U.S. Deflation CPI Drops 1.3% in Past Year, Biggest Drop in 59 Years; Where To From Here?

Economics / Deflation Jun 17, 2009 - 01:31 PM GMTBy: Mike_Shedlock

MarketWatch is reporting Consumer prices inch 0.1% higher in May.

MarketWatch is reporting Consumer prices inch 0.1% higher in May.

U.S. consumer prices increased a seasonally adjusted 0.1% in May as falling food prices largely offset higher gasoline prices, the Labor Department reported Wednesday.

It was the first increase in three months in the consumer price index, which tracks inflation at the retail level. The CPI has fallen 1.3% in the past year, the sharpest decline in prices since April 1950.

The Federal Reserve has warned that deflation remains a major risk, with the global recession putting downward pressure on prices. Slack in the nation's economy -- a high unemployment rate and many idle factories and stores -- should keep inflation in check for the next year or two, Fed officials say.

The entire decline in prices over the past year stemmed from a 27.3% drop in energy prices. Crude-oil and gasoline prices have turned higher recently, however.

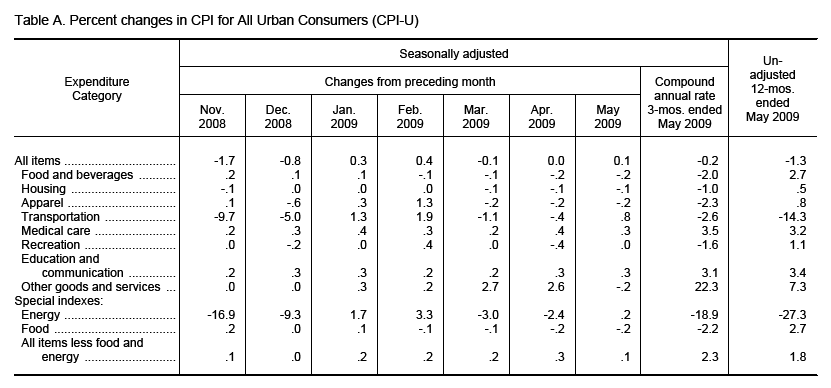

BLS Consumer Price Index May 2009

Please consider this table from the May 2009 BLS Consumer Price Index Report.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in May before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Over the last 12 months the index has fallen 1.3 percent. This is the largest decline since April 1950 and is due mainly to a 27.3 percent decline in the energy index.

On a seasonally adjusted basis, the CPI-U increased 0.1 percent in May after being unchanged in April. The index for energy, which had declined the previous two months, rose 0.2 percent in May as an increase in the gasoline index more than offset declines in other energy indexes. The food index decreased for the fourth consecutive month, falling 0.2 percent as the indexes for all major grocery store food groups declined.CPI-U Percent Changes in CPI for All Urban Consumers

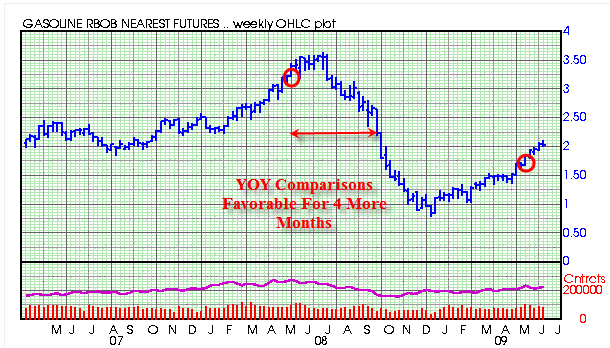

Weekly Gasoline Futures

Gasoline peaked in July of 2008 along with most other commodities. Year over year comparisons will be very favorable for the next 4 months and favorable to relatively benign for another year.

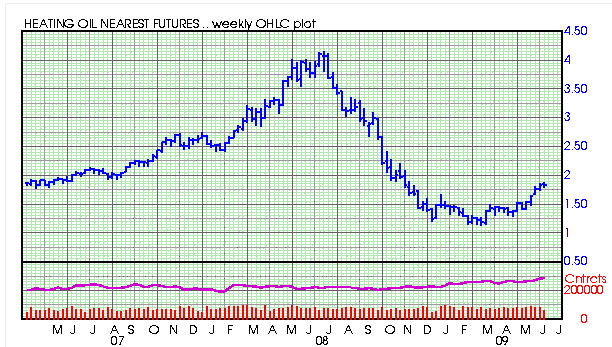

Heating Oil Futures

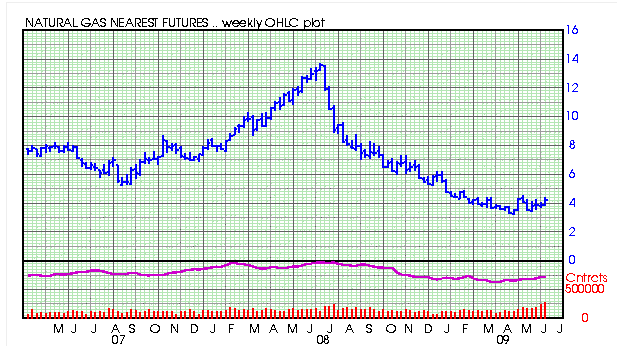

Natural Gas Futures

All of the energy components in the CPI have favorable to very favorable year over year comparisons for 4 months or longer.

Unless energy prices skyrocket from here (doubtful in my opinion), the energy effect on the CPI will be benign. Moreover, if energy prices decline from these levels, we will start to see favorable month over month comparisons as well as year over year comparisons.

This was the largest drop since April 1950, but more records are likely to be broken in the next few months.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.