Next Phase In The Financial and Economic Crisis

Stock-Markets / Credit Crisis 2009 Jun 02, 2009 - 04:12 AM GMTBy: Paul_Lamont

The recent stock market rise is lulling investors back to sleep.

The recent stock market rise is lulling investors back to sleep.

Ulysses and the Sirens. Herbert James Draper. WikiCommons.

***More For Clients and Subscribers***

Bailouts Usher In Next Crisis

History (and our recent Report titled "The Invisible Hourglass") suggests how this financial episode will end. The bailout borrowings are ushering in the next wave of the crisis. Just like the bankers who could not see their own downfall, it is the politicians and their Keynesian advisors that are now pushing us over the second cliff. As expected, the Treasury bond yield has risen sharply from 2.53% to over 4.5% in 5 months. The Fed is confused. According to Russell Napier (author of Anatomy of the Bear), yields over 6% could cause the next leg down. He expects this within the next two years. We disagree, there's no definite trigger point. As we mentioned in The Haughty Bond, yields rose as investors dumped Bonds (well, everything) for cash. Stocks and bonds were sold simultaneously. Regardless, the yield is on track to reach 6% by this fall. According to Weiss Research's recent white paper on banking bailouts:

"In the 1930s, interest rates moved down, up, and then down again, in three distinct phases: In Phase 1, all interest rates declined due to deflation. In Phase 2, however, despite sharp GDP declines, interest rates surged unexpectedly: The 3-month Treasury-bill rate jumped six fold - from about a half percent to 3 percent; the yields on 20-Year Treasury bonds surged beyond their pre-crash peak; and the average yield on low-grade corporate bonds exploded higher to 11 percent. At this juncture, like today, the federal government came under increasingly intense pressure from creditors to reduce its federal deficit; limit its efforts to save failing banks; and, shift to a more disciplined, austere, tough-love approach. Finally, in Phase 3, interest rates fell and mostly remained low for the balance of the decade."

Source: Weiss Research Inc.

Instead of borrowing money to prop up Wall Street Firms, the U.S. Treasury should save its ammo. More important events could come along that would require government action.

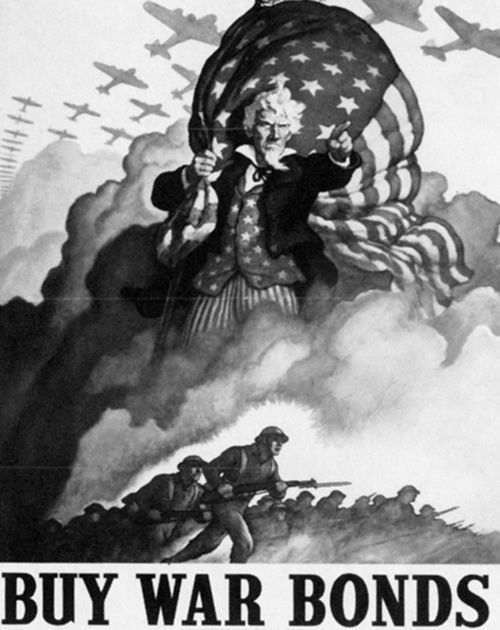

WikiCommons.

As we wait for creditors to force the issue, Treasury bond yields continue to fly.

By Paul Lamont

www.LTAdvisors.net

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us . Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions.

Copyright © 2009 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama . Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.

Paul Lamont Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.