Why the S&P 500 Stock Market Index Could Crash Another 50%

Stock-Markets / Stocks Bear Market May 28, 2009 - 03:06 AM GMTBy: Graham_Summers

With the words “green shoots” and “bull market” getting more and more coverage in the mainstream financial press, it’s worth considering if this current market/ economy is actually improving. Personally I don’t know what data the folks at CNBC are looking at. Because to me, all signs point to further wealth destruction and great economic contraction to come in the months ahead.

With the words “green shoots” and “bull market” getting more and more coverage in the mainstream financial press, it’s worth considering if this current market/ economy is actually improving. Personally I don’t know what data the folks at CNBC are looking at. Because to me, all signs point to further wealth destruction and great economic contraction to come in the months ahead.

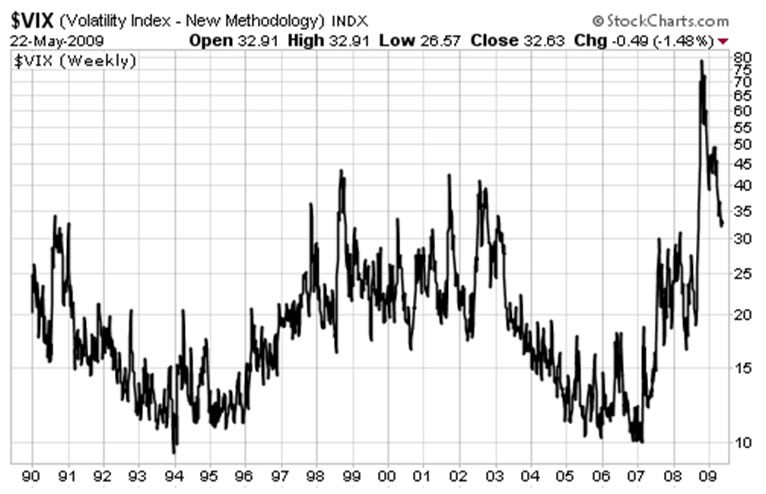

For starters, there’s the issue of sentiment. Many commentators have made a big deal out of the fact the Chicago Board of Options Volatility index (VIX)¾ a common measure of investor sentiment¾ recently fell below 30 for the first time since the Market Crash in October. However, a VIX reading of 30 only indicates that investors are back to normal “bear market” freak out mode as opposed to full-blown “the world is ending” crisis hysteria: remember the VIX was at 30 during the recession of 1990-91 and during the Tech crash. So this hardly indicates things are getting much better.

Moreover, from a valuation perspective, stocks are nowhere near cheap. During the recessions of the early ’70s and ‘80s, stocks fell to trade at single digit Price-to-Earnings (P/E) ratios. With this current recession obliterating earnings every month, P/E ratios are actually rising, NOT falling.

Consider that earnings estimates for the S&P 500 in 2009 currently stand at $28.51. With the S&P 500 trading at 887, this values the stock index at 31! That’s the kind of valuation seen during bubbles, NOT bear markets.

For the S&P 500 to trade at a P/E of 7 (where it did during the last two major bear markets), the S&P 500 would have to fall to 200 (I’m not saying this will happen, but simply pointing out how expensive stocks are). Even a P/E of 15 would put the S&P 500 at 382: a more than 50% decline from where the market trades today.

Of course, this is assuming that the current earnings estimates are accurate: as recently as Feb 9, 2009, earnings estimates for the S&P 500 in 2009 were as high as $42. It’s also worth mentioning that earnings are generally massaged to be higher than real profits via various accounting gimmicks. REAL corporate profits (cash flow) are likely to be even lower.

No, if this bear market goes the way of others, we’ve still got quite a ways to fall. Indeed, as far as bear markets go, we’re currently right in the middle based on the number of weeks declining and the price decline (see the chart below).

Bottomline: Don’t trust the mainstream financial commentators or government officials. We may be seeing “green shoots,” but remember that green shoots can spring up even in barren parking lot. This doesn’t mean you’ve got the makings of sustained growth.

Instead, it’s far more likely that this market has a looooong way to fall. We’re certainly long overdue for a correction of 10% or so. I wouldn’t be surprised if we got this in the next four weeks.

Prepare your portfolio accordingly.

Graham Summers

PS. I’ve prepared a FREE Special Report detailing three investments that will soar when the Second Round of the Financial Crisis hits. I call it the Financial Crisis Round Two Survival Kit. Swing by www.gainspainscapital.com/roundtwo.html to pick up your free copy today.

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.