Manipulated Financial Markets and Mainstream Media

News_Letter / Financial Markets 2009 Jun 28, 2009 - 10:59 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

June 27th, 2009 Issue #49 Vol. 3

Dear Reader

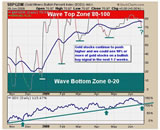

If you are a trader or are just interested in trading, then your primary tools will tend to be the price charts , as a good chart is priceless if it helps to identify a great opportunity. But without the right education, you could be missing high-probability trade setups that should be staring you right in the face.

That’s where the FREE report, How to Use Bar Patterns to Spot Trade Setups, could help.

The free report includes 13 instructional charts accompanied by simple explanations that teach you how to spot specific bar price pattern formations.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. U.S. Economy Trending Towards an Inflationary Depression |

By:Bob Chapman

As Emperor Obama (Romulus the Usurper) fires GM's CEO, steals money from Chrysler's bondholders, puts together Public-Private Investment Partnerships (PPIP's) that will privatize gains and socialize losses in an attempt to stabilize derivative prices by having banks buy their toxic waste from one another in the usual "smoke and mirror" tradition of Wall Street, and creates what currently is an annualized 1.8 trillion dollar federal budget deficit that will grow exponentially over time to finance zombie banker bailouts, to fascistically nationalize the financial, insurance and auto manufacturing industries, and to provide inane, flash-in-the-pan, socialistic spending programs (euphemistically called "stimulus packages" that will do little or nothing to stimulate production or to create permanent jobs).

| 2. A Tale of Two Economic Depressions |

By: John_Mauldin

This week's Outside the box looks at some very interesting research done by two economic historians, Barry Eichengreen of the University of California at Berkeley and Kevin O'Rourke of Trinity College, Dublin They give us comparisons between the Great Depression and today's downturn.

| 3. The Great Reflation Continues Amidst a Tsunami of Debt |

By: Ty_Andros

Saturday morning I woke up and the headline was “Great America files for bankruptcy”. Later on when I read the article, I learned it was only the theme park Six Flags that went broke. The dominoes of destruction continue to fall as the mainstream media and public servants try to put lipstick on a pig, aka the G7 economies.

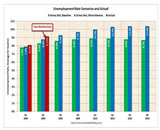

| 4. No Green Shoots of Economic Recovery with US Debt at 700% of GDP |

By: Phil_Williams

What have we learned in 2,000 years?

"The budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt. People must again learn to work, instead of living on public assistance." -Cicero - 55 BC

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

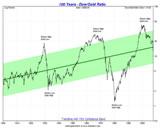

| 5. GOLD, A Case for the Bulls |

By: Alistair_Gilbert

The last year has seen some pretty dramatic falls in commodity prices but Gold actually managed to end 2008 as one of the best performing investments with a gain of about 5%. This was despite the fact that Gold normally rises inversely to the dollar and last year the dollar rose relentlessly, catching a lot of people off guard.

| 6. Investors Don't Get Trapped in the Next Asset Bubble |

By: Gary North

I have identified the next bubble. It has already begun. It is in full swing.

Investors want to identify the next big bubble. Some investors want to buy in now, maybe using borrowed money (margin loans) to make a killing. They are confident that they will sell out near the top. They won't. Other investors just want to avoid getting trapped. They prefer to let the first group bear the uncertainty of profiting from a bubble sector.

| 7. The Great Depression Revisited |

By: Hans F. Sennholz

Although the Great Depression engulfed the world economy many years ago, it lives on as a nightmare for individuals old enough to remember and as a frightening specter in the textbooks of our youth.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

To access the Newsletter archive this link

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.