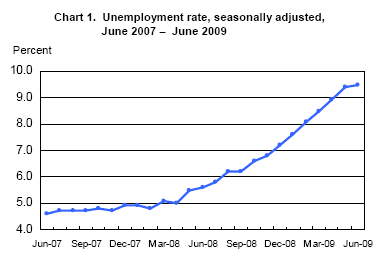

U.S. Unemployment Rate Hits 9.5%, Jobs Contract 18th Straight Month

Economics / Recession 2008 - 2010 Jul 02, 2009 - 04:43 PM GMTBy: Mike_Shedlock

This morning, the Bureau of Labor Statistics (BLS) released the June Employment Report.

This morning, the Bureau of Labor Statistics (BLS) released the June Employment Report.

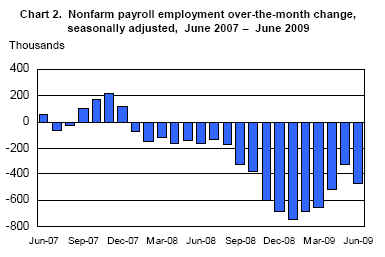

Nonfarm payroll employment continued to decline in June (-467,000), and the unemployment rate was little changed at 9.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Job losses were widespread across the major industry sectors, with large declines occurring in manufacturing, professional and business services, and construction..

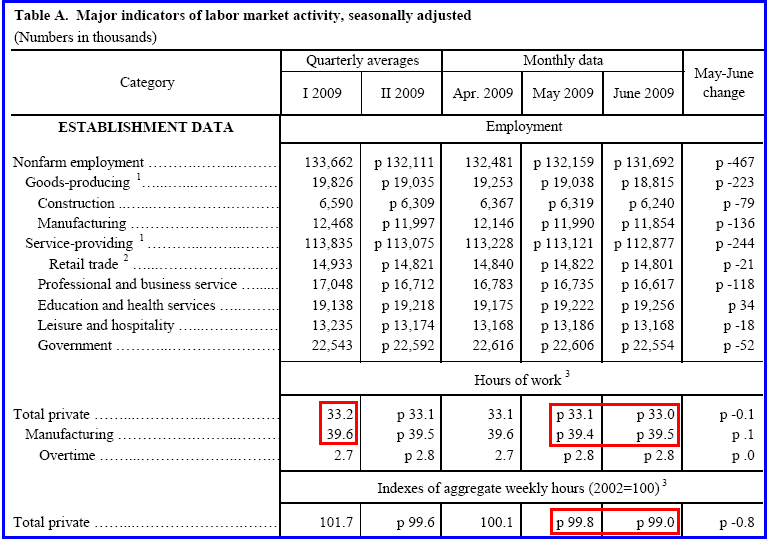

Establishment Data

Highlights

- 467,000 jobs were lost in total vs. 345,000 jobs last month.

- 79,000 construction jobs were lost vs. 59,000 last month.

- 136,000 manufacturing jobs were lost vs. 156,000 last month.

- 244,000 service providing jobs were lost vs. 120,000 last month.

- 21,000 retail trade jobs were lost vs. 18,000 last month.

- 118,000 professional and business services jobs were lost vs. 51,000 last month.

- 34,000 education and health services jobs were added vs. 44,000 added last month.

- 18,000 leisure and hospitality jobs were gained vs. 3,000 added last month.

- 52,000 government jobs were lost vs. 7,000 last month.

It was nearly a clean sweep again this month with education and health services jobs the only real winner for the month.

Note: some of the above categories overlap as shown in the preceding chart, so do not attempt to total them up.

Index of Aggregate Weekly Hours

Work hours are now down to 33.0 in aggregate. This is contributing to household problems. The expectation was for work hours to rise.

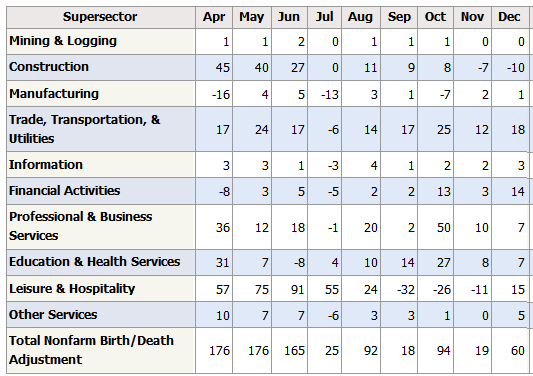

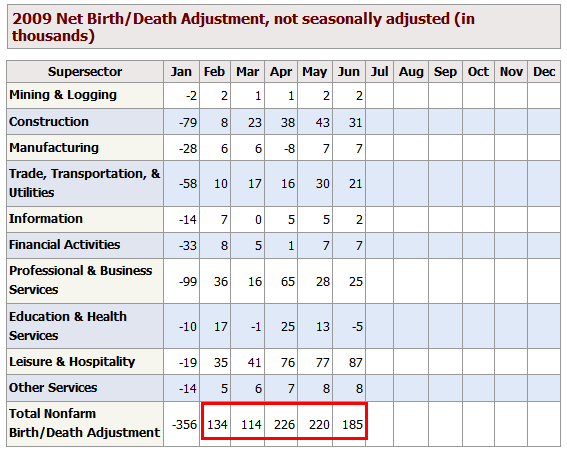

Birth Death Model Revisions 2008

Birth Death Model Revisions 2009

Birth/Death Model Revisions

After the typical in January in which the Birth/Death Model revisions bore some semblance of reality, the Birth/Death numbers remain in deep outer space.

At this point in the cycle birth death numbers should have been massively contracting for months. The BLS is going to keep adding jobs through the entire recession.

The Birth/Death numbers are a complete joke and has been for at least two years now.

BLS Black Box

For those unfamiliar with the birth/death model, monthly jobs adjustments are made by the BLS based on economic assumptions about the birth and death of businesses (not individuals). Those assumptions are made according to estimates of where the BLS thinks we are in the economic cycle.

The BLS has admitted however, that their model will be wrong at economic turning points. And there is no doubt we are long past an economic turning point.

Here is the pertinent snip from the BLS on Birth/Death Methodology.

- The net birth/death model component figures are unique to each month and exhibit a seasonal pattern that can result in negative adjustments in some months. These models do not attempt to correct for any other potential error sources in the CES estimates such as sampling error or design limitations.

- Note that the net birth/death figures are not seasonally adjusted, and are applied to not seasonally adjusted monthly employment links to determine the final estimate.

- The most significant potential drawback to this or any model-based approach is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend.

Household Data

The number of unemployed persons (14.7 million) and the unemployment rate (9.5 percent) were little changed in June. Since the start of the recession in December 2007, the number of unemployed persons has increased by 7.2 million, and the unemployment rate has risen by 4.6 percentage points.

The number of long-term unemployed (those jobless for 27 weeks or more) increased by 433,000 over the month to 4.4 million. In June, 3 in 10 unemployed persons were jobless for 27 weeks or more.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in June at 9.0 million. Since the start of the recession, the number of such workers has increased by 4.4 million.

Persons Not in the Labor Force

About 2.2 million persons (not seasonally adjusted) were marginally attached to the labor force in June, 618,000 more than a year earlier. These individuals wanted and were available for work and had looked for a job sometime in the past 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, there were 793,000 discouraged workers in June, up by 373,000 from a year earlier.

Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The other 1.4 million persons marginally attached to the labor force in June had not searched for work in the 4 weeks preceding the survey for reasons such as school attendance or family responsibilities.

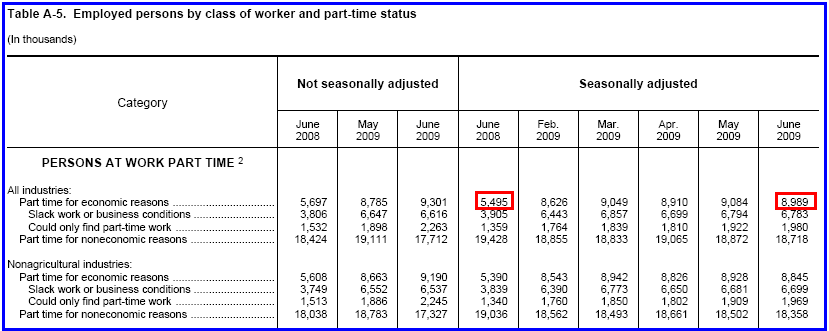

Table A-5 Part Time Status

The chart shows there are 9 million people are working part time but want a full time job. A year ago the number was 5.5 million.

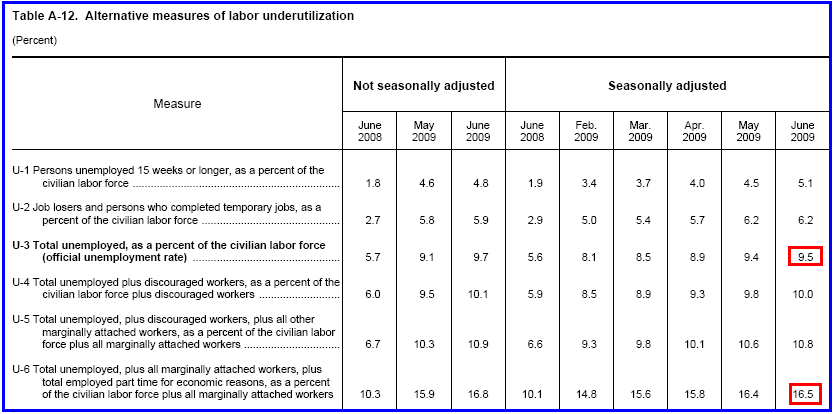

Table A-12

Table A-12 is where one can find a better approximation of what the unemployment rate really is. Let's take a look

Grim Statistics

The official unemployment rate is 9.5% and rising. However, if you start counting all the people that want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6.

It reflects how unemployment feels to the average Joe on the street. U-6 is 16.5%. Both U-6 and U-3 (the so called "official" unemployment number) are poised to rise further although most likely at a slower pace than earlier this year.

Looking ahead, I expect the service sector to continue to weaken. Mall vacancy rates are rising and a huge contraction in commercial real estate is finally started. There is no driver for jobs and states in forced cutback mode are making matters far worse.

Unemployment is likely to continue rising until sometime in 2010.

Depression Level Statistics

I consider these job losses to be depression level totals. Admittedly conditions are not as bad as the great depression, but this is certainly no ordinary recession by any economic measure including lending, housing, bank failures, jobs, the stock market, commodity prices, treasury yields etc. For more on this idea please see Humpty Dumpty On Inflation.

Regardless of whether you think these are depression level statistics, unemployment is high and rising. Moreover, the "adverse scenario" in the Fed's stress test was unemployment at 10.3% at the end of 2010.

If you want something to think about after reading that jobs report, please consider Aircraft repair jobs sold to foreign workers, resumes not important.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.