Treasury Bonds, Not the Time to Become a Bear (yet)

Interest-Rates / US Bonds Jul 05, 2009 - 07:21 AM GMTBy: Frederic_Simons

Despite all hyper-inflation scenarios that can be read about in almost every financial newspaper and market commentary nowadays, the 30 year Treasury Bond (ZB September 09) has been in a steady uptrend for quite a while now, advancing from a low of 111'215 on 6/11/09 to a high of 119'095 this past week.

Despite all hyper-inflation scenarios that can be read about in almost every financial newspaper and market commentary nowadays, the 30 year Treasury Bond (ZB September 09) has been in a steady uptrend for quite a while now, advancing from a low of 111'215 on 6/11/09 to a high of 119'095 this past week.

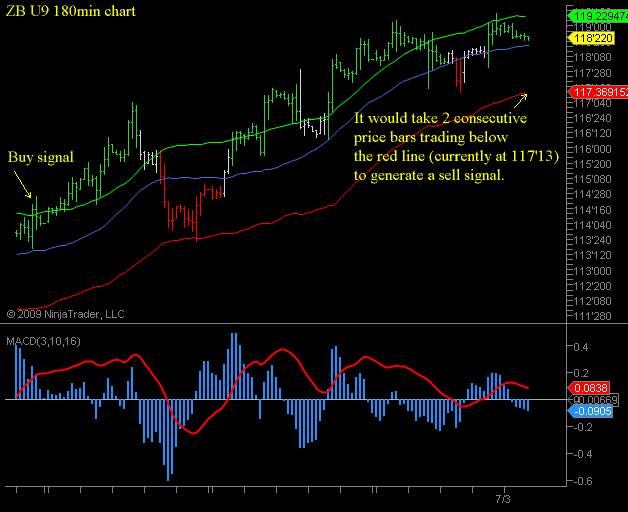

As you might already know, Crossroads FX uses an approach that bases short- and intermediate term trade decisions on the actual behaviour of prices, not on fundamental aspects. For this purpose, we developed a proprietary indicator that identifies the line of least resistance both to the downside and to the upside, and prints them on the chart as a green line (buy line) and a red line (sell line).

You can see on the following chart that if the price trades for 2 consecutive bars above the green line, rising prices are to be expected. Once the price trades for 2 bars below the red line, you should prepare for falling prices:

Using this method, a buy signal on the 30year Treasury Bonds was generated on 6/12/09, enabling us to capture the best part of the current uptrend:

As you can see on the 180min chart, there is no compelling reason to become a bond-bear again unless prices trade below 117'13.

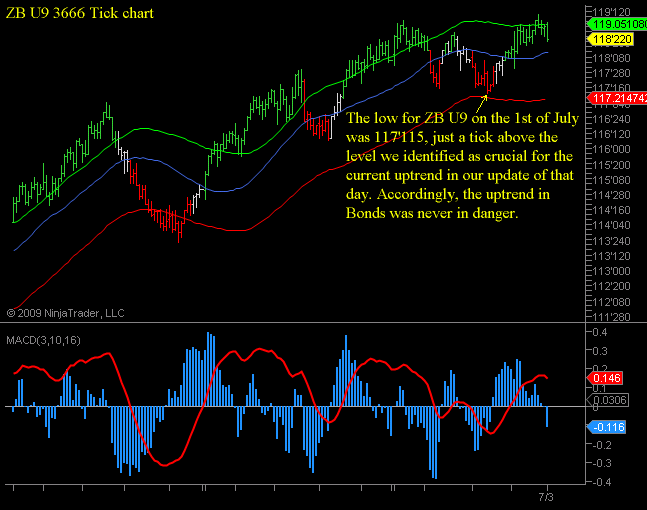

In the Crossroads FX Bond Market Update published on 07/01/09 you could read that only "if ZBu9 trades below 117'11, the current uptrend would be in danger". The low for that day was 117'115, and after touching that level, Bonds shot higher without looking back.

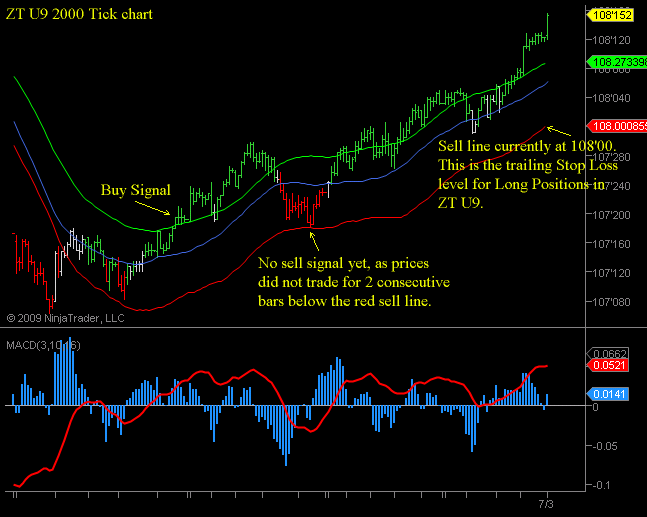

If you look at the 2-year Treasuries, you can see an even more bullish picture:

Since going long via a buy signal at 107'19, the uptrend has never been seriously challenged. The sell line is currently at 108'00 and rising strongly, indicating a steep uptrend.

There is no reason to become bearish on the 2 Year treasuries for now. There may be a consolidation of the recent upmove within the next week with some sideways price action, with the consequence that the red sell line goes horizontal at current levels. For bears, this is the best they can hope for. In this uptrend, surprises will be to the upside for the time being.

If you have any questions, please do not hesitate to contact us by writing an email to

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.