Companies Flooding Stock Markets With New Shares to Drive Stocks Lower Over Summer

Stock-Markets / Financial Markets 2009 Jun 19, 2009 - 12:54 AM GMT

Mark Hulbert says, “Notwithstanding the carnage the stock market suffered between October 2007 and March of this year -- the worst since the Great Depression -- corporations' share issuance departments are partying like it's 1999. In fact, firms have recently issued far more shares of their stock (either through initial public offerings or secondary offerings) than they did even in the go-go years of the late 1990s and at the top of the Internet bubble in early 2000. That's not good news, from a contrarian point of view: The stock market historically has tended to perform poorly following periods in which firms have flooded the market with more shares.”

Mark Hulbert says, “Notwithstanding the carnage the stock market suffered between October 2007 and March of this year -- the worst since the Great Depression -- corporations' share issuance departments are partying like it's 1999. In fact, firms have recently issued far more shares of their stock (either through initial public offerings or secondary offerings) than they did even in the go-go years of the late 1990s and at the top of the Internet bubble in early 2000. That's not good news, from a contrarian point of view: The stock market historically has tended to perform poorly following periods in which firms have flooded the market with more shares.”

Party on…party on. The hangover starts tomorrow.

The BKX appears ready to decline in what may be the strongest move of the bear market. It clearly shows a broken trendline today after a pullback from the top. What is not shown on the chart is a head and shoulders pattern with a target of 26! Full details are available to subscribers.

The SPX crossed its trendline on Tuesday and has bounced off its 200-day moving average. Today it attempted to retest the underside of that trendline and failed. It now appears to be rolling over. A drop under its 200-day moving average may send it tumbling to 850 or lower. The 200-dma makes a good head and shoulders neckline, so I am treating it as such. There is a small chance that equities may have found their cycle bottom early, on the 17th. Right now it appears that it hasn’t happened yet, so I am expecting a much lower bottom by early next week. Seat belts on?

The NDX has not yet crossed its trendline. However, once it does, the next natural target will probably be its 200-day moving average, which is almost exactly at the 50% retracement. We’ll have to see whether the NDX finds support at 1300 or not. Should it fail, the next level may be the bottom of the cycle band, which is at 1050.

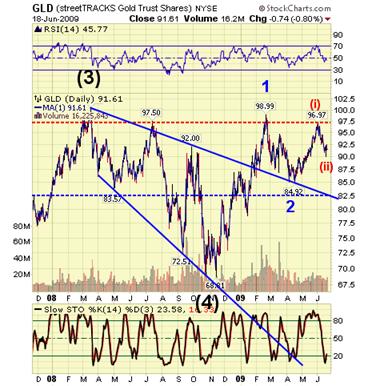

GLD found support at the 50% level in its cycle band. I had been suggesting that, once it successfully tested that area, GLD has the opportunity to go much higher than the current top of the cycle band. Watch the gold bugs pile on when that happens!

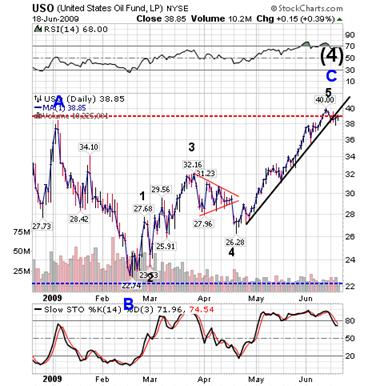

USO has had a reversal pattern, crossed its trendline and is sitting at the top of its cycle band. In this case, what the cycle bands are saying is that USO has the capability to fall all the way down to its lower band in this decline! It staggers the imagination, but so did the decline last fall.

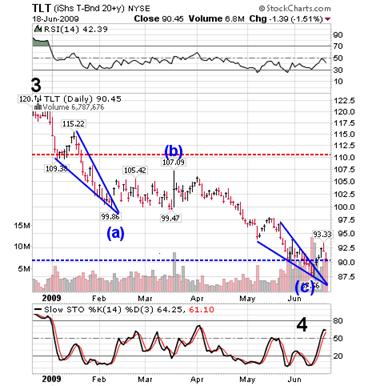

Better luck the second time, TLT! I have drawn two bullish wedges in TLT. The first one has obviously failed. The second one pierced the bottom of the cycle band and now there is a very clear reversal pattern. Today TLT retested the bottom band, so should it remain above 90, it may climb well beyond the top band at 110.

The US Dollar (UUP) has reversed its fortunes and has shown a completed and successful reversal pattern. UUP now has the ability to rally up to and possibly beyond the top cycle band at 27.

We will be seeing some 3rd wave action of one degree or another starting (most likely) tomorrow. I sincerely doubt that the market can hold up another day as it did today. If my assumption is right, we may see a very deep ½ (!) cycle low early next week.

I’ll be back in touch on Monday.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.