Optimistic Unemployment and Housing Market Forecasts Looking Silly

Economics / Recession 2008 - 2010 Jun 07, 2009 - 02:40 PM GMTBy: Mike_Shedlock

Economics may be the "dismal science" but economists as a group sure seem to be an optimistic lot. Yes, there are a handful of "doomers" like Nouriel Roubini but most economists did not see the recession coming until it was already 10 months old.

Economics may be the "dismal science" but economists as a group sure seem to be an optimistic lot. Yes, there are a handful of "doomers" like Nouriel Roubini but most economists did not see the recession coming until it was already 10 months old.

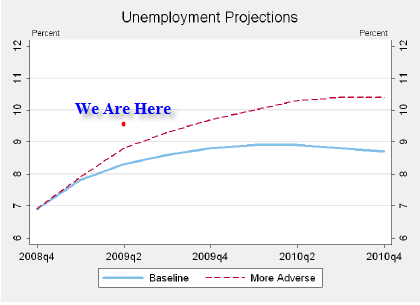

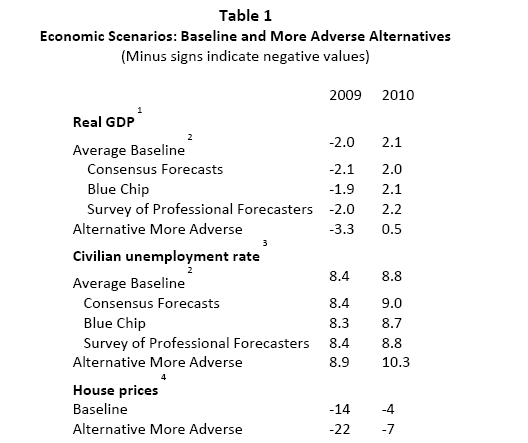

Please consider unemployment forecasts. The Fed forecast unemployment at 8.4% in 2009 and the "adverse forecast" was at 10.3% in 2010.

Hello Ben, in case you did not notice, Jobs Contract 17th Straight Month; Unemployment Rate Soars to 9.4% and Bankruptcy Filings Reach 6,000 A Day.

Adverse Assumptions

Let's take a look at all the Fed's adverse assumptions for the recently conducted "stress-free test" as laid out in the Fed's Stress Test White Paper.

1 Percent change in annual average.

2 Baseline forecasts for real GDP and the unemployment rate equal the average of projections released by Consensus Forecasts, Blue Chip, and Survey of Professional Forecasters in February.

3 Annual average.

4 Case‐Shiller 10‐City Composite, percent change, fourth quarter of the previous year to fourth quarter of the year indicated.

Case Shiller Housing Index

Please consider the latest Case Shiller Housing Index.

The S&P/Case-Shiller Home Price Index ― which covers 20 metropolitan areas ― showed a price decline of 18.7% in March, suggesting a greater fall in prices than expected. Analysts were looking for an -18.40% reading, following the -18.67% reading for February. The 10-city measure fell a similar 18.6%.

The numbers were even worse on a quarterly basis. The Q1 report ― which covers all nine U.S. census divisions, rather than just 20 metropolitan areas ― recorded a 19.1% decline compared to the first quarter of 2008, marking the steepest fall ever in the 21-year history of the index.

“All 20 metro areas are still showing negative annual rates of change in average home prices with nine of the metro areas having record annual declines,” said David Blitzer, Chairman of the Index Committee at Standard & Poor’s. “Seventeen metro areas recorded a monthly decline in March, with Minneapolis, Detroit and New York posting record monthly declines.”Note that the baseline scenario for housing for 2009 is -14%. Home prices are already down 19.1% and the adverse scenario will be under attack next month.

Unemployment Projections

The consensus forecast of unemployment for 2009 was 8.4%. The Blue Chip Forecast, a survey of America's leading business economists that costs $875 annually. Blue Chip had the unemployment rate at 8.3% for 2009 and 8.7% for 2010.

Check out this footnote in the WhitePaper.

The “more adverse” scenario was constructed from the historical track record of private forecasters as well as their current assessments of uncertainty. In particular, based on the historical accuracy of Blue Chip forecasts made since the late 1970s, the likelihood that the average unemployment rate in 2010 could be at least as high as in the alternative more adverse scenario is roughly 10 percent.

As noted, the Fed had a mere 10% chance the unemployment numbers get as high as the adverse scenario. The adverse scenario for 2009 has already been exceeded unless you think unemployment has peaked and is going lower over the next several months.

Meanwhile the Survey of Professional Forecasters pegged the unemployment rate at 8.4% for 2009 and 8.8% for 2010 (now revised much higher as is always the case).

Across the board, the Fed's adverse scenarios were a cakewalk, especially the unemployment forecasts.

Flashback February 11, 2008

White House: Unemployment to stay near 5%

The Bush administration's top economists see annual unemployment remaining just below 5% through 2013, meaning an extended period when the jobless rate would top the full-year average in six of the last 10 years.

The annual outlook of the president's Council of Economic Advisors, released Monday, also projects that the economy will keep growing this year and avoid a recession. In fact, real gross domestic product is forecast to rise by a healthy 2.7% when comparing the fourth quarter of this year to a year earlier.

But the report projects the full-year unemployment rate will rise to 4.9% in 2007, up from 4.6% each of the last two years. And it expects the unemployment rate will stay at the 4.9% rate in 2009 before starting to retreating slightly to 4.8% in each of the following four years.Are economists paid to say what people want to hear? If not, can someone please tell me why economists are perennially such an optimistic lot, seldom collectively in the ballpark and constantly revising forecasts lower?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.