U.S. Treasury Bonds Bear Market Final Head-Fake

InvestorEducation / US Bonds Jun 19, 2009 - 12:02 AM GMTBy: John_Handbury

My past articles have offered excellent advice, for example, buying Eurodollars (July 2008) and shorting gold (April 2008). The last two years have been profitable.

My past articles have offered excellent advice, for example, buying Eurodollars (July 2008) and shorting gold (April 2008). The last two years have been profitable.

This trade is my most confident yet....

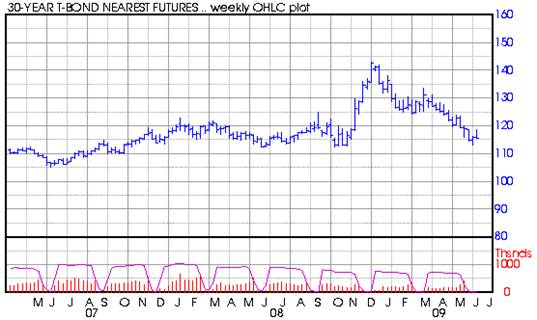

30-year Treasury Bonds have been descending since the end of 2008, when they reached the lofty height of 140 points, a yield of about 2.50% per annum. The only exception to this descent was when the Fed announced in Mar 2009 that they would buy $300,000,000,000 in treasuries, which resulted in bonds rising 8 full points in one day, an event without precedent.

Let’s be clear, this bear market in bonds will come to an abrupt end. Why? Bond traders will come to the realization that long-term bonds can’t sustain a yield of near 5% when:

- Inflation is below 2% and descending, threatening deflation

- Employment is at historical low levels and still descending

- The Fed has remarked that employment will not return to pre-crisis levels until after 2011

- The Fed has no intention of raising short-term rates for a long time, and is committed to adopting policies to also reduce long-term rates

- Company earnings are low, and predictions are too rosy

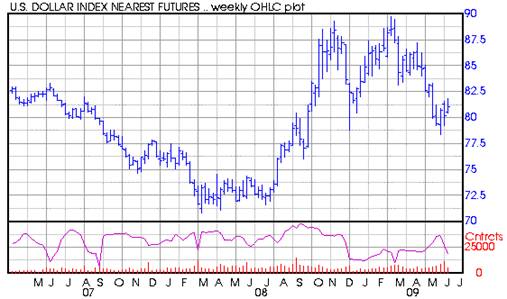

- The US dollar is stabilizing (Yes, I repeat, the US dollar is stabilizing as shown below and could go much higher)

The bond bears argue that the US stimulus packages have resulted in the government selling a large amount of treasuries for funding, which has deflated prices. This is true, but it is temporary. Of course bond prices are based on instantaneous supply and demand, however ultimately these risk-free financial instruments are priced based on only two factors; inflation, and the cost of borrowing. Both these are very low right now, and do not support a yield of almost 5%.

The final head fake was today when continuing jobless claims had a slight reduction, which is due mostly to the long-term unemployed reaching the end of their claim period. 30-year bonds dropped a full two points upon this ridiculous news? This moved derailed enough bond bulls to start a nice trend upwards.

December 2008 30-year 125 Calls are trading at about $1000 each. I will be a buyer over the next few days. I’m predicting at least 140 by the end of 2009. Nice to have a 15-fold gain.

By: John Handbury

Independent Trader

© 2009 Copyright John Handbury - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Handbury Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.