U.S. Treasury Bond Market Drags Dollar Lower Under Weight of Bond Issuance

Currencies / US Dollar May 28, 2009 - 07:48 PM GMTBy: Ashraf_Laidi

Talk of Fed Exit Strategy is Premature. Yesterdays 23-basis point jump in 10-year yields to 3.74% may have been helped by mortgage backed securities traders hedging, but the upward trend remains clearly intact. With Fed increasingly behind the curve in catching up with US Treasurys relentless bond issues, 10 year yields have now retraced over 50% of their decline from their 5.32% high of June 2007 to their record low of 2.03% in December.

Talk of Fed Exit Strategy is Premature. Yesterdays 23-basis point jump in 10-year yields to 3.74% may have been helped by mortgage backed securities traders hedging, but the upward trend remains clearly intact. With Fed increasingly behind the curve in catching up with US Treasurys relentless bond issues, 10 year yields have now retraced over 50% of their decline from their 5.32% high of June 2007 to their record low of 2.03% in December.

The path is now paved towards the 4.1% market, last attained in October 2008. We cannot imagine the Fed sticking with its current plan to purchase $300 bln in treasuries when their yields are exasperating the fragile jobless recovery and further endangering the value of their foreign holders. The only solution so far is for the FOMC to step up purchases towards the $500-700 billion target, the implications of which will flash the green-light for dollar selling.

"Green Shoots" optimists, credit rating pessimists and bonds-to-stocks rotation realists have all provided arguments for the jump in bond yields. The acceleration could be extended by reduced portfolio weightings in government bonds and onto metals and agriculture. Portfolio re-allocations from fixed income to commodities may be uncommon, but central banks reflationary policies leave little choice for investors to pursue seek capital preservation strategies.

The chart above illustrates the USD index/10 yr yield index ratio, highlighting the ensuing retracement in the value of the greenback relative to bond yields after the ratio shot up to a record high of 37 in November. A rising ratio reflects an appreciating greenback relative to bond prices, while a declining ratio highlights the bonds underperformance relative to the US currency. The overshoot in the USD/Yield ratio of Q4 reflected the combination of violent repatriation flows into US treasuries, which boosted the USD and dragged down yields. The ratio, currently at 22 (80.9/3.7) is above its 39-year average of 15 and is bound for further declinesin line with broader retreat in the greenback.

The EURUSD chart below supports the view for continued gains towards the $1.41, followed by $1.47 by end of quarter. Meanwhile we could see an interim retreat limited to $1.3720-30s. The same applies for AUDUSD, whose support holds at 0.7650, while paving the way for 0.820

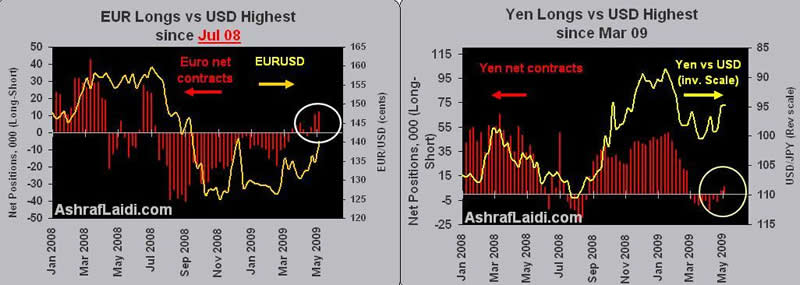

More Speculative Dollar Shorts Ahead. Last week's data from currency futures showed euro longs vs. USD exceeded the shorts by 12,250 contractsthe highest level since the week of July 15 (the week when EURUSD hit its record high). Meanwhile, yen longs vs. USD exceeded the shorts by 6,000 contracts, the highest since March. Aussie net longs vs. USD also hit their highest since July, reflecting the extent of deepening anti-USD sentiment among the speculative (non-commercial) community. Considering that EUR and JPY net longs vs. USD are about 11 times lower than their record highs, speculators have plenty of upside against the USD in terms of quantity as well as price.

For an 8-year view on Forex speculators' positions on euro, yen, sterling, aussie and loonie, click here.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.