Inflation or Deflation, Which is More Likely?

Economics / Deflation Jun 21, 2009 - 04:49 AM GMTBy: Brian_Bloom

“Hyperinflation” in the USA is a concept which has been freely bandied about in recent weeks, and a friend – who lives in Switzerland – recently queried this analyst’s view that deflation is the more likely eventual outcome for the world economy as a whole. In the conversation which ensued, what finally emerged was that communication on the subject is fraught with definitional issues.

“Hyperinflation” in the USA is a concept which has been freely bandied about in recent weeks, and a friend – who lives in Switzerland – recently queried this analyst’s view that deflation is the more likely eventual outcome for the world economy as a whole. In the conversation which ensued, what finally emerged was that communication on the subject is fraught with definitional issues.

For example, my friend pointed to the comment by Marc Farber that "I am 100 percent sure that the US will go into hyperinflation", as quoted on Bloomberg May 27, 2009

The response of this analyst was: “Well, let’s think it through on a step by step basis”.

The fact is that the US economy only accounts for 25% of the global economy, whilst the proportion of US Dollars in the world’s total foreign exchange reserves (based on the most recent number this analyst has seen) is around 65%.

From this it follows that, if there is hyperinflation, it will be denominated in US Dollars – because it is the US Fed that is “printing” trillions of dollars – and the primary price inflation impact will be felt within the USA. That will cause volumes of transactions to contract in the USA and that will cause volumes of imports into the USA to contract.

Why will volumes contract? Let’s look at the issues from a business perspective rather than an economic perspective. How do business people cope in times of hyperinflation? How do they manage their businesses?

In the early 1990s, this analyst was involved in exporting Australian medical and environment management technologies to Latin America. Countries like Brazil had just come through a period of hyperinflation in the 1980s and Brazilian workers were facing price adjustments of items as mundane as bread on a regular basis – often more than once a day.

The way this process was managed – as far as this analyst could tell at that time – was that the prices of all goods and services were benchmarked against a strong currency (say the US Dollar). That is, a notional price in US Dollars was allocated to a loaf of bread. The price of the bread was then adjusted in Cruzeiros based on the regular publication by the Brazilian banks of the rapidly changing exchange rates of the Cruzeiro to the US Dollar.

It was never explained to this analyst precisely how often wages were adjusted or paid, but the assumption he made at that time was that even if wages were payable daily, they would always be paid at the end of the day and the implication was that the standard of living was constantly under pressure. For example, if the price of bread was adjusted upwards before you had a chance to spend your wages from yesterday then you would probably have to forego buying something else.

The reality at that time was that this analyst visited several hospitals in Latin America which could not afford to buy even sutures, and where hospital beds had no linen. When your currency is decreasing in value relative to every other currency in the world, you cannot afford to import anything except the most critically important products/services.

So, without straining our brains trying to work out which currency would be the benchmark against the US Dollar prices for everyday commodities that would need to be adjusted more than once a day within the USA in a period of hyperinflation (it may or may not be gold), it becomes immediately obvious that the volume of imports into the USA would collapse if the US Dollar collapses.

Thus, by way of illustration, if China is producing all the sutures which will need to be used to stitch up the parts of the bodies of the thousands of people that will be cut and/or torn and/or bullet riddled in the American food riots that will likely emerge then, when the wounded presented themselves to hospitals to get themselves sewn together again, there will likely be no sutures.

Now let’s look at this same situation from the perspective of China:

Volumes of exports to the USA will fall. Profits that are calculated in Renminbi or Yuan by businesses in China will fall. Chinese manufacturers’ ability to service their debts will negatively affected. Some manufacturers will go insolvent.

Overall economic activity within China will be negatively impacted. Bad debts inside China will rise. Unemployment within China will rise. Volumes of transactions inside China will fall and China, which has not been printing trillions of Yuan, will experience deflation because capacity will exceed demand and this will exert a downward pressure on Yuan denominated prices.

Now let’s look at this picture from the perspective of someone living in Switzerland. Why would hyperinflation within the USA affect the Swiss – except insofar as there will be a deflationary impact on the Swiss economy? Switzerland will sell less chocolate and fewer banking services.

This analyst lives in Australia. We export coal and other minerals. Hypothetically in an era of US$ hyperinflation, the price of coal may rise to a million US Dollars a ton. But this will be because the value of the US dollar has fallen. In Australian dollar terms we will still be getting (say) A$50 a ton.

But here’s the problem: We will be selling less quantities of coal. So in order to sell more quantities of coal we will be forced to reduce the A$ price of coal. In fact we did this only a few weeks ago with our iron ore. In order for BHP to retain its contracts to supply the same volume of iron ore to Japan, we had to reduce the price by 33% - in US$ terms. If the US$ falls, can you imagine how badly that will affect the Australian iron ore mines?

Unfortunately for China, they will be hit twice. They will not only find their economy contracting because they are exporting less to the USA, they will also find the value of 50% of the foreign exchange assets (US$) reduced to virtually nothing.

Right now, the Chinese are sweating. They are hoping and praying that the US Dollar will not collapse.

Interim Conclusions

It is in no ones’ interests for the US$ to fall – not the US and not any other country.

This talk of US$ hyperinflation is merely a distraction to anyone who lives outside the USA. If, for example, Marc Farber turns out to be correct when he opines that "I am 100 percent sure that the US will go into hyperinflation” then, it will follow with 100% certainty that outside the USA the rest of the world will experience deflation.

At the extreme, we will all of us (the US included) be facing a world Depression.

Looking forward

It is emphasized that all of the above represents an extreme outcome. In between the extreme of black and the extreme of white there are shades of grey.

Given the chilling logic of the above, it becomes immediately apparent that no government in its right mind will deliberately do anything that is likely to result in a collapse of the US Dollar. For example: Arguably, Saddam Hussein was not in his right mind when he attempted to price Iraq’s oil in Euros. He was blinded by political hysteria. What happened was that he was quickly neutralized. The stakes were too high to let him sabotage the entire world’s economy. That’s presumably why Australia’s Prime Minister fell meekly into line when George Dubya decided to attack Iraq despite the fact that a very large proportion of the Australian population tried to send a strong message to John Howard that it didn’t want Australia involved in the US’s domestic problems. The facts were that Hussein’s actions threatened the entire world’s economy and the argument about “weapons of mass destruction” was just smoke.

This example serves to illustrate that the world is now globalized. It has already happened. What happens in the USA will not leave anyone else unaffected. Therefore, to talk about “hyperinflation” being certain in the USA assumes that the Rest of the World will just stand by while the US dollar collapses. To the contrary, in this analyst’s view, it is 100% certain that the rest of the world will not just stand by and watch whilst the US Dollar collapses.

Of course, this does not mean that the US Dollar won’t collapse. It merely means that no one in authority wants it to collapse, and everyone in authority will be trying their best to avoid that outcome.

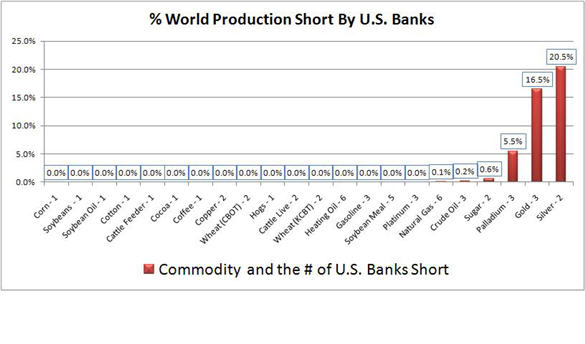

The above logic will go some way towards explaining why the US banks are short such larges volumes of precious metals – as can be seen from the chart below:

Source: Casey`s “Daily Resource Plus” commentary.

Last week, according to Casey, US banks were short 16.5% of the combined annual output of entire world’s gold mining industry.

And that brings us to the market speculators. If the combined weight of all the world’s speculators is able to overcome the combined weight of all the world’s financial authorities then, presumably, people like Jim Sinclair will be proven correct – and the price of gold will rise to US$1600 an ounce before rising to get to Alf Field’s numbers in the multiple thousands of dollars.

All of these men (Farber, Casey, Sinclair, Field) are giants in their field and this analyst is not about to take any of them on. But what he is prepared to do is ask the following question: “So, if the price of gold rises to (say) $5,000 an ounce, then what?”

Who would want to be a dollar santifascarillionaire in an environment where the dollar is worth one santifascarillionth of its former value?

In context of a world Depression which will – with 100% certainty – follow a US Dollar collapse, the question we need to ask is how will we protect our net worth? The answer to that is virtually impossible to articulate. Demand for almost everything will collapse flowing from people’s inability to pay for anything. Cash will be king, but what will constitute cash? Will it be gold? Will I go down to my local supermarket and tender 1/400th of an ounce of gold for a loaf of bread? (A$1200/400 = A$3 for a loaf of bread). Maybe rice will become cash in the East. Maybe wheat will become cash in the West.

At some point, we have to start thinking more like businessmen and less like economists. The reality is that commercial life will become virtually impossible to cope with across the planet if the US$ collapses.

This in no way implies that the US$ won’t collapse, but it does put under the spotlight that we should be thinking of ways and means to prevent such an outcome rather than gleefully rubbing our hands together when it seems increasingly likely that the US$ will collapse.

Ultimately, we need to ensure that the world economy keeps turning. Ultimately, the probability of that happening will be highest if low cost energy is made available to as many people across the planet so that we can harness the entrepreneurial ingenuity of as many people as possible. When the going gets tough, the tough get going – provided they have access to the basic accessories. Low cost energy is the most basic of all wealth creation accessories.

But next time around we will have to behave differently, if for no other reason than that Mother Nature is getting restless. She is getting mighty tired of being raped by anyone who takes a fancy to the notion that becoming a santifascarillionare is the purpose of human life on earth.

Beyond Neanderthal, which was published by this author in June 2008, is a factional novel which was written with the object of putting some perspective on all of this. We absolutely cannot continue to think within the paradigms which stood humanity in good stead from 1750 CE to 2000 CE! The game has changed! For example, owning a Lexus or a Beemer or a Harley or a bright orange Gucci track suit is no longer as important as it used to be. The question is: How do we come through all of this and, if possible, improve the quality of our lives? And, in answering this question, we need to recognize that more quantity does not necessarily translate into more quality.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.