Investing in Royalty Trusts: How Some Investors Are Getting Paid $3,600 an Hour

Stock-Markets / Investment Funds Jun 01, 2009 - 12:27 PM GMTBy: Q1_Publishing

The two of us just sat there eating some leftovers from KD’s Bar BQ, drinking from sweaty bottles of water, watching it.

The two of us just sat there eating some leftovers from KD’s Bar BQ, drinking from sweaty bottles of water, watching it.

The numbers on the rusty old meter just kept rolling over. One…by one…by one.

“This has to be the best business in the world,” I said.

“Yep, nothing can get done without them. They all need our compressors.” the company’s chief engineer said in a thick Texas accent.

412…413…414…

“Is this for real?”

“Yep. The compressors are essential for the wells to work.”

421…422…423…

“No. No. No. I get that. In fact, I love that. But I mean this – the numbers,” I said.

“Ohhh, those. You betcha. They’re real…”

429…430…431…

“Hmmm…so someone just made $114 while we’ve been sitting here in the middle of nowhere eating some sandwiches. $120…$126…$132…That’s obscene.”

“Multiply by that by 12. That’s how many they own. Now that’s obscene.”

That was how I came across one of the simplest, most lucrative business in the world. And right now could be the perfect time to invest in it once again.

Investing in Royalty Trusts: The Easiest $3,600 an Hour Job

The conversation above happened about three years ago in the fall of 2006. Ameranth, a large hedge fund, took a highly leveraged bet on natural gas prices. The bet went sour and the fund imploded.

Unwinding the bet sent the natural gas prices plummeting. Shares of natural gas companies went down just as fast (it was yet another case of Wall Street’s inability to think as far as three months into the future).

Despite the sell-off, none of the fundamentals changed for natural gas. Demand was outstripping supply and the artificially low natural gas prices wouldn’t last forever.

The window of opportunity was open and it was time to move. After a few late nights of research and a couple dozen phone calls and I was on a plane to the natural gas fields of Texas to get answers.

I landed at the airport in Odessa-Midlands – a medium-sized town in west Texas. I wasn’t there to watch the country’s most heated high school football rivalry or anything like that (although, if you ever get the chance to see a game there, it’s definitely a worthwhile experience). I was there to check out a couple of natural gas equipment companies.

One of the companies I was eyeing was Natural Gas Services Group (NYSE:NGS). It makes natural gas compressors, a piece of equipment essential to getting gas from “unconventional” gas wells.

The factory tour went well. The company was run by a group of professional, experienced, and motivated team who worked well together (that’s always a big key for small-cap companies). Operating margins were expanding and the backorder log was growing too. It was the perfect set-up. My readers at the time went on to make as much as 146% in the next two years.

The thing that has stuck out in my mind though was that conversation. We were just watching the meter on top of the well - which tracks the amount of natural gas which comes out of the well – roll over again and again.

At the time, with natural gas at $6 per Mcf, the owners of the well made about $1 every second. That worked out to about $60 a minute or $3,600 an hour.

But the owners of the well owned 11 more wells. The numbers are astronomical.

It’s all income too. Sure, there are expenses and the price in that market isn’t as high as it is in the Northeast because of transportation costs, but once you find the gas and build the well, all of the revenue pretty much goes straight in the bank.

And right now, with the U.S. dollar started what’s resuming its long and drawn out decline, businesses like these which will offer investors plenty of safety and a steady, inflation-protected revenue stream will do well.

Investing in Royalty Trusts: A Paycheck of Royal Proportions

Of course, owning your own gas or oil well is a bit impractical - especially if you’re not an old money, well-connected Texas family. There is, however, an easy way to buy into the next best thing – oil and natural gas royalty trusts.

A royalty trust is a special corporate entity set up to distribute cash flows directly to shareholders. They are primarily in the high cash flow businesses like natural gas and oil production and mining. In most cases they are required to pay out 90% of profits in cash to shareholders. As a result, they are not taxed at the corporate level like profits in other businesses (although the tax rules are slated to change in Canada in 2011).

Basically, owning shares of a royalty trust is just like owning part of an oil or natural gas well. There is staff, management, and overhead to pay for. But after that, the rest goes straight to shareholders.

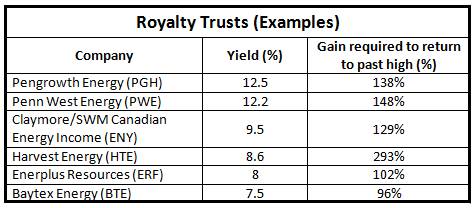

Royalty trusts were some of the best performing investments during oil’s last run-up. As a group, they consistently spun off dividends of between 6% and 14%. Shares of the trusts also steadily tracked the price of oil with many rising 200% or more as oil prices ran up to $147 a barrel.

When the energy bubble burst though, the royalty trusts were hit hard too. Shares in the energy trusts were decimated. But now, with oil prices back on the rise, energy trusts offer a very stable source of income with some protection against any inflation as well.

As you can see in the table below, a few of the leading energy trusts offer exceptional yields. Also, they offer plenty of upside potential if oil prices climb above and beyond $147 a barrel and natural gas prices return to their highs (depending on whether the trust produces primarily oil or natural gas) in the years ahead:

The best part about energy trusts - from an income investor’s perspective at least - is that the cash flow is tied to the commodities produced by the trust. The gains here are three-fold.

First, the assets of the company, like large oil reserves, only become more valuable in an inflationary environment.

Second, the cash flows are protected from inflation as well. The purchasing power of the dividends is protected because they’re tied to profits. Profits, of course, are closely tied to commodity prices.

Finally, the trust is required to pay out most of its profits in cash. As a result, they will be required to substantially increase their dividends if (when) inflation does really start getting out of hand.

Investing in Royalty Trusts: The Dollar’s Great Fall

The energy trusts are just one additional way to protect your wealth from the decline in the value of U.S. dollars. Although I’d hesitate against giving the U.S. dollar only a few months to live, it’s tough to imagine a situation where the U.S. dollar is higher three years from now.

A serious decline is only a matter of time. And you don’t want to be one of the many who is not prepared.

Already, a lot of big money managers are starting to get the picture. And the impact of their preparation is closing the window of opportunity.

This week gold and gold stocks continued to surge. According to Marketwatch, silver had its biggest monthly gain in 22 years. And a few weeks ago investment legend Jim Rogers warned, “We’re going to have a currency crisis, probably this fall or the fall of 2010.”

Although much more analysis of energy trusts is needed to start buying individual ones, you don’t have to fly across the country to realize there is an opportunity to collect high levels of current income and have those income streams protected (although KD’s Bar BQ is almost worth the trip itself).

Investing doesn’t have to be complicated. One of the keys to investing success is to buy businesses which just make sense at the right time. In this environment, owning an oil and natural gas well makes a lot of sense.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

P.S. That’s not the case for agriculture though. The way things are shaping up, there could be a tremendous short-term opportunity in agriculture on top of the exceptional long-term prospects. More to come in the weekend edition of the Prosperity Dispatch.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.