Gold and Commodities Breakout?

News_Letter / Gold & Silver 2009 May 31, 2009 - 11:54 PM GMTBy: NewsLetter

Dear Reader

Gold ended the week sharply higher at $977, now within touching distance of $1000 and beyond. However before you decide to invest ensure to read the timely 40 page Ebook on gold and silver analysis prepared by our colleagues at EWI, that may change the way you think about precious metals. Learn more about the Free Special 40-page Gold and Silver eBook here.

Gold ended the week sharply higher at $977, now within touching distance of $1000 and beyond. However before you decide to invest ensure to read the timely 40 page Ebook on gold and silver analysis prepared by our colleagues at EWI, that may change the way you think about precious metals. Learn more about the Free Special 40-page Gold and Silver eBook here.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Financial Markets and Economic Crash, the Next Leg Down Will be Worse |

By:Mike_Whitney

Collapsing home prices and credit markets continue to put downward pressure on consumer spending, forcing the Federal Reserve to take even more radical action to revive the economy. Last week, Fed chief Ben Bernanke raised the prospect of further monetizing the debt by purchasing more than the $1.75 trillion of Treasuries and mortgage-backed securities (MBS) already committed.

| 2. Bilderberg Plan For Remaking the Global Political Economy 2009 |

By: Andrew G. Marshall

Andrew G. Marshall writes: From May 14-17, the global elite met in secret in Greece for the yearly Bilderberg conference, amid scattered and limited global media attention. Roughly 130 of the world’s most powerful individuals came together to discuss the pressing issues of today, and to chart a course for the next year.

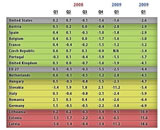

| 3. Global Debt Deleveraging Recession Gets Worse as Government Deficit Grows |

By: John_Mauldin

There is something that is bumping around in my worry closet. The bond market is not behaving as if there is deflation in our future, and the dollar is getting weaker. Unemployment keeps rising, but most of all, the US government deficit looks to be spinning out of control. This week we look at all of this and take a tour around the world to see what is happening. There is a lot of interesting material to cover.

| 4. The Biggest Reason to Get Excited About Investing in Agriculture |

By: Chris Mayer

There is some mind-bending stuff percolating in the agricultural markets. In fact, the setting recalls the one that set off the big move in oil prices in recent years...

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

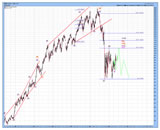

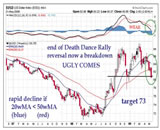

| 5. Stocks Bull Market or Bear Trap? It’s Easy to See |

By: John_Handbury

There has been a large volume of press regarding the latest run-up in stock prices and whether this is a legitimate beginning of a trend, or a bear market trap. The answer is pretty simple and easy to see from the plot below:

| 6. Memorial Day Disaster, Foreigners Dumping Dollar Assets, Stocks & Bonds |

By: Martin Weiss

This would normally be my time for a quiet Memorial Day at home.

But even as we seek calm, investors overseas are doing precisely the opposite.

| 7. Stocks Bear Market, Russo Vs Prechter an Elliott Wave Count Comparison |

By: Joseph_Russo

First, we wish to state for the record that there is no meaningful difference in the intermediate and long-term market opinions held by the astute Mr. Prechter and those held by this analyst. Secondly, we would like to note that we hold the utmost respect for Mr. Prechter’s talents, skills, contributions, and achievements in both his publishing empire, and in his eloquent and brilliant sharing of Elliott Wave Theory.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

To access the Newsletter archive this link

Forward a Message to Someone [FORWARD]

To update your preferences [PREFERENCES]

How to Unsubscribe - [UNSUBSCRIBE]

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.