Basic Financial Markets Analysis – PartI

InvestorEducation / Learning to Invest Jun 20, 2009 - 01:21 AM GMTBy: Andy_Sutton

In an age of green shoots, fluff, and spin, it is probably worthwhile to put our feet on the ground every so often and take a look at some old fashioned ways that we might value a project, a firm, or capital stock. Too many times over the past 15 years in particular, investors have been lured into various valuation traps. Probably the most noteworthy was the dotcom era of the late 1990’s and the first part of the 21st century. Not a great start to a new millennium. And so the trend has been that each time the investing public deviates from the ‘old fashioned’ rules of finance and analysis, there is always a good whipping waiting just around the bend.

In an age of green shoots, fluff, and spin, it is probably worthwhile to put our feet on the ground every so often and take a look at some old fashioned ways that we might value a project, a firm, or capital stock. Too many times over the past 15 years in particular, investors have been lured into various valuation traps. Probably the most noteworthy was the dotcom era of the late 1990’s and the first part of the 21st century. Not a great start to a new millennium. And so the trend has been that each time the investing public deviates from the ‘old fashioned’ rules of finance and analysis, there is always a good whipping waiting just around the bend.

Unfortunately, turning on the television won’t do much in the way of helping one to find answers in this regard. Much like the medical community, the financial and investing world is littered with incomprehensible jargon, which can be downright boring at best, and impossible to follow at worst.

The Elusive Concept of ‘Value’

So how exactly does one ascertain the value of a stock? This is absolutely the wrong place to start, and this is one reason why many folks never get their investing careers off the ground. You cannot start with the capital stock and back your way into the value of the company, its product pipeline, revenue streams etc. First of all, there are many flaws with stock prices, the biggest being the fact that there are emotional and irrational human beings involved in the formation of those prices.

Just think of the dotcom blowout a few years ago. Anything with ‘E’ in front of it headed for the Moon, but ran out of rocket fuel halfway there. Those carcasses of financial recklessness are still drifting in outer space and should be a testimony to the rest of us of what can happen when we allow our emotions and irrational nature to control our investment decisions.

The second is that there is generally some level of incomplete information. The Internet has helped mitigate this to some degree, but at any given instant in time, there are some buyers who know a whole lot more about a firm than others. And to compound matters, occasionally firms will withhold negative information from the markets until a certain time such as the end of trading for the day or week. What was a ‘rational’ price at 4PM ET on Friday might suddenly become an irrational one when the market opens Monday morning as irrational people scramble to catch up with the information.

In my opinion this is where the Internet has actually had a deleterious affect on accurate stock price formation. People aren’t investors anymore; they’re traders. They buy black box software that spits out red and green arrows, and then click mouse buttons based on those arrows. They know nothing about the underlying security, nor do they care to know anything. Just make me rich they say. I’d say the smart money would bet on their financial demise and be right more often than wrong. The proponents of such systems will be the first to tell you that their methodology takes the emotion out of trading. But they neglect to tell you that their system is based market data, which is the result of all the other emotional traders out there. So how devoid of emotion is it really? We could go on for pages on this topic, but I think the point is clear.

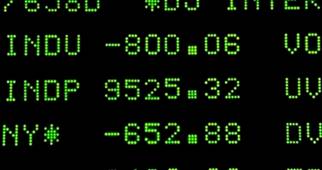

It would certainly seem that when the accurate (but by no means complete) analysis above is considered that the deck is stacked against someone who is truly inclined to be an investor. Not so at all. Navigating today’s markets is all about being a filter. Filtering noise. Filtering meaningless ‘events’ in favor of information that might change a trend or an assumption that one has made. It is about conviction. It is about being able to sit back and watch while the rest of the world goes absolutely berserk. It is also about recognizing that prices oscillate around the approximate tangible value of any financial instrument much like a sine wave. Obviously once you’ve identified your target stock, you want to buy when the price is oscillating below your measurement of its real value. In other words, you buy it on sale. Conversely then you would want to sell it when the price is peaking above the real value thereby selling it at a premium and maximizing your profit. If it were truly that simple however, I wouldn’t need to write this article at all. The market throws enough curve balls at investors as it is. If we can nail down an approximate real value of the financial instruments we are interested in purchasing, we have a fighting chance of doing well.

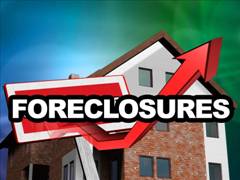

One important carryaway message from all this is that you must have patience. Our world has fallen prey to the doctrine of instant gratification. Everything must be instant or immediate. Processes that used to take days and weeks to initiate and complete now take minutes and hours. Two prime examples come to mind. The time it takes to purchase a home and the time it takes to invest money. It used to take weeks of shuffling papers to buy a house. Now it can be done in a few days’ time if everyone is properly motivated. The same is true for investing. People opened an account, purchased their stock and then watch the Sunday paper from week to week and charted their progress. Look at all that has happened because making large financial decisions has become too easy and the rational thought process became susceptible to impulse. The problem is that patience just isn’t cool anymore. It isn’t en vogue. After all, the rabbit always beats the turtle….right?

It is my goal over the next few weeks to give readers a window into valuing financial instruments. Once the value of an instrument is known, then it is just a matter of waiting for your price. However, it is not really appropriate to think in terms of things going on sale at your favorite electronics outlet. There are only two reasons someone buys a financial instrument. They are either purchasing a cash stream as in the case of a dividend-paying stock or they are purchasing the instrument in the firm belief that someone will come back at a time point in the future and buy it from them for a higher price than they paid. When you go to your favorite electronics outlet, you’re buying something to use and the thought process is different.

Zeroing In on Value

Probably the first mistake people make in beginning their search for suitable financial investments is they start with a preconceived notion of what is ‘hot’. They get a tip from a friend or see the name of a firm in the financial section of a magazine or newspaper and decide to begin searching. In reality, the best way to start valuing financial instruments is to first figure out which of them are actually worth valuing in the first place. This approach is often called the ‘top-down’ approach and it starts with coming to a general understanding of the economic environment under which one is operating. What is the direction of interest rates? Is the borrowing environment friendly or restrictive? Are consumers extending or retrenching? What is the condition of the labor market? Are trade conditions favorable due to currency and political factors? And what about energy costs for product transportation?

These are just a sampling of the questions that you will need to find answers for. It was by this process that it was easy for me to eliminate most things dealing with the consumer discretionary sector as the economy dove into recession in late 2007. Seeing that recession ahead of time prevented misallocations and the subsequent losses that would have occurred. There were other sectors though that had their problems. Some have already since emerged in dramatic fashion, while others have yet to.

Once you have some answers and a basic economic analysis, you can pretty much tick down through a list of industries and themes and find the ones that will be well-served by the current environment and those to stay away from. It is perhaps even more important to form something of a forecast for at least the next year to two years. Once you get past two years, it becomes exceedingly difficult for even the most gifted economist to be accurate given the complexities of a modern world and financial system.

Themes versus Forecasting

One of the biggest problems with economic forecasting is that it is both time and resource intensive and is a full-time job. That said, forecasts are easily purchased from a myriad of sources at a cost. Perhaps another way of looking at things and deciding on which areas are worth further scrutiny is by using themes. It is pretty simple. Take the debt situation that exists in the United States today at a government, state, local, and personal level. It would seem to be a pretty good bet that this will impede economic growth well into the future, and thus absent a lot of monetary creation and stimulus, it is unlikely to see consumer discretionary spending accelerate all that much. That is a theme. Realize we aren’t dealing with percentages, statistical analysis, or anything more fancy than sitting down and applying some common sense to our current realities and coming up with some likely outcomes. We can easily use such themes as a basis for either including or excluding certain sectors for further investigation and analysis.

Notice we haven’t even used one math formula, a calculator or pulled a single stock quote and I’ll bet you’re already thinking of a number of potential themes and comparing them to what is in your current portfolio. If so, congratulations! You’ve taken the first step in performing basic financial analysis. Next time we’ll take a look at identifying the players both large and small in a given sector and looking at the potential benefits and detriments of each. This will assist us in forming an appropriate mix given our risk tolerance and other objectives.

For more information about generational accounting and our current fiscal and consumption gap, listen to our interview with Professor Laurence Kotlikoff by visiting our podcast page: www.my2centsonline.com/radioshow.php and looking in the ‘Spin Cycle’ section. Next week we’ll conclude our cubic analysis with a discussion of energy and natural resources with Zapata George Blake.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.