Stock Market Investor Sentiment Widening Divergence

Stock-Markets / Stock Market Sentiment May 25, 2009 - 03:41 PM GMTBy: Guy_Lerner

For the US equities market, we see a widening divergence between the "Smart Money" and the "Dumb Money" indicators. The "dumb money" has maintained its extreme bullishness from last week while the "smart money" is now more bearish.

For the US equities market, we see a widening divergence between the "Smart Money" and the "Dumb Money" indicators. The "dumb money" has maintained its extreme bullishness from last week while the "smart money" is now more bearish.

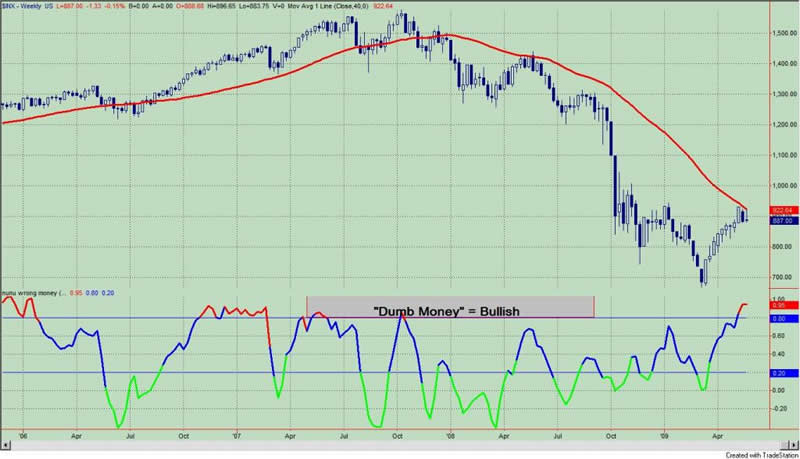

The "Dumb Money" indicator is shown in figure 1. The "Dumb Money" indicator looks for extremes in the data from 4 different groups of investors who historically have been wrong on the market: 1) Investor Intelligence; 2) Market Vane; 3) American Association of Individual Investors; and 4) the put call ratio.

Figure 1. "Dumb Money"/ weekly

The "Smart Money" indicator is shown in figure 2. The "smart money" indicator is a composite of the following data: 1) public to specialist short ratio; 2) specialist short to total short ratio; 3) SP100 option traders.

Figure 2. "Smart Money"/ weekly

In general, it is best to bet against the "dumb money" and bet with the "smart money". Of course, there are exceptions to these "rules". As we noted two weeks ago, it takes bulls to make a bull market, so too many bulls, as we see now, could be a good thing. On the other hand, as we noted last week, the 4.9% sell off in the S&P500 two weeks ago was atypical for a bullish trend characterized by too many bulls. In fact, such a downdraft usually portended lower prices.

This week we now have the "Smart Money" indicator becoming less bullish while the "Dumb Money" indicator has maintained a very bullish posture. In a bear market environment, this widening divergence will favor the "smart money". In other words, look for the market to roll over. In a bull market, such a divergence was of no consequence.

It has been my view (since the rally began on March 9, 2009) that this is not the "technical" launching pad for a new bull market. I have summarized this research in the article "Bear Market Rally or New Bull?" So per my methodology, we are still in a bear market, and I am expecting the rally to rollover in the next couple of weeks. In this instance, I want to be betting against the "dumb money" and betting with the "smart money". In addition, I think that this notion of too many bulls as a sign of new bull market will be wrong in this case as last week's data point suggests. To go higher the market will need to go lower first. More bulls need to be converted to bears.

If wrong in my assessment, I discussed where and when I would throw in the towel and jump on the bullish bandwagon. As I wrote on May 5:

I am well aware that a bull market can start without my criteria being met. The market seems to have a way of spoiling the best of plans. So I still must be prepared for the possibility that my indicators and tools just aren't sensitive enough to detect a new bull market.

If this turns out to be the case, then I would "throw in the towel" if the S&P500 closed about its simple 10 month moving average on an end of month closing basis. Mebane Faber, from the World Beta Blog, has presented a very simple (yet effective) timing system that utilizes the simple 10 month moving average. If the S&P500 were to keep rising and print a monthly close above its simple 10 month moving average, then I would call this a new bull market. I will also point out that no major index has yet to end the month above its simple 10 month moving average.

Until then, I still believe we are in a bear market. Until my indicators give the signal, I still don't believe the potential for a new bull market exists. The possibility of a new bull market is always present, but the probability at this point in time seems rather remote.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.