and weaker exports, by aiming to establish an artificial floor under the US-dollar at 94-yen, through covert intervention, mainly through money printing operations.

Ironically, the yen has become a so-called safe haven currency, during times of strife in the global banking sector. While European and US-banks are writing down more than $1-trillion in subprime losses, Japanese banks have been surprisingly stable. Japanese banks, hammered by the collapse of a real estate bubble in the early 1990’s, haven’t reported gigantic losses related to the collapse of the American real estate bubble since its peak in August 2006.

Instead, Japan’s megabanks, - Mitsubishi UFJ Financial, Mizuho Financial, and Sumitomo Mitsui Financial, have admitted to only $5-billion of sub-prime losses so far. “The maximum losses of Japanese financial institutions are 1-trillion yen ($9.4 billion), not big enough for the government to act,” said Kaoru Yosano, former chairman of the ruling Liberal Democratic Party’s fiscal reform panel.

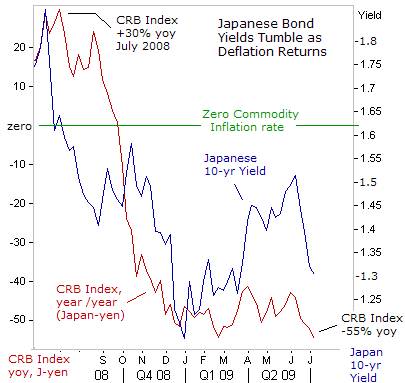

Tokyo has laid out plans to sell a record 44-trillion yen ($460-billion) of new debt in the fiscal year thru March 2010, to finance regular and stimulus spending to ease the pain of recession. Yet despite the record issuance, Japanese 10-year bond yields still remain depressed near historic lows. The Tokyo bond market is the world’s second largest, with $8.5-trillion outstanding, yet 10-year JGB yields have been locked in a super-tight range between 1.15% and 2.00% for the past eight years.

The BoJ will monetize roughly half of the supply of new debt to hit the market this year. Yet massive yen printing and record debt sales haven’t translated into sharply higher JGB yields. Instead, Japanese 10-year yields are trending lower, weighed down by the specter of deflation. The Fed hasn’t been able to duplicate the BoJ’s mastery over the Tokyo bond market, because the US has the distinction of being the world’s largest debtor nation, and dependent upon the whims of other lender nations, while Japan is the opposite – the largest creditor.

Japan became a creditor nation about thirty-years ago, when Japanese investors held $11.5-billion more in foreign assets than foreigners held in Japan. By 2007 however, Japan’s overseas assets rose to a record 610-trillion yen ($5.9-trillion), making it the world’s largest creditor nation for the 17th year running.

To hear a July 4th interview with Gary Dorsch and Financial Sense’s Jim Puplava, including predictions for the Dow Jones Industrials, and the long-term outlook for US-dollar, click on the following link: www.sirchartsalot.com

This article is just the Tip-of-the-Iceberg of what’s available in the Global Money Trends newsletter, for insightful analysis and predictions of the future direction of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, steel, and soybeans (3) Foreign currencies, including exotics, (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.