U.S. Economy Economic Recovery Achilles Heel

Economics / Recession 2008 - 2010 Jul 03, 2009 - 04:01 AM GMTBy: Puru_Saxena

BIG PICTURE – The much anticipated economic recovery is now fully discounted by the financial markets. Most strategists and economists seem to agree that the US economy is stabilising and will start to revive towards the end of the year. Interestingly, the ‘great depression’ hyperbole doing the rounds last autumn has now been replaced by the ‘green shoots’ hype. It seems as though everyone is spotting some kind of ‘green shoots’ somewhere in the economy. If one didn’t know any better, after reading the latest headlines in the media, one could easily get the impression that perhaps the geniuses in the financial community have now become experts in horticulture!

BIG PICTURE – The much anticipated economic recovery is now fully discounted by the financial markets. Most strategists and economists seem to agree that the US economy is stabilising and will start to revive towards the end of the year. Interestingly, the ‘great depression’ hyperbole doing the rounds last autumn has now been replaced by the ‘green shoots’ hype. It seems as though everyone is spotting some kind of ‘green shoots’ somewhere in the economy. If one didn’t know any better, after reading the latest headlines in the media, one could easily get the impression that perhaps the geniuses in the financial community have now become experts in horticulture!

Make no mistake; every credit-induced boom in history has been accompanied by a brilliant tag line to promote the agenda and the ‘green shoots’ hype is no different. Back in the mid-1990’s, when Asian markets were roaring, nations in the region were referred to as the ‘Asian Tigers’. Thereafter, the technology mania was widely accepted as the ‘new era’. More recently, the recent boom in China and India was coined the ‘Chindia Express’. And we all know how these supposedly permanent periods of prosperity worked out!

As far as the recent recovery in the markets is concerned, I am convinced that it is largely due to deeply oversold conditions seen in the autumn crash and the fact that central banks have flooded the system with trillions of dollars. So, the recent strength in asset prices is because of the ongoing debasement of currencies and the consequent decline in the purchasing power of cash. In my humble opinion, the recent rebound in stocks and commodities has very little to do with any sustainable improvement in the overall economy. Whether you like it or not, the global economy is still very weak and the recession is likely to last for at least another six months.

The US economy is choking on debt, American households are deleveraging, commercial bank credit is contracting and unemployment is still climbing. More importantly, the American housing market is still extremely weak and cracks are beginning to appear in commercial real-estate.

Across the pond, economic activity in the ‘Old World’ is even more pathetic. Britain is reeling from the financial crisis; the City of London is a far cry from its former glory days and to make matters worse, the North Sea is running dry. After exporting oil for over 20 years, Britain has now become a net importer of oil. Over on the mainland, the Spanish economy is a total mess, Italy is struggling, Germany is in recession and Eastern Europe is possibly in the worst shape. Unfortunately, most of the nations in the West are up to their eye balls in debt and I find it hard to accept that they will take on even more debt in order to oblige the policymakers.

Over in Asia, things are much better than elsewhere. By and large, the region has huge foreign exchange reserves, a high savings rate and low debt levels. Unfortunately, many Asian nations depend heavily on exports to the West and their economies are feeling the pain. In the first quarter (when compared to a year ago); economic output fell by roughly 10% in Hong Kong, Japan, Taiwan and Singapore. It is clear that declining exports are hurting these economies but the bigger problem is the over-capacity which has emerged in the system due to a collapse in demand.

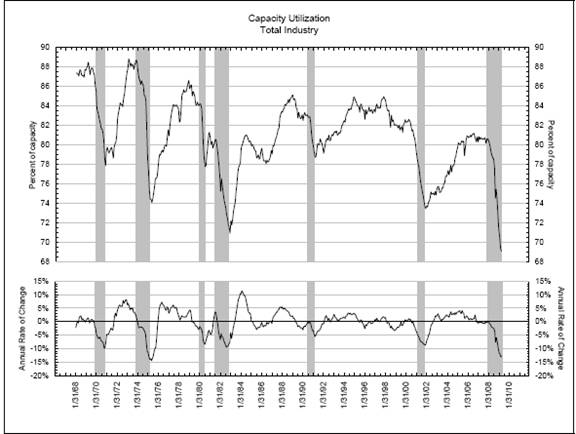

It is worth noting that a genuine economic boom occurs when consumption or aggregate demand pushes up against existing capacity. When that happens, businesses engage in massive capital spending in order to meet demand and this phenomenon brings about economic prosperity. At present, we are dealing with a situation whereby the entire world is operating well below existing capacity. For instance, the US economy is currently operating at roughly 70% capacity (Figure 1). Globally, the capacity utilisation rate is only slightly better at roughly 80%, however there is still a lot of unused industrial capacity.

Figure 1: Slump in US capacity utilisation

Source: The Chartstore

Given the fact that households in the West are repaying their debt and the world faces excess capacity, a robust and sustainable economic recovery is out of the question.

In my view, what is more likely is that governments all over the world will engage in massive fiscal spending over the coming years. In other words, politicians (who aren’t the best allocators of capital) are going to spend trillions of dollars on state-sponsored infrastructure projects. Needless to say, governments will fund these ambitious projects by either borrowing or printing money (or a combination of both). Whatever their source of fund raising, any economic recovery brought about by monetary inflation will be short lived. Once the stimulus kicks in and economic activity picks up, we will witness a tidal inflationary wave in the form of sky-high prices for natural resources. When prices spiral out of control and speculative juices start to flow again, short-term interest rates will rise and the stage will be set for the next colossal bust.

Although the global economy faces serious challenges, some positive signs have emerged in the past few weeks. Recently, China’s Purchasing Managers Index (PMI) and Korea’s industrial production have rebounded sharply and these are early signs that the free fall in global economic activity may have ended.

Furthermore, the Baltic Dry Freight Index has more than tripled from its crash low and this is another positive development. After the horrendous crash in freight rates, the shipping industry is getting some relief as China starts to build up its inventories of various key commodities.

Finally, the credit markets seem to have improved with the inter-bank lending rate (LIBOR) declining to below 0.7 bps and credit spreads are also narrowing.

All these are encouraging developments and suggest that the worst part of the contraction may be over. Now, before you reach for your champagne bottle and commence the celebrations, I want to highlight the Achilles’ heel which is likely to disturb the recovery in America.

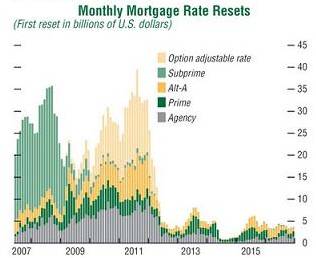

Remember, the ongoing crisis was brought about by excessive leverage and rampant speculation in US housing. Encouraged by the misconception that home prices never fall, millions of homeowners in America took out the following types of mortgages:

a. Prime - good credit rating

b. Subprime - sub-par credit rating

c. Alt-A – no income proof or asset proof

d. Option Adjustable Rate Mortgages – minimum repayment with teaser rates

Out of the above mortgage categories, the really dubious ones are Alt-A and Option Adjustable Rate Mortgages. Under Alt-A mortgage type, potential homeowners simply walked into a bank with no asset or income proof and walked out with a hefty mortgage.

Worst still, under the Option Adjustable Rate Mortgage, instead of the bank, it was the homeowner who decided how much he/she wished to repay each month! In some instances, borrowers decided to repay only the interest and in other cases, borrowers didn’t even repay the entire interest and the unpaid interest was added to the outstanding loan. To make matters worse, these ‘convenient’ mortgages came with extremely low teaser rates which were subject to resets at higher rates.

Make no mistake; it was the foreclosure avalanche triggered by the subprime mortgage resets which caused the credit crisis. Figure 2 shows that although the bulk of the subprime resets are now behind us, billions of dollars worth of Alt-A and Option Adjustable Rate Mortgages are coming up for resets between now and 2011. So, it is probable that the second wave of foreclosures will cause even more problems in the banking sector. Accordingly, I sincerely suggest that you stay away from bank stocks.

Figure 2: Achilles’ heel of the US economy

Source: Credit Suisse

Look; up until now, apart from using taxpayers’ money to save insolvent banks, Mr. Obama’s administration has not done much in the way of helping distressed homeowners. Unless the US establishment urgently restructures this mountain of debt, we are likely to see further problems in the US economy. It is crucial that debt restructuring becomes top priority for the US establishment, otherwise the ‘green shoots’ may turn into toxic weeds.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2009 Puru Saxena Limited. All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.