Gold Stock Correction Timing

Commodities / Gold & Silver Stocks Jun 21, 2009 - 11:19 AM GMTBy: Adam_Brochert

I am a big time Gold stock bull based on the deflationary depression that I believe has already begun (for those who don’t understand why deflation is good for Gold miners, look here). The stock market is a dangerous place to be right now and there’s no rush to speculate on the upside right now. Patience will be rewarded as the new bear leg down in the stock market that has begun will take even good sectors down with it.

I am a big time Gold stock bull based on the deflationary depression that I believe has already begun (for those who don’t understand why deflation is good for Gold miners, look here). The stock market is a dangerous place to be right now and there’s no rush to speculate on the upside right now. Patience will be rewarded as the new bear leg down in the stock market that has begun will take even good sectors down with it.

Gold stocks made their secular lows last fall in the Great Panic of 2008 and won’t be making any lower lows, unlike general stocks. I believe the top is in for the major Gold Miner indices like the HUI, XAU and the GDX ETF. Every stock makes its own movements and I am actually bullish right now on Gold royalty company Royal Gold (ticker: RGLD), but I wouldn’t put new money into GDX right now for longer-term investors.

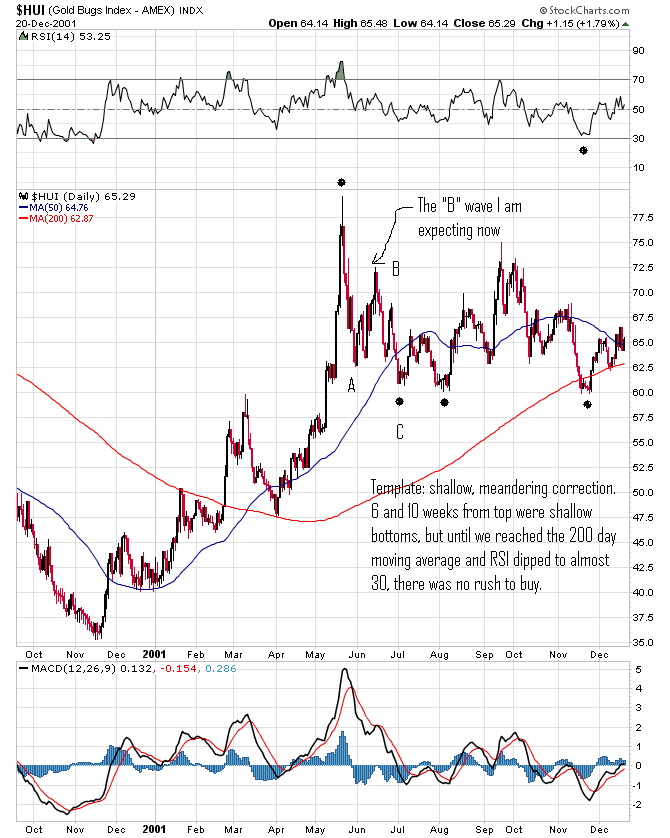

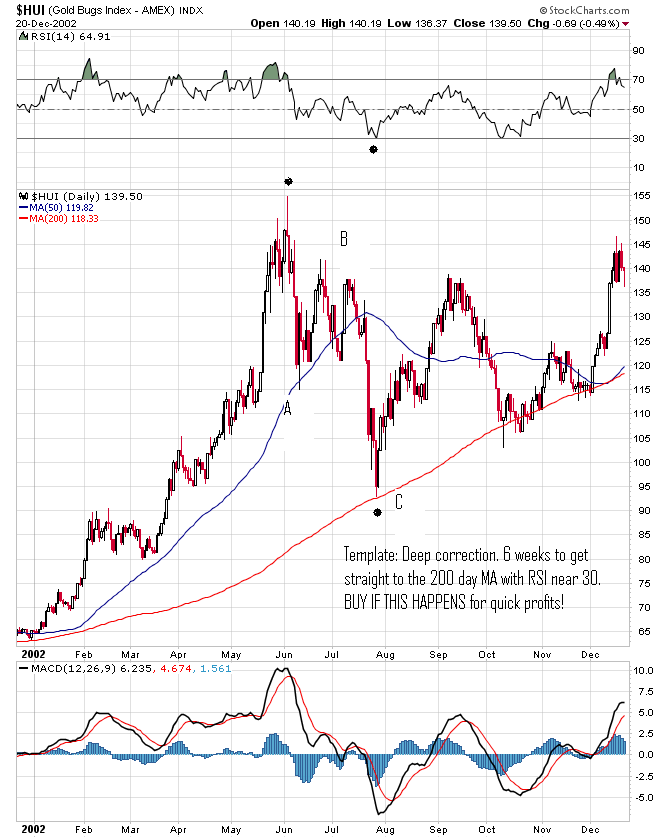

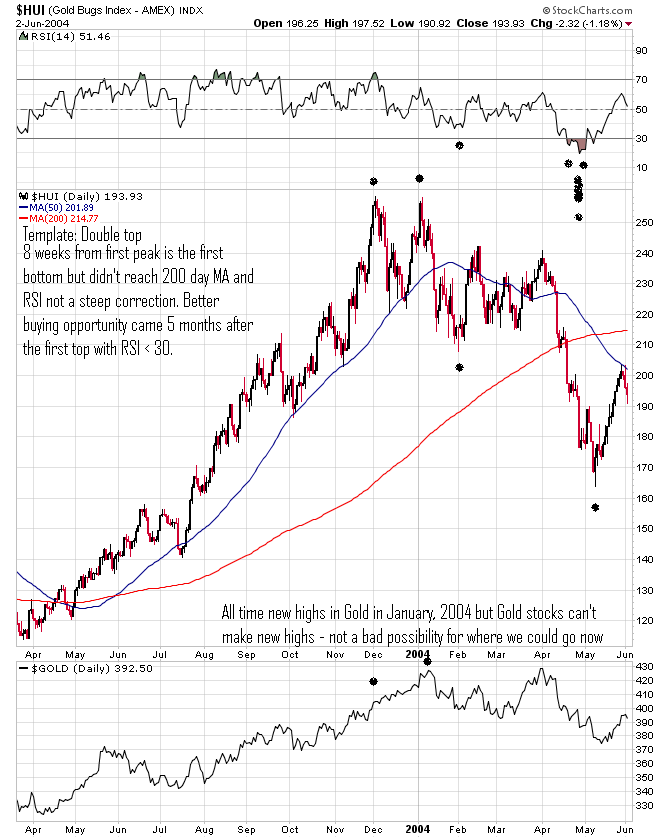

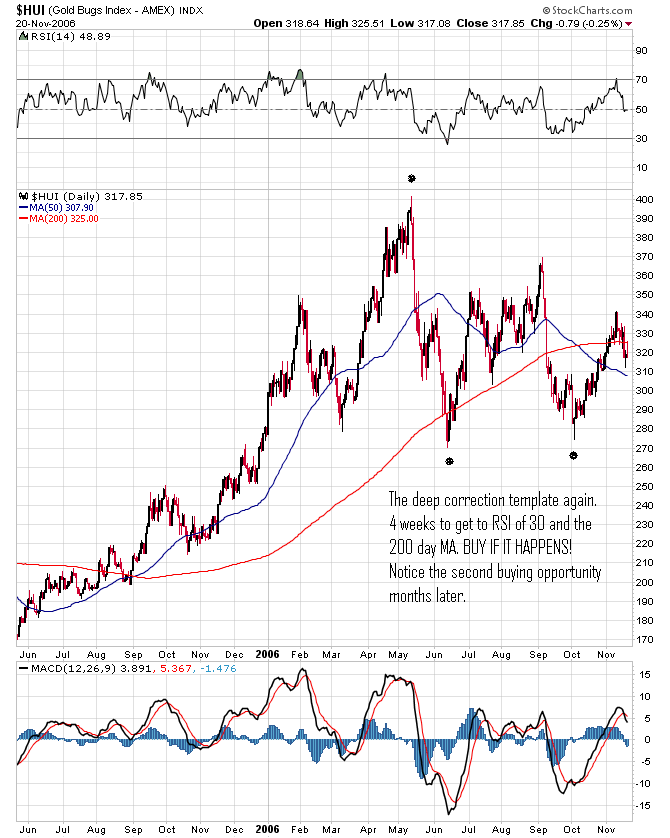

Senior Gold stock indices usually begin a correction with a typical “A-B-C” configuration. This may or may not be the final corrective low for the entire correction, as corrections can grind on for months, particularly after a strong bull thrust. These corrections are boring and can be frustrating for those trying to get rich quick, but are a necessary part of any healthy bull market.

Rather than base my analysis on macroeconomic events, which so many try to use to justify different outcomes, I’d rather look at the rich history of the current secular Gold stock bull market for clues. We have entered a seasonally weak period for stocks, including Gold stocks, and now is not the time to be making new senior Gold stock purchases for the longer term in my opinion. This is because I believe better buying opportunities lie ahead.

Fundamentals are strong for Gold miners and those who understand how Gold stocks make money already know it. This doesn’t stop corrections from happening and never has! In fact, I am expecting Gold miners to correct deeply at a time when their fundamentals are actually getting stronger. Markets aren’t always rational and this is why technical analysis can help timing new purchases during a bull market.

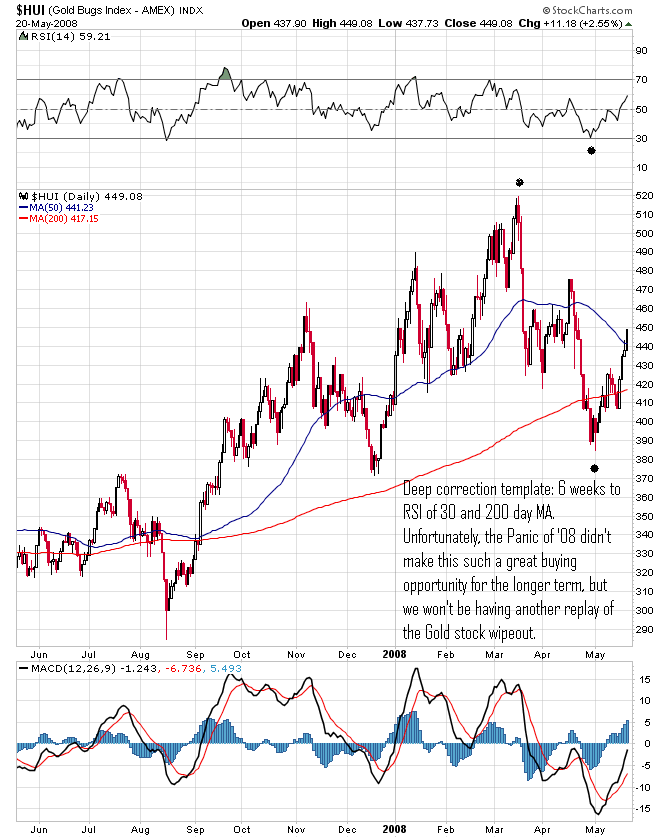

Here are multiple charts of previous intermediate-term corrections in this Gold stock bull following intermediate-term multi-month bull thrusts like the one that started last fall. These are put in sequential order from oldest to most recent with my comments imbedded in the charts:

So there are three major “templates” for Gold stock corrections during the current secular bull market in Gold stocks, which is not close to being over:

1. Steep correction (most common): 4-8 weeks to get to an important low that makes a good trade or longer-term buy and hold. Look for index to reach the 200 day moving average and RSI to be around 30 on a daily chart.

2. Shallow correction: 4-8 weeks to get to a non-important low. Not a great buying or trading opportunity and one should sit on their hands if this occurs. Look for RSI well above 30 and stock index well above 200 day moving average on a daily chart. Shallow corrections imply more time and price correction will eventually occur later in the summer or fall.

3. Double top: May happen if Gold moves to new highs over the next month, which is a distinct possibility. DO NOT BUY GOLD OR GOLD STOCKS IF GOLD MAKES IT TO NEW HIGHS AND SENIOR GOLD STOCK INDICES DON’T. This is a classic bull trap and will cost investors dearly.

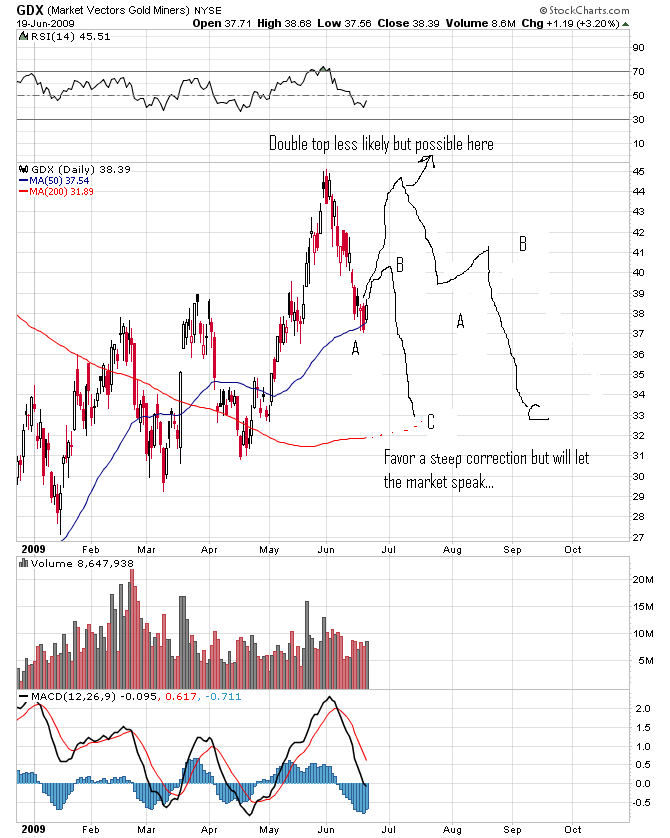

Here is the current chart of the GDX ETF, used because it is easily tradable without options (unlike XAU or HUI), with my thoughts:

I believe the “A” wave in the “A-B-C” correction is over. We will now rise for a week or two (or longer if a double top scenario is brewing), which is the “B” wave of the correction, then decline into a lower low in a “C” wave. In either scenario, or even if the shallow correction scenario occurs, better buying opportunities lie ahead. I think the shallow correction scenario is unlikely primarily because I expect volatility to increase markedly over the next month.

I would avoid buying senior Gold stocks until their RSI is near 30 and they are near their 200 day moving averages, as this provides a much higher reward to risk ratio. Not every stock will bottom at the same time, to be sure. Though such an analysis may seem overly simplistic, one should not try too hard to outsmart a volatile bull market! It also doesn’t pay to be overly bullish at inappropriately early times during one of the worst cyclical stock bear markets that any of us will likely witness in our lifetimes. Babies can get thrown out with the bathwater as the saying goes during deep bear market plunges.

Junior mining stocks and Gold royalty companies are a different animal altogether and this analysis does not apply to these sectors.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Adam Brochert Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

free mcdonalds food coupons

13 Sep 09, 10:40 |

great blog post.

Thanks very much for that nicely written entry. |