Bad News for Gold Bulls

Commodities / Gold & Silver 2009 Jul 07, 2009 - 01:21 AM GMTBy: Frederic_Simons

Don't shoot the messenger. In the last Gold Market update (click here to access), we mentioned the range in which Gold was trading then.

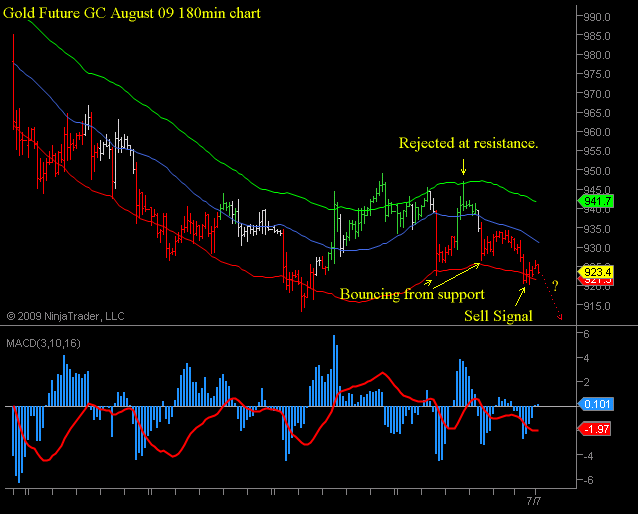

On Monday, this trading range was left to the downside, as marked by more than two consecutive price bars trading below the red sell line, negating the buy signal made on June 26th:

As a consequence, the line of least resistance is to the downside for now, and it remains to be seen how far the bears will be able to push prices lower in the near future.

Should prices recover however - and there are a lot of fundamental reasons for doing so - it would take two consecutive price bars trading above the green buy line, currently at 941.7 USD, to turn the 180min chart bullish again. A bounce in the Gold price that reverses before surpassing that price level might however be taken as another opportunity for the trader to sell short.

If you have any questions, please do not hesitate to contact us by writing an email to

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.