Stocks Bear Market Rally Consolidating Before the Rally Resumes

Stock-Markets / Stocks Bear Market Jun 01, 2009 - 12:30 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Down! The very-long-term cycles have taken over and if they make their lows when expected, the bear market which started in October 2007 should continue until 2012-2014. This would imply that much lower prices lie ahead.

SPX: Intermediate trend - Sideways! The counter-trend rally which started on March 6 is undergoing a consolidation which could last two or three more weeks, after which the bear market rally will continue.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview:

The rally which started on March 6 is turning out to be much stronger than most had expected. Not only did the SPX go up uninterrupted for over two months and 263 points, but we can't even get a decent correction after all this! Last Friday, the index closed only 11 points from its high and, by closing on its high of the day, looks ready to go higher. Well, don't get fooled by looks. It's more than likely that the correction is not over, and the next couple of weeks will be down. After that, the bear market rally will continue and find a more decent top which will bring about a real correction or, to be more exact, will bring about the return of the bear market and a new SPX low.

On Friday, the NDX made a new recovery high, which would also seem to intimate that we are ready to extend the rally. The problem is that the internals were not supportive of the move, and that neither the Russell nor the Value line appear ready to follow. Now, if we should explode upward on Monday morning, I will be ready to change my mind, but until I see some more evidence that we are ready to go forward, I think it's more probable that we will retrace.

Other signs of market readiness that we look for, such as the sentiment indicator, is still more bearish than bullish, and the daily momentum indicators are not making a convincing "buy" pattern. Conclusion: more consolidation is ahead.

More often than not, lows tend to coincide with an important cycle making its low. There are none directly ahead. Those that could have brought the market down and that were mentioned repeatedly in the past few weeks are now behind us after disappointing the bears, and with the possibility that at least one or two may have inverted. There are only a couple of short-term cycles bottoming in mid-June. They could be the ones that will end this consolidation. Let's keep June 16 and 17 in mind.

What's ahead?

Chart Pattern and Momentum

The two brown lines represent a secondary trend channel. The index is consolidating under the top trend line and will probably go through it after the consolidation is over. This will not signal that we are in a new bull market. The primary trend channel is much higher around 1200 and I sincerely doubt that the rally from 667 will continue long enough to come even close to it.

Since I expect Friday's move to have reached its peak at the close, or early on Monday, I have made certain assumptions about the end of the consolidation which I have noted on the chart. These assumptions would be invalidated if Friday's move continued and closed higher than 925 on an hourly basis. There are several other factors which could nullify or modify that scenario, even if we found a top at 919.

Both oscillators are close enough to give a buy signal so I think that we won't have long to wait and should know by Monday's close whether or not we have a buy signal or if additional consolidation is needed.

Next, I want to show you the divergence which exists between the SPX (top chart ) and the NDX (bottom). Historically, the NDX has led the SPX in intermediate moves. On the charts below, you can see that the NDX refused to make a new low in March while the SPX did, by a good margin. This was a clue that we were near a reversal which subsequently turned out to be of intermediate nature That was confirmed when the NDX went above a resistance level which the SPX only approached 3 weeks ago at the beginning of the current consolidation.

The NDX is still leading, on Friday, it closed 23 cents below its early May high, while the SPX is 21 points below its comparable high. If the NDX shoots decisively above its former high on Monday, and continues the rally, we can pretty much assume that the SPX will not be far behind.

Something to watch for farther down the line will be when this relative strength begins to wane because it should signal the end of the "C" wave from 667 and, hopefully, the end of wave (4) and the beginning of wave (5)

But since we are still trying to determine if we have ended the consolidation or if there is more to go, let's see if we can get some clues by turning to the hourly chart and do some micro analysis.

Unfortunately, even the hourly chart does not give us a clear picture, and all we can do is to point out a few negatives about Friday's action which could be wiped out by the wink of an eye if we have a strong opening on Monday.

The A/D and the volume did not support the closing spike, and there was no follow-through after the close which would lead one to believe that it was for real! I had given my subscribers a projection of 917 if we could not break below 903 before the close. We went to 919 instead! That's not enough to invalidate the 917 projection, especially when you consider that the spike was probably mostly short-covering. But it does open the possibility of a follow through to 923-27.

If we have a strong opening on Monday morning and keep going beyond the above projection, I would have to consider going back to the drawing board.

Cycles

The two cycles mentioned in the opening section are the 6-wk which should bottom on June 16, and the 8-wk, which is due on the next day.

The 20-wk cycle is due in early July.

Projections:

The next projection above 917 is 923-927. Should this turn out to be a genuine break-out and we keep on going, there would be resistance at the former top of 930 and the January top of 943.85 which would approximately coincide with meeting the top trend line of the down channel.

866 would be the best estimate for the low of the consolidation if we do not break out.

Breadth

The NYSE Summation index (courtesy of StockCharts) which is shown below, remains overbought. And like the market which has only managed a shallow, sideways correction after its impressive rise, is a display of strength.

The daily indicator which was overbought, has corrected itself and is back to neutral. It's current position does not have any predictive value.

The latest readings of the hourly chart are ones of negative divergence to price, and if this is not changed on Monday morning, it will have signaled an extension to the correction.

Market Leaders and Sentiment

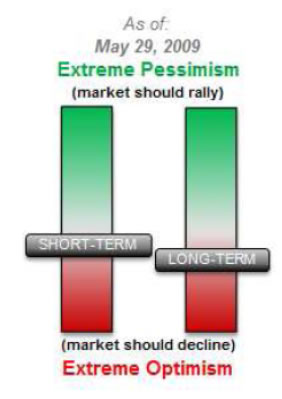

The Sentiment indicator below (courtesy of Sentimentrader), shows the market to be slightly vulnerable in the short-term and, after the consolidation we have experienced, a little less so than it was on the longerterm.

Summary

After becoming overbought by its relentless rise, the market has been consolidating for the past three weeks. On Friday, the SPX had a closing surge which made it appear as if the consolidation was over. Since this was not really supported by internal data, one should be wary and wait for confirmation provided by the follow through of additional strength on Monday.

The following are examples of unsolicited subscriber comments:

Awesome calls on the market lately. Thank you. D M

Your daily updates have taken my trading to the next level. D

… your service has been invaluable! It's like having a good technical analyst helping me in my trading. SH

I appreciate your spot on work more than you know! M

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.