Credit card fees: What are you paying for?

Personal_Finance / Credit Cards & Scoring May 31, 2007 - 11:04 PM GMTBy: MoneyFacts

Michelle Slade of Moneyfacts.co.uk – the money search engine comments:“Since the OFTs intervention in the credit card market to cap penalty fees, card providers have used numerous rate and fee increases, and have tweaked terms and conditions in an attempt to recoup the lost revenue, with the latest tack being to introduce annual fees.

“Most annual fees recently introduced have the common condition to charge only when the card has low usage, either in terms of the frequency of transactions or their value.

“But we must remember there are several cards available which charge either a monthly or annual fee regardless of how many times you use your card. Generally you will be paying for the additional benefits and incentives. But the fees on credit cards need to come with a similar warning to those on packaged current accounts. Are you really getting what you pay for?

“The most common benefit is annual travel insurance, while others include purchase protection or discounted offers. But as with any benefit it’s worth checking that it is something that you will actually use and gain some benefit from. Take the travel insurance offered on these cards for example; many will require you to pay for your holiday with your card, which in many instances will incur a transaction cost, ultimately meaning that it could have been cheaper to buy your insurance independently. And before you travel, check the policy covers all you need. Is it worldwide or just for Europe? Does it cover an individual or your family? Does it cover winter sports? Are existing medical conditions covered? What are the maximum payouts?

“But don’t think incentives are only available on annual / monthly fee cards, as many other cards offer incentives, including a handful which include worldwide travel insurance.

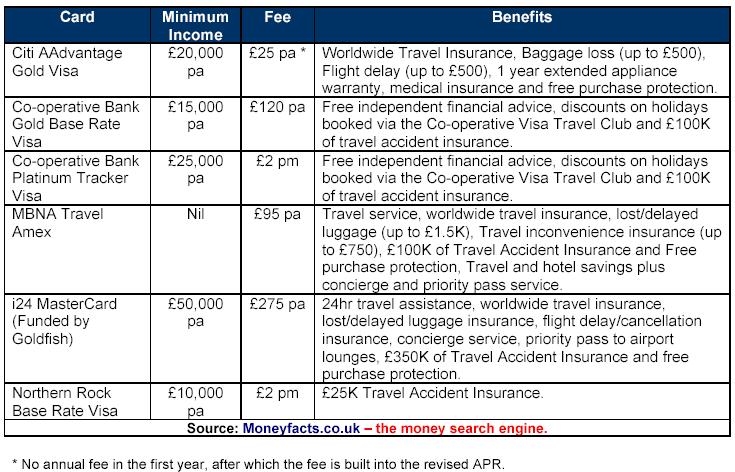

“Fees can range from £2 pm (£24 pa) to £275 pa, but alarmingly there seems to be little difference in the benefits offered. This is highlighted with the two Co-op cards listed in the table below. These cards offer the same benefits, but one charges £2 per month and the other £120 per year. The difference between these cards is the balance transfer deal available, the interest rates and the guarantee to match an existing credit limit.

“As neither of these cards offer the most competitive deal in the market, it would be worthwhile shopping around for the best deal and use the money saved to buy any benefits independently.

“Don’t think that just because you are paying for your card, you are getting anything exclusive in return. Gold and Platinum cards have lost their exclusive appeal, with often similar or better deals available on standard cards. If you do choose a card with an annual fee, make sure you are getting value for money in return.

“While in the future we may see more and more annual fees, today most credit cards are free and some offer very competitive deals. So why not take advantage of them while you can?”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.