The Great Reflation Continues Amidst a Tsunami of Debt

Economics / US Debt Jun 20, 2009 - 02:06 AM GMTBy: Ty_Andros

In This Issue: Fingers of Instability, Part IV

In This Issue: Fingers of Instability, Part IV

Tsunami of Death, er….Debt

Banks, the New Healthy!

Character Assassination!

Green Shoots

Fall of Babylon

Capital Flight

Lessons from 55 BC

Introduction

Saturday morning I woke up and the headline was “Great America files for bankruptcy”. Later on when I read the article, I learned it was only the theme park Six Flags that went broke. The dominoes of destruction continue to fall as the mainstream media and public servants try to put lipstick on a pig, aka the G7 economies. The monthly unemployment figure was announced at an approximate -350,000; but, after unwinding the accounting fictions, the true figure, as calculated by John Williams of www.shadowstats.com, was a loss of 538,000. The truth, too ugly to disclose, is that the executive branch decided to build on the legacy of the previous administration; doublespeak in the finest tradition of George Orwell. Credit continues to contract in almost all categories of lending, and in Ponzi asset-backed economies, this is the proverbial “kiss of death” because the greater fool cannot take the baton from the previous one.

The greatest transfer of wealth from those that hold their wealth in paper to those that don’t has commenced: A “Crack-up Boom” approaches. - Ty Andros

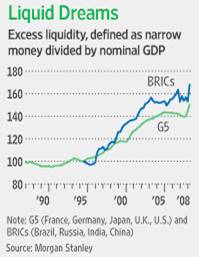

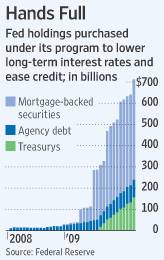

As the GREAT REFLATION continues, Bernanke’s helicopter drops (liquidity is at RECORD highs; see chart) and Quantitative Easing (printing money out of thin air) FAIL to reach their targets and instead, head into asset markets (stocks, bonds and commodities) rather than into new lending, to seek shelter from the printing presses. I believe there is one more category which the Fed is monetizing, and that is the stocks and bonds of the BIG BANKS in the financial industry.

The Press is creating the idea that they can withdraw this stimulus. IF THEY TRY TO DO SO, IT’S BOMBS AWAY on the economy. Even talk of it will do tremendous NEW damage to asset prices which are the epicenter of the solvency of the financial system. This IS NOT a LIQUIDITY crisis, it is a solvency crisis. Take a look at the mountains of liquidity being injected; these charts are mirrors of each other:

No shortage of liquidity, it’s a solvency crisis. It’s the oligarchs (CRONY CAPITALISTS) and G7 governments which are morally and fiscally BANKRUPT. They are transferring their insolvency onto the captive victims, also known as their citizens, with MONEY printing and mountains of new debts to pay for their future follies, past mistakes and mismanagement of their countries’ futures.

No shortage of liquidity, it’s a solvency crisis. It’s the oligarchs (CRONY CAPITALISTS) and G7 governments which are morally and fiscally BANKRUPT. They are transferring their insolvency onto the captive victims, also known as their citizens, with MONEY printing and mountains of new debts to pay for their future follies, past mistakes and mismanagement of their countries’ futures.

The TARP program has become a unique FAILURE as the toxic assets STILL sit on the books of the BIG banks, except for the $2 trillion which now resides on the Fed’s balance sheet. And sales really can’t take place, because to do so would be a repeat of the Merrill Lynch fire sale of last July which triggered the financial-sector collapse into the fall -- as one sale creates “mark- to make believe” the fantasy it is.

If you recall, Merrill sold some of their toxic inventory for 22 cents on the dollar and financed 75% of the purchase for the buyer. Mark to market did the rest, and the shell game of tier-3 assets was punctured, creating disastrous fourth-quarter results for the banks. As detailed in last week’s missive, the accounting rules were reversed under POLITICAL pressure when the first quarter came to a close in March. Nonetheless, the treasury did acquire significant stakes in OVER 600 banks which are now just waiting for instructions from their NEW “politically directed” LENDING officers inside the beltway, aka PUBLIC SERVANTS.

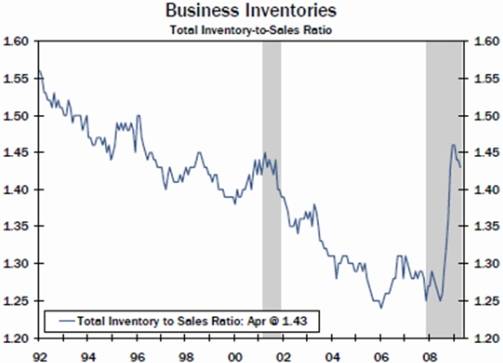

As we see an inventory bounce in the economic numbers, it is apparent that a continued expansion is predicated on the pickup in CONSUMER spending. Inventories are building, but sales continue to plummet, so inventories must be reduced AGAIN because they are once more at elevated levels. It’s always fun to put these things into VISUAL perspective, so let’s take a look:

As we see an inventory bounce in the economic numbers, it is apparent that a continued expansion is predicated on the pickup in CONSUMER spending. Inventories are building, but sales continue to plummet, so inventories must be reduced AGAIN because they are once more at elevated levels. It’s always fun to put these things into VISUAL perspective, so let’s take a look:

This is not the face of a consumer comeback and GREEN SHOOTS. It is an unfolding DISASTER. Household incomes are plummeting, as are incomes on all levels of the G7: individual, corporate, municipal, state and federal. In fact, it is the picture of the next leg down for the manufacturing sector as it and the retailers it supplies n reduce inventory for the SECOND time, while at the same time, banks and financial industry defaults continue to accelerate.

In its latest MONEY GRAB, the Congress and Chief Executive passed a bill that authorizes the FDA to regulate tobacco, extending the grip on the tobacco industry as a source of new funds from new fees and taxes, and of course, new campaign contributions to buy regulatory forbearance. The federal and state governments have nationalized the tobacco industry in everything but name only -- partners in preying on smokers. This becomes ethical when it raises more CASH FOR GOVERNMENT.

Tsunami of Death, er…. Debt

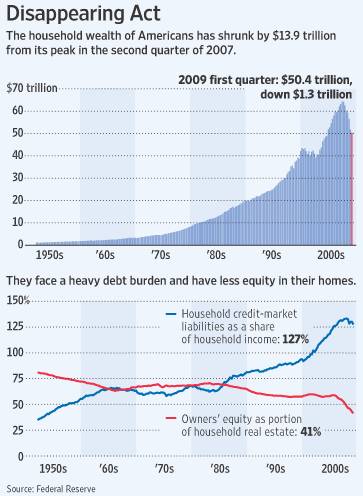

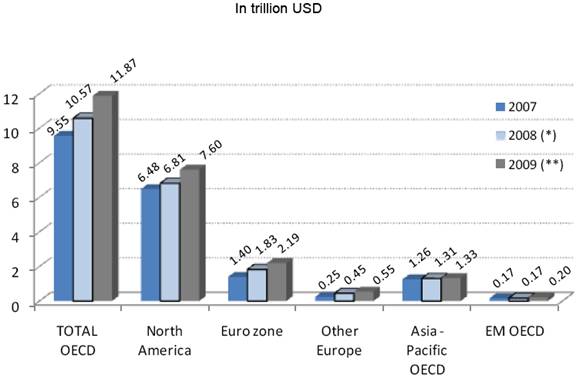

The destruction of the dollar, G7 currencies and bond markets face a significant acceleration in the next six months. The rally in global bond markets nears its completion as new issuance and the rolling of old debt issues increasing proves PROBLEMATIC for global financial markets. Let’s take a quick tour around some of the challenges facing borrowers in the coming months, and a look at the biggest borrowers first - the gluttons of government:

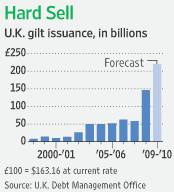

This government debt is paying RECORD low rates. Combine this with the fact that any half-wit knows that the deficits are only going to continue to grow for the near future, as G7 deficits now approach 10 to 15% of GDP for 2009, and are set to continue to explode in 2010. Take a look at the UK tsunami of debt. Unable to go directly to the market or their primary dealer networks, they have now turned to the big banks syndication groups to HAWK the offerings:

Up over 400% in two years, the US is also up 400% since LAST year. Auction failures loom large as INSOLVENT borrowers try to sell offerings SIMULTANEOUSLY over the next nine months; PONZI borrowing where they borrow new funds to retire old obligations and fund new DEFICIT spending. The last person to buy their issuance before the credit markets refuse to buy will be paid back in PRINTED, worthless coupons known as dollars, Euros, pounds, Swiss francs, yen, etc.

Up over 400% in two years, the US is also up 400% since LAST year. Auction failures loom large as INSOLVENT borrowers try to sell offerings SIMULTANEOUSLY over the next nine months; PONZI borrowing where they borrow new funds to retire old obligations and fund new DEFICIT spending. The last person to buy their issuance before the credit markets refuse to buy will be paid back in PRINTED, worthless coupons known as dollars, Euros, pounds, Swiss francs, yen, etc.

This doesn’t include all the new costs from ENTITLEMENTS (free health care) and taxes from the new ENERGY bill. The major banks in the United States face record amounts of short-term debts of over $417 billion coming due in the next year and a half, and in Europe they face similar challenges. However, those in Europe may have waited TOO long as credit markets are about to be flooded with issuance.

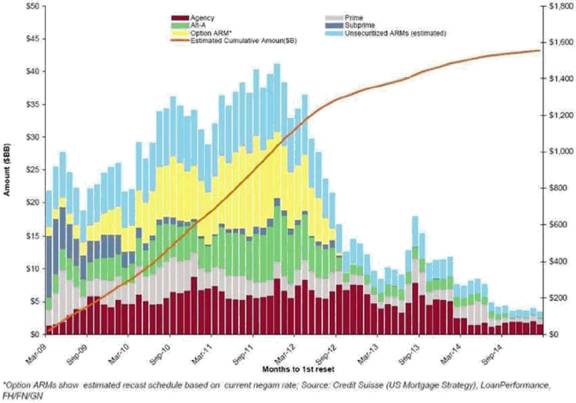

Now let’s look at the next wave in the adjustable mortgage crisis, which is set to rise all the way into the first quarter of next year and stay high into 2012:

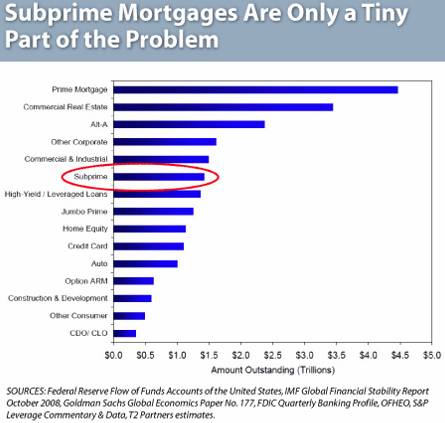

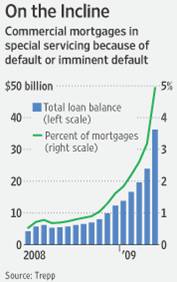

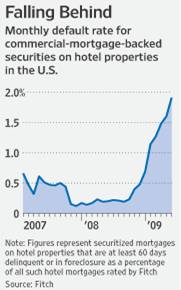

This does not include the regular 30-year prime and jumbo mortgages issued during the 2004-2008 period, which are now mostly into negative equity. What other categories out there and write-offs are still to unfold?

This does not include the regular 30-year prime and jumbo mortgages issued during the 2004-2008 period, which are now mostly into negative equity. What other categories out there and write-offs are still to unfold?

This is just the US side of the problem. The collateral underpinnings of these loans have DECLINED 20 to 30%. How many of these borrowers will default because they owe more than their assets are WORTH and who can’t refinance?

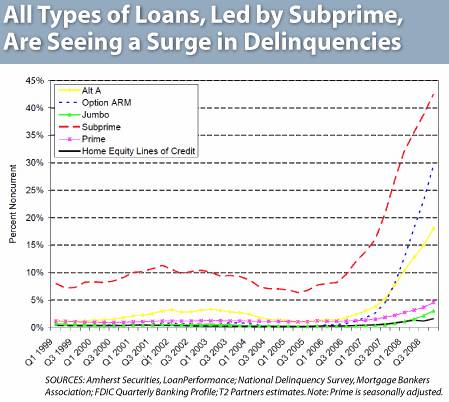

As all types of loans increasingly head into delinquency …

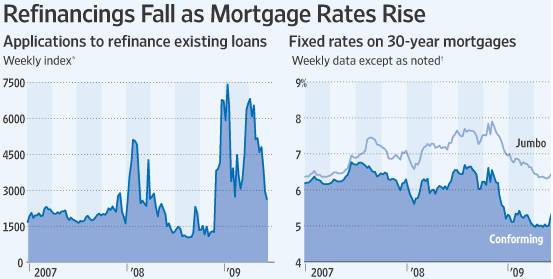

… and lending rates rise, these new issues and refinancing are going to be increasingly hard to finance. The higher rates go, the harder it is for borrowers to show the ability to repay on assets that are FALLING in value:

The losses in all categories of lending are just worsening, and rolling or refinancing the debt for most of these borrowers is OUT OF THE QUESTION. The amount of new BORROWING required by insolvent borrowers is about to SKYROCKET.

The losses in all categories of lending are just worsening, and rolling or refinancing the debt for most of these borrowers is OUT OF THE QUESTION. The amount of new BORROWING required by insolvent borrowers is about to SKYROCKET.

Who will be the latest patsies? Institutions, high net-worth individuals (in the hands of the big private wealth management companies) and pension funds, which recognize these un-payable obligations as high-quality, long-term investments as defined by: YOUR GOOD FRIENDS AT THE RATINGS AGENCIES, AND G7 financial regulators who can define trash as treasure, rather than the trash they truly represent. Just ask bondholders of MCI, Enron, CDO’s, CLO’s, mortgage-backed securities, and soon municipal and state debt.

As anyone can see by the velocity of money printing, the value of which continues to plummet, lending continues to contract in real terms. To offset this, the FEDERAL RESERVE cannot turn off the monetization (of more and more of these failing lending decisions), and can only consider the expansion of it; anything less than this is financial system SUICIDE. Shrinking balance sheets and deleveraging is hard to do, but it starts with refusing to roll loans and refinance existing debt which is no longer underpinned by collateral values. It’s either Hi Ho, Hi Ho, off to the printing presses they go, or curtains……

Banks, the New Healthy!

Stress tests on the biggest 19 banks in the United States have just been completed. After much haggling, they were deemed to need only about $75 billion in new capital to deal with the WORST case of defaults on the debt outlined in the tsunami of death, er debt. The worst case scenarios have ALREADY been breached. Let’s take a look at the reality of the situation. In the June 11, 2009 issue at www.ft.com Lex’s column, entitled: “Banks, the New Healthy”, they detailed the CURRENT definition of the most healthy bank in the US by the treasury:

“As an investor, would you touch the following bank with a cattle prod?

Its total assets dwarf common equity by 25 times to one – higher than the average for US banks over the past decade. Think of this another way: just a 4 per cent hit to the balance sheet and wave goodbye to shareholders’ equity. Even comparing tier one capital with risk-weighted assets reveals that its gearing is 14 times.

What about those assets then? Barely at the start of a household deleveraging process that will last for years, two-thirds of its outstanding loans are to consumers, with mortgages accounting for a quarter and credit cards for 10 per cent. Yet its non-performing loan ratio of 12 per cent for mortgages in the first quarter, for example, was the highest of all the banks that are covered by Barclays Capital. That ratio increased by almost 250 basis points versus the previous quarter, and there are few signs that house prices have stopped falling yet.

Then there are its off-balance sheet investment vehicles. This bank still has a $93bn exposure – a third of which relates to conduits that purchase securities funded by commercial paper. True, outside investors are technically first in line to take any hit. But if things get really bad, banks usually have to step up. What is more, it has so-called “level three” assets equivalent to 126 percent of tangible common equity. These are assets which cannot be valued using observable inputs such as market prices – you just have to trust the bank’s internal calculations.

Finally, like all banks, its past earnings power will be diminished due to lower economic growth and rising regulation. Unlike others, however, it is now free from the troubled asset relief programme. It is also considered by far the healthiest of the big US banks.”

Do you really believe the banks are not going to have 4% losses on the tsunami of death er debt? Absurd. The US government may have provided the proviso that they are guaranteed not to fail, but their stocks should trade at the other state-owned enterprises such as AIG, Fannie Mae, Freddie Mac, GM and Citigroup at about $1 dollar. In Sunday’s New York Times, Gretchen Morgenson in “Debt coming due at just the wrong time” states:

“It has been a long slog through the credit morass, and investors are understandably eager to think they are emerging onto higher ground. Still, the bad debt that was amassed by consumers and companies in recent years hasn’t been fully purged, even with the help of the Troubled Asset Relief Program. And the debt on financial companies’ balance sheets must do a lot more shrinking before we can move on from this ugly chapter in financial history.

To get a fix on how much work remains to be done, consider the substantial amount of short-term debt coming due at financial companies in the next year or two. As you absorb these figures, keep in mind that many of the entities that bought this debt when it was issued aren’t around now — they’ve either left the market or are gone, casualties of the crisis.

As a result, they’re not around to step up and buy the debt again. So issuers can’t roll it over. They’ll be forced to buy back the debt, at a time when they’re already wallowing in other forms of troublesome debt and short on liquidity.

Barclays Capital has analyzed financial company debt among United States institutions coming due over the next decade. During the rest of the year, for example, roughly $172 billion in debt will mature; in 2010, an additional $245 billion comes due. That amounts to about $25 billion a month in debt rolling into a market with a shortage of buyers willing to invest in it.

The size and nature of this financial services debt — and the customers who bought it — are central to the late great credit mania we have just lived through. Banks and other finance companies issued these obligations for relatively short periods — five years or less — and paid investors either variable interest rates or the fixed variety.

Issuance of this financial debt exploded during the mid-2000s. Back in 1999, paper issued by American financial companies made up 30 percent of Barclays’s fixed- and floating-rate corporate debt index. By 2007, this type of debt accounted for almost half of the index.

Of the $172 billion coming due by year-end, Barclays says, $123 billion was floating-rate debt. And of the $245 billion maturing next year, some $141 billion pays a variable rate.”

Do they issue this with FDIC guarantees to get it to roll? I bet that is the only way any of these holders stick around. If it is issued with the FDIC wrap, why are these banks exiting the TARP? NO WAY will they get access to lenders for this amount of new issues. Keep in mind that the US federal government must issue $3 trillion worth of debt by September, and $2 trillion is new issues and $1 trillion is rollover debt; next year the numbers project to be the same or greater.

As I am writing this, S&P ratings agency is downgrading 18 big banks (some of them are escaping the TARP today) to near junk status, not a sign of balance-sheet health

Throughout Europe the story is the same, massive insolvencies covered up by regulators, public servants and crony capitalists.

The banks are still INSOLVENT, every one of them and so are the US and G7 governments. PONZI lending and borrowing (assisted by your G7 governments and public servants) just postponing the inevitable demise of the G7 financial systems.

Character Assassination!

Since this crisis began years ago, we have all understood the nature of the problems of fiat currency and credit creation. There have been lots of VILLAINS and VICTIMS, and the list just seems to get longer as the plots and plunders have multiplied.

Easy Al was a part of a legal counterfeiting cartel known as the Federal Reserve System and the private groups that own it. At one time a libertarian in the best Ayn Rand “Atlas Shrugged” tradition, once he acquired absolute power (and as they say “absolute power corrupts absolutely”), he was corrupted. Now it’s Washington, DC’s turn at absolute corruption. When he left, there was NO ESCAPE from the ultimate debacle and the printing press.

Helicopter Ben Bernanke was brought in to stop deflation since he was generally recognized as one of the greatest academics on the subject. I believe his intentions are to save, rather than destroy, the financial system and global economy; at this point , an impossible task for its masters in the council on foreign relations, Bilderbergs and other global elites. If this was left to the fools on the hill, also known as Congress and the Executive Branch, the system would have died worse than it already has. Right or wrong on specific details during the height of the crisis, Bernanke almost single-handedly saved the financial system from demise last winter.

In the long run, there is no saving the G7 financial and currency system, only they don’t know it yet. History outside the Keynesian and Chicago Schools of Economics is unknown to them, and this time the key is Austrian Economics. When Keynes was asked if his theories would work in the long run, he did not answer; instead, he said in the long run we are all dead. Unfortunately, he died and the fallacies of his theories are here to torture those of us that remain!

Ben was handed the problem and has dealt with it to the best of his ability and beliefs, right or wrong. Now the beltway is inhabited by the corrupt public servants, blinded by greed and a power hunger of which most of us cannot conceive, completely in the grasp of special interests with no conscience or intent to serve their constituents any longer than to get re-elected. Their constituents are dumbed down and impoverished by inflation and desperate for “change they can believe in”, always hoping for the better, always sent thin gruel from their masters in DC, so they can sell the “hope and change” message again and again.

PREDICTION: The writing is on the wall. They are going to drive Ben over the cliff just as they and their media partners regularly do to so many others that stand in the way of their machinations and nefarious plans. And, I believe they will install Director of the National Economic Council, Lawrence Summers, as Chairman of the Federal Reserve when Ben’s term expires early next year. Look for Barney and Chris to lead the charge of extending the political tentacles of the public sector increasingly in the time leading up to the end of Bernanke’s term as Chairman. It will be a snake fight, Congress versus the Federal Reserve.

It is imperative for the public servants to capture the printing presses as global lenders increasingly spurn their debt offerings, at which time the money printing will REALLY accelerate because the beltway public serpents, er servants will monetize all the most grandiose plans like the socialists and Marxists they truly are. They have already taken over the largest mortgage companies - Fannie and Freddie, the largest car companies - GM and Chrysler, the largest insurer - AIG, what used to be the largest bank - Citigroup, the tobacco industry, and now have their sights on the healthcare and energy industries, as well as the Federal Reserve. Do you see a pattern here?

Larry Summers denies they wish to nationalize and run all these industries. Well, here’s a voice from the grave and one of the President’s IDOLS:

“In politics, nothing happens by accident. If it happens, you can bet it was planned

that way.”

–Franklin Delano Roosevelt

Despite their cries that they don’t want to run these companies, they keep on seizing them, regulating them into submission (fees and taxes), or legislating their demise and transfer of the profits to themselves. Marxism and socialism are MISERY spread ever more WIDELY and they have arrived in the US in epidemic fashion. Let’s watch and see…. and WEEP….

Green Shoots!

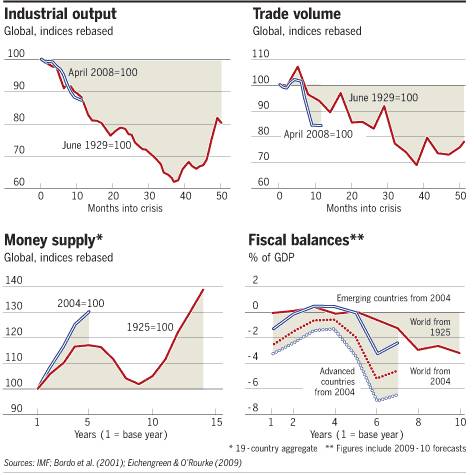

We report, you decide. Everyone in the mainstream media and the public servants are talking about their successes in stopping the slide into depression. In today’s www.ft.com, Martin Wolf publishes a comparison of the global economy then and now. Look at the charts and decide for yourself:

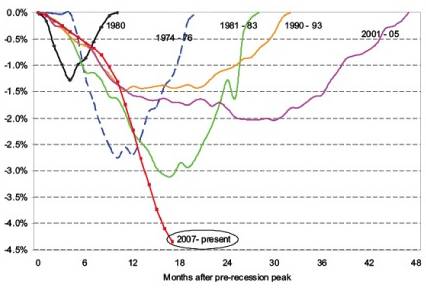

As you can see, the only thing at a higher level is the MONEY PRINTING, OUCH. Now let’s take a look at unemployment peak to valley of the last five recessions (courtesy of www.agorafinancial.com ):

Of course, you can see it far exceeds previous episodes and WILL FALL much further since these numbers are HIGHLY massaged by the government. If properly measured using pre-Clinton era methods, the picture is much worse (see www.shadowstats.com ).

Martin summed up his article quite nicely:

"Last year the world economy tipped over into a slump. The policy response has been massive. But those sure we are at the beginning of a robust private sector-led recovery are almost certainly deluded. The race to full recovery is likely to be long, hard and uncertain.

-- Martin Wolf, Financial Times

June 17, 2009

The green shoots are just plain old greenbacks, pounds, euros, yen and every other fiat currency in the world rolling off the printing presses. Hyperinflationary depression, anyone?

Fall of Babylon!

In a fabulous article summing up the Amerikan situation quite nicely, Chris Hedges hits the nail on the head in his essay entitled “The American Empire Is Bankrupt”. He describes what is happening and what is about to unfold; MORAL and fiscal BANKRUPTCY. I couldn’t agree more with everything, except for the comment about FOX news. I admire Chris because he is a liberal speaking the truth to the left, so he is a brave man indeed. A bit nasty to deal with, they have no tolerance for views other than their own. I urge you to read it…

Capital Flight

The TICS data (international capital flows) was released and another $53 billion FLED the new socialist state of AMERIKA. An interesting observation can be seen in the numbers as central banks stepped up their lending. Far from a vote of confidence, this shows people converting to other currencies, and the central banks being forced to buy more US treasury issuance to sterilize the conversion to prevent their home currencies from skyrocketing against the dollar. Since March, central banks have gone from buyers of about 25% of issuance, to as high as 50% recently. This explains the indirect bidders buying US treasuries and the high bid-to-cover ratios we are seeing. CAPITAL is FLEEING at record rates due to the anti-capitalist attacks on the private sector by our MASTERS in the beltway…

Lessons from 55 BC

What have we learned in the last 2000 years?

"The budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt. People must again learn to work, instead of living on public assistance." -- Cicero – 55 BC

Nothing….

In conclusion

There is a full scale flight of capital OUT of the United States and the US dollar. The calls of support for the dollar from central banks around the world are nothing more than attempts to contain the panic sweeping the world. NO ONE wants to yell FIRE as the building is burning. Spending, deficits and borrowing are spiraling out of control. The criminals inside the beltway are aiming to take EVERYTHING you have and transfer it to themselves, their special interests, and their crony capitalist supporters.

The expanding nationalization of the US economy is accelerating, and once they seize the Federal Reserve, energy and healthcare industries in one form or another, they will come after small business. The NEW pay CZAR will then set wage controls for everyone because everyone will work for the government - the President has nationalized the auto industry and spent almost $100 billion in doing so, without one vote in Congress (his dozens of new czars), to reward his union campaign supporters. Ob@ma and his dozens of new CZARS will reign over their fiefdoms without regard to the rule of law.

The Tsunami of debt will begin to hit in the second half of this year and continue for quite some time (deflationary spiral as asset prices collapse due to no new lending to insolvent borrowers), at which point, the G7 financial systems will reach the ultimate destination of all fiat currency and credit systems in history: their DEMISE. Deflation will be met with the printing press until the public understands, then POOF, Zimbabwe and Argentina, here we come…

I have just returned from Europe and Americans are despised and loathed, and most of all, their government is despised. NO ONE wants to do business with us here or there. Anything can happen at this point and none of it is good. EVERYONE wants to bring down the US government, and they will succeed soon. The US government must learn to live within its means and borders, or it will be imposed upon them from abroad. It is firmly in the planning stage.

Look no further than the BRIIC (Brazil, Russia, India, Indonesia and China) summit in Ekaterinburg, Russia. The United States asked to attend and the answer was NO. The emperor has no clothes and it is beginning to dawn on him. The empire is over and it must get out of other people’s business and stop trying to impose its will upon others; the sooner the better for us all. Of course, they won’t, because they are BLIND ideologues (functionally deaf), so it will all end in tears…

The political classes and their elite supporters in the G7 are OUT of CONTROL and desperately trying to hold on to their lofty perches in their respective countries. They are trying to pin the tail on the donkeys as scapegoats for their lack of leadership and lack of fiduciary preparation for their respective countries’ futures.

There is only one thing good about all this: you know and can prepare yourself and your family. Volatility is set to explode in all markets as people WAKE UP and figure it out, driving markets and investing opportunities right into your arms. The new normal is a long way away…

I will be doing several presentations on the unfolding “Crack-up Boom” and inflationary depression at FREEDOMFEST in Las Vegas, July 9th - 11th. I urge you to attend. You can find information at www.freedomfest.com. I will be meeting with people upon request. Just call me and let’s get together… Hope to see you there; last year was exciting.

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.