Investment Grade Bonds Return 9.2%, Junk Returns 29%; Has the "Hard Money" Been Made?

Interest-Rates / Corporate Bonds Jul 01, 2009 - 02:35 AM GMTBy: Mike_Shedlock

As long as the corporate bond market is healthy there is going to be a bid on equities. And in the first half of 2009, junk bonds have been running.

As long as the corporate bond market is healthy there is going to be a bid on equities. And in the first half of 2009, junk bonds have been running.

Please consider Corporate Bonds Show Lehman Doesn’t Matter With 9.2% Return.

Nowhere is the recovery in financial markets more evident than in corporate bonds, where Lehman Brothers Holdings Inc.’s bankruptcy is becoming a distant memory.

U.S. investment-grade company debt returned 9.2 percent in the first half of the year, outperforming Treasuries by 13.7 percentage points, the most on record, according to Merrill Lynch & Co. index data. Corporate bonds also did better than the Standard & Poor’s 500 Index of stocks, marking the first time since 2002 that the fixed-income securities outshined both Treasuries and equities.

Yields on investment-grade company securities fell to within 3.31 percentage points of Treasuries yesterday, the least since Sept. 10, according to Merrill’s U.S. Corporate Master Index. Spreads widened to a record 6.56 percentage points on Dec. 5, and the securities lost 6.8 percent in 2008, the worst year on record, as the shock to financial markets from Lehman’s collapse Sept. 15 froze credit markets and sparked a run on Treasuries that caused bill rates to fall below zero.

“Spreads on corporate debt were so out of whack coming into the year, implying default rates that indicated more than 20 percent of all speculative-grade companies would go bankrupt,” said Kevin Sherlock, co-head of loan and high-yield capital markets at Deutsche Bank in New York. “The risk appetite is far more aggressive now than it was three months ago. It’s about where we were last summer at pre-Lehman levels.”

The biggest returns came in the riskiest securities. High- yield, high-risk bonds gained 29 percent, or 34 percentage points more than Treasuries, Merrill Lynch indexes show.

While credit spreads are narrowing, defaults continue to rise. The U.S. speculative-grade default rate jumped to 8.1 percent in May, the highest since October 2002, and may reach 14.3 percent by the first quarter of 2010, according to S&P.

“The easy money has been made,” said Richard Lee, a managing director in the fixed-income trading department of closely held broker-dealer Wall Street Access in New York. “You could have bought any corporate credit in January and February and made out like a bandit.”

Other measures of credit also show improvement. The difference between what banks and the U.S. government pay to borrow for three months, the TED spread, has shrunk to 41 basis points, the lowest since July 2007 and down from 464 basis points in October. A basis point is 0.01 percentage point.

The Libor-OIS spread, an indicator for banks’ willingness to lend, ended yesterday at 0.38 percentage point. That’s approaching the 0.25 percentage point that former Fed Chairman Alan Greenspan has said would indicate that markets were back to “normal.”Has The Hard Money Been Made?

It is perfectly clear the easy money has been made. Junk bonds are up 29% for the year while the S&P 500 is up 3.2%.

The question now is "Has the Hard Money Been Made?"

While no one knows the answer to that question, we do know risk appetite is back at pre-Lehman levels even though speculative grade defaults are at 8.1 percent and climbing, the highest since October 2002.

Please note the differences. In October of 2002 the economy and jobs were about to improve dramatically along with consumer spending. Housing was robust and about to get white-hot.

This go around, there is not going to be a quick revival in jobs and the housing bottom is still not in. Even when housing bottoms, where is it going? I suggest nowhere in real terms for a decade. Moreover, consumer attitudes towards debt and saving are dramatically different now than in 2003.

Household Deleveraging

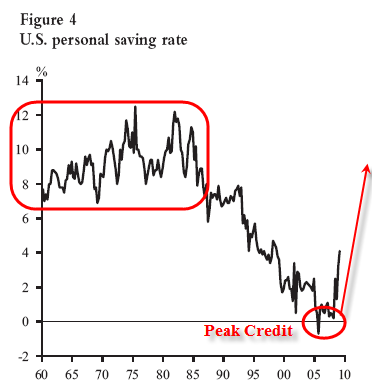

In Effect of Household Deleveraging on Housing, Consumption and the Stock Market I posted the following chart and commentary.

Going forward, it seems probable that many U.S. households will reduce their debt. If accomplished through increased saving, the deleveraging process could result in a substantial and prolonged slowdown in consumer spending relative to pre-recession growth rates. Alternatively, if accomplished through some form of default on existing debt, such as real estate short sales, foreclosures, or bankruptcy, deleveraging could involve significant costs for consumers, including tax liabilities on forgiven debt, legal fees, and lower credit scores. Moreover, this form of deleveraging would simply shift the problem onto banks that hold these loans as assets on their balance sheets. Either way, the process of household deleveraging will not be painless.

....

Think the US stock market is going to come roaring back if consumer deleveraging plays out as it must? Think again.

Expect another "Lost Decade" when it comes to housing and the stock market. It's the deflationary payback for the greatest credit binge in world history.

On June 26, the US Savings Rate Hits 6.9%, Highest In 15 Years. It was 4% when I posted the above chart on May 19, 2009.

Consumer attitudes towards spending have changed. So have banks' attitudes towards lending.

Moreover, the so-called stimulus plans and Bernanke's wizardry have bailed out banks (at taxpayer expense) but have done nothing for consumer debt levels or housing. Indeed Home Loan Delinquencies Double on Prime Loans; Foreclosure Filings Top 300,000 3rd Straight Month.

Expect a double dip recession because one is coming. A triple dip is certainly not out of the question. With that in mind, and with rising junk bond defaults, the stock market and corporate bonds are both priced for perfection.

Nonetheless, if junk bonds continue to run more "hard money" can be had. Feelin' Lucky?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.