ISM Report, Businesses Still Contracting, Economic Weakness Continues

Economics / Recession 2008 - 2010 Jun 03, 2009 - 01:18 PM GMTBy: Mike_Shedlock

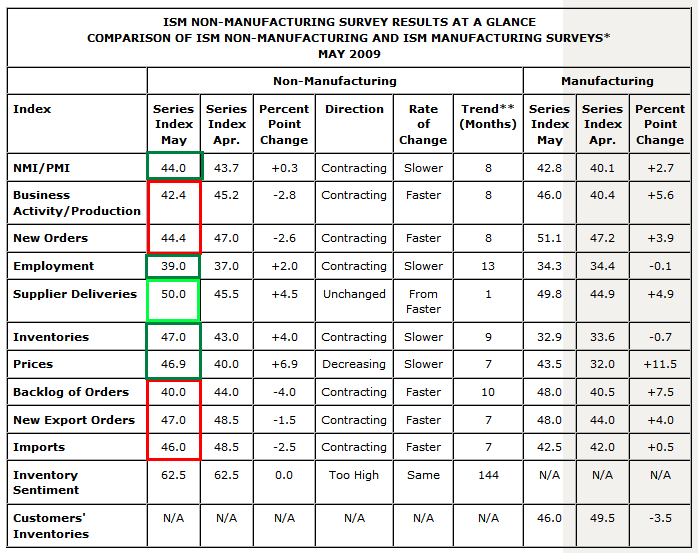

The Institute for Supply Management Report On Business® shows the May 2009 Non-Manufacturing ISM is Still Contracting, but at a lesser rate. As is often the case, details and the headline numbers suggest different things.

The Institute for Supply Management Report On Business® shows the May 2009 Non-Manufacturing ISM is Still Contracting, but at a lesser rate. As is often the case, details and the headline numbers suggest different things.

The NMI (Non-Manufacturing Index) registered 44 percent in May, 0.3 percentage point higher than the 43.7 percent registered in April, indicating contraction in the non-manufacturing sector for the eighth consecutive month, but at a slightly slower rate.

ISM's Non-Manufacturing Business Activity Index in May registered 42.4 percent, a decrease of 2.8 percentage points when compared to the 45.2 percent registered in April. Six industries reported increased business activity, and 10 industries reported decreased activity for the month of May. Two industries reported no change from April. Comments from respondents include: "Many initiatives and plans on hold"; and "Delay in start date of new client projects."

The six industries reporting growth in May based on the NMI composite index — listed in order — are: Real Estate, Rental & Leasing; Arts, Entertainment & Recreation; Utilities; Retail Trade; Construction; and Accommodation & Food Services. The 11 industries reporting contraction in May — listed in order — are: Other Services; Mining; Educational Services; Management of Companies & Support Services; Wholesale Trade; Finance & Insurance; Public Administration; Agriculture, Forestry, Fishing & Hunting; Transportation & Warehousing; Health Care & Social Assistance; and Information.

Employment

Employment activity in the non-manufacturing sector contracted in May for the 16th time in the last 17 months. ISM's Non-Manufacturing Employment Index for May registered 39 percent. This reflects an increase of 2 percentage points when compared to the 37 percent registered in April. Three industries reported increased employment, 12 industries reported decreased employment, and three industries reported unchanged employment compared to April. Comments from respondents include: "Layoffs and non-replacement of attrition continue to lower overall employee populations"; "Hired some line workers for small increase in business"; and "Properties beginning to add back staff to take care of increased demand."

The industries reporting an increase in employment in May are: Arts, Entertainment & Recreation; Real Estate, Rental & Leasing; and Mining. The industries reporting a reduction in employment in May — listed in order — are: Educational Services; Public Administration; Other Services; Information; Transportation & Warehousing; Management of Companies & Support Services; Wholesale Trade; Construction; Finance & Insurance; Accommodation & Food Services; Health Care & Social Assistance; and Retail Trade.

There is much more in the report so inquiring minds may wish to take a look.

Data Weaker Than Headline Number

Orders, employment, backlog of orders, imports, and exports suggest the report is much worse than the headline sentiment of "contracting at a lesser rate".

New Orders is arguably the most important measure of activity and orders are contracting faster than last month. The Backlog of Orders index is also contracting at a faster pace.

Employment is contracting at a lesser pace. However, employment is sitting at 39, the weakest component, and a long way from neutral. Inventories are contracting at a lesser pace. Prices are falling at a lesser rate, but the US$ has also been getting crushed.

Collectively, the data suggests an inventory replenishment phase as opposed to "green shoots" that will amount in sustainable trends. The report may not have been a disaster, but the details show it was not very good.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.