Speculative Bets Against the U.S. Dollar Highest Since July 15 2008

Currencies / US Dollar Jun 02, 2009 - 03:19 PM GMTBy: Mike_Shedlock

Anti-dollar sentiment is again running rampant. Please consider Bets against dollar highest since start of economic crisis.

Anti-dollar sentiment is again running rampant. Please consider Bets against dollar highest since start of economic crisis.

Speculative bets against the dollar have risen to their highest level since the onset of the financial crisis.

Positioning data from the Chicago Mercantile Exchange, often used as a proxy for hedge fund activity, showed that in the week ending May 19, bets against the dollar – short positions – versus the euro exceeded bets on dollar strength by 12,250 contracts.

This net short position was the highest level since the week of July 15, when the dollar hit a record low of $1.6038 against the euro.

Ashraf Laidi at CMC Markets said considering that long positions in the euro and yen against the dollar were still about 11 times lower than their record highs, speculators had plenty of upside against the dollar in terms of quantity as well as price.

Dollar Bears with an Ugly American Accent

Professor James Kostohryz offered his thoughts on the dollar on Monday. It’s well worth another look. Emphasis mine.

Dollar Bears with an Ugly American Accent

One of the things that have always puzzled me is how it is that perma-bears that are forever predicting the demise of the US Dollar never speak about any other problem other than the ones in the US. It s as if the US were the only country that had any problems.

Truth be told, my long experience with these folks has been that the vast majority of them simply don t know much of anything about foreign countries and even less about foreign currencies and interest rates.

The fact is that economic fundamentals in the US, and the fundamentals of the US financial system in particular, are much better on average than in the vast majority of other industrialized countries. Inexplicably, although the value of the dollar is measured against other currencies, the bears never even seem to fathom this.

Next time you run across one of these Dollar Cassandras, please ask them to tell you the names of the currencies that the Dollar going to decline against, and to please speak to you in detail about the relative fundamentals of these nations. Ask them about sovereign debt ratios. Ask them about external debt ratios. Ask them about bank capitalization ratios. My experience has been that when you pose this question to the perma-bears, it usually elicits a long pause and empty stare.

For example, none of the Dollar bears that were getting all lathered up last week about how rising Treasury yields were signaling the Demise of America appeared to have any clue that rates were rising all over the world.

Indeed, yields on many equivalent European bonds, including the Bunds, rose by even greater amounts.

Another example is that the perma-bears that are forever talking about Dollar Debasement, seem to think that monetary stimulus only happens in the USA. They seem blissfully unaware of central bank stimulus measures in other nations that have been just as expansionary or even more so than the policies of the US Fed.

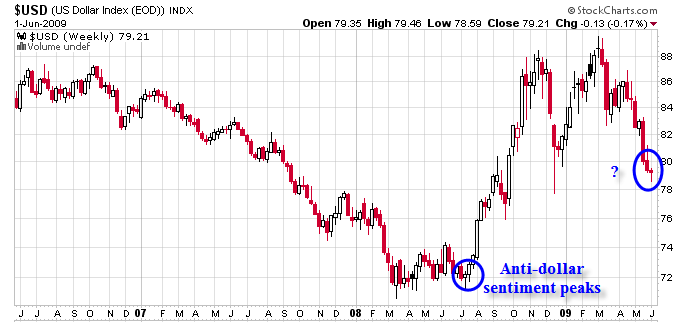

Folks who emit opinions on the US Dollar need to spend as much, or even more, time analyzing and explicating economic and financial conditions outside of the US as they do handwringing about the demise of the USA.The US dollar retested a bottom in July 2008. Anti-dollar sentiment was rampant. Here is the chart.

Carry Trade Is Back

One thing is certain. The carry trade is back (borrowing money in one currency to invest in another currency with higher interest rates, or in foreign stocks or commodities). It remains to be seen how carried away speculators get with these positions but I can guarantee they will have to be unwound at some point.

In the meantime, I caution everyone not to make bets on the basis of Commitment Of Traders reports on sentiment. The COT reports are not a timing device.

Moreover, please note that I am not a huge dollar bull. I was at the lows, and to be honest, quite some time before that. However, since the top (when dollar bulls came out of the woodwork), I called for a trading range. Now we are well within that trading range and there is plenty of room for the dollar to go either way.

Fundamentally it's hard to like the dollar here. However, it's not easy to like the Euro here either. And the fundamentals of the British Pound are even worse than the dollar in my estimation.

As noted in US Manufacturing Contracts 16th Consecutive Month; China Expands 3rd Month China passed a $586 billion stimulus package. For the size of China's economy, $586 billion is quite massive. That stimulus went directly into production, and if the global economy does not pick up to support Chinese exports, China may easily overheat.

Those who think the RMB (Yuan) is going to replace the US dollar as the next world's reserve currency are in complete fantasyland. I doubt there even is a next reserve currency.

Hell's Bells, the RMB does not even float yet.

Of course fiat currencies do not really float anyway. They simply sink at varying rates, slowly going worthless over time.

Eventually, every fiat currency in existence is headed for zero. Gold is not headed to zero.

Short-term, I do not know where the dollar goes, nor does anyone else. What I do know is anti-dollar sentiment is quite extreme and that signals caution on anti-dollar bets.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.