Stocks Bear Market Not Finished

Stock-Markets / Stocks Bear Market Jun 23, 2009 - 04:27 PM GMTBy: Donald_W_Dony

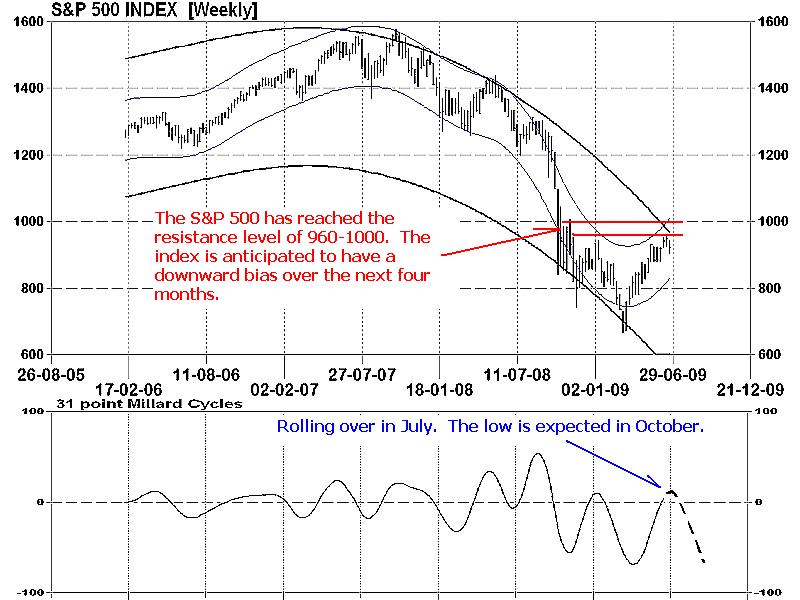

The aggressive rally which propelled the S&P 500 upward 35% from March to June appears to be only half of the bigger picture. Long-term models for the index indicate that the S&P 500 trades on an approximate 7-8 month cycle. The complete movement is from March to October. July represents the mid-point of the cycle.

The aggressive rally which propelled the S&P 500 upward 35% from March to June appears to be only half of the bigger picture. Long-term models for the index indicate that the S&P 500 trades on an approximate 7-8 month cycle. The complete movement is from March to October. July represents the mid-point of the cycle.

Technical evidence would suggest that the next four months should produce a downward bias on the big index.

Once the S&P 500 breaks down to 890, then the present rally has stopped and the expected downward drift to October has begun. The first level of underlying support is at 800. The second is at 740.

Bottom line: Models would suggest that the bear market is not completely finished. There is an increased probability of downward pressure building over the next four months.

Investment approach: Longer-term investors may wish to wait for the correction to unfold before adding new long positions. As most stocks and sectors follow the general path of the underlying index, there is a greater likelihood of obtaining better pricing by October.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.