U.S. Dollar Roll Over Accelerates into Mid 2009

Currencies / US Dollar May 28, 2009 - 02:11 AM GMTBy: Donald_W_Dony

In 2008, as the global bear market gather momentum, investors were drawn to the fundamentally weak U.S. dollar as a 'safe haven'. However, as volatility slowly erodes from the equity markets in 2009 and the appetite for risk in commodities and stocks gradually returns, the flight-to-safety mentality for the $USD is also evaporating. In its place is a return to a more rational fundamental review of the American currency.

In 2008, as the global bear market gather momentum, investors were drawn to the fundamentally weak U.S. dollar as a 'safe haven'. However, as volatility slowly erodes from the equity markets in 2009 and the appetite for risk in commodities and stocks gradually returns, the flight-to-safety mentality for the $USD is also evaporating. In its place is a return to a more rational fundamental review of the American currency.

As the current economics for the big dollar remain negative, traders are now limiting their exposure to the USD and diversifying their currency portfolios. This action is removing the underpinning support and driving the dollar down at an accelerated pace.

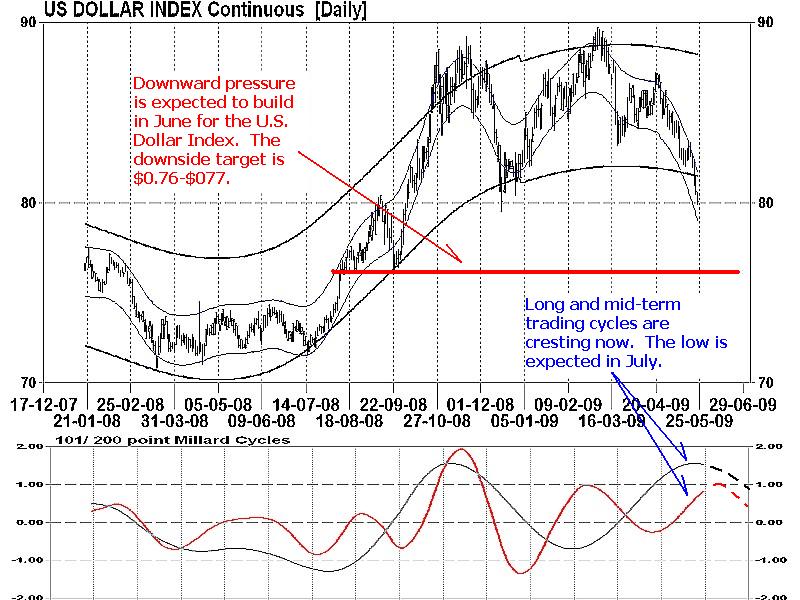

Technical models (Chart 1) indicate that the multi-month roll-over, that began in November, has quickened. Both long and mid-term models (lower portion of Chart 1) suggest that additional downward pressure can be expected throughout June and into July. The main support level for the dollar is the $0.80 line. Over the past 30 years, this line-in-the-sand has been the measuring level that has separated the Greenback from either a bull or bear market. Models continue to indicate that this key line will be broken again in early June.

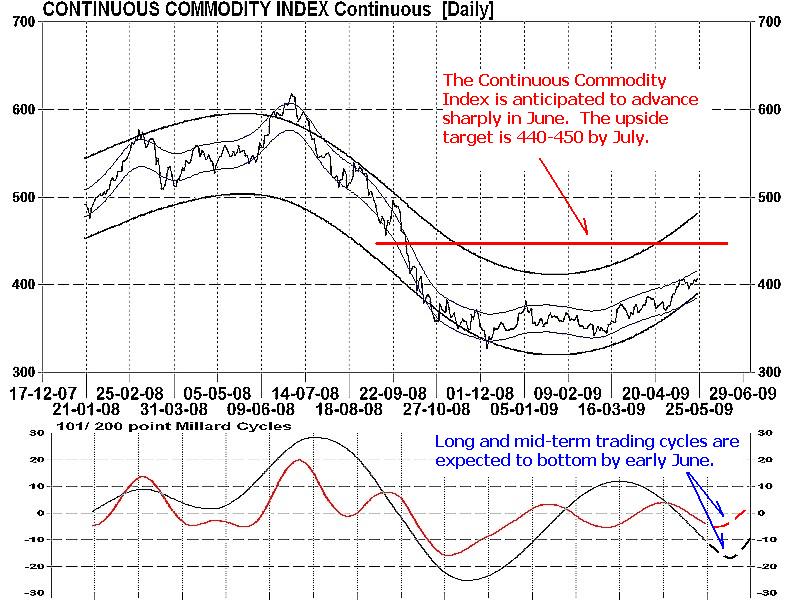

The opposite correlation with the dollar is with commodities. As the $USD descends, it provides upward pressure on natural resource prices. Chart 2, of the equally-weighted Continuous Commodity Index, illustrates the positive affect that the declining dollar has had on raw materials. While the dollar has been cresting in the 4th quarter of 2008, the Continuous Commodity Index has found solid support at 340 and formed a stable foundation. Recent weakness from the $USD in April and May has only added greater upward momentum to the index.

Bottom line: The expected downward acceleration in June and July of the U.S. Dollar Index should propel commodity prices higher. The longer-term outlook for the big dollar remains equally bleak as the national debt continues to expand at an unprecedented rate and the introduction of new policies that generate addition tax revenue are unlikely in the near-term. The downside target for the dollar in July remains at $0.76-$0.77.

Investment approach: The commodities market has out performed the broader S&P 500 for most of 2009. This pattern is expected to continue as the U.S. dollar drifts lower. Commodity-based ETFs will likely provide the best vehicles for participating in this advancing market as they offer diversification, transparency and liquidity. Investors may wish to review the following CDN dollar ETFs:

- Claymore Global Agriculture-COW

- Claymore Natural Gas-GAS

- Claymore Oil Sands Units-CLO

- Claymore Global Mining-CMW

- Horizon Beta Bull Oil-HOU

- Horizon Beta Bull Agriculture-HAU

- iShares Energy-XEG

- iShares Materials-XMA

- iShares Comex Gold Fund-IGT

- iShares Gold Fund-XGD

Additional research will be available in the upcoming June newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.