Yen Carry Trade Suggests Global Stock Markets Base Building Underway

Stock-Markets / Stocks Bull Market Jul 03, 2009 - 02:55 PM GMTBy: Donald_W_Dony

The "Yen carry trade" has provided traders with a reliable source of near-endless funds for many years. This pool of capital has helped fuel the 2002-2007 bull market. Technical evidence (Chart 1) illustrates the Japanese Yen verses the Dow Jones World Stock Index. Since 2002, the Yen has been trading flat or drifting downward against the USD$. Traders have been shorting the Yen and using the funds to purchase stocks, currencies and high-yielding securities around the world.

The "Yen carry trade" has provided traders with a reliable source of near-endless funds for many years. This pool of capital has helped fuel the 2002-2007 bull market. Technical evidence (Chart 1) illustrates the Japanese Yen verses the Dow Jones World Stock Index. Since 2002, the Yen has been trading flat or drifting downward against the USD$. Traders have been shorting the Yen and using the funds to purchase stocks, currencies and high-yielding securities around the world.

However, as of mid-2007, the 'free bank account' started to become more and more costly. The unwinding of the "Yen carry trade" in late 2007 spelled the end of the bull market. As the Yen began to accelerate upward in 2008, The Dow Jones World Stock Index plunged. Quite simply, the global equity markets began to fall when the tap was turned off to cheap money. Traders were now forced to buy back massive Yen short positions and sell assets to pay for it.

But what is the "Yen carry trade"? It is borrowing at very low interest rates (near zero) in Yen and using the loan to buy higher yielding assets elsewhere. During the past 12 years, the trade has become standard business practice for many institutional investors. Perhaps the most popular form of the strategy exploits the yield gap between U.S. and Japanese fixed income securities. Another plus that came with the Yen/U.S. dollar cross was from the dollar’s rise against the yen. Investors make their profit when they reverse the trade and pay back the Yen loan.

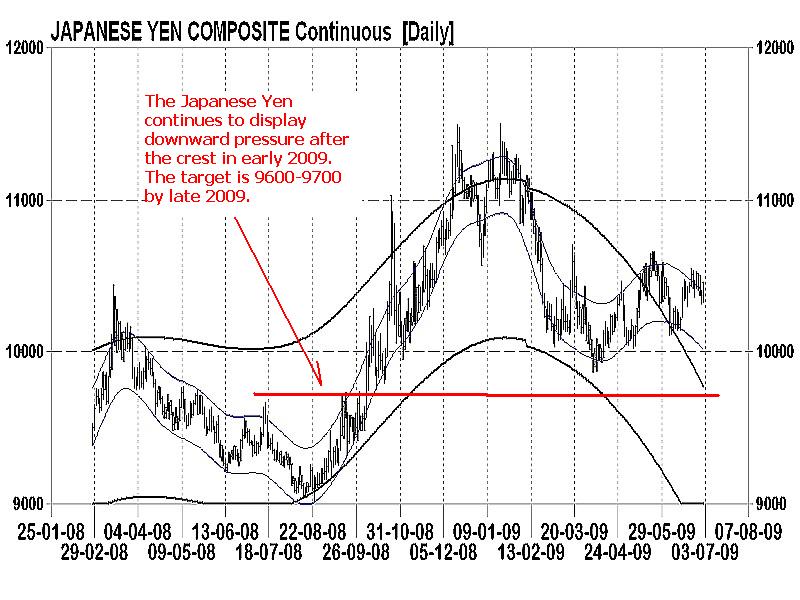

In early 2009, the Yen peaked and began to retrace some of its previous gains. Models in January were suggesting a reversal should be expected. The Japanese currency (Chart 2) is now pulling back and settle at lower levels. This action is corresponding to the recent rebound of the DJ World Stock Index.

Bottom line: The tight linking of the trading patterns between the Japanese Yen and the Dow Jones World Stock Index points to additional base building for global equities. As models for the Yen indicate a downside target of 9600-9700 by late 2009, this movement is anticipated to be positive for stocks.

More research on currencies, commodities and equities is available in the July newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.