Long-term Review of Stock & Commodity Bull Markets, Alternating Leadership

Stock-Markets / Investing 2009 Jun 11, 2009 - 01:14 AM GMTBy: Donald_W_Dony

Over the past 120 years, there has been a constant shifting of leadership between stocks and commodities. From 1875 to 1905, the U.S. stock market provided greater relative performance than raw materials. This changed to highlight commodities over equities from 1905 to 1920. The crown shifted back to stocks throughout the 1920s only to lose that leadership again to natural resources from 1930 to 1946. Stocks, once again, offered greater relative performance over commodities in the the late 1940s and continue to prove superior until 1965 where raw material prices took the leadership back from stocks and provided higher returns for investors until 1982.

Over the past 120 years, there has been a constant shifting of leadership between stocks and commodities. From 1875 to 1905, the U.S. stock market provided greater relative performance than raw materials. This changed to highlight commodities over equities from 1905 to 1920. The crown shifted back to stocks throughout the 1920s only to lose that leadership again to natural resources from 1930 to 1946. Stocks, once again, offered greater relative performance over commodities in the the late 1940s and continue to prove superior until 1965 where raw material prices took the leadership back from stocks and provided higher returns for investors until 1982.

The secular shift occurred again in the 1980s and 1990s with raw material prices remaining flat to down and the S&P 500 enjoying one of its strongest upward runs. The leadership was once more transferred back to natural resources in 2000 and commodities are now in a secular bull market whereas the paper-based S&P 500 has been pinned in a nine year bear market.

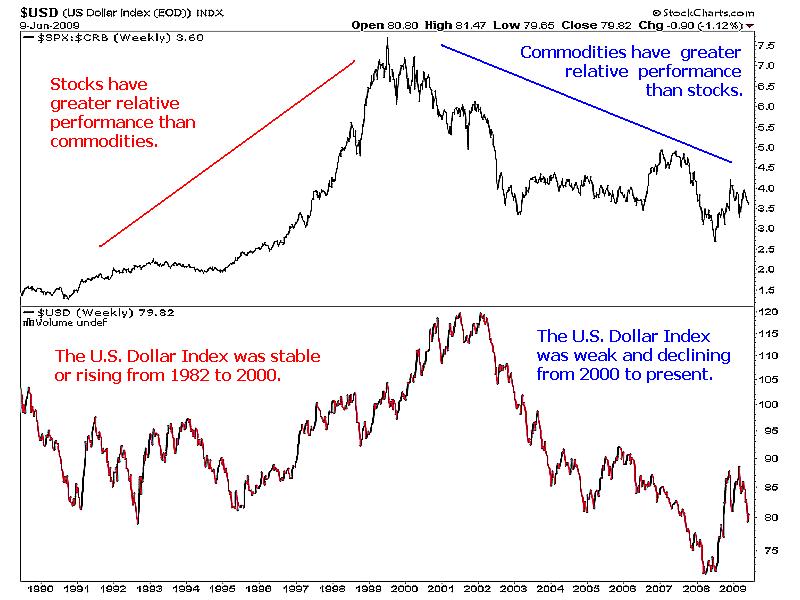

Chart 1 illustrates the leadership transfer, over the past 20 years, of the S&P 500 and the Commodity Research Bureau Index (CRB). One of the main triggers for this alternating performance is the movements of the U.S. Dollar Index. In recent times, from the mid-1960s to present, whenever the USD has been weak, it has fueled future inflationary pressures and driven the price of commodities upward. In contrast, the stability and upward movement of the big dollar in the 1980s and 1990s provided the underpinning for a disinflation environment which allowed the paper-based S&P 500 to enjoy a substantial advance from 90 to 1600.

As mounting nation debt and negative fundamentals began to weight down the American currency in 2000-2002, the tide of greater relative performance began to favour commodities over stocks. The secular bull market for stocks had ended and the next long-term run for natural resources had begun.

The correlation between the dollar on the CRB can be closely seen in Chart 2. This long-term picture outlines the affects of the currency to raw material prices.

Bottom line: Since 1875, the average transfer of bull market leadership between stocks and commodities has been about 18 years. Historical data would suggest that the current 9-year bear market of the S&P 500 is only half completed. Building inflationary pressures are also a byproduct of prolonged leadership in natural resources. During the last great commodities bull market (1965-1980) stagflation was the initial development in the early 1970s which was followed by hyperinflation and interest rates exceeding 20%.

Investment approach: The downward trending USD is steadily moving commodity prices higher. Economic demand, largely generated from Asia, is anticipated to rebuild starting in 2010. Commodities can be expected outperform stocks for another two business cycles (8-9 years). As the leadership contest between stocks and raw materials is a normal reoccurring development within the markets, investors may wish to overweight their portfolios toward commodities for the next few years to take advantage of this present secular bull market.

Suggested exchange traded funds are: PowerShares DB Commodity Index Tracking (DBC), PowerShares Agriculture (DBA), StreetTracks Gold (GLD), PowerShares DB Base Metals (DBB), iShares Comex Gold Trust (IGT), iShares S&P/TSX Materials (XMA), iShares S&P/TSX Energy (XEG), Claymore Global Mining (CMW)and Claymore Global Agriculture (COW).

More research is available in the June newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.