Stocks and Commodities Rally In the Direction of Economic Recovery Whilst Bonds Retreat

Stock-Markets / Financial Markets 2009 Jun 14, 2009 - 01:46 PM GMT “Words from the Wise” this week comes to you in a shortened format as “day-job” responsibilities precludes me from doing a comprehensive commentary. However, a full dose of excerpts from interesting news items and quotes from market commentators is provided.

“Words from the Wise” this week comes to you in a shortened format as “day-job” responsibilities precludes me from doing a comprehensive commentary. However, a full dose of excerpts from interesting news items and quotes from market commentators is provided.

Signs of stability characterized trading on financial markets during the past week. As investors placed their bets on a global economic recovery, equities, base metals and crude oil made further headway, with long-term government bond yields remaining at elevated levels, but declining somewhat after a successful US 30-year bond auction and pro-US Treasury comments from Japan’s minister of finance.

Notwithstanding buyers returning to US long-term bonds, the greenback retreated on concerns of the huge issuance of government bonds, whereas commodity-linked and other high-yield currencies improved strongly.

Source: Jeff Stahler, June 9, 2009.

The British pound also advanced as the UK’s National Institute for Economics and Social Research said the recession had passed through its trough in March. Also, the Organization for Economic Co-operation and Development (OECD) reported on Monday (via the Financial Times) that most of the world’s big economies were close to emerging from recession and that data pointed to a possible recovery by the end of the year. “Twenty-two out of the 30 OECD countries saw a rise in forward-looking measures of activity,” said the report.

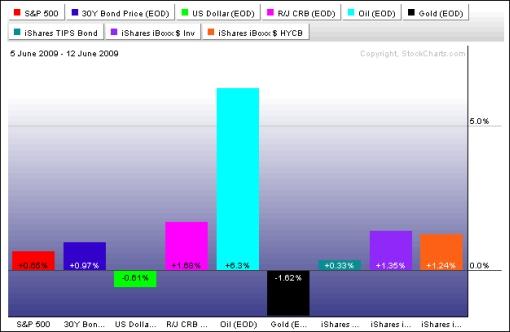

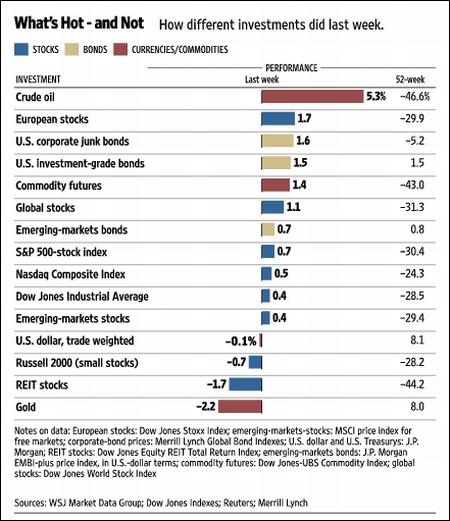

The week’s performance of the major asset classes is summarized by the chart below. Not shown, platinum (-2.1%) and silver (-2.9%) cooled off in tandem with gold bullion (-1.6%). As the precious metals consolidate, gold bull Richard Russell (Dow Theory Letters) said in frustration: “Gold, gold, you’re making me old.”

Source: StockCharts.com

The surge in oil prices to an eight-month high of more than $72 a barrel (in the case of West Texas Intermediate Crude), raised concerns as this is equivalent to a two-percentage-point drag on real GDP growth, according to David Rosenberg (Gluskin Sheff & Associates). In order to provide guidance on the direction of crude oil, Adam Hewison of INO.com has prepared another of his popular technical analyses, arguing that the long-term trend is bullish, but that a short-term pullback appears likely. Click here to access the short presentation.

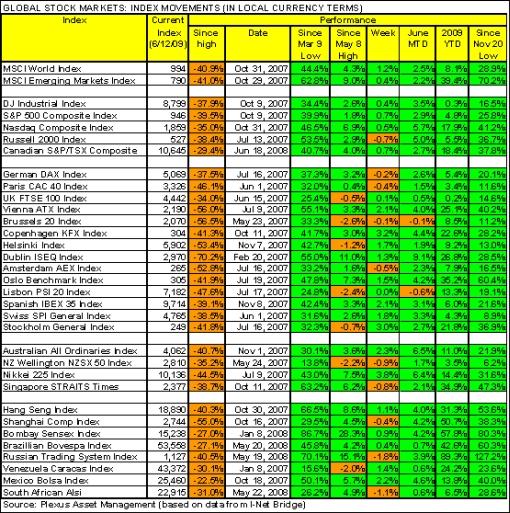

The MSCI World Index (+1.2%) and the MSCI Emerging Markets Index (+0.4%) last week again added to the rally’s gains to take the year-to-date returns to +8.1% and a massive +39.4% respectively. Both these indices have only had one down-week since the advance commenced in early March.

Although trading was relatively flat, the major US indices (with the exception of the Russell 2000 Index) nevertheless gained for a fourth consecutive week - and for the twelfth week out of the past 14 - as seen from the movements of the indices: S&P 500 Index (+0.7%, YTD +4.8%), Dow Jones Industrial Index (+0.4%, YTD +0.3%), Nasdaq Composite Index (+0.5%, YTD +17.9%) and Russell 2000 Index (-0.7%, YTD +5.5%).

The Dow on Friday became the last of the major indices to break into positive territory for the year to date, albeit by a meager 0.3%.

Click here or on the table below for a larger image.

As far as non-US markets are concerned, returns ranged from top performers Namibia (+8.5%), Vietnam (+6.5%), Mauritius (+5.4%), Palestine (+4.5%) and Thailand (+4.0%), to Ghana (-8.7%), Serbia (-5.2%), Sudan (-4.8%), Taiwan (-4.4%) and Bahrain (-2.4%), which experienced headwinds.

Among the major markets, the Japanese Nikkei 225 Average jumped by 3.8% to breach the 10,000 level for the first time since October on the back of recent data releases, indicating that the pace of Japan’s recession was moderating. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the leaders for the week included MSCI Thailand (THD) (+6.2%), iShares MSCI Sweden (EWD) (+6.0%) and PowerShares DB Base Metal (DBB) (+5.6%), with notable laggards being Market Vectors Gold Miners (GDX) (-9.2%), iShares Silver Trust (SLV) (‑6.4%) and iShares Taiwan (EWT) (-5.8%).

Other news is that Chrysler completed its deal with Fiat, the US Treasury Department announced that ten banks would repay TARP funds, and the Obama administration is dropping its plan to cap salaries at firms receiving bailout funds and has backed away from a large-scale reduction in the number of agencies overseeing financial markets.

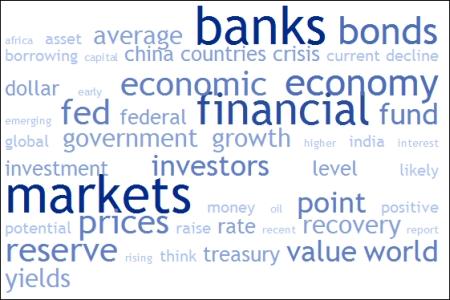

Next, a tag cloud of all the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “banks”, “markets” and “financial” featured prominently. “Bonds”, “yields” and “value” have soared in prominence as pundits debate whether government bonds and stock markets have seen secular turning points. “Recovery” also moved up the ranks as an increasing number of reports showed the global recession was abating.

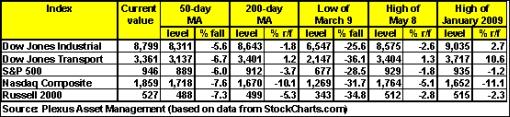

Back to the stock markets: an analysis of the moving averages of the major US indices shows all the indices (with the exception of the Dow Jones Transport Index) above their 50- and 200-day moving averages and May 8 highs. The S&P 500, Nasdaq and Russell 2000 have also surpassed their early January peaks.

Click here or on the table below for a larger image.

According to Bloomberg, the S&P 500 Index has not posted a daily rise or fall of 1% or more since June 4, the longest stretch in 14 months. Since September 15, 2008, when Lehman Brothers filed the largest ever US bankruptcy, 131 out of the 188 trading days have had moves of 1% or more.

The S&P 500 seems to be mapping out a trading range between 925 and 950 as shown in the chart below. Time will tell the direction of the eventual break out of the trendless market, but stock markets would appear to be getting somewhat exhausted, as indicated in last Sunday’s “Words from the Wise“.

Source: StockCharts.com

The last words regarding stock markets go to David Fuller (Fullermoney) who said: “I am certainly not moving away from my view that this is a bull, since much of what we have seen since last October and everything since March has been consistent with a new bull market. However, extreme rallies to break the previous downtrends are often prone to lengthy pullbacks and ranging, because they discount improving or less bad news very quickly.

“Where the corrections occur, they are likely to be sharper in high-flying emerging markets but delay the next upward move on Wall Street for longer, because it is underperforming and is a much bigger market.”

For more discussion on the direction of stock markets, also see my recent posts “Video-o-rama: Risky assets - optimism waxing, pessimism waning“, “Faber: The frame of mind of American economic policymakers“, “Favorite theme: commodities“, “Donald Coxe: Investment recommendations (June 2009)“, “High-yield spreads heading south“, “Grantham on the markets“, “Technical talk: Sell the news” and “Interview with Yale’s David Swensen“. (Also, Donald Coxe’s weekly webcast makes for good listening and can be accessed from the sidebar of the Investment Postcards site.)

Economy

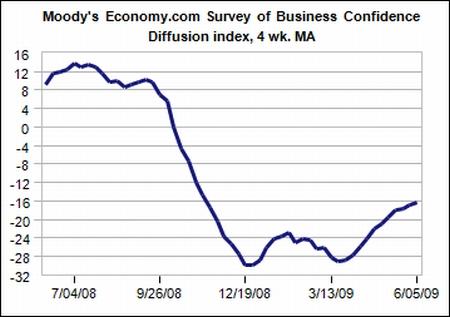

“Global business confidence in early June improved to its best reading since last October. Sentiment remains consistent with a global recession, but the recession is quickly moderating. Expectations regarding the outlook for year’s end are also much improved,” said the latest Survey of Business Confidence of the World conducted by Moody’s Economy.com. The Survey highlighted that US and Canadian confidence had notably improved in recent weeks, with businesses saying that sales conditions were stabilizing.

Source: Moody’s Economy.com

Nobel Prize-winning economist Paul Krugman commented that the US economy would probably emerge from the recession by September. “I would not be surprised if the official end of the US recession ends up being, in retrospect, dated sometime this summer. Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing,” Krugman said at the London School of Economics (via Bloomberg).

According to Bloomberg, Richmond Fed Bank President Jeffrey Lacker said on Wednesday the Federal Reserve had to avoid the risks of “waiting too long or moving too slowly” to tighten monetary policy once an economic recovery begins. “The challenge for us on the Federal Open Market Committee will be to shrink our balance sheet and tighten policy soon enough when the recovery emerges to prevent rising inflation. The danger will be that we will not shrink our balance sheet enough when the recovery emerges.”

US interest rate futures rose to price in a tightening in the interest rate by the Federal Reserve by the end of this year. However, Andrew Balls, PIMCO’s managing director in London, believes this to be premature and wrote in a report (via Bloomberg) that signs of recovery in economies around the globe pointed to a slower pace of decline rather than recovery. “Rate hikes will be some time in coming.”

Week’s economic reports

Source: Yahoo Finance, June 12, 2009.

In addition to an interest rate announcement by the Bank of Japan (Tuesday, June 6), the US economic highlights for the week include the following:

Monday, June 15 NY Empire Manufacturing Index and Net Long-Term TIC Flows

Tuesday, June 16 Building Permits, Housing Starts, PPI, Capacity Utilization and Industrial Production

Wednesday, June 17 CPI

Thursday, June 18 Initial Jobless Claims, Leading Economic Indicators, and the Philadelphia Fed Survey

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, June 12, 2009.

Will Rogers offered the following advice: “Buy stocks that go up, and if they don’t go up, don’t buy them.” (Hat tip: Vitaliy Katsenelson.) It sounds simple enough! Let’s hope the news items and quotes from market commentators included in the “Words from the Wise” review will help Investment Postcards readers to have some advance warning of the most likely winners and losers.

(For short comments - maximum 140 characters - on topical economic and market issues, web links and graphs, you can also follow me on Twitter by clicking here.)

That’s the way it looks from a cold Cape Town.

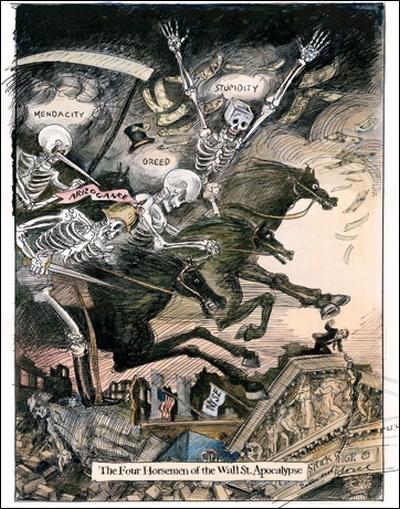

The four horsemen of the Wall Street Apocalypse

Source: Edward Sorel, Vanity Fair, July 2009.

Financial Times: Lewis grilled over Merrill deal “Ken Lewis, Bank of America chief executive, came under withering attack in the US Congress on Thursday over the lack of disclosure of information about escalating losses at Merrill Lynch before his shareholders voted on acquisition of the investment bank in December.

“In a congressional hearing into whether federal regulators exerted undue pressure on Mr Lewis to move forward with BofA’s acquisition of Merrill last year, Mr Lewis reiterated his position that Merrill’s losses became a cause for concern only in mid-December. That was after BofA shareholders voted to approve the deal.

“But Dennis Kucinich, Democrat of Ohio, challenged that account, disclosing internal e-mails from the US Federal Reserve casting doubt on Mr Lewis’s that assertion Merrill’s problems only became more than BofA expected in mid-December. In one e-mail, a Fed officer writes: ‘Ken Lewis’ claim that they were surprised by the rapid growth of the losses seems somewhat suspect.’

“Another e-mail indicates disclosures issued ‘could cause problems for him’.

“Asked why he did not disclose Merrill’s mounting losses to his shareholders before they voted on December 5 to approve the takeover, or afterwards, when Merrill’s losses caused him to threaten the invocation of a ‘material adverse change’ clause to scuttle the transaction, Mr Lewis replied: ‘I leave that decision to securities lawyers and outside counsel.’

“Mr Lewis also adamantly denied the former Treasury secretary Hank Paulson’s pledge to remove Mr Lewis and his BofA board if Mr Lewis invoked the ‘MAC’ clause was a ‘threat’ that drove his decision to consummate the transaction. ‘It was a strong influence on my decision, but it wasn’t the only influence,’ he said.”

Source: Greg Farrell and Alan Rappeport, Financial Times, June 11, 2009.

Financial Times: Ten US banks to repay Tarp funds “Ten financial groups including JPMorgan Chase and Goldman Sachs were on Tuesday allowed to repay a combined $68 billion to the US Treasury in a move that marks a turning point in the economic crisis but formalises the divide between healthy and fragile banks.

“The companies, which also include Morgan Stanley and American Express, can now shed the restrictions on pay and hiring that came with the troubled asset relief programme launched last year at the height of the turmoil in global markets.

“However, the move raises questions over the competitiveness of other big banks such as Citigroup and Bank of America, which have not yet been allowed to repay the combined $90 billion in Tarp money they have received.

“The first batch of Tarp repayers includes eight banks that last month were found not to need additional capital after government stress tests. Others allowed to return the funds included Morgan Stanley, which was instructed to raise capital, and Northern Trust, a bank catering to wealthy individuals that was not among the 19 institutions subjected to stress tests.

“The repayment by the ten institutions, which stepped up their campaign to be free of Tarp after Congress introduced constraints on bankers’ pay, is a sign of stability in the financial system.

“Although the banks set to leave Tarp will escape the most strict rules on compensation, Tim Geithner, US Treasury secretary, told Congress that planned reforms - set to be announced in the next few days - would affect all institutions.

“‘We need to help encourage substantial reforms in compensation reforms,’ Mr Geithner said. ‘I think boards of directors did not do a good job [before the crisis]. I think shareholders did not do a good job.’

“The congressional oversight panel, set up to monitor Tarp spending, on Tuesday recommended a new round of stress tests on the banks because of worsening economic data, such as rising unemployment.

“The Treasury declined to identify the banks, but people familiar with the list said they were Goldman, Morgan Stanley, JPMorgan, Amex, Northern Trust, BB&T, State Street, US Bancorp, Capital One Financial and Bank of New York Mellon.”

Source: Tom Braithwaite and Francesco Guerrera, Financial Times, June 9, 2009.

Financial Times: Doubts mount over US toxic asset plan “The controversial US toxic asset clean-up plan, aimed at clearing bad loans from US banks’ books to enable them to raise capital and lend freely, has fallen behind schedule, and may never be fully implemented.

“The plan has fallen prey to concerns from potential investors and regulators and waning interest from the banks themselves. Investors fear that Congress may set caps on pay while regulators are beginning to doubt whether the plan is really necessary.

“Last week, the Federal Deposit Insurance Corporation, which was supposed to provide finance for investors to purchase bubble-era bank loans, postponed plans for a pilot sale, saying it was less urgent than had been thought.

“‘The timing just is not right,’ an FDIC official told the Financial Times. He said the FDIC still wanted to test a mechanism for loan auctions but might hold it in reserve rather than activating it for general use.

“Officials say the need for these facilities has waned, and add that several banks have raised billions of dollars in share capital even with toxic assets on their books.

“‘Banks have been able to raise capital without having to sell bad assets through the LLP [limited liability partnership], which reflects renewed investor confidence in our banking system,’ Sheila Bair, chairman of the FDIC, said last week.”

Source: Krishna Guha, Edward Luce and Saskia Scholtes, Financial Times, June 7, 2009.

Financial Times: Geithner’s plans for Wall Street regulation “When Barack Obama’s administration first circulated its proposals to reform Wall Street regulation, at their core was a plan to consolidate Washington’s Balkan map of overlapping regulatory agencies. That idea underestimated the power of entrenched interests on Capitol Hill.

“Tim Geithner, the Treasury secretary, will next week unveil revised plans, which are likely to include the creation of two new structures on top of the existing alphabet soup of agencies. These will include a ‘council of regulators’ - likely to comprise the heads of the largest agencies - which will oversee the Federal Reserve’s new uber-regulatory role of overseeing systemic risk.

“There is also likely to be a new agency to regulate consumer products, such as mortgages and credit cards. Far from simplifying Washington’s inefficient system of regulation, many fear the envisaged reforms will ‘Balkanise the Balkans’, as one financial lobbyist put it.”

Source: Edward Luce, Financial Times, June 11, 2009.

MarketWatch: Stimulus funds susceptible to fraud “As much as 10% of the federal government’s stimulus money is likely to get lost to fraud, says David Williams, chief executive of Deloitte Financial Advisory Services. MarketWatch’s Greg Morcroft reports.”

Source: MarketWatch, June 11, 2009.

Bill King (The King Report): Bernanke in Congress’s crosshairs “Polls show Americans are strongly against further government bailouts and spending. Politicians live by polls and fund raising. So now that Americans are disgusted with TARP, PPIP and other crony capitalist bailouts politicians are looking for scapegoats to divert attention from their complicity in the schemes.

“Bernanke and the Fed are at the top of the scapegoat list. To date the Fed has refused to divulge what it is doing with taxpayer money, which is unlawful. “Politicians for the past several months have cowered to Hank, Ben and Little Timmy because they were afraid that they would be [correctly] blamed.

“Politicians again were betting that the Fed would paper over their destructive welfare-state spending. But now numerous politicians understand that Keynesian and monetarist free lunches are ending for the state.

“So Congress pressured the Fed to divulge what it is doing with taxpayer money. In order to avert legislation, which is redundant, the Fed released details of its holding but would NOT divulge to whom it was granting taxpayer money. Several Congressmen and Senator expressed outrage with the Fed.

“Bernanke is now in the Congress’s crosshairs. Pundits are already forecasting his possible replacement.

“The funny-money rebound of 2003 to 2007 greatly concentrated wealth and income. A select few made unimaginable profits, but the average American’s living standards and wages stagnated by bogus government statistics and declined sharply in reality.

“The same dynamic is occurring now on a greatly diminished scale. Banks and a select few insiders have been rescued at the expense of average Americans - in the present but more so in the future.

“Polls during the last recovery showed that average Americans were not doing well economically. The Street and its stooges were aghast that the serfs did not realize how splendid things were.

“Despite the recent robust stock market rally, average Americans continue to see their living standards and earnings fall. If another down leg materializes, public fury will be intense and someone will pay dearly.

“Politicians have their red paint are trying to artfully place bulls-eyes on would-be patsies.”

Source: Bill King, The King Report, June 11, 2009.

The Wall Street Journal: High court clears way for sale of Chrysler “The US Supreme Court on Tuesday cleared the way for Chrysler to exit bankruptcy court, lifting a stay on its proposed sale to a group including Italy’s Fiat.

“The high court’s move marks a victory for the Obama administration and its ambitious plan to remake the American auto industry by pushing both Chrysler and General Motors through quick and painful restructurings under Chapter 11 bankruptcy.

“But the order is a setback for a group of Indiana pension funds and others who maintained the government’s heavy-handed treatment of creditors in the case could chill private lending to distressed firms and alter the rules of bankruptcy reorganizations.

“The Supreme Court, in a brief order, said that the funds had not ‘carried the burden’ of proving that their grievances merited the court’s attention.

“Both Chrysler and the Obama administration argued strenuously that speed was of the essence in the company’s Chapter 11 restructuring, and that any delays could jeopardize the Auburn Hills, Mich., automaker’s future, chasing away potential customers, straining its suppliers, and potentially causing Fiat to turn away from the deal.”

Source: Mark Anderson and Neil King, The Wall Street Journal, June 10, 2009.

Financial Times: Geithner sees “global storm” abating “Tim Geithner on Tuesday identified ‘encouraging signs’ in the US economy and a better outlook internationally, adding there would be a reduced role for a key US programme to stimulate the market for toxic assets and loans.

“Mr Geithner said: ‘The force of the global storm is receding a bit,’ as conditions in securitisation and the market for asset-backed securities eased.

“The Treasury secretary, who is to travel to Italy for a Group of Eight meeting this week, declined to criticise European efforts to fight the financial crisis but said they would be judged on their merits.

“‘They’re going to make different judgments than we are, partly because they have different systems, different constraints, different opportunities,’ he said.

“‘What matters to all of us is, are they going to achieve enough? That’s the standard we should be held to and that’s the standard I think we’ll hold them to.’

“France and Germany, in particular, have adopted a less aggressive stance to stimulus plans and unconventional monetary policy than the US.”

Source: Tom Braithwaite, Financial Times, June 9, 2009.

BBC World: The beginning of a recovery? “Where would the world be without all the economic stimulus money? Are the trillions of dollars of economic stimulus packages actually working - reviving economies and creating jobs?

“Opinions are divided. The World Bank President Robert Zoellick has said it’s not clear where the demand to fuel an economic recovery will come from.

“The White House is optimistic, promising to step up the stimulus spending - pledging that 600,000 jobs will be created or saved in the coming months.

“So where would we be without all the stimulus money?

“One man thinks we might have been heading for another 1930s style Depression - and his opinion counts more than most, since he is one of the most successful investors in the world - hedge fund manager and philanthropist George Soros.

“Commentator Martin Wolf asked Mr Soros where he thought we were, in the course of the crisis.”

Click the image below to listen to the interview.

Source: BBC World, June 9, 2009.

Financial Times: Major economies are “close to low point” “Most of the world’s big economies are close to emerging from recession, according to data published on Monday by the Organisation for Economic Co-operation and Development that pointed to a possible recovery by the end of the year.

“The Paris-based organisation reported in its latest monthly analysis of forward-looking indicators that a ‘possible trough’ had been reached in April in more developed countries that make up almost three quarters of the world’s gross domestic product.

“The composite index for 30 economies rose 0.5 points in April, the second monthly rise in a row, after falling for the previous 21 months. The index seeks to identify turning points in the cycle about six months in advance.

“The OECD said its overall measure of advanced member countries - ranging from the eurozone and the UK to the US, Mexico and Japan - now pointed to ‘recovery’ instead of the ’strong slowdown’ they had been suffering since last August.

“‘It is still too early to assess whether it is a temporary or a more durable turning point,’ the organisation said. But the data ‘point to a reduced pace of deterioration in most of the OECD economies with stronger signals of a possible trough in Canada, France, Italy and the United Kingdom’.

“Twenty-two out of the 30 OECD countries saw a rise in forward-looking measures of activity. The US saw its first improvement in the outlook since July 2007, while Germany and Japan both among the worst hit economies in the developed world, saw an improvement in their outlook for the first time since early last year.

“China had seen a ‘possible trough’, though India, Brazil and Russia were still facing a sharp slowdown, the OECD said.

“The OECD measure is based on data such as share price moves, inventory levels and consumer and business confidence in its member nations.”

Source: Daniel Pimlott, Financial Times, June 8, 2009.

Ambrose Evans-Pritchard (Telegraph): Europe swings Right as depression deepens “The establisment Left had been crushed across most of Europe, just as it was in the early 1930s.

“We have seen the ultimate crisis of capitalism - what Marxist-historian Eric Hobsbawm calls the ‘dramatic equivalent of the collapse of the Soviet Union’ - yet socialists have completely failed to reap any gain from the seeming vindication of their views.

“It is not clear why a chunk of the blue-collar working base has swung almost overnight from Left to Right, but clearly we are seeing the delayed detonation of two political time-bombs: rising unemployment and the growth of immigrant enclaves that resist assimilation.

“Note that Right-wing incumbents in France (Sarkozy) and Italy (Berlusconi), survived the European elections unscathed.

“Left-wing incumbents in Germany, Austria, the Netherlands, Spain, Portugal, Hungary, Poland, Denmark, and of course Britain were either slaughtered, or badly mauled.”

Click here for the full article.

Source: Ambrose Evans-Pritchard, Telegraph, June 8, 2009.

Forbes: Is Eastern Europe on the brink of an Asia-style crisis? “The collapse of the Thai baht in July 1997 helped spark the Asian financial crisis. Could events in Latvia spawn a similar contagion? Eyes are focused on this small Baltic economy - amid growing talk of a devaluation - because of the potential for spillover effects into its fellow Baltic states, Sweden and the broader Eastern European region.

“Strong trade and financial linkages, not to mention similar macroeconomic vulnerabilities, mean a Latvian crisis would almost surely have knock-on effects on neighboring Estonia and Lithuania. A Latvian crisis would also have negative spillover effects into Sweden via Swedish banks’ heavy exposure to the Baltic trio.

“The wild card is how a Latvian crisis would affect the greater Central and Eastern European (CEE) region. Direct trade and financial linkages between Latvia and the CEE economies, excluding the Baltics, are limited. Nevertheless, many of these countries - particularly Bulgaria and Romania - share similar macroeconomic vulnerabilities with Latvia, meaning a crisis there could awaken investors to the potential for crises in the rest of the region.

“If a balance-of-payments crisis occurs in the Baltics and it spills over into other Eastern European economies (and note that this is a big ‘if’), then the Eurozone could be affected. The Eurozone’s exposure results from Western European banks’ heavy exposure to Eastern Europe, via subsidiaries, where they hold 60% to 90% market share (as a percentage of assets), depending on the country. Given the CEE’s strong financial linkages with Western Europe, the health of Eastern Europe’s economies and its banks could potentially afflict Western European banks.”

Click here for the full article.

Source: Nouriel Roubini, Forbes, June 11, 2009.

Moneynews: Einhorn - Obama blowing up another bubble “The Obama administration is using the same naive playbook the Bush administration used, says Greenlight Capital fund manager David Einhorn.

“‘The basic strategy appears to be to try to bring us back to 2006 by propping up asset prices and re-inflating the popped credit bubble while hoping for an economic recovery,’ Einhorn told attendees at the recent Ira W. Sohn Investment Research Conference.

“‘President Obama and the policymakers are not stepping up to the plate, but are instead trying to stretch things out in the hope that time will solve the problems.’

“Einhorn says the White House has adopted an attitude that ‘what’s good for the banks is good for the economy,’ setting in motion a plan by which big banks are buying time rather than restructuring their bad loans.

“As a result, companies and consumers with too much debt refrain from hiring, spending and investing.

“‘Forbearance has not stopped people from losing their jobs or prevented asset prices from falling; it is delaying the recovery,’ Einhorn notes.”

Source: Julie Crawshaw, Moneynews, June 8, 2009.

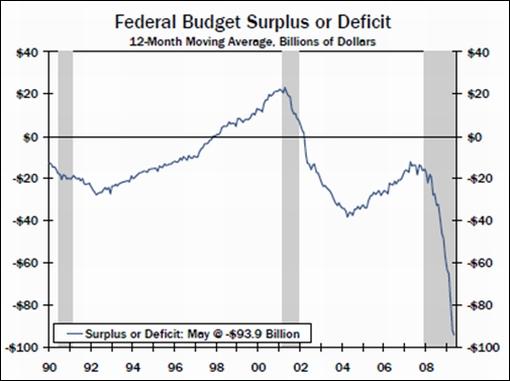

Kim Whelan (Wachovia): US budget - growing deficit set another record in May “In the eighth straight record-setting month, the deficit now stands at $991.9 billion fiscal year-to-date, even larger than consensus expected. Relative to the prior year, government receipts were down 5.7%, while spending went the other direction, up 5.8%. Oversized deficits will be a reality for the foreseeable future.

“The US government is deeper in the red than it has ever been as taxes continue to come in at a slower pace than last year and spending continues to ramp up. This combination does not bode well for hopes for a shrinking deficit.

“Individual and corporate income tax receipts are down substantially, about 24% year-over-year. As the economy enters recovery we may see marginal improvements.

“With such an enormous deficit there is a significant need for financing, especially through public borrowing. As net saving nations look to diversify their holdings and bond yields creep up interest payments grow larger, making deficit financing increasingly expensive. While it has not yet become a problem to finance the deficit, interest payments may become increasingly burdensome to the Treasury.”

Source: Kim Whelan, Wachovia, June 10, 2009.

The Wall Street Journal: Deficit is both short- and long-term problem for Obama “The deficit is a long-term problem for President Obama - but also is a short-term psychological problem requiring him to convince markets and voters that he is serious about reducing the red ink over time. WSJ Executive Washington editor Jerry Seib explains.”

Source: The Wall Street Journal, June 11, 2009.

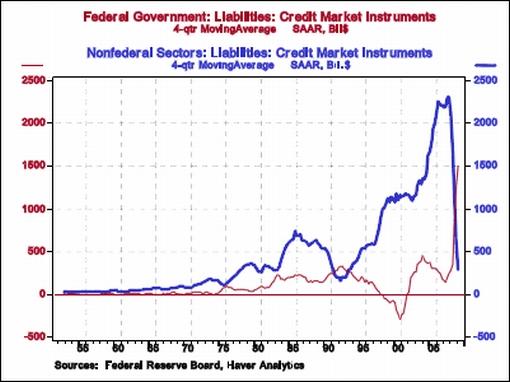

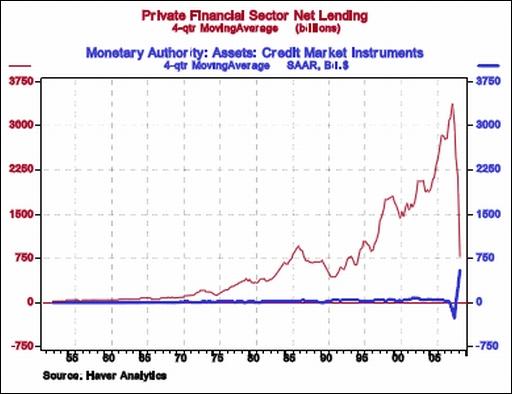

Paul Kasriel (Northern Trust): Yes, Treasury borrowing is massive, but what about total US borrowing? “In the four quarters ended Q1:2009, federal government borrowing has averaged approximately $1.5 trillion at an annual rate. Whew! This compares with average federal borrowing of only $273 billion annualized in the four quarters ended Q1:2008. But what has happened to nonfederal domestic borrowing? It has gone from an average $2.1 trillion annualized in the four quarters ended Q1:2008 down to only $291 billion in the four quarters ended Q1:2009. So, although Treasury borrowing has skyrocketed in the past four quarters, total domestic nonfinancial borrowing has slowed from a four-quarter moving average of $2.4 trillion in Q1:2008 down to $1.8 trillion in Q1:2009 - the slowest rate of total borrowing since Q3:2004.

“Similarly, although Federal Reserve credit creation has soared in the past year, private financial sector credit creation has plunged. Before one gets too worked up about Treasury borrowing and Fed credit creation, one has to take into consideration how much private nonfinancial sector borrowing and private financial sector credit creation have slowed.”

Source: Paul Kasriel, Northern Trust - Daily Global Commentary, June 12, 2009.

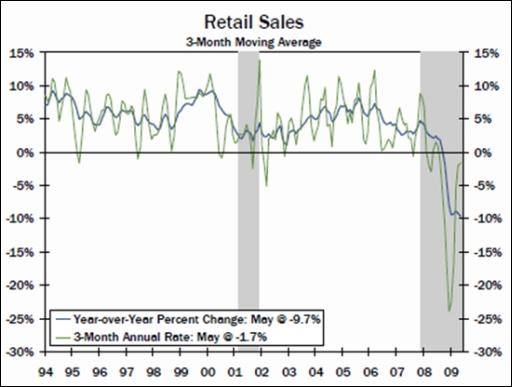

Adam York (Wachovia): Retail sales increased for first time since February “Sales at the nation’s retailers increased 0.5% in May, pushed higher by rising gasoline prices as well as a gain in the beleaguered building materials sector. Our preferred ‘core’ series which strips out gasoline stations, building materials retailers and auto dealers was flat on the month after two straight declines.

“Sales moved higher for the first time since February, but are off more than 11% over the past year. Performance across sectors was mixed with big moves higher in gasoline stations and building materials, while sporting goods and electronics saw the largest declines. We expect that consumers will continue to prioritize spending towards essential items until the labor market begins to improve.”

Source: Adam York, Wachovia, June 11, 2009.

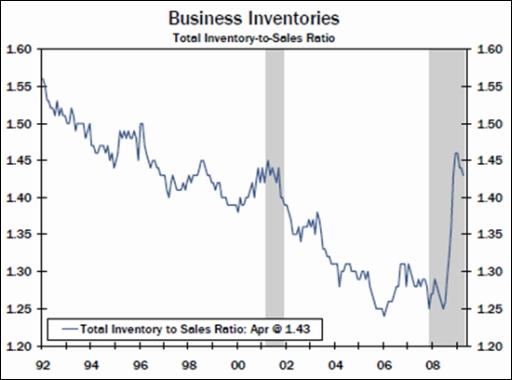

Kim Whelan (Wachovia): Another notch down in business inventories “Retailers, wholesalers and manufacturers drew down inventories at a 1.1% pace in April, which represents one more month of progress in an extremely long process, as businesses got caught with far too much supply early in the recession. The weak sales environment has firms still searching for an elusive supply-demand equilibrium.

“April’s data show that the inventory cycle is continuing in full force - the second quarter will likely experience another substantial inventory change.

“The overall inventories-to-sales ratio has likely peaked, albeit at an extremely high level, showing that stockpiles remain severely misaligned with sales. While sales are still falling, the pace slowed to -0.3 percent on the month.”

Source: Kim Whelan, Wachovia, June 11, 2009.

RealtyTrac: US foreclosure activity decreases 6% in May “RealtyTrac today released its May 2009 US Foreclosure Market ReportTM, which shows foreclosure filings - default notices, scheduled auctions and bank repossessions - were reported on 321,480 US properties during the month, a decrease of 6% from the previous month but an increase of nearly 18% from May 2008. The report also shows that one in every 398 US housing units received a foreclosure filing in May.

“‘May foreclosure activity was the third highest month on record, and marked the third straight month where the total number of properties with foreclosure filings exceeded 300,000 - a first in the history of our report,’ said James Saccacio, chief executive officer of RealtyTrac. ‘While defaults and scheduled foreclosure auctions were both down from the previous month, bank repossessions, or REOs, were up 2% thanks largely to substantial increases in several states, including Michigan, Arizona, Washington, Nevada, Oregon and New York. We expect REO activity to spike in the coming months as foreclosure delays and moratoria implemented by various state laws come to an end.’”

Source: RealtyTrac, June 11, 2009.

Robert Shiller (The New York Times): Why home prices may keep falling “Home prices in the United States have been falling for nearly three years, and the decline may well continue for some time.

“Even the federal government has projected price decreases through 2010. As a baseline, the stress tests recently performed on big banks included a total fall in housing prices of 41% from 2006 through 2010. Their ‘more adverse’ forecast projected a drop of 48% - suggesting that important housing ratios, like price to rent, and price to construction cost - would fall to their lowest levels in 20 years.

“Such long, steady housing price declines seem to defy both common sense and the traditional laws of economics, which assume that people act rationally and that markets are efficient. Why would a sensible person watch the value of his home fall for years, only to sell for a big loss? Why not sell early in the cycle? If people acted as the efficient-market theory says they should, prices would come down right away, not gradually over years, and these cycles would be much shorter.

“But something is definitely different about real estate. Long declines do happen with some regularity. And despite the uptick last week in pending home sales and recent improvement in consumer confidence, we still appear to be in a continuing price decline.

“There are many historical examples. After the bursting of the Japanese housing bubble in 1991, land prices in Japan’s major cities fell every single year for 15 consecutive years.

“Why does this happen? One could easily believe that people are a little slower to sell their homes than, say, their stocks. But years slower?

“Several factors can explain the snail-like behavior of the real estate market. An important one is that sales of existing homes are mainly by people who are planning to buy other homes. So even if sellers think that home prices are in decline, most have no reason to hurry because they are not really leaving the market.

“Furthermore, few homeowners consider exiting the housing market for purely speculative reasons. First, many owners don’t have a speculator’s sense of urgency. And they don’t like shifting from being owners to renters, a process entailing lifestyle changes that can take years to effect.

“Among couples sharing a house, for example, any decision to sell and switch to a rental requires the assent of both partners. Even growing children, who may resent being shifted to another school district and placed in a rental apartment, are likely to have some veto power.

“In fact, most decisions to exit the market in favor of renting are not market-timing moves. Instead, they reflect the growing pressures of economic necessity. This may involve foreclosure or just difficulty paying bills, or gradual changes in opinion about how to live in an economic downturn.

“This dynamic helps to explain why, at a time of high unemployment, declines in home prices may be long-lasting and predictable.”

Click here for the full article.

Source: Robert Shiller, The New York Times, June 6, 2009.

Bloomberg: Nobel winner Krugman sees US recession ending soon “The US economy probably will emerge from the recession by September, Nobel Prize-winning economist Paul Krugman said.

“‘I would not be surprised if the official end of the US recession ends up being, in retrospect, dated sometime this summer,’ he said in a lecture today at the London School of Economics. ‘Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing.’

“Krugman, a Princeton University economist, has warned recently that the US government hasn’t done enough to help the country’s economy recover. Last month, at a conference in Abu Dhabi, he said the fiscal stimulus is ‘only enough to mitigate the slump, not induce recovery’.

“The National Bureau of Economic Research, based in Cambridge, Massachusetts, is the official arbiter of US recessions and expansions. Last week, Robert Hall, the head of the NBER’s business-cycle-dating committee, said it’s ‘way too early’ to say the contraction is over.

“Even with a recovery, ‘almost surely unemployment will keep rising for a long time and there’s a lot of reason to think that the world economy is going to stay depressed for an extended period’, Krugman said.

“The US Federal Reserve’s efforts to stabilize markets - measures that have swelled the central bank’s balance sheet - have helped, Krugman said. ‘A lot of the spreads in the markets have come down’ and ‘the acute financial stuff seems to have come to a halt’, he said.

“The Fed’s swollen balance sheet is ‘a little alarming. In the long run you really don’t want the central banks to be so involved in the business of lending,’ Krugman said. ‘But it’s arguably necessary’ even if there are questions about ‘where does it stop?’”

Source: Courtney Schlisserman, Bloomberg, June 8, 2009.

Moneynews: Volcker - chances for strong recovery unlikely “A healing process in financial markets seems to be underway and it is reasonable to expect some growth late this year and next in the United States, Paul Volcker, an economic adviser to the Obama administration, said on Thursday.

“The prospects for a really strong recovery, typical of most recessions, seem unlikely, Volcker told a meeting of the Institute of International Finance in Beijing.

“‘A long slog, with continuing high levels of unemployment, seems to be in store,’ Volcker, a former chairman of the Federal Reserve, said.

“‘This is not an environment in which inflationary pressures are at all likely for some time to come,’ he added.”

Source: Moneynews, June 11, 2009.

John Authers (Financial Times): Fed’s monetary policy - too soon for increases “William McChesney Martin, the longest-serving chairman of the Federal Reserve, said it was the Fed’s job ‘to take away the punch bowl just as the party gets going’. After a strange six months in which nobody has worried about the Fed’s target lending rates, the punch bowl is back at the centre of market concerns. This is, at the very least, a clear sign that life on the markets is returning to normal.

“Last week’s US jobs report provoked the renewed concern about the punch bowl. Non-farm payrolls declined by 345,000; markets had expected more than 500,000 to lose their jobs.

“Yields on two-year bonds, which are sensitive to the short-term interest rate outlook, rose by more than 0.40 percentage points.

“Prices of Fed Funds futures implied a virtual certainty that the Fed will raise its target rate to at least 0.5% by the end of the year. They had previously showed virtual certainty that rates would stay at historic lows throughout the year. Stocks fell a bit, perhaps because of these rate fears.

“So as far as the market is concerned, the jobs report was clear evidence of incipient recovery, and sharply changed the punch bowl calculus for the Fed.

“But there are reasons for concern. First, nobody could yet liken the real economy to a party. The unemployment rate rose more than expected to 9.5%. May saw more jobs lost than in the worst month of either of the two previous recessions, and the data are prone to revisions.

“Thus a ‘punch bowl’ seems a poor analogy for the Fed’s current monetary policy. It is more like an energy drink, or even a syringe full of anabolic steroids. At some point, it will have to reduce the dose, or face inflation. But it looks too soon to say for sure that that moment will come within six months.”

Source: John Authers, Financial Times, June 8, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.