Decade of Lost Jobs, Worst Since the Great Depression

Economics / Great Depression II Jun 25, 2009 - 11:43 AM GMTBy: Mike_Shedlock

Before taking a look at the worst 10-year job growth record since the Great Depression, let's take a look at the unexpected rise in weekly unemployment claims.

Before taking a look at the worst 10-year job growth record since the Great Depression, let's take a look at the unexpected rise in weekly unemployment claims.

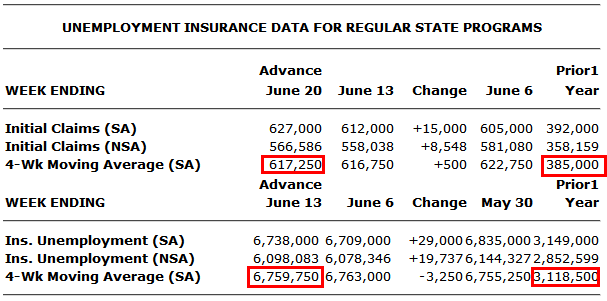

Please consider the Department of Labor Weekly Claims Report.

Seasonally Adjusted Data

In the week ending June 20, the advance figure for seasonally adjusted initial claims was 627,000, an increase of 15,000 from the previous week's revised figure of 612,000. The 4-week moving average was 617,250, an increase of 500 from the previous week's revised average of 616,750.

The advance seasonally adjusted insured unemployment rate was 5.0 percent for the week ending June 13, unchanged from the prior week's unrevised rate of 5.0 percent.

The advance number for seasonally adjusted insured unemployment during the week ending June 13 was 6,738,000, an increase of 29,000 from the preceding week's revised level of 6,709,000. The 4-week moving average was 6,759,750, a decrease of 3,250 from the preceding week's revised average of 6,763,000.Weekly Claims

For eight weeks I have been saying the dip in initial claims from the March peak of roughly 650,000 is not accelerating very fast, if indeed at all.

In three months the 4-week moving average of initial claims has gained roughly 35,000 jobs. For the sake of argument let's call it 15,000 jobs per month. At that rate it will take another 4 months just to get to where we were a year ago and those were God awful numbers at 381,500 claims a week.

Of course things might speed up significantly, then again I was reasonably generous with the initial rate of improvement. Moreover, A drop in initial claims will mean that corporate firings have stabilized, it will not mean that significant hiring is underway.

However you slice things the employment situation remains grim.

Horrifying Job Statistics

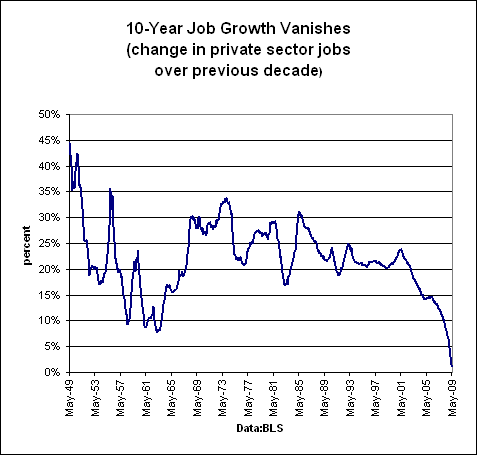

Michael Mandel of BusinessWeek is writing about a Lost Decade For Jobs.Private sector job growth was almost non-existent over the past ten years. Take a look at this horrifying chart:

Between May 1999 and May 2009, employment in the private sector sector only rose by 1.1%, by far the lowest 10-year increase in the post-depression period.

It’s impossible to overstate how bad this is. Basically speaking, the private sector job machine has almost completely stalled over the past ten years.

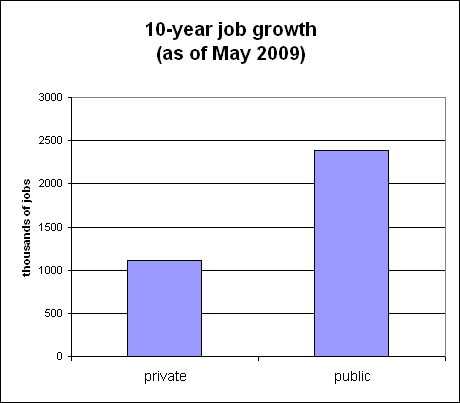

Over the past 10 years, the private sector has generated roughly 1.1 million additional jobs, or about 100K per year. The public sector created about 2.4 million jobs.

But even that gives the private sector too much credit. Remember that the private sector includes health care, social assistance, and education, all areas which receive a lot of government support.Where The Jobs Are

Mandel goes on with tables that show what sectors gained jobs. The top three were Private healthcare, Food and drinking place, and Gov Education.

It's easy to forecast another 1.1 million job losses in the next year given that we are currently losing jobs at the rate of 345,000 a month. (See Jobs Contract 17th Straight Month; Unemployment Rate Soars to 9.4% for details).

Note that the economy has been shedding jobs at a rate of 500,000 a month or more for months on end. The unemployment rate is currently 9.4%.

Within months, the economy will have lost jobs over a full decade for the first time since the Great Depression. Moreover no job recovery is in sight.

At the beginning of the year President Obama made a Fantasyland prediction of 8% unemployment whereas I predicted 9.8% by August and 11% next year. President Obama now concedes the unemployment rate will reach 10%.

Obama claims his policies will save or create millions of jobs. President Bush made similar claims. Such claims are ridiculous because there is no way to measure a "saved job". No matter what the jobs picture looks like, Obama will be free to say he "saved" 3.5 million jobs, or whatever number he wants.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.