Financial Markets Analysis - Record Debt Forcing Inflation and Interest Rates Higher

News_Letter / Financial Markets 2009 Jun 14, 2009 - 10:49 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

June 13th, 2009 Issue #44 Vol. 3

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Economic Collapse, Time to Run? |

By:Lila Rajiva

Is it time to run?

That's what I've been asking myself for three years now.

| 2. The Great Crash Not Over, Stocks Bear Market Rally Built on Sand |

By: Bob Chapman

A recovery is supposed to be in the works in the midst of increased savings, declining debt balances on credit cards, more bankruptcies, higher unemployment and new wave of foreclosures.

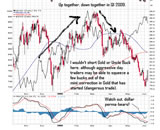

| 3. Stock Market Summer Trend Into a Crash |

By: David_Petch

The daily chart of the S&P 500 Index is shown below, with upper 21 and 34 MA Bollinger bands riding the index higher while lower BB’s continue to rise alongside the index, along with a potential Elliott Wave count displayed (which has a lower probability of occurrence compared to the other displayed patterns. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K above the %D in stochastics 1 and 3. If the %K can manage to remain hooked up and cross the %D in stochastic 2, it increases the likelihood that the continued price movement in the S&P 500 index drifts between 900-1000 over the course of the next 1-2 weeks at a minimum before topping out.

| 4. Gold Myth Busting- U.S. Dollar, Deflation and Hyperinflation |

By: Adam_Brochert

There are a lot of myths and “old wives’ tales” out there about Gold and the frequently accompanying topics of inflation and deflation. In no particular order, I’d like to debunk three big ones with facts rather than universally accepted catch-phrases that prey on lazy investors and speculators.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Crude Oil Imminent Trend Reversal |

By: Clive_Maund

Oil has staged the relief rally predicted in the last Oil Market update posted early in March. Our original target was the $70 - $80 area, but due to the time it has taken to get to the current level, the target is now lowered to the current level or a shade higher.

| 6. Will the British Pound Get Pounded? |

By: Bryan Rich

When financial markets were on the way down, risk aversion reigned and every investment that was deemed risky crashed. The U.S. dollar and 10-year Treasuries did well as global investors fled to safety.

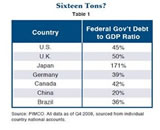

| 7. U.S. Debt Crisis as Treasury Bond Prices Collapsing and Interest Rates Surging |

By: Martin Weiss

Just as we’ve been warning, the United States Treasury is the next and largest victim of this great debt crisis.

Right now, the Treasury’s finances are collapsing … its bond prices plunging … its interest rates surging.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.