Bond Yields Soaring is Not Always an Inflationary Event

Interest-Rates / International Bond Market Jun 13, 2009 - 05:11 AM GMTBy: Adam_Brochert

Bond yields soaring is not always an inflationary event. The traditional teaching is that rising bond yields indicate economic recovery and/or inflation. This is true until it isn't. The problem is that the best parallel for when it ain't true is what's happening right now. Damn, this investing stuff gets complicated when you look through actual history.

Bond yields soaring is not always an inflationary event. The traditional teaching is that rising bond yields indicate economic recovery and/or inflation. This is true until it isn't. The problem is that the best parallel for when it ain't true is what's happening right now. Damn, this investing stuff gets complicated when you look through actual history.

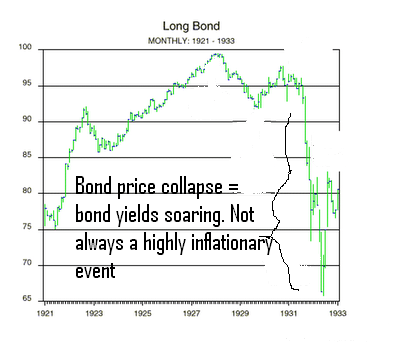

Here it is in all its glory: A monthly long bond price chart from 1921-1933 (remember that a falling bond price means a rising yield):

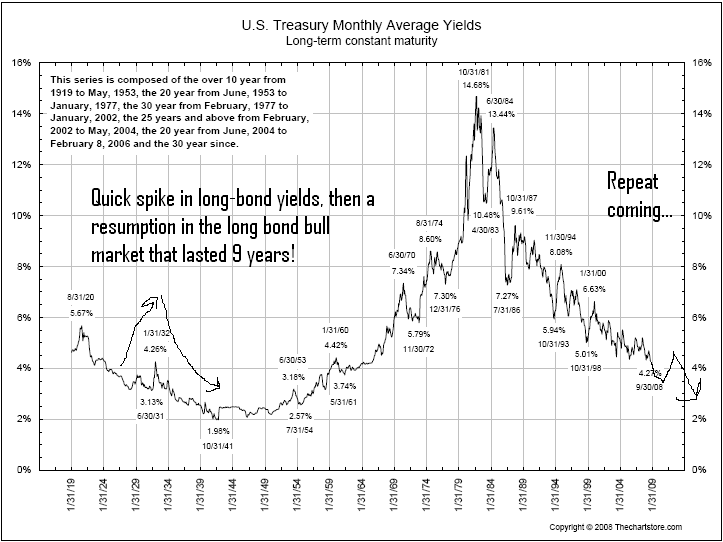

Ok, so what gives? People flee risk at this point in a secular credit contraction/economic depression and liquidity dries up. Governments get desperate and risky at this point in the cycle, so people rush into cash, Gold and short-term government debt as the longer-term outlook becomes uncertain. As the chart below demonstrates, the fall in long bond prices in the early 1930s actually represented a great buying opportunity (chart from www.thechartstore.com):

So, when the Gold bugs say that rising bond yields indicate the coming hyperinflation and when the CNBC jag-offs say the rising bond yields are due to a recovery and/or concerns regarding inflation, ask them to explain bond yields between 1931-1932. I am not saying that there won't be a coming inflation - of course there will be, eventually. But the path we have started down is deflationary, not hyperinflationary.

Eventually, all fiat currencies depreciate until they are completely worthless and subsequently abandoned. That's as safe a bet as there is! But the death throes of a fiat currency in extremis are not as easy to game as you might think. A deflationary collapse can precede hyperinflation (or just regular aggressive inflation) and holding Gold is thus the easiest no-brainer investment for the typical retail investor in this environment.

Holders of Gold will do just fine in this deflationary environment. Those who understand Gold know that Gold is money. Gold is a currency. Holding "real" cash in a deflationary depression maintains wealth and enhances it relative to one's neighbors who stay invested in stocks, commodities, corporate bonds and real estate. If you hold onto your physical Gold, you will be able to buy your neighbors' stocks, commodities, corporate bonds and real estate at pennies on the dollar in a few short years.

This is where I part company with many deflationists who think the Gold price will collapse during deflation. To assume so is to defile Gold and relegate it to commodity status when it is well known that Gold is money, not a commodity. If cash is king during deflation, then Gold is the grand emperor wizard senior king. Being no one's liability and being non-debaseable are qualities that become critical during times that create desperate central banks and governments. Why else would governments punish holders of Gold with unfair capital gains taxes and sometimes even confiscate citizens' Gold (like in 1933)?

I believe Gold will outperform every form of fiat currency, including the U.S. Dollar. I also believe Gold will trounce other commodities, including oil. Nothing like severe demand destruction to trump peak oil and export-based economies like China. Gold outperforms in a Kondratieff Winter because it requires no confidence, no economic activity and no risk taking. We all also know that the reserve status of the U.S. Dollar is in trouble and that a geopolitical event could dethrone it.

Central bankers own more Gold than anyone. Let me repeat that in case you've missed the profound implications of this basic statement: central bankers own more Gold than anyone. You think the central bankers are going to be the losers in this mess? Hahahahahahahaaaaaaaa!

Get some physical Gold. You won't regret it. When the Dow to Gold ratio gets to 2 (or lower as I personally anticipate), you can think about trading Gold for something else.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Adam Brochert Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.